This version of the form is not currently in use and is provided for reference only. Download this version of

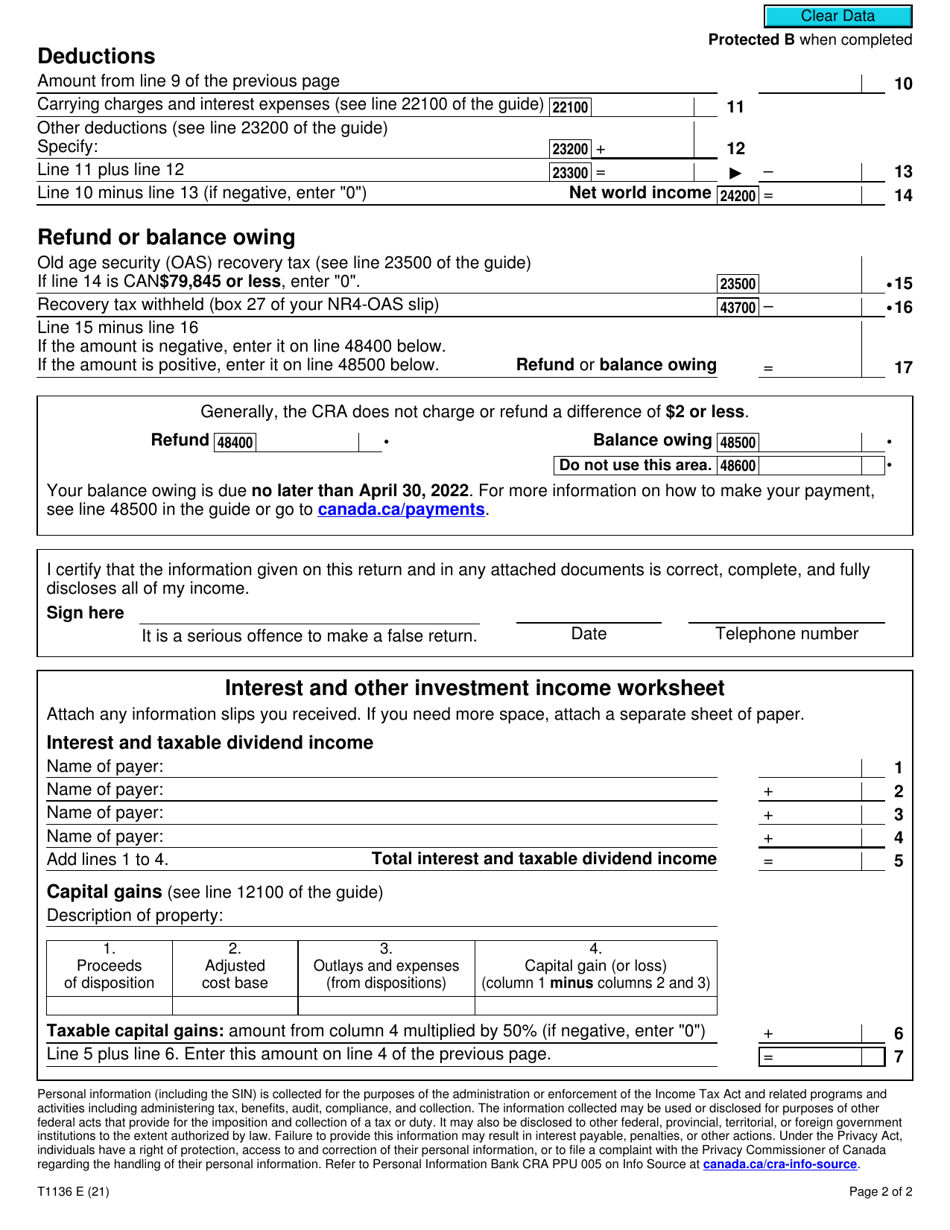

Form T1136

for the current year.

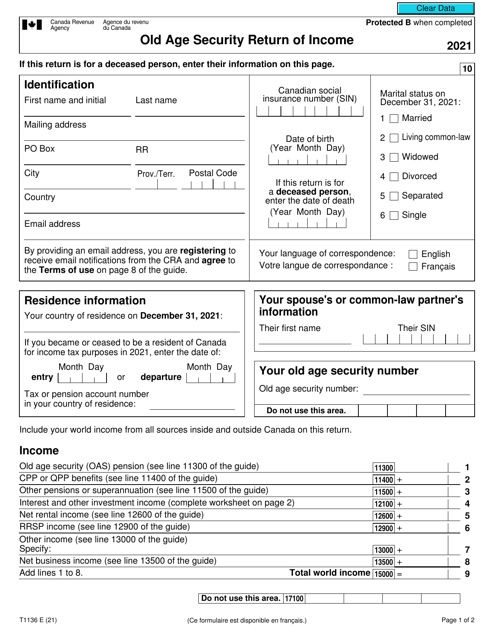

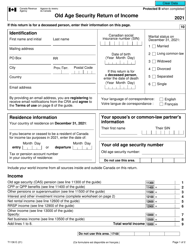

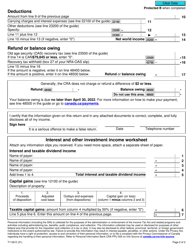

Form T1136 Old Age Security Return of Income - Canada

Form T1136 Old Age Security Return of Income in Canada is used to report your income for the purpose of determining eligibility and calculating the amount of Old Age Security (OAS) benefits you are entitled to receive. It helps the government keep track of your income and ensure the correct amount of OAS benefits are being provided to you.

The Form T1136 Old Age Security Return of Income in Canada is typically filed by individuals who receive the Old Age Security (OAS) pension and have to report their income for taxation purposes.

FAQ

Q: What is Form T1136?

A: Form T1136 is the Old Age Security Return of Income form in Canada.

Q: Who needs to file Form T1136?

A: Anyone who receives Old Age Security benefits in Canada and has a net income above a certain threshold needs to file Form T1136.

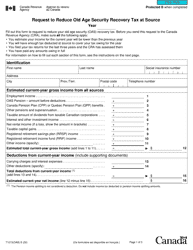

Q: What is the purpose of Form T1136?

A: The purpose of Form T1136 is to report your income to the Canada Revenue Agency (CRA) in order to determine if any of your Old Age Security benefits are subject to a recovery tax.

Q: When is Form T1136 due?

A: Form T1136 is due on April 30th of the following year, just like regular income tax returns in Canada.

Q: What happens if I don't file Form T1136?

A: If you are required to file Form T1136 and fail to do so, your Old Age Security benefits may be temporarily reduced or withheld until the form is filed and assessed by the CRA.

Q: Can I file Form T1136 electronically?

A: Yes, you can file Form T1136 electronically using the CRA's Netfile service or through approved tax software.

Q: Do I need to include documentation with Form T1136?

A: In most cases, you do not need to include documentation with Form T1136. However, you should keep all relevant documents for at least six years in case the CRA requests them for verification.

Q: What if I have questions or need help with Form T1136?

A: If you have questions or need help with Form T1136, you can contact the Canada Revenue Agency directly or seek assistance from a tax professional.