This version of the form is not currently in use and is provided for reference only. Download this version of

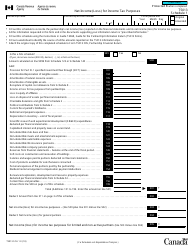

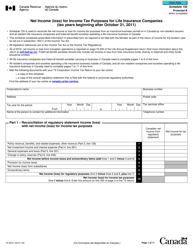

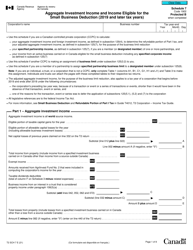

Form T1139

for the current year.

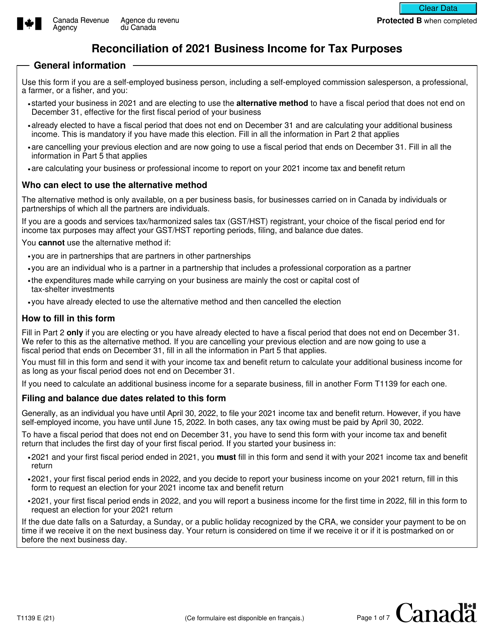

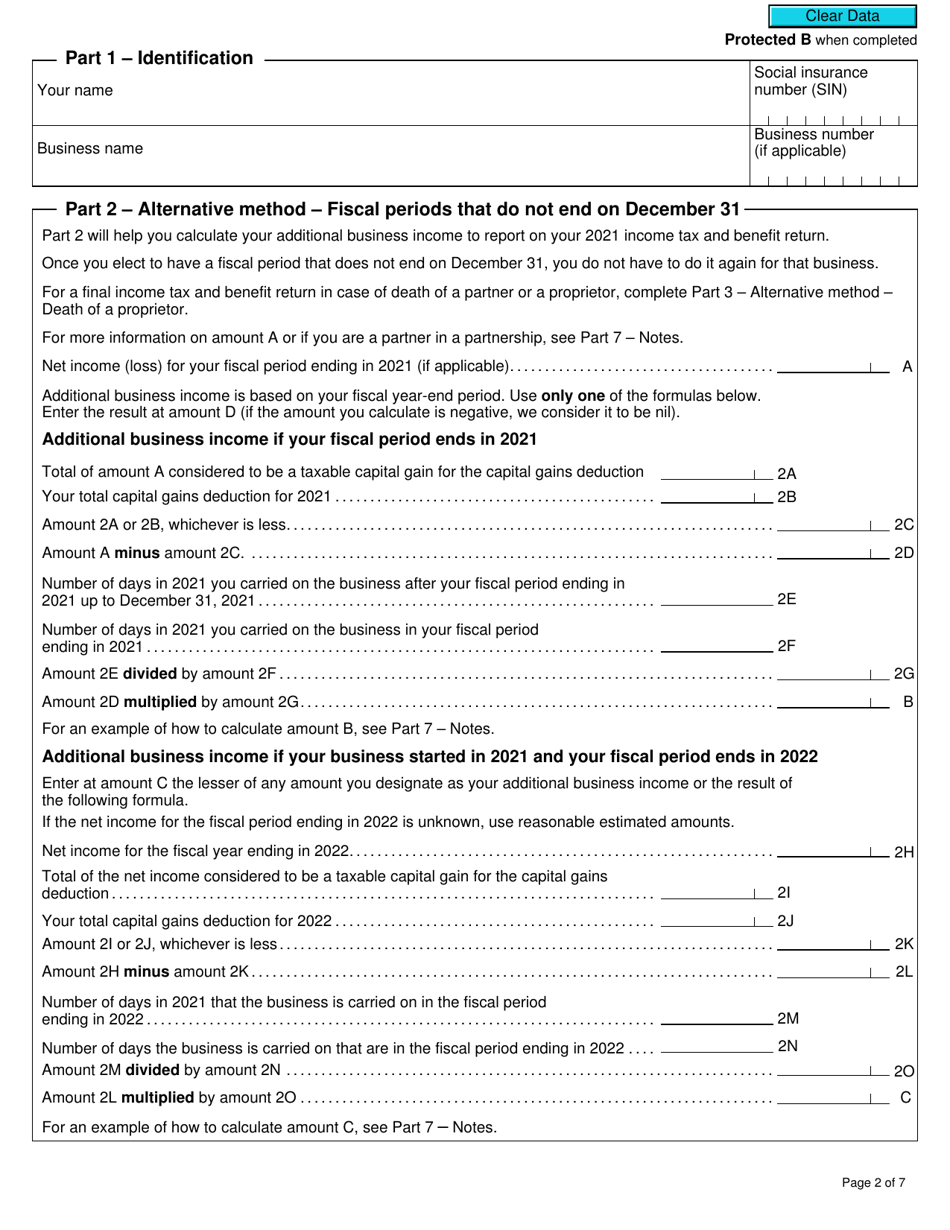

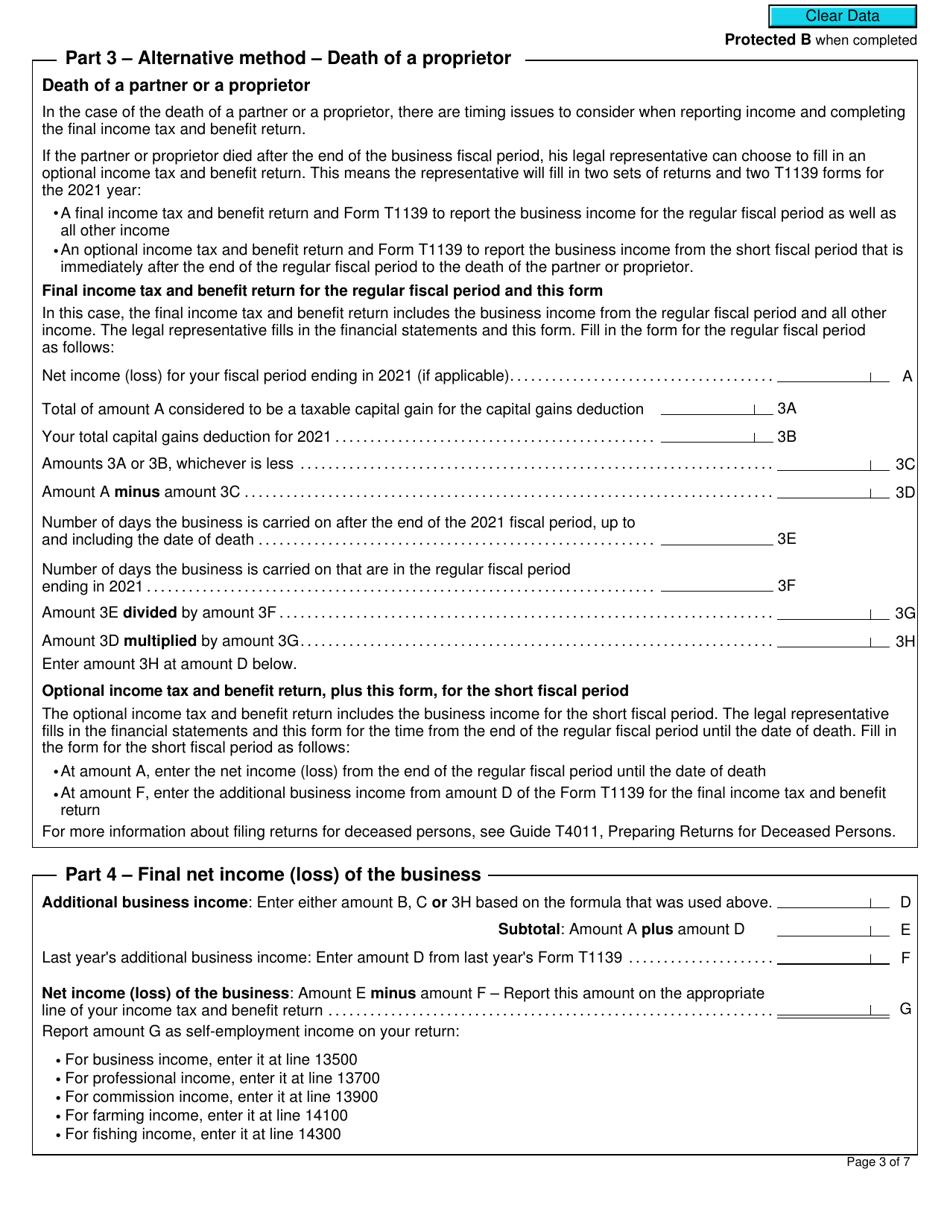

