This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1163

for the current year.

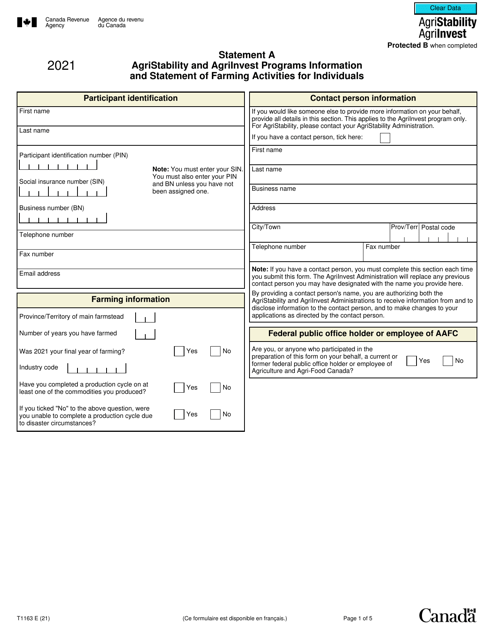

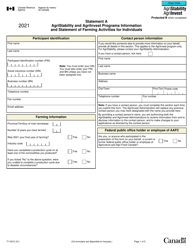

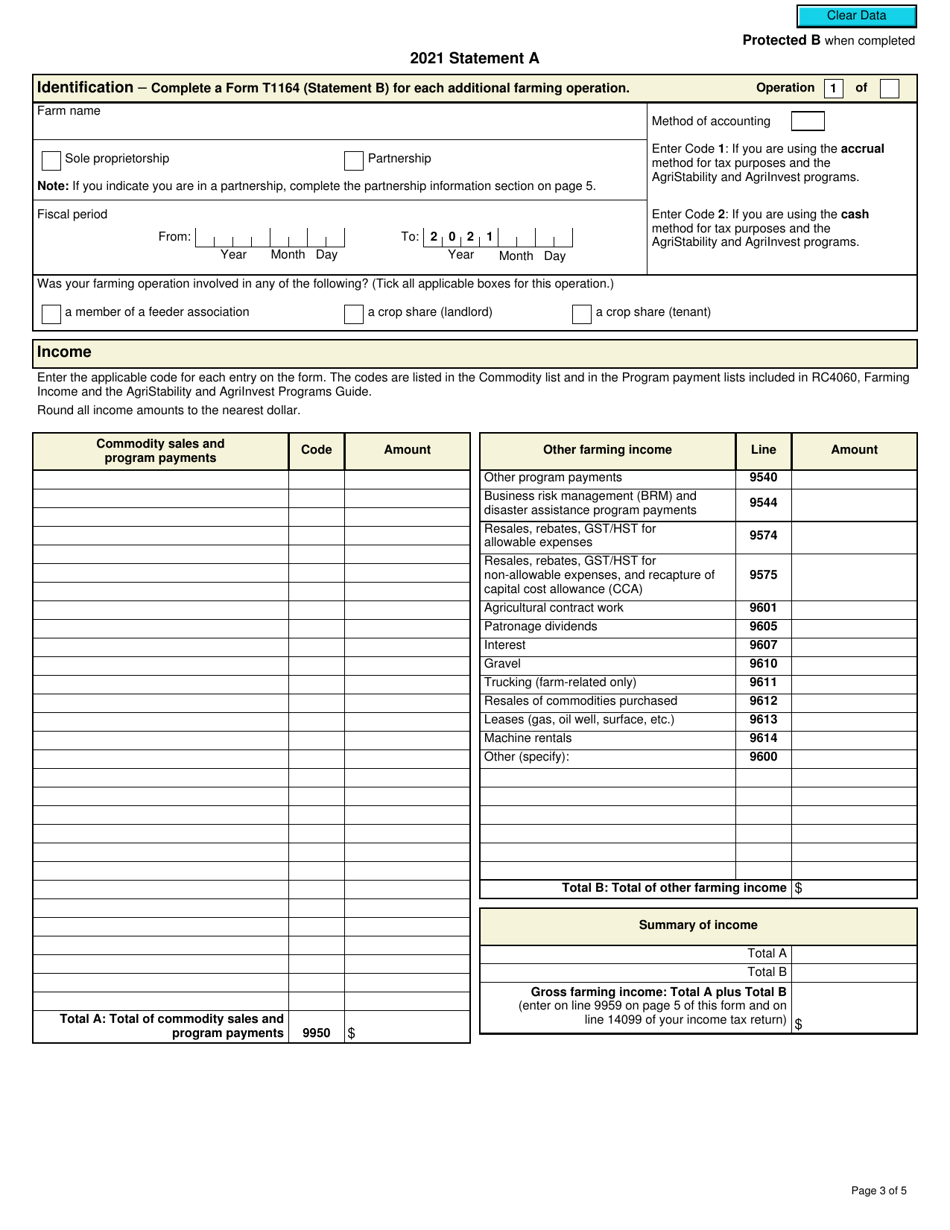

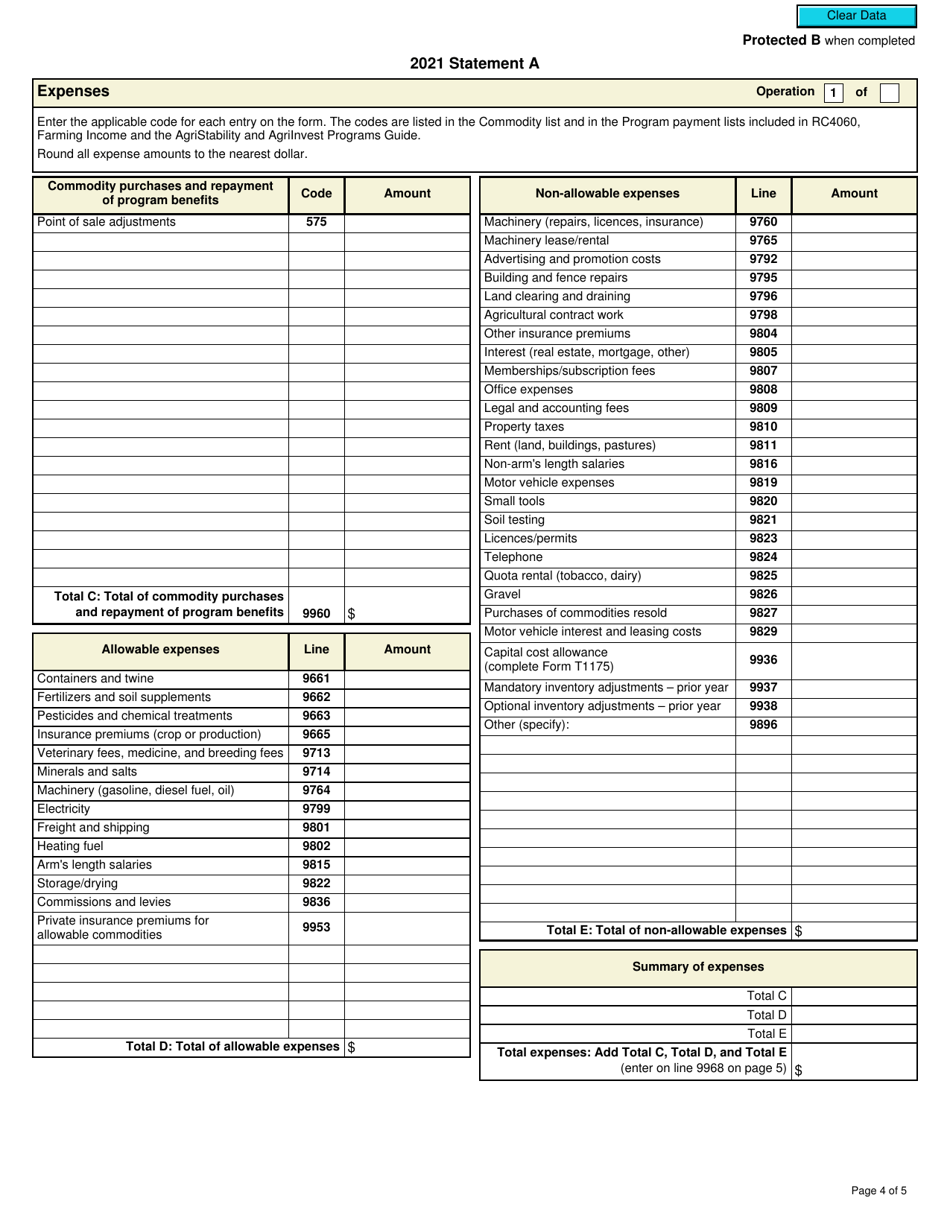

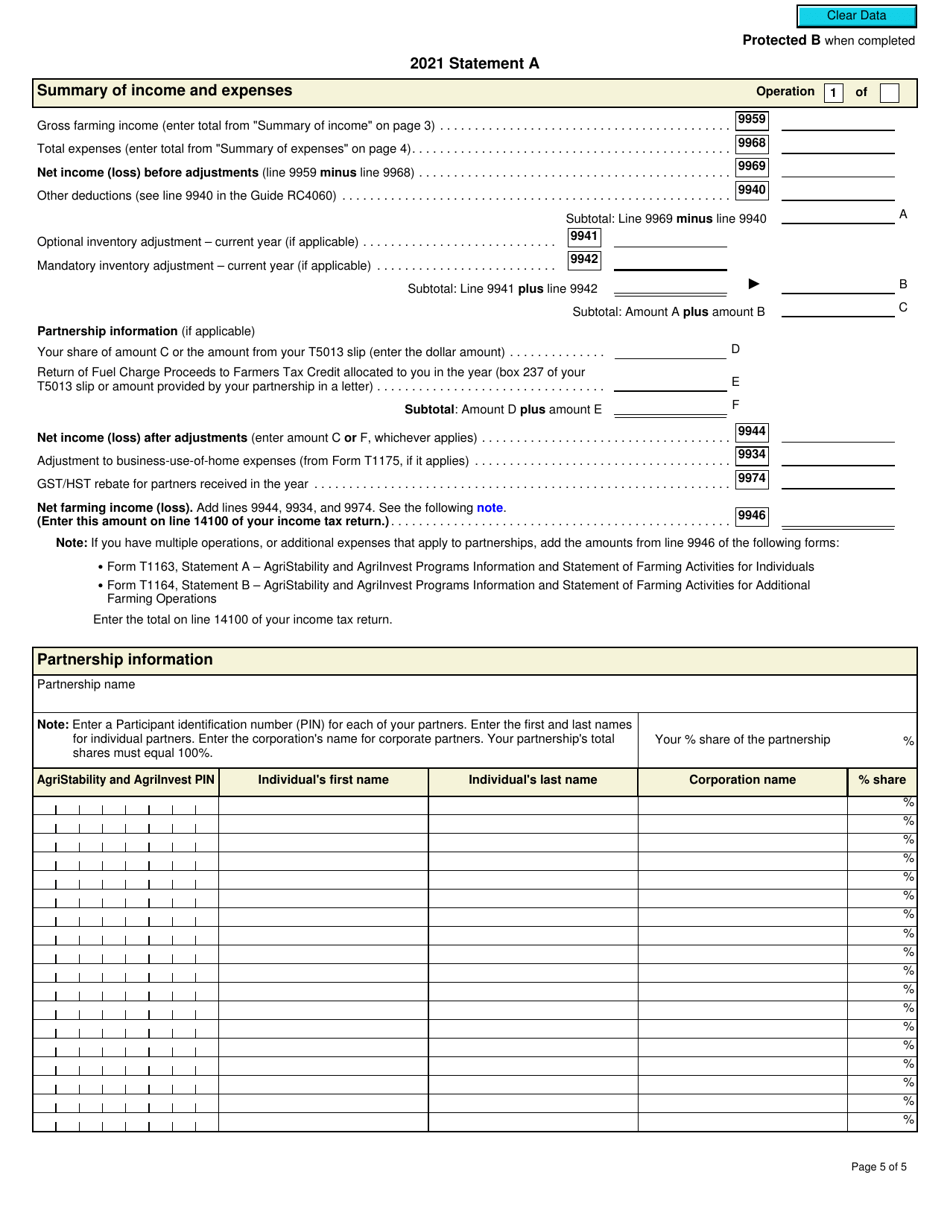

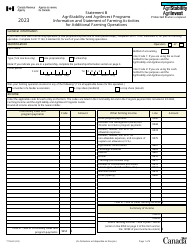

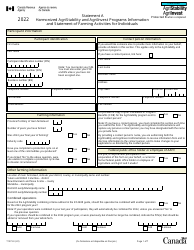

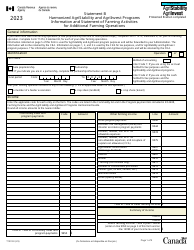

Form T1163 Statement a - Agristability and Agriinvest Programs Information and Statement of Farming Activities for Individuals - Canada

