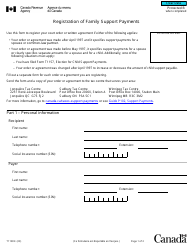

This version of the form is not currently in use and is provided for reference only. Download this version of

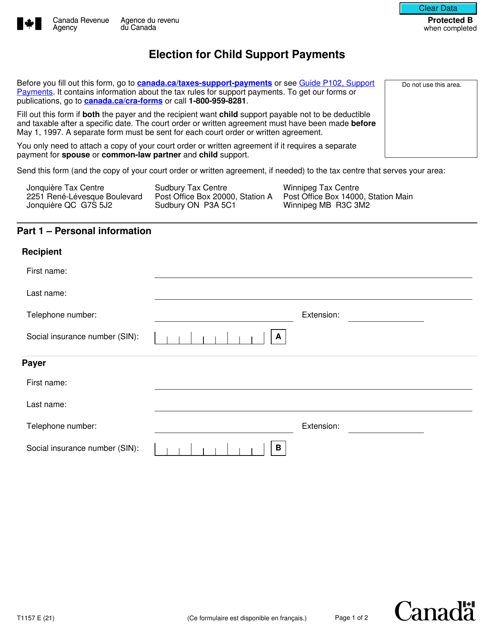

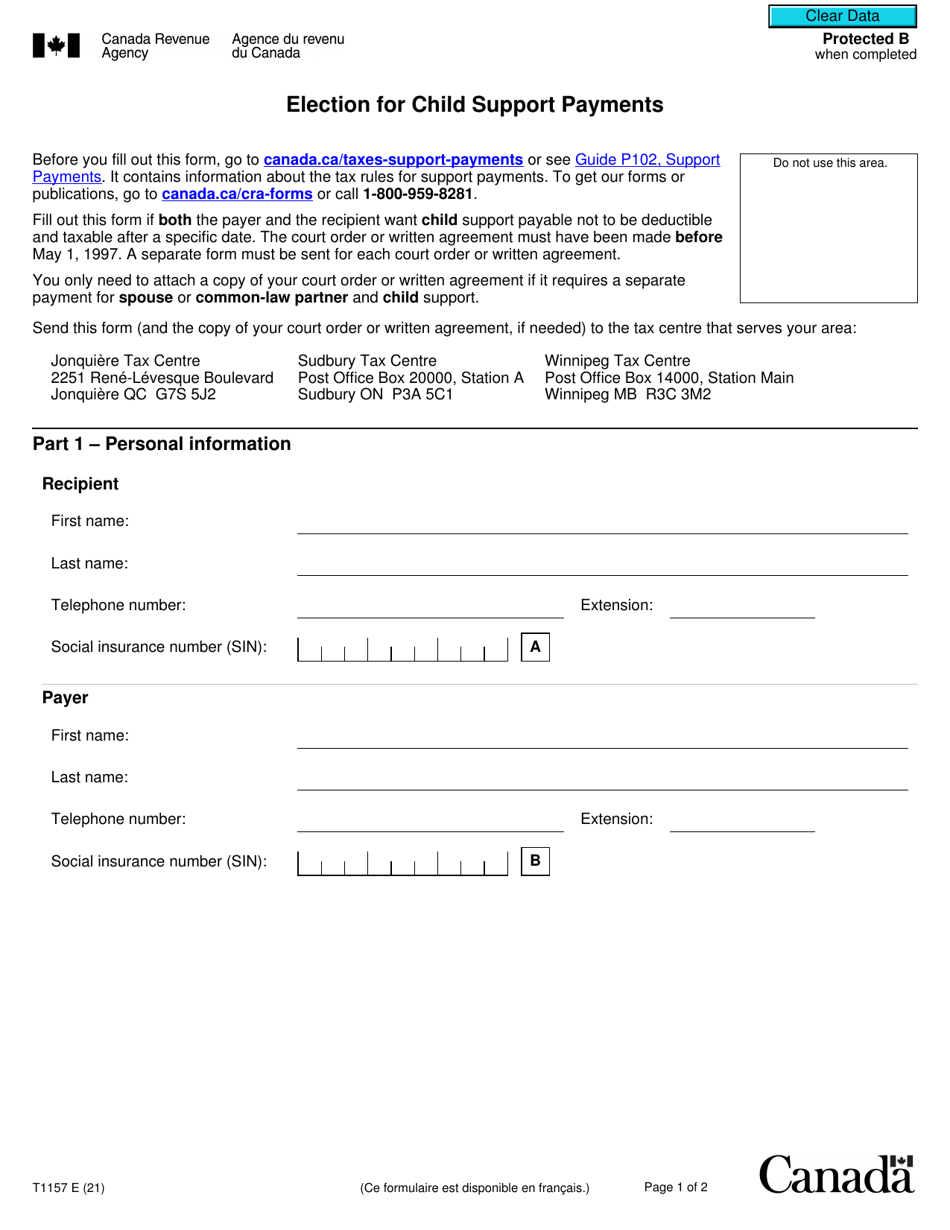

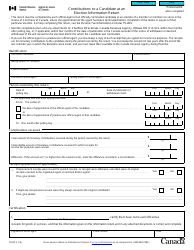

Form T1157

for the current year.