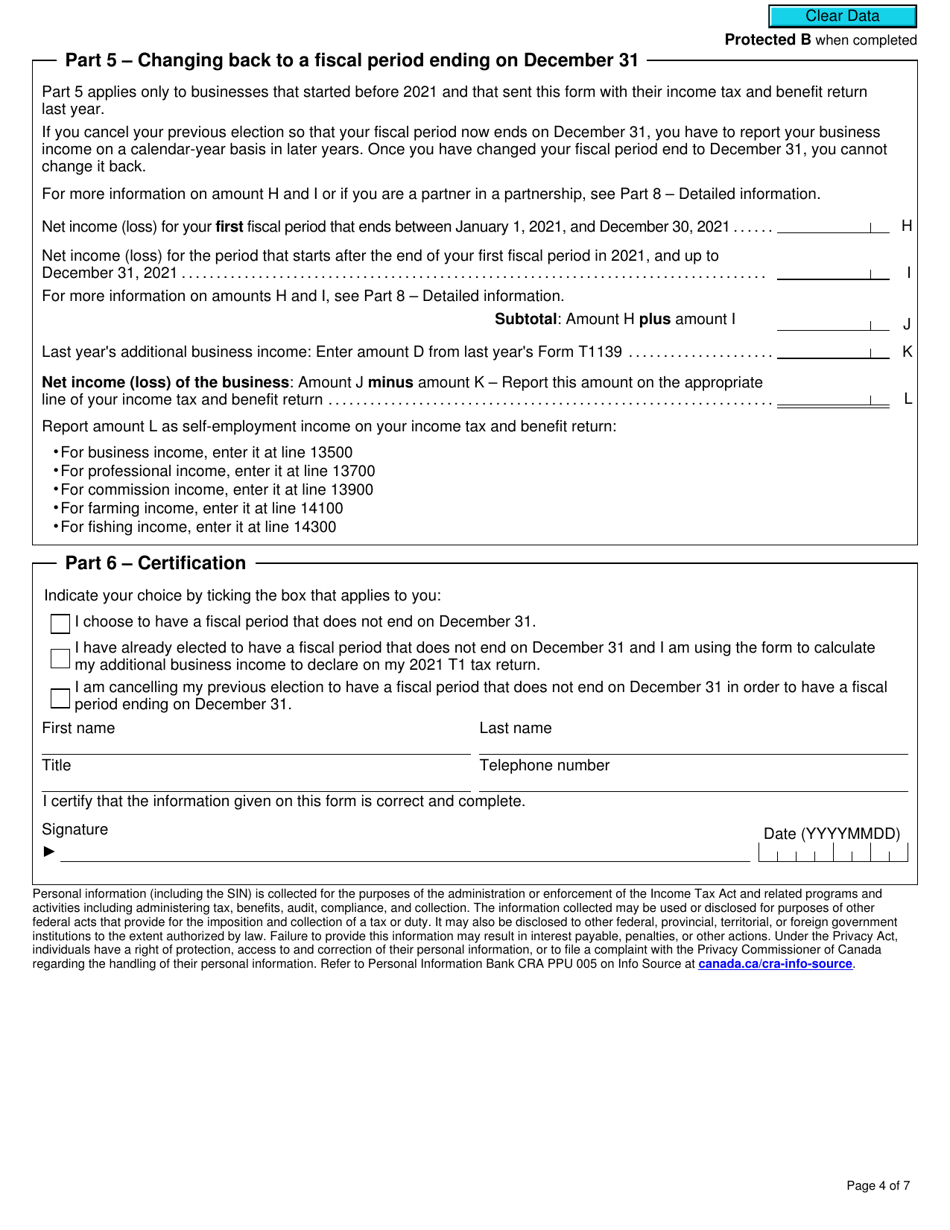

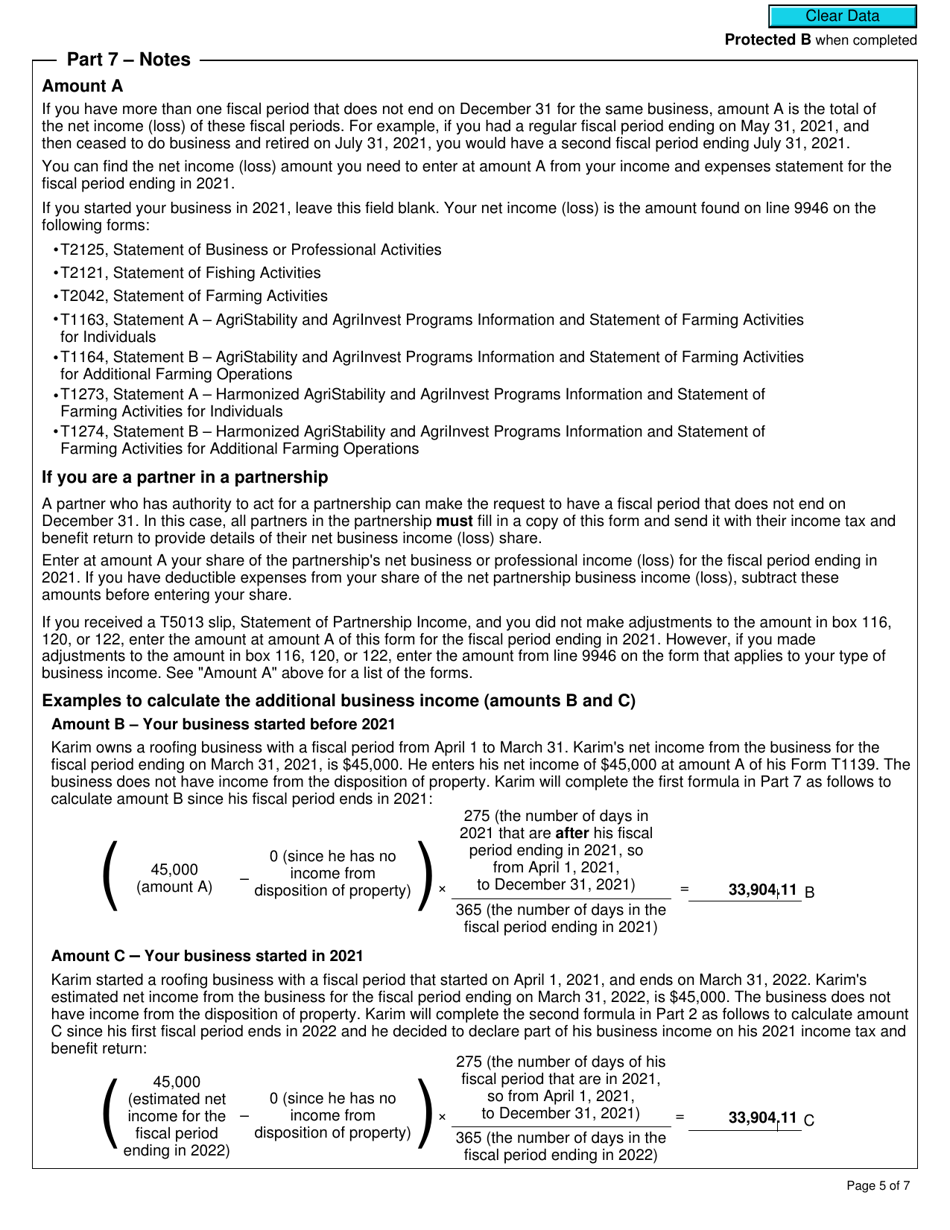

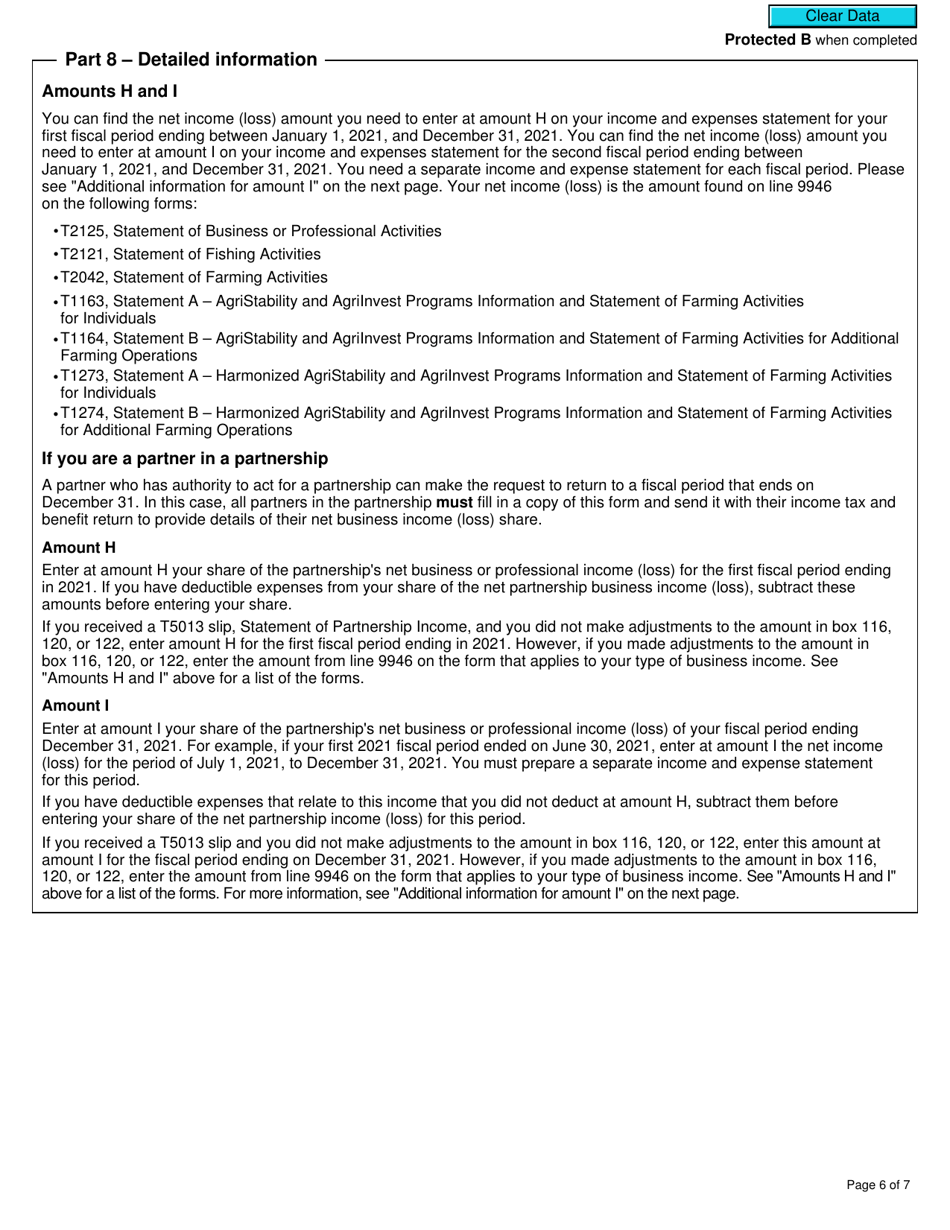

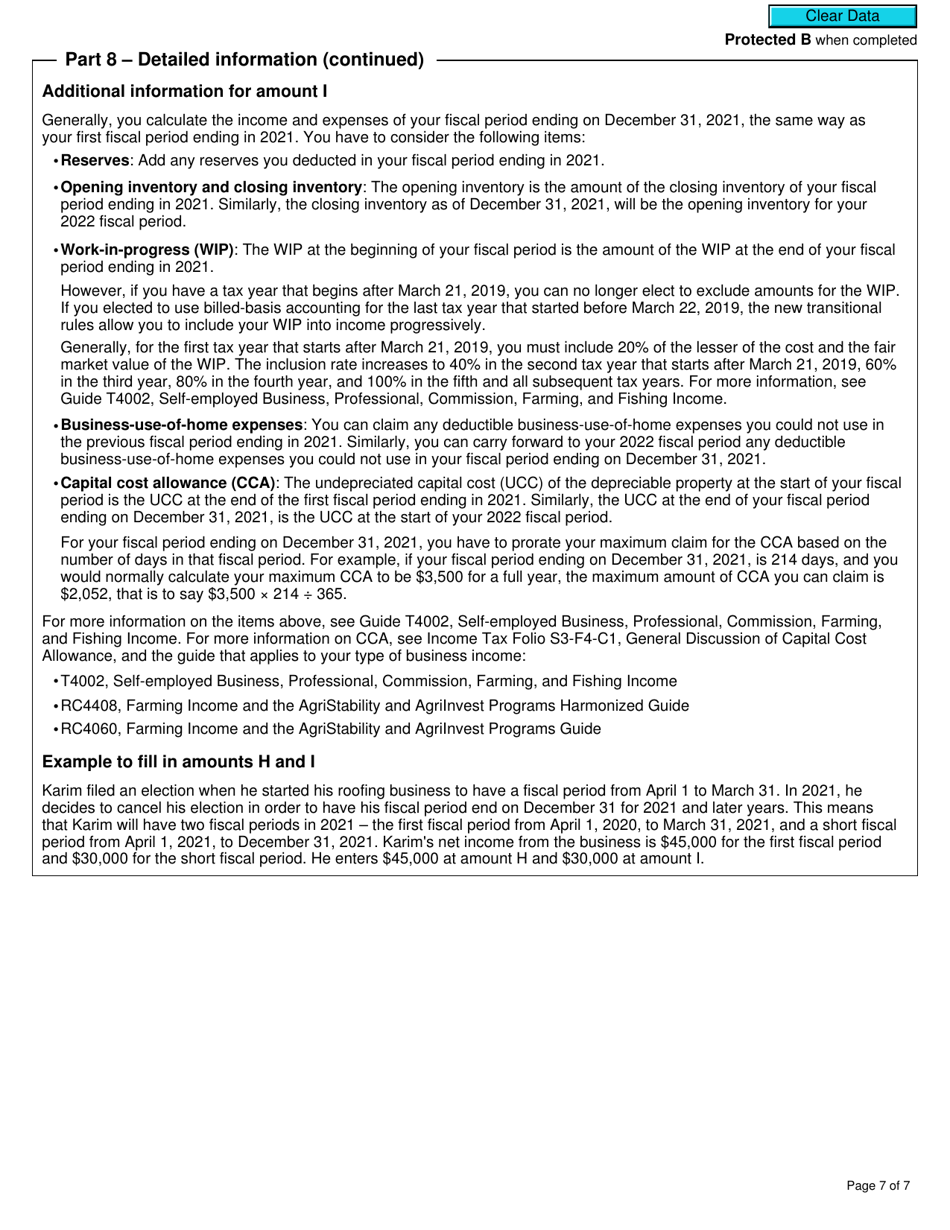

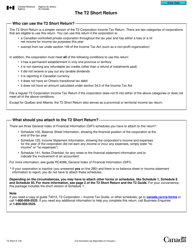

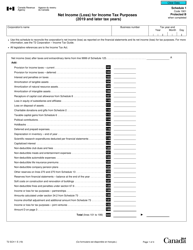

Form T1139 Reconciliation of Business Income for Tax Purposes - Canada

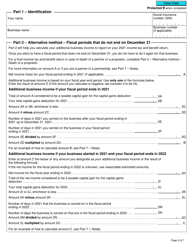