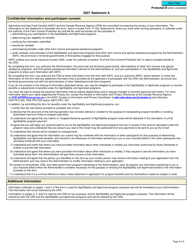

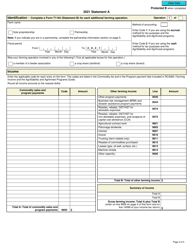

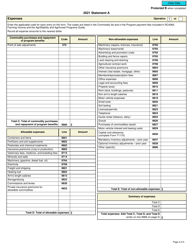

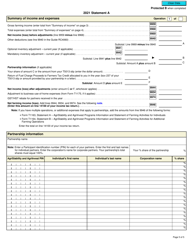

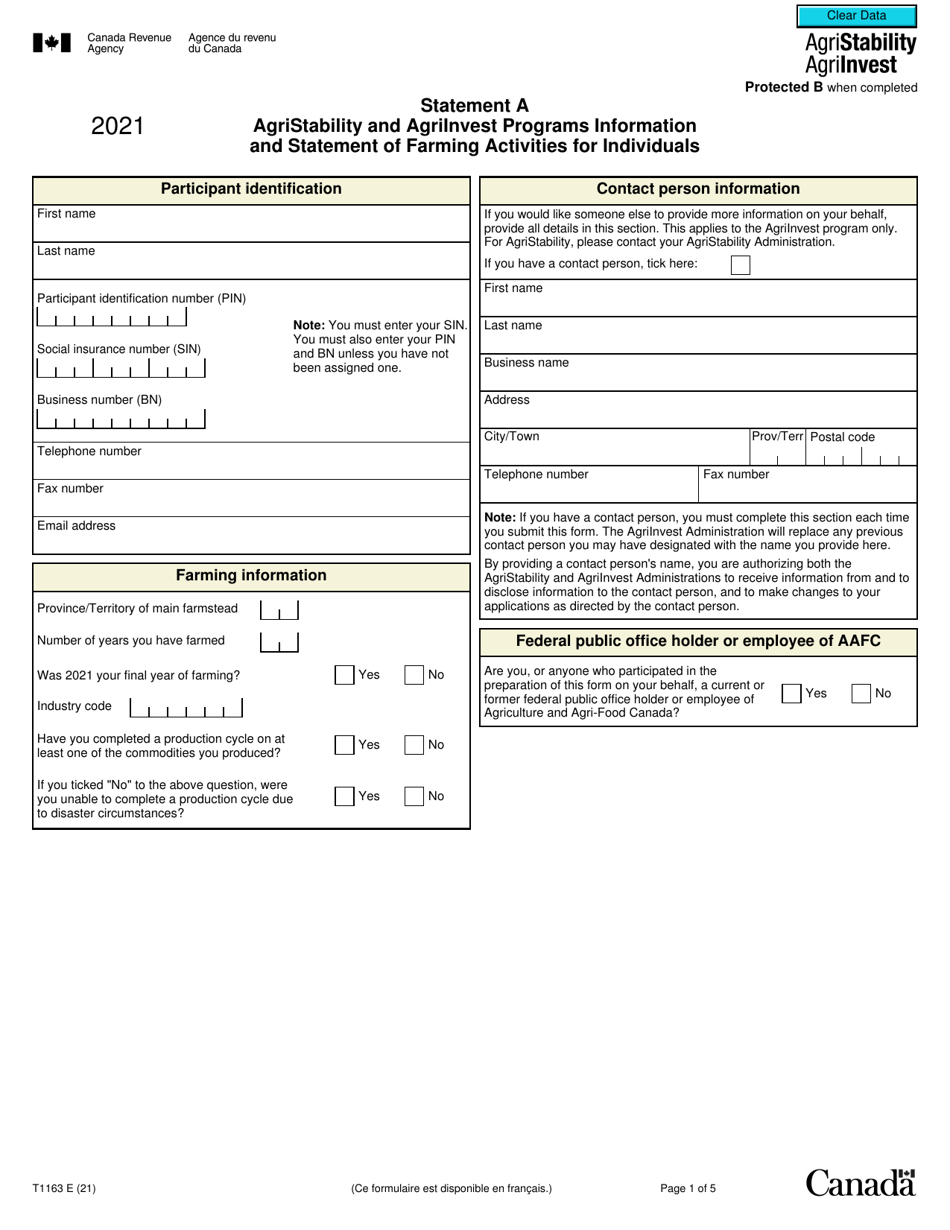

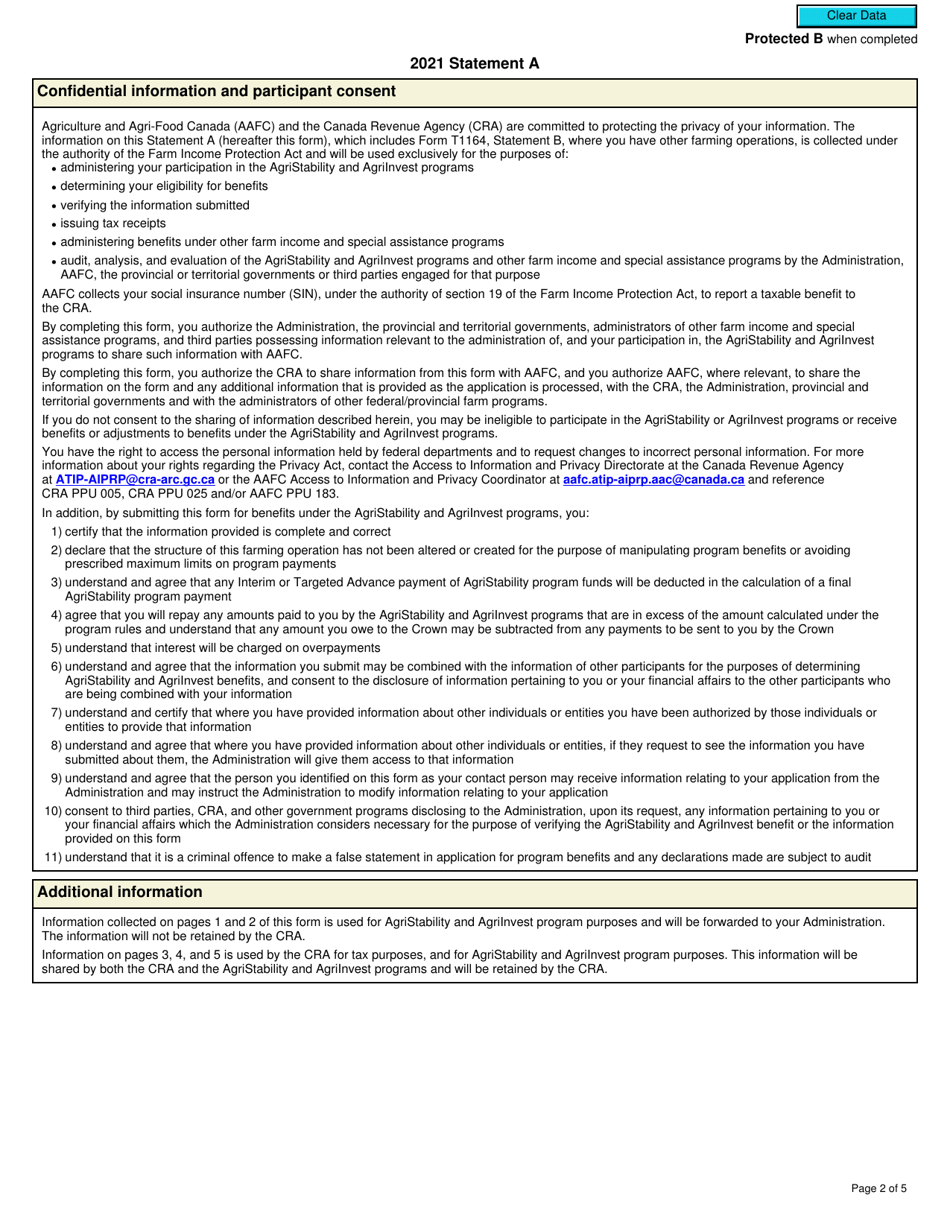

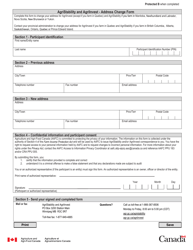

Form T1163 is used by individuals in Canada who are participating in the Agristability and AgriInvest Programs. This form serves two main purposes. First, it provides information about farming activities carried out by the individual during the tax year. This includes details such as the type of farming operation, income and expenses, and other relevant information. Second, it serves as a statement of farming activities for the purpose of calculating payments under the Agristability and AgriInvest Programs. These programs are designed to provide financial assistance and risk management support to farmers in Canada.

