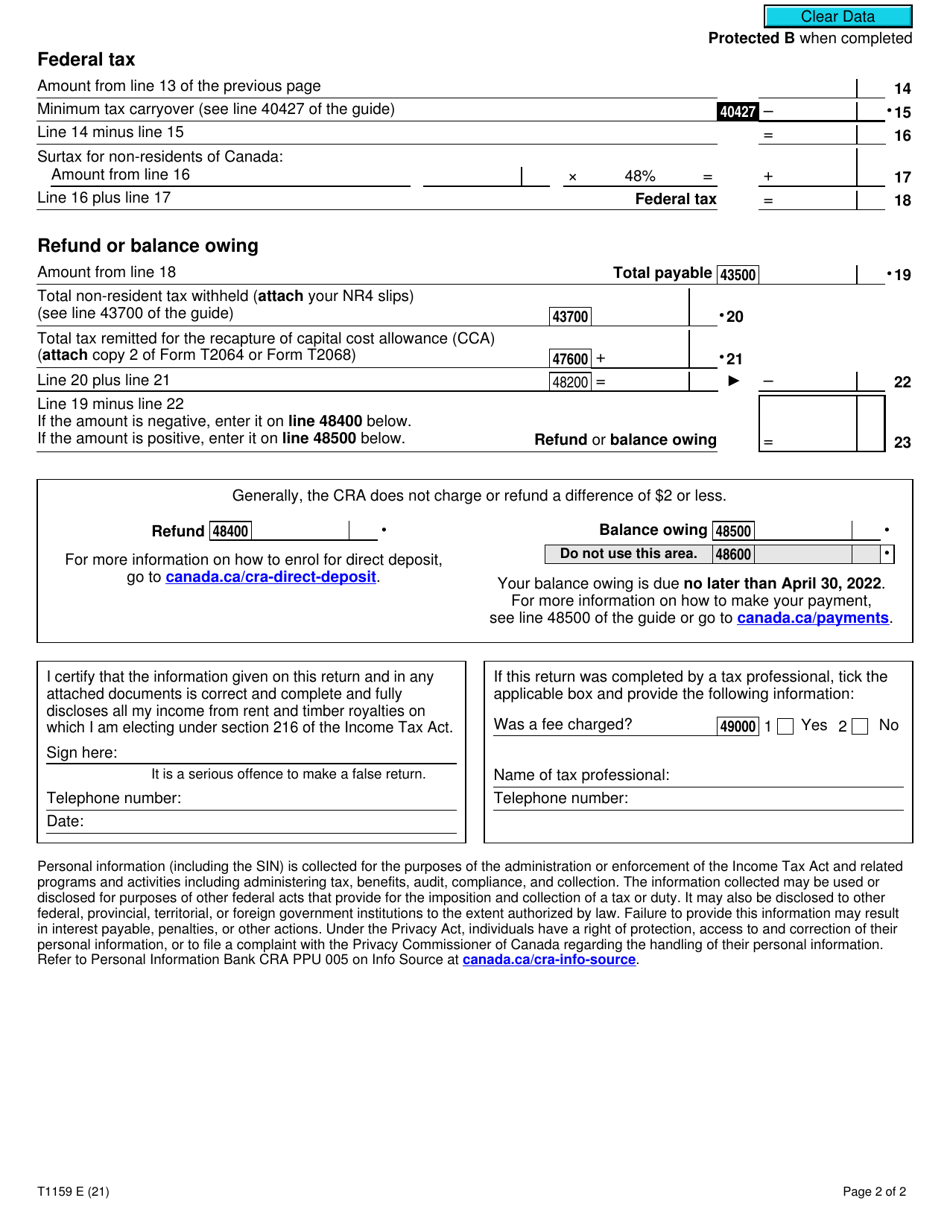

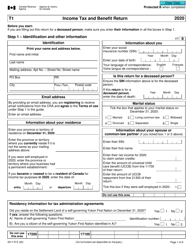

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1159

for the current year.