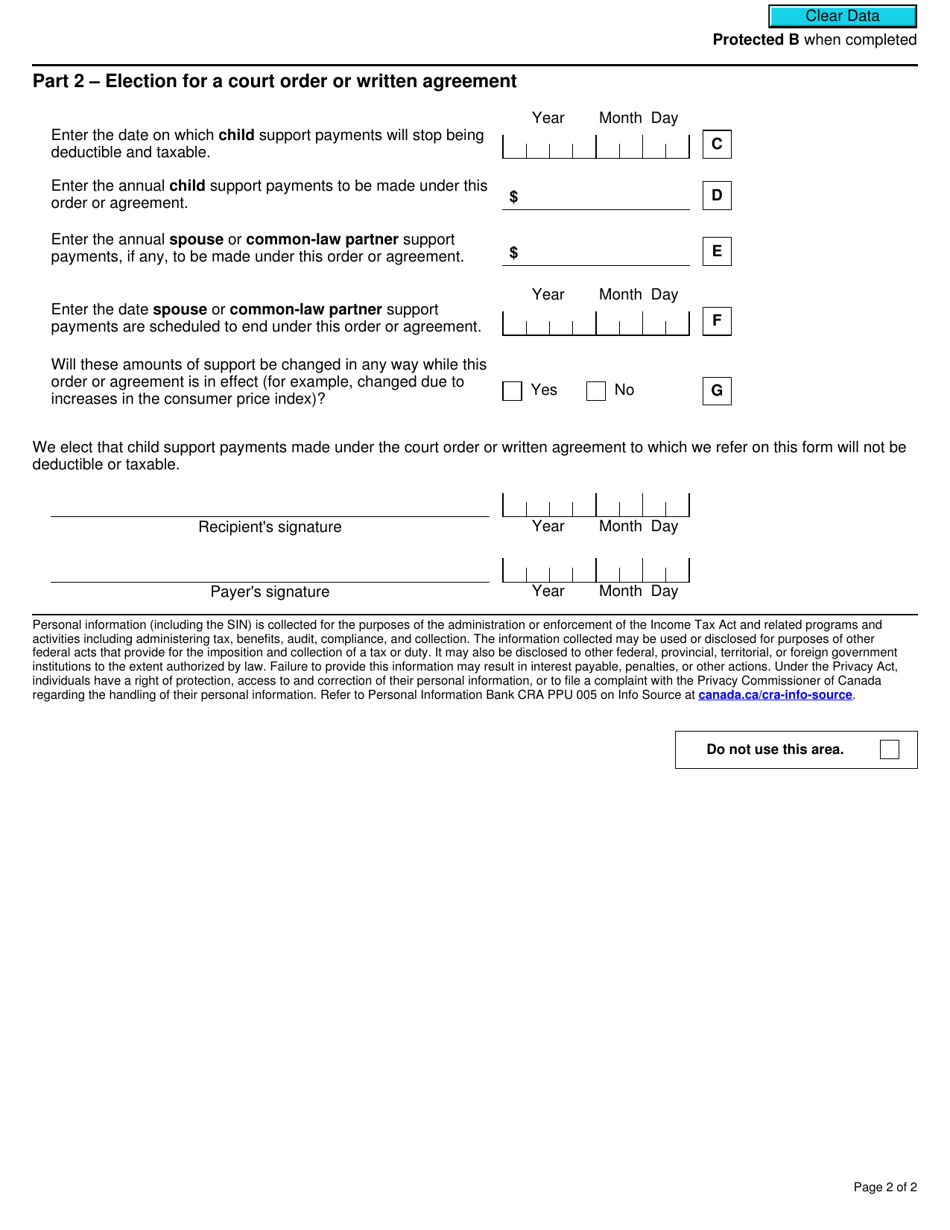

Form T1157 Election for Child Support Payments - Canada

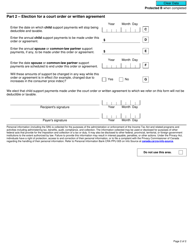

The Form T1157 Election for Child Support Payments in Canada is used to determine if child support payments made by the payer can be deducted for income tax purposes. It allows parents to choose whether to include child support payments as taxable income or claim them as a deduction.

In Canada, the Form T1157 Election for Child Support Payments is filed by the custodial parent who wants to include the child support received as income for tax purposes.

FAQ

Q: What is Form T1157?

A: Form T1157 is a form for Canadian taxpayers to make an election for child support payments.

Q: Who can file Form T1157?

A: Any Canadian taxpayer who is making child support payments can file Form T1157.

Q: What is the purpose of Form T1157?

A: The purpose of Form T1157 is to allow taxpayers to elect to deduct child support payments from their income.

Q: Is Form T1157 mandatory?

A: No, Form T1157 is not mandatory. It is an optional form that taxpayers can use to make an election for child support payments.

Q: When should I file Form T1157?

A: Form T1157 should be filed with your annual tax return for the year in which the child support payments were made.