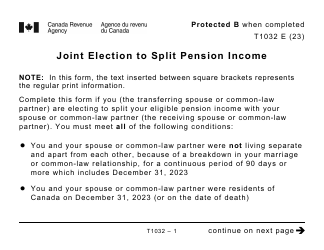

Form T1032 Joint Election to Split Pension Income - Large Print - Canada

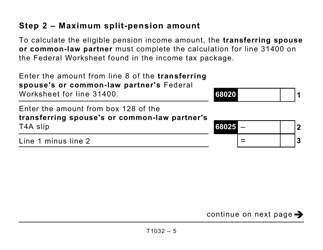

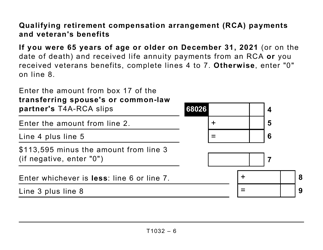

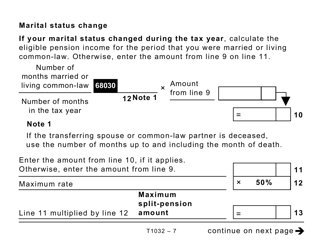

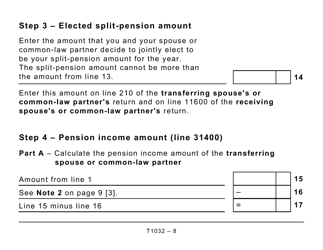

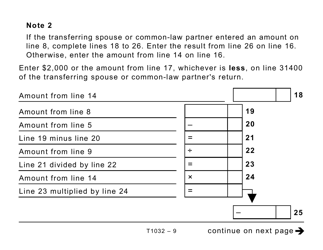

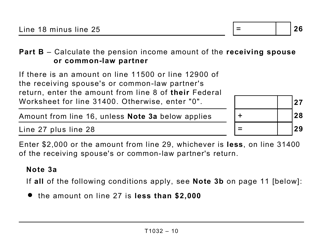

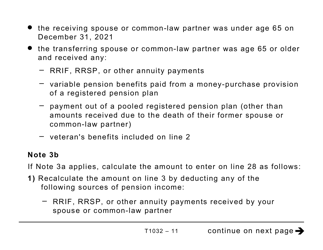

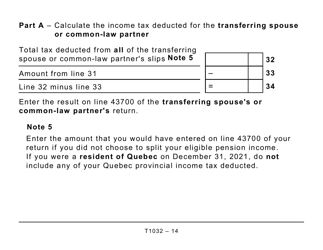

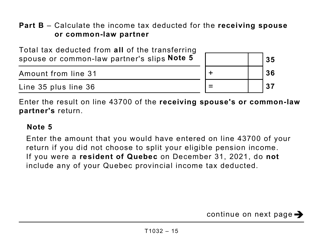

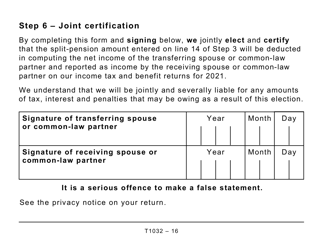