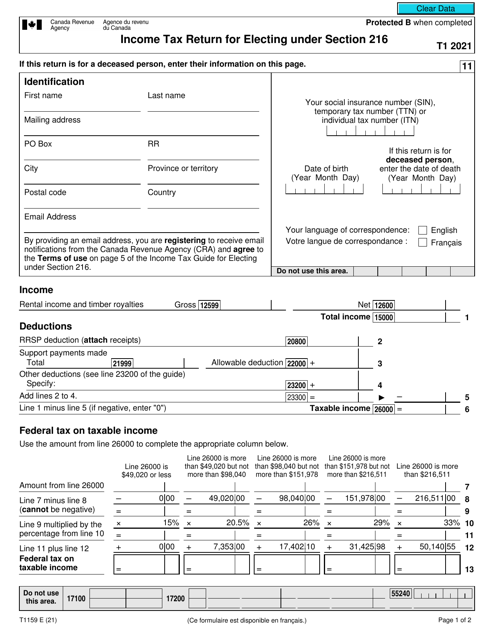

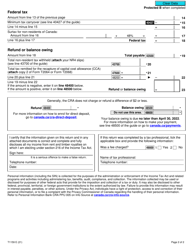

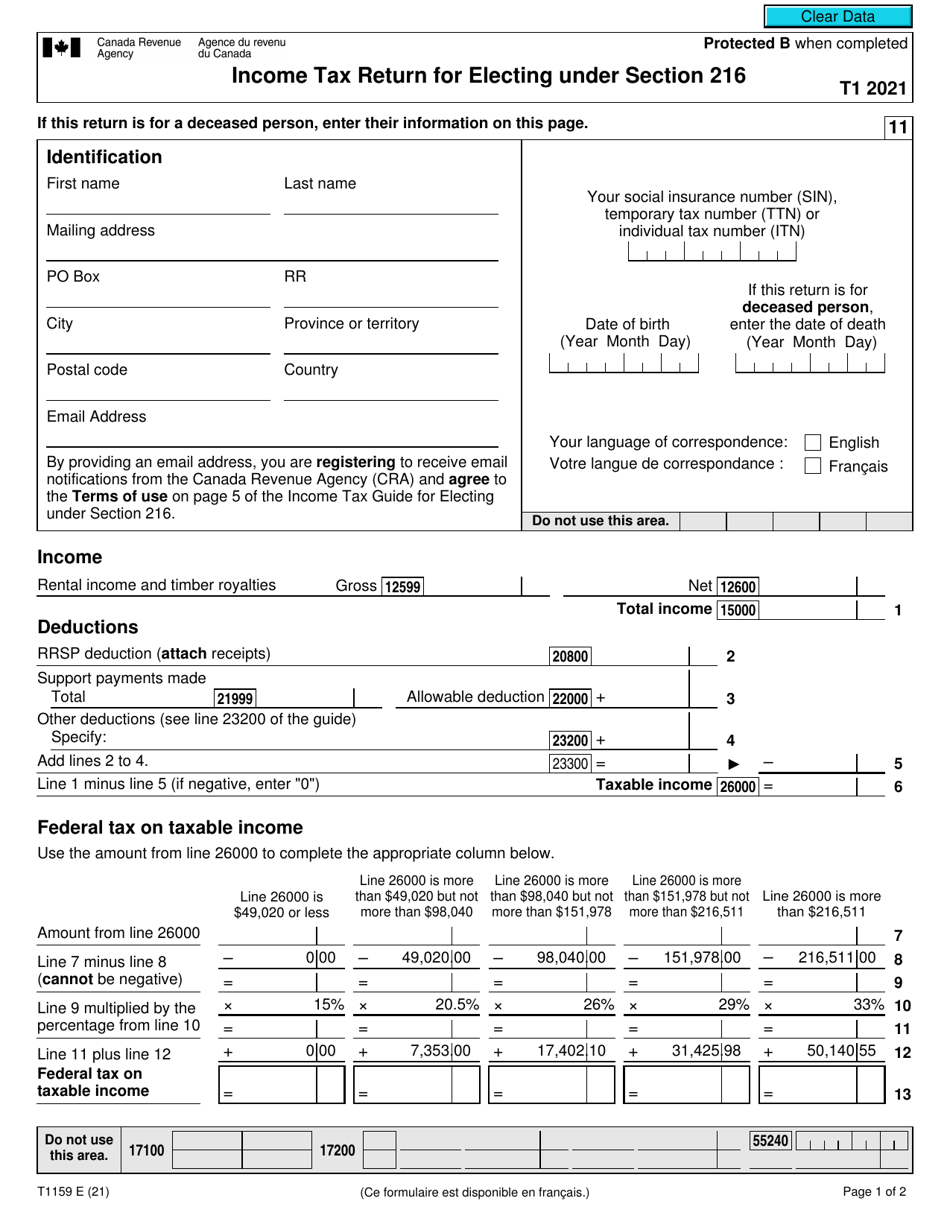

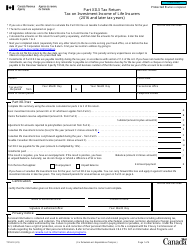

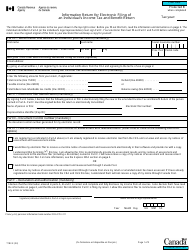

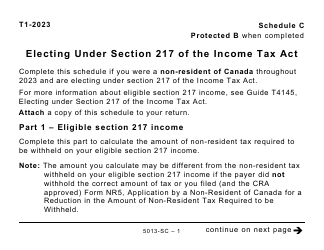

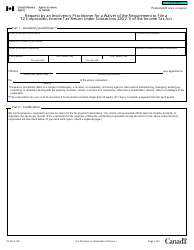

Form T1159 Income Tax Return for Electing Under Section 216 - Canada

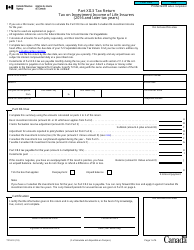

Form T1159 Income Tax Return for Electing Under Section 216 in Canada is used by non-resident individuals who own Canadian rental properties and want to elect to pay tax on the net rental income instead of the gross rental income. By filing this form, they can take advantage of certain tax benefits and deductions available to them.

The form T1159 Income Tax Return for Electing Under Section 216 is filed by non-residents of Canada who earned rental income from Canadian real estate.

FAQ

Q: What is a Form T1159?

A: Form T1159 is an income tax return for electing under Section 216 in Canada.

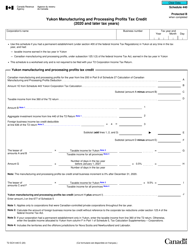

Q: Who needs to file Form T1159?

A: Individuals who are non-residents of Canada and have rental income from Canadian property need to file Form T1159.