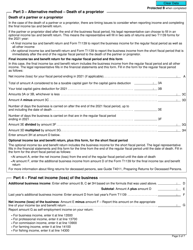

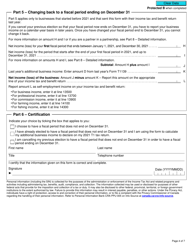

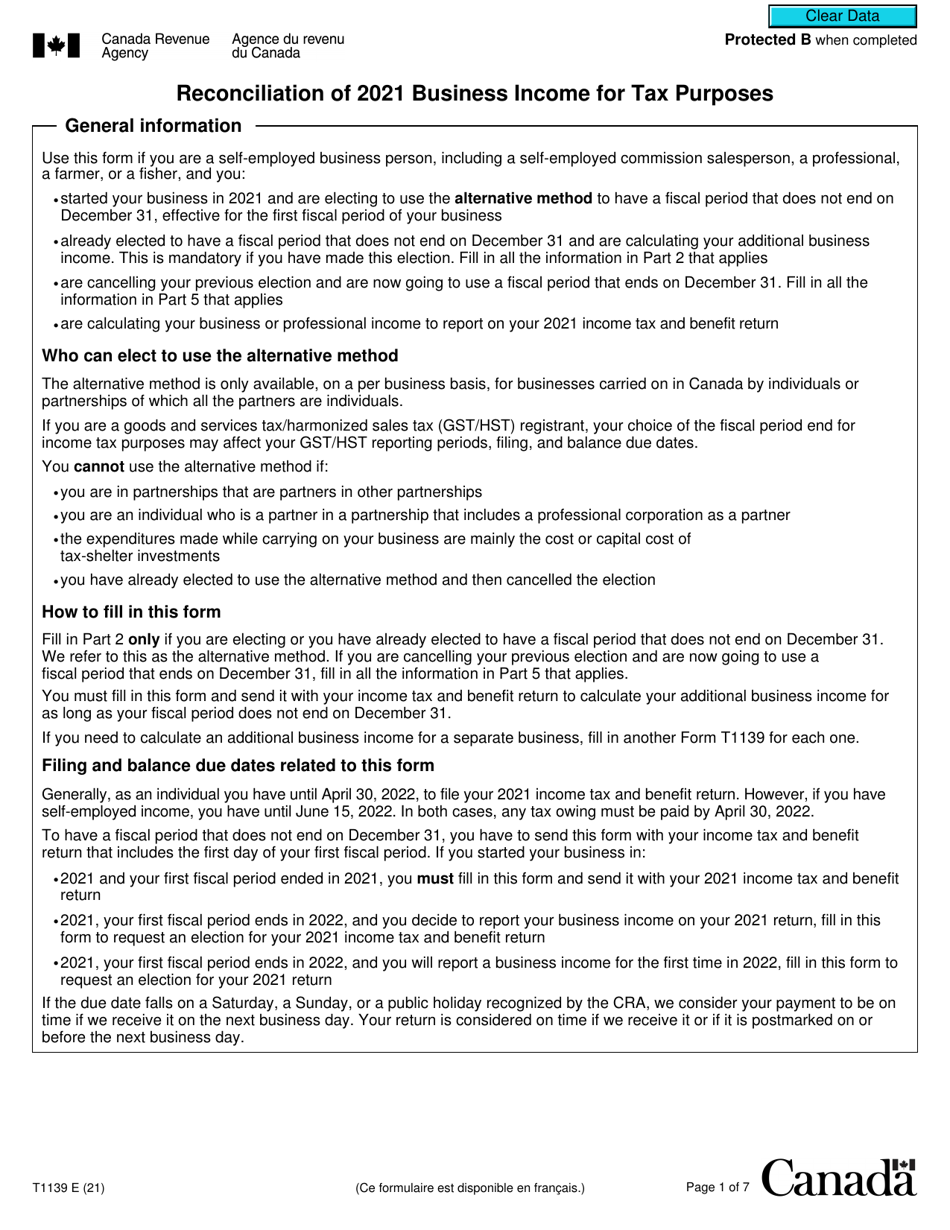

The Form T1139 Reconciliation of Business Income for Tax Purposes in Canada is used to report and reconcile the differences between the financial statement income of a business and its income for tax purposes. It helps ensure that businesses