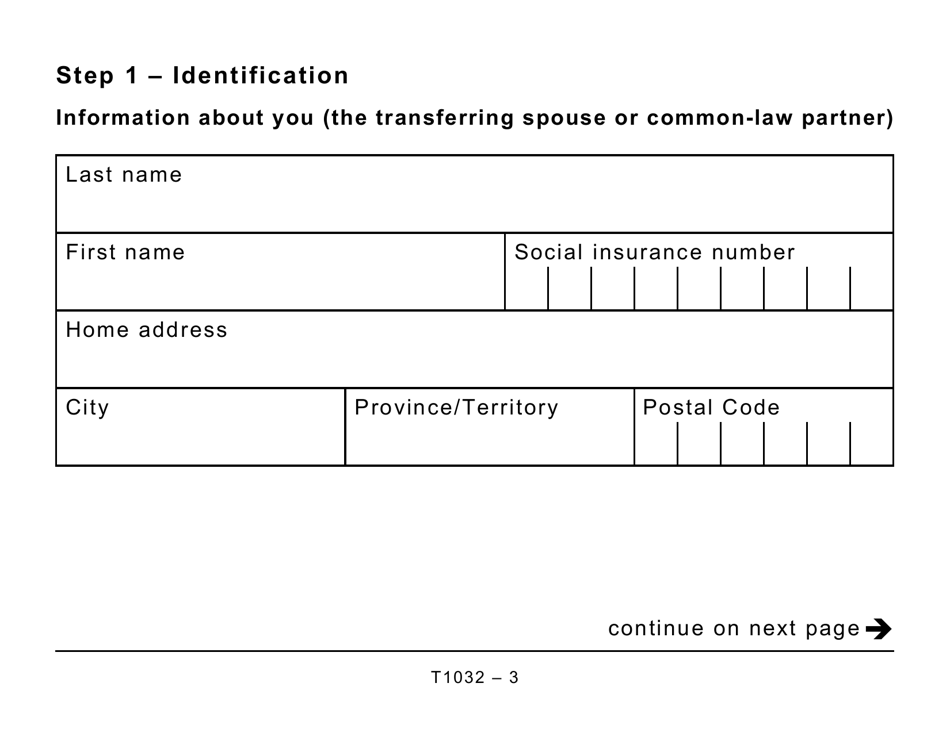

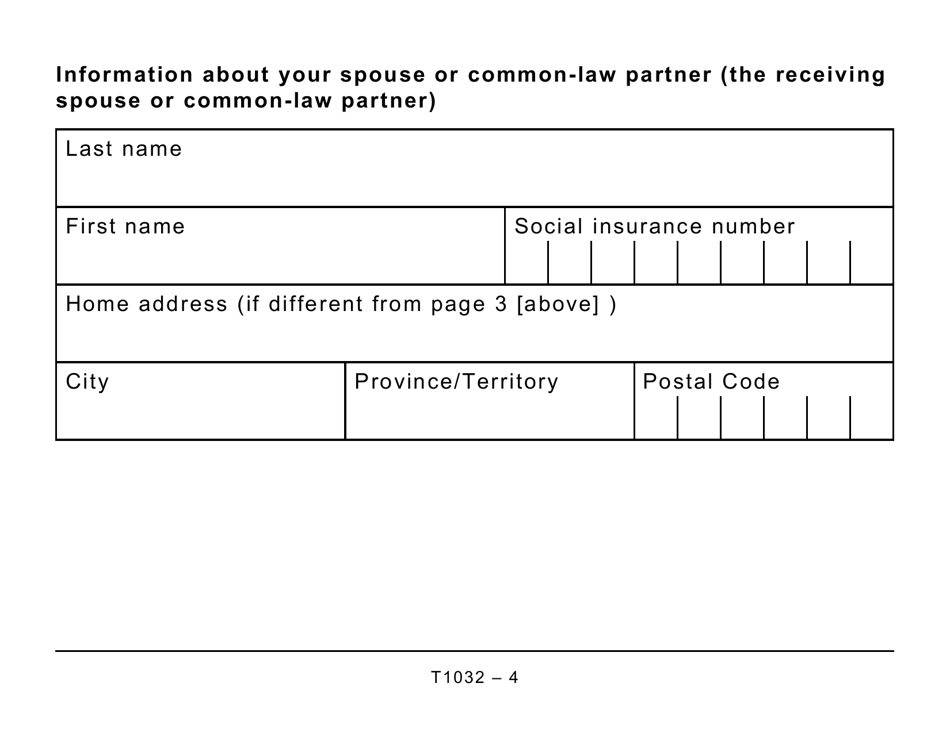

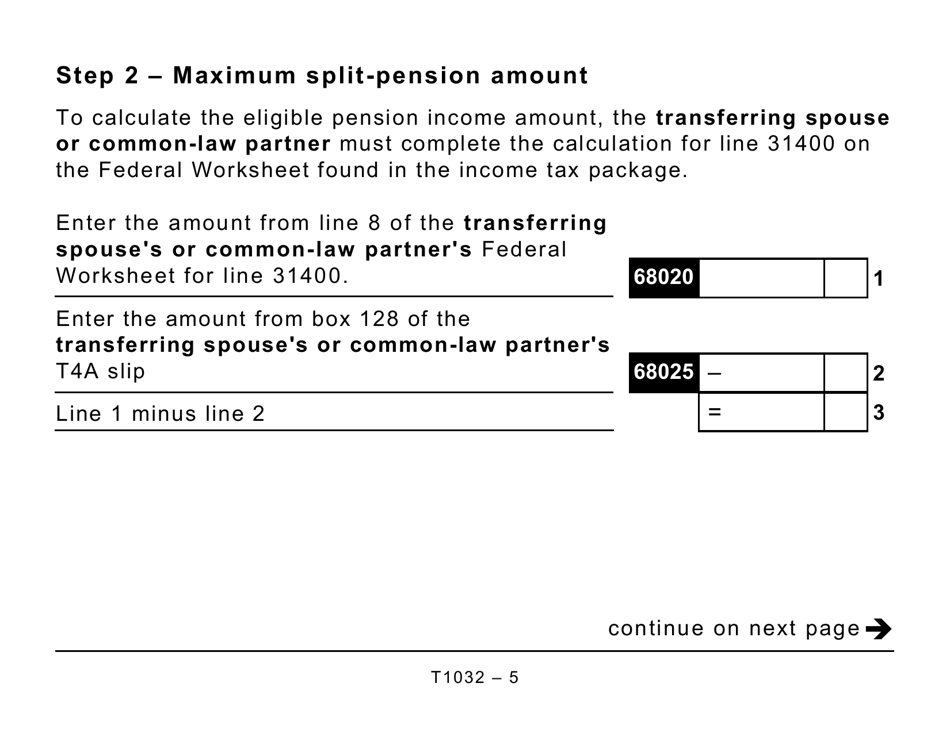

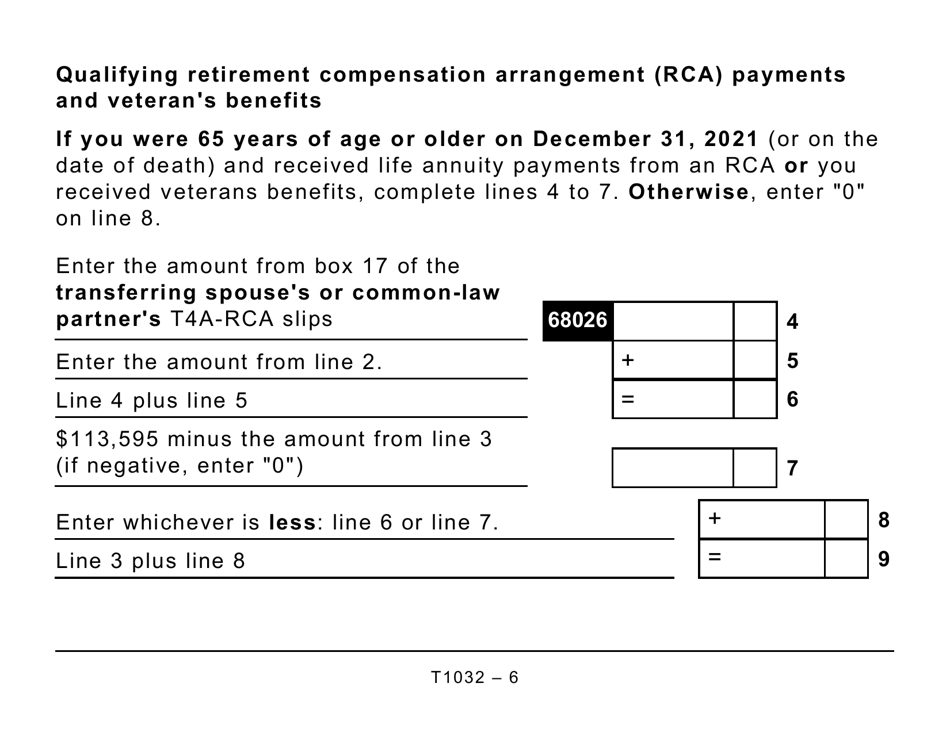

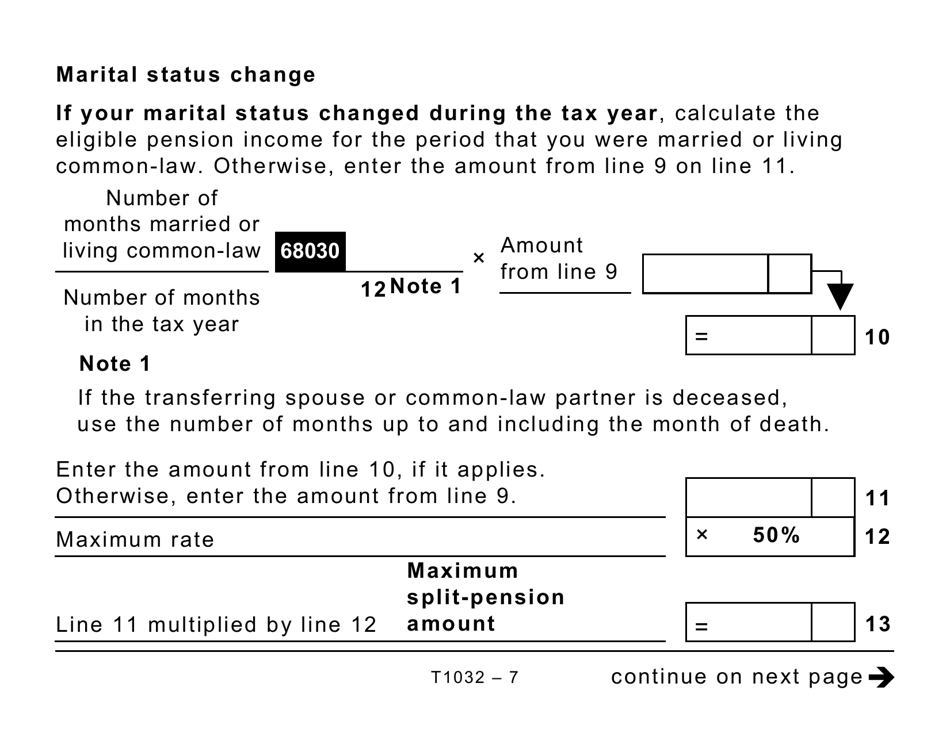

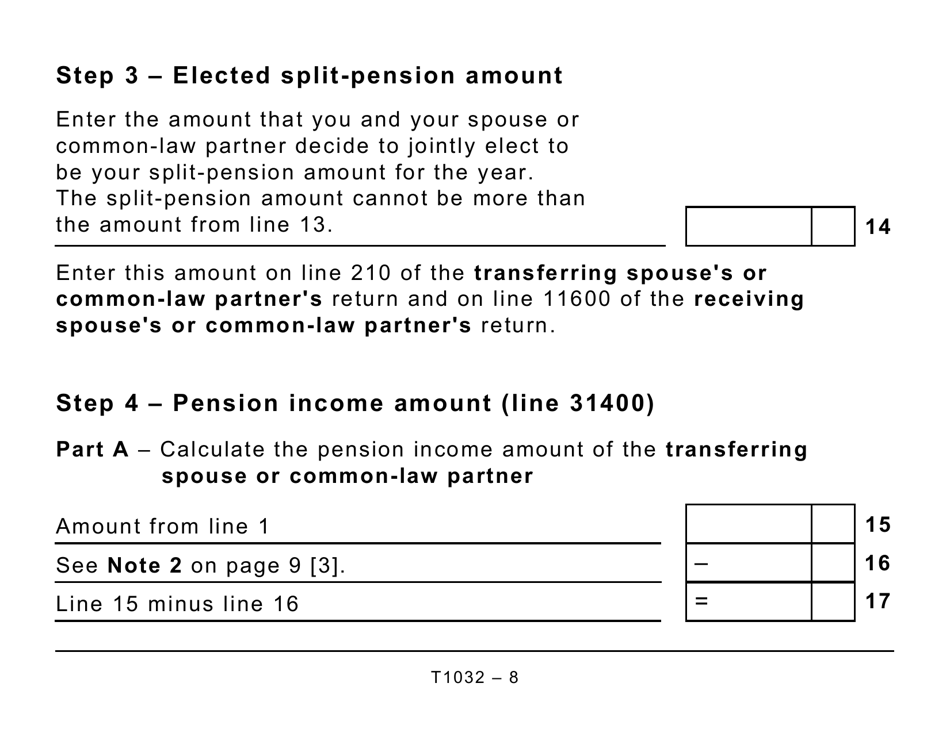