The Form T1163 Statement A - Agristability and AgriInvest Programs Information and Statement of Farming Activities for Individuals in Canada is typically filed by individuals who participate in the Agristability and AgriInvest programs offered by Agriculture and Agri-Food Canada. These programs provide financial assistance and risk management tools to farmers, and the form is used to report farming activities and information related to the programs.

FAQ

Q: What is Form T1163?

A: Form T1163 is a statement used by individuals in Canada to provide information about their farming activities for the Agristability and AgriInvest programs.

Q: What are the Agristability and AgriInvest programs?

A: Agristability and AgriInvest are programs in Canada that provide support and financial assistance to farmers.

Q: Who needs to fill out Form T1163?

A: Individuals in Canada who are involved in farming activities and want to participate in the Agristability and AgriInvest programs need to fill out Form T1163.

Q: What information is required on Form T1163?

A: Form T1163 requires individuals to provide details about their farming activities, including income and expenses, as well as information about their participation in other farming programs and government assistance.

Q: What is the deadline to file Form T1163?

A: The deadline to file Form T1163 is usually the same as the individual's income tax filing deadline, which is typically April 30th of the following year.

Q: Are there any penalties for not filing Form T1163?

A: Yes, there may be penalties for not filing Form T1163 or for filing it late. It is important to adhere to the deadlines and requirements set by the CRA to avoid any penalties.