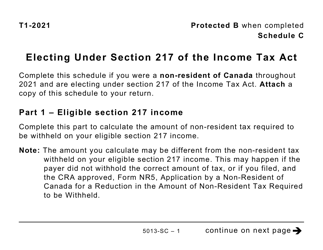

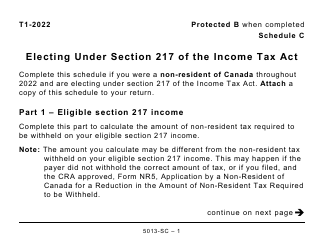

Q: What is Section 216?

A: Section 216 of the Canadian Income Tax Act allows non-residents to elect to pay tax on their Canadian rental income at a rate of 25%.

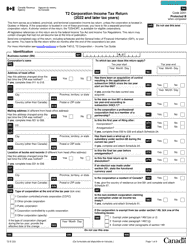

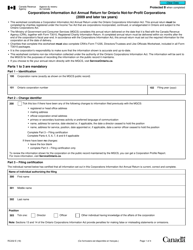

Q: What information is required for Form T1159?

A: Form T1159 requires details about the rental income, expenses, and taxes paid, as well as your personal information.

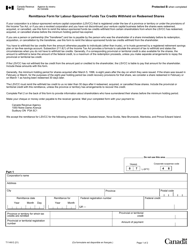

Q: When is the deadline to file Form T1159?

A: The deadline to file Form T1159 is the same as the regular Canadian income tax filing deadline, which is usually April 30th.

Q: Is it mandatory to file Form T1159?

A: If you are a non-resident of Canada and have rental income from Canadian property, it is mandatory to file Form T1159.

Q: What happens if I don't file Form T1159?

A: If you are required to file Form T1159 and you fail to do so, you may be subject to penalties and interest charges by the Canada Revenue Agency.

Q: Can I get a refund if I overpaid taxes through Form T1159?

A: Yes, if you have overpaid taxes through Form T1159, you may be eligible to claim a refund.