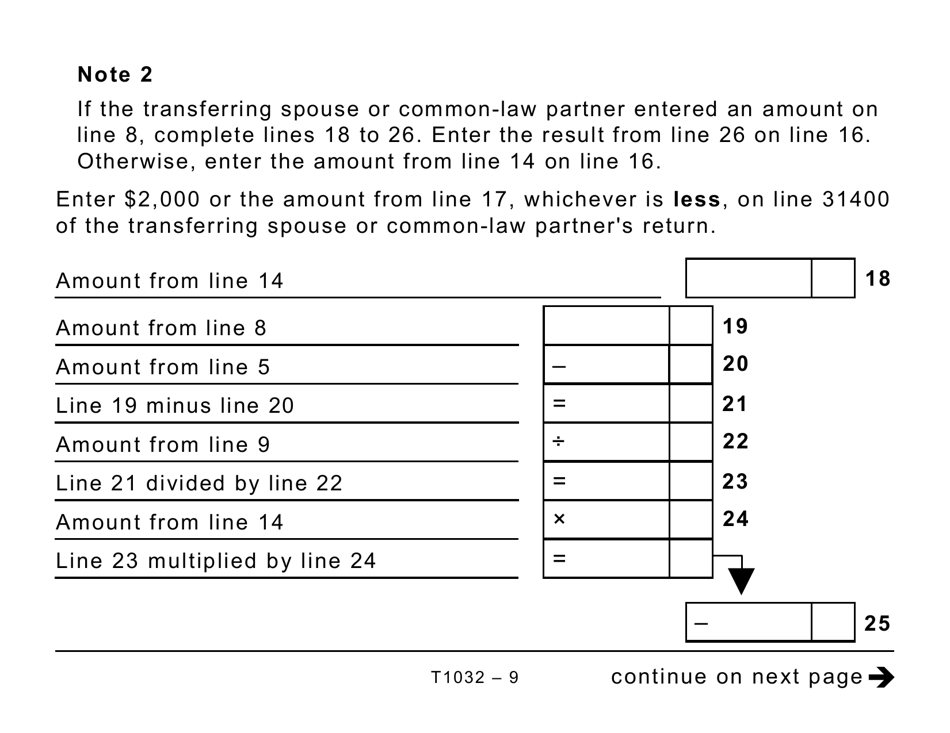

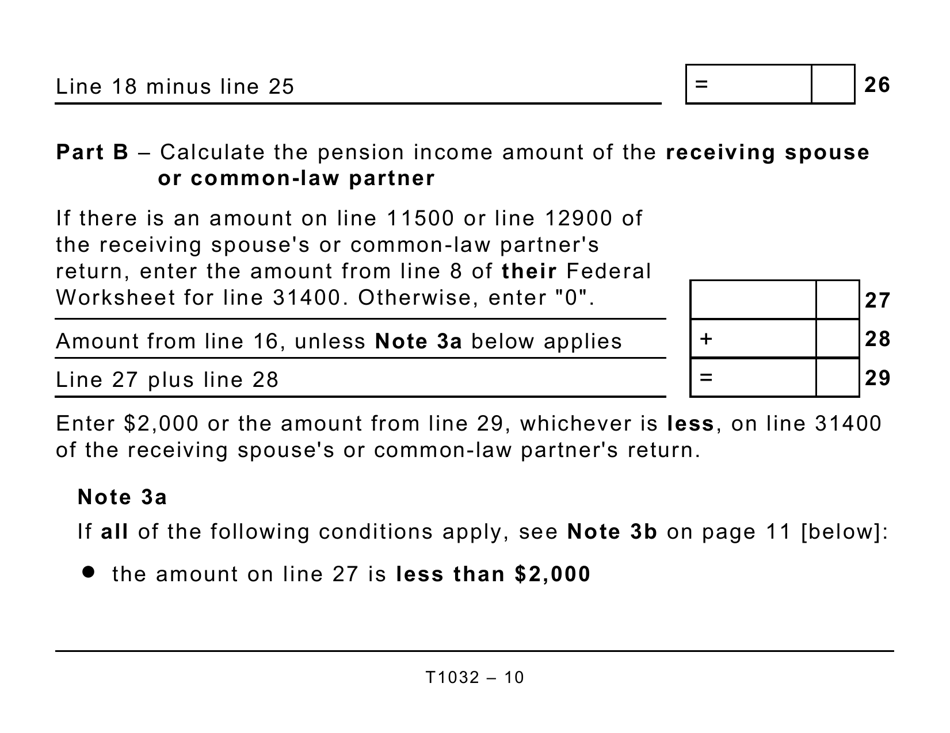

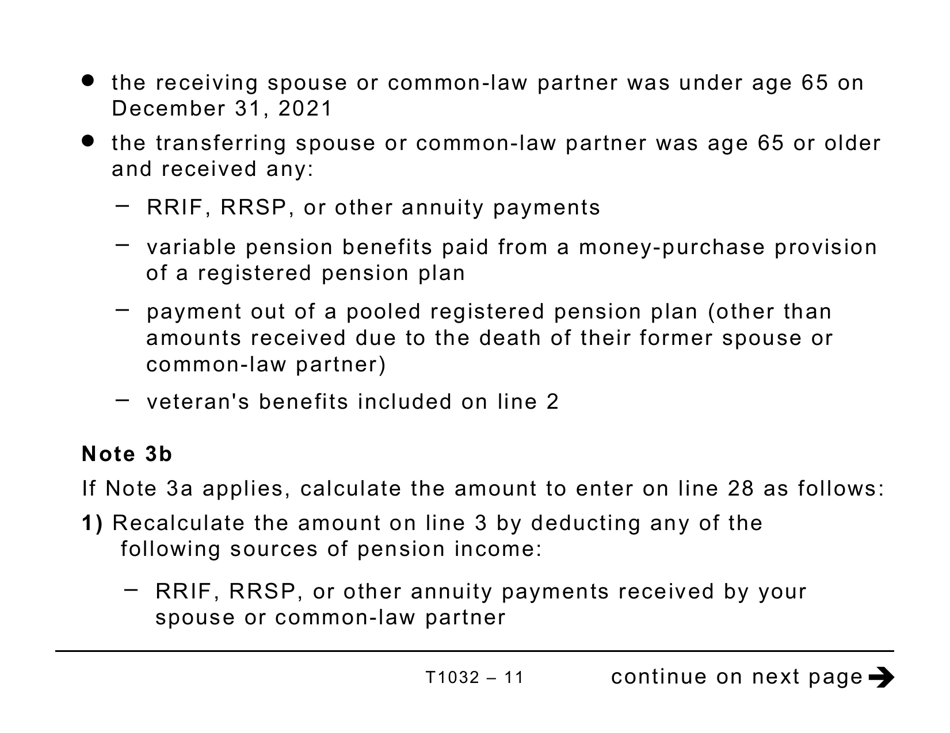

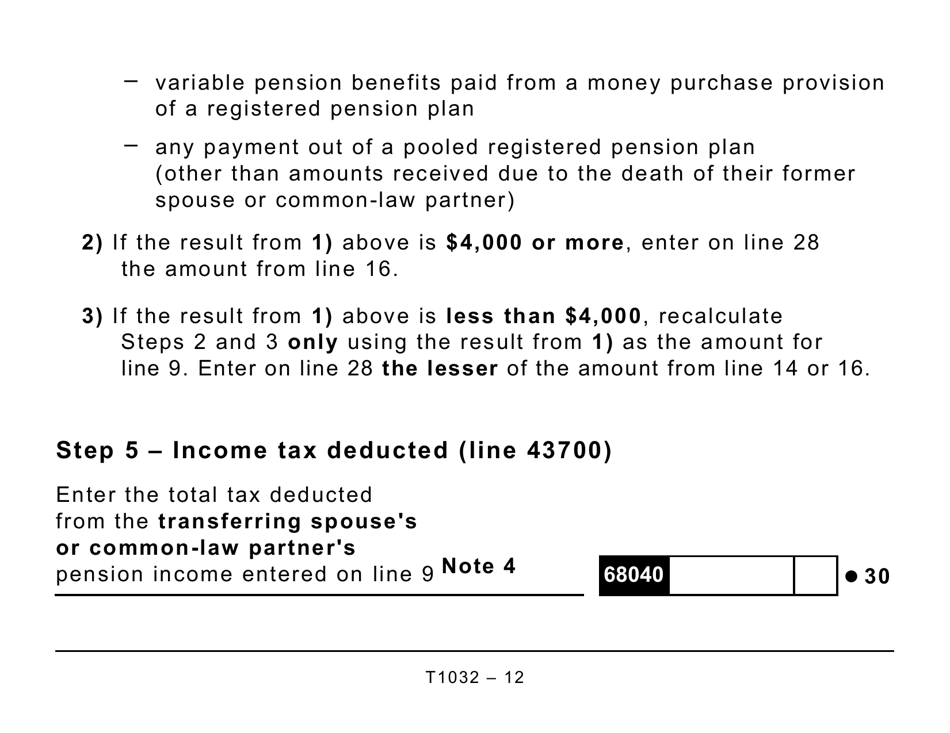

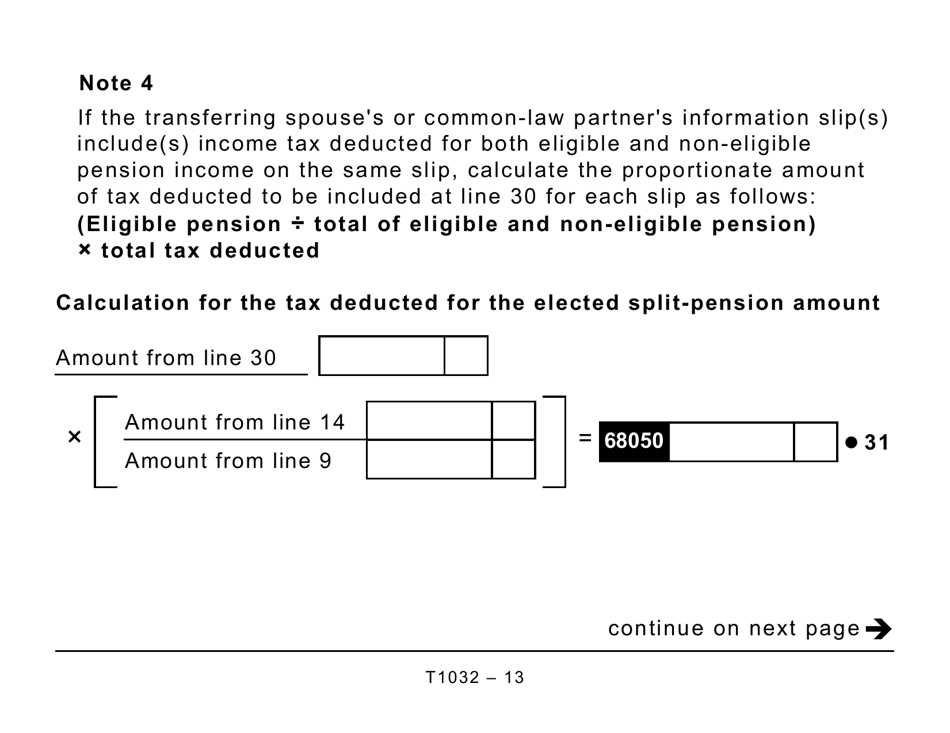

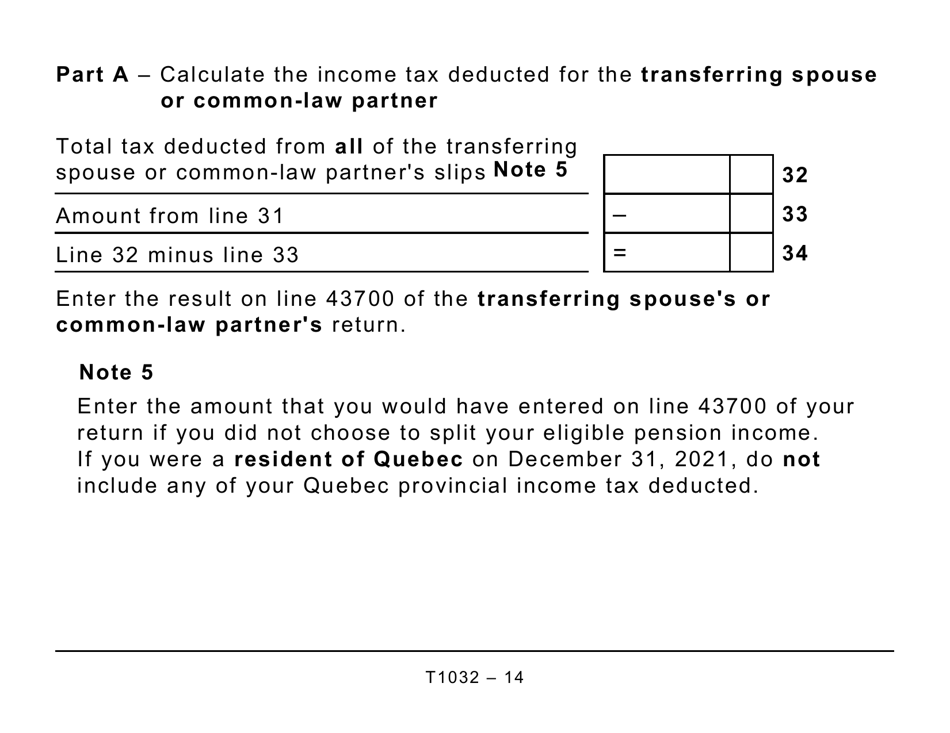