accurately calculate their taxable income and comply with Canadian tax laws.

The Form T1139 Reconciliation of Business Income for Tax Purposes in Canada is filed by corporations and self-employed individuals.

FAQ

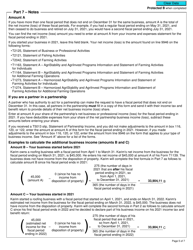

Q: What is Form T1139?

A: Form T1139 is a reconciliation form used in Canada to report and reconcile business income for tax purposes.

Q: Who needs to file Form T1139?

A: Canadian taxpayers who have business income and need to reconcile it for tax purposes must file Form T1139.

Q: What is the purpose of Form T1139?

A: The purpose of Form T1139 is to reconcile the business income reported on the taxpayer's income tax return with the income reported on their financial statements.

Q: When is Form T1139 due?

A: Form T1139 is generally due on the same date as the taxpayer's income tax return, which is generally April 30th for individuals and June 15th for self-employed individuals.

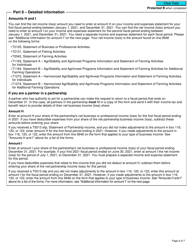

Q: Are there any penalties for not filing Form T1139?

A: Yes, there may be penalties and interest charges for failing to file Form T1139 or for filing it late. It is important to file the form on time to avoid potential penalties.

Q: Do I need to include supporting documents with Form T1139?

A: Yes, it is important to include supporting documents such as financial statements and schedules that reconcile the business income reported on Form T1139.

Q: What if I need help filling out Form T1139?

A: If you need assistance filling out Form T1139, you can contact the CRA directly or consult a tax professional for guidance and support.

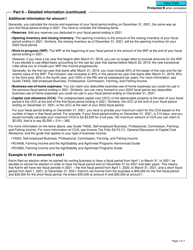

Q: Can I amend my Form T1139 if I make a mistake?

A: Yes, if you make a mistake on Form T1139, you can file an amended form to correct the error. It is important to do so as soon as possible to ensure accurate reporting.