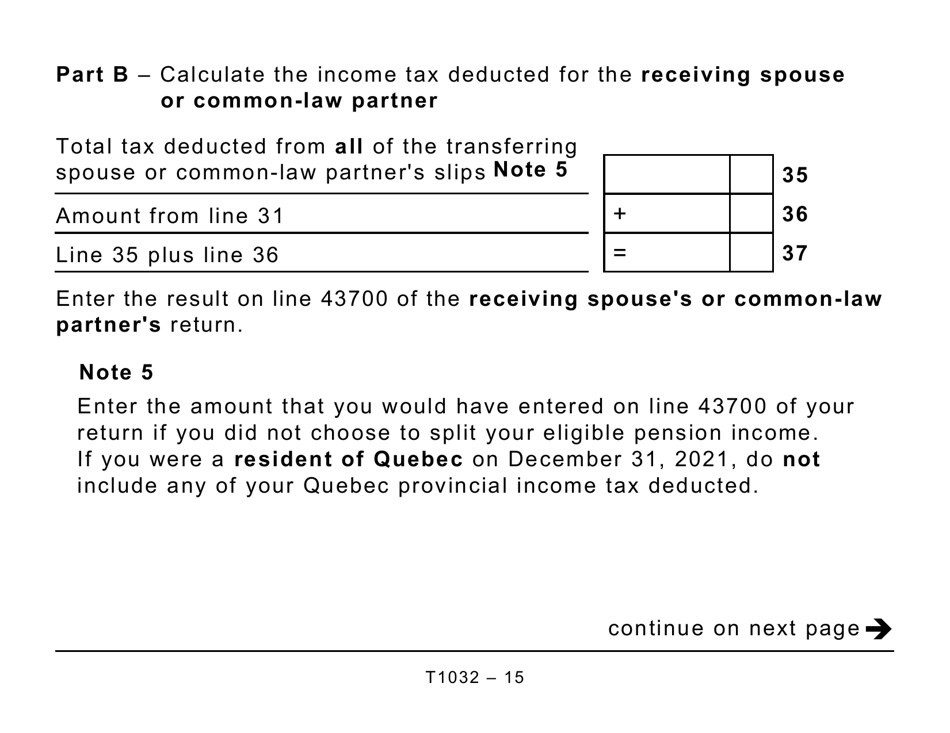

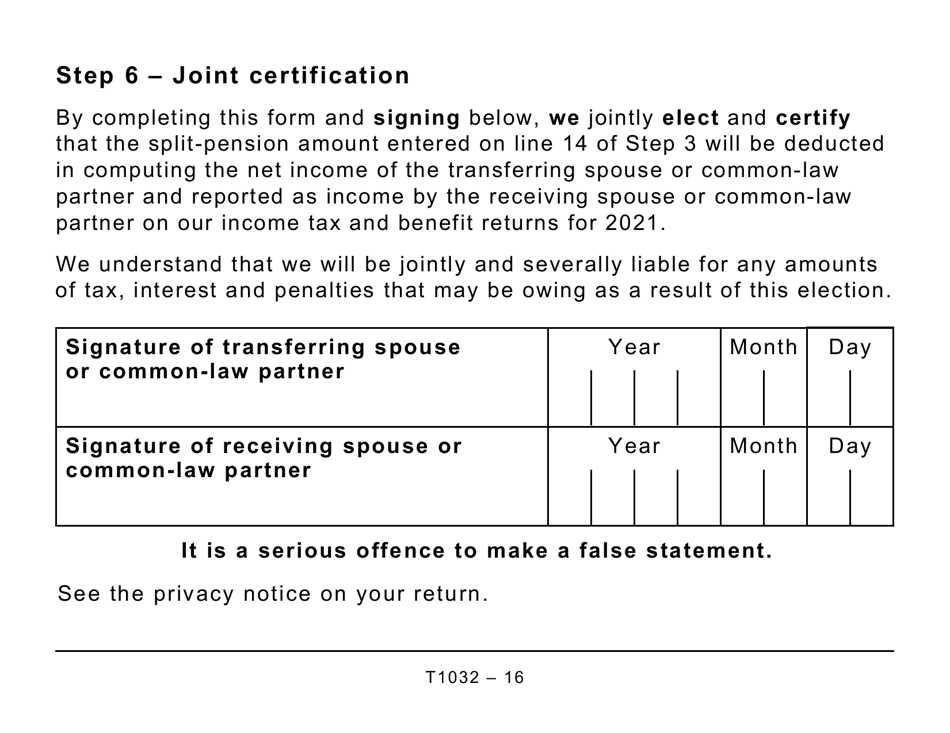

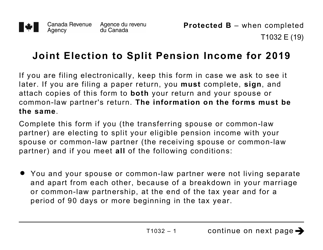

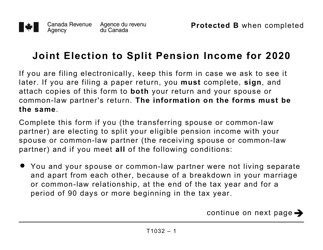

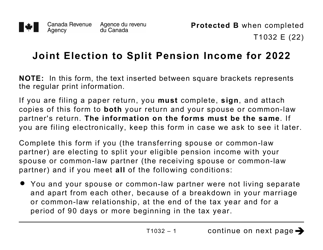

Form T1032 Joint Election to Split Pension Income - Large Print in Canada is used to elect to split pension income between you and your spouse or common-law partner. This form allows you to allocate a portion of your eligible pension income to your spouse or partner, which can help reduce your overall tax liability.

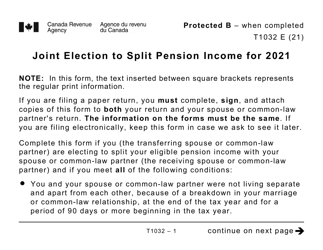

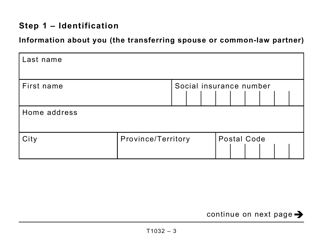

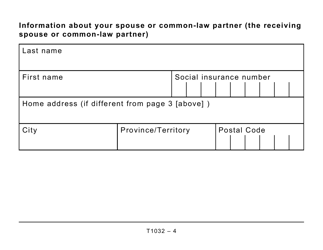

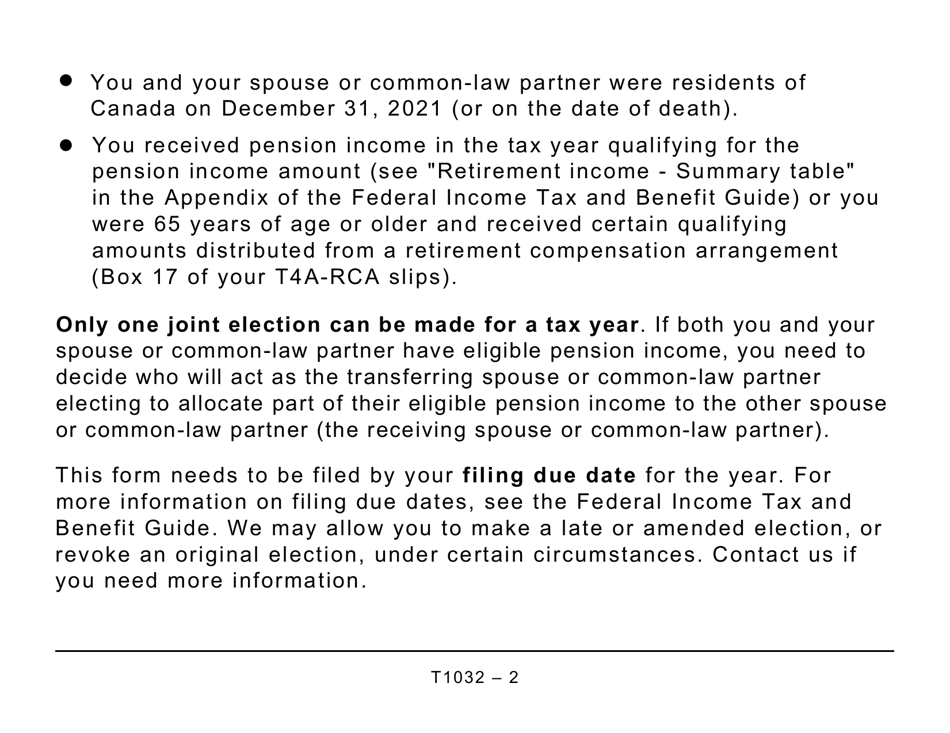

The Form T1032 Joint Election to Split Pension Income - Large Print in Canada is typically filed by both the pension recipient and their spouse or common-law partner.

FAQ

Q: What is Form T1032?

A: Form T1032 is a document used in Canada for making a joint election to split pension income.

Q: What is the purpose of Form T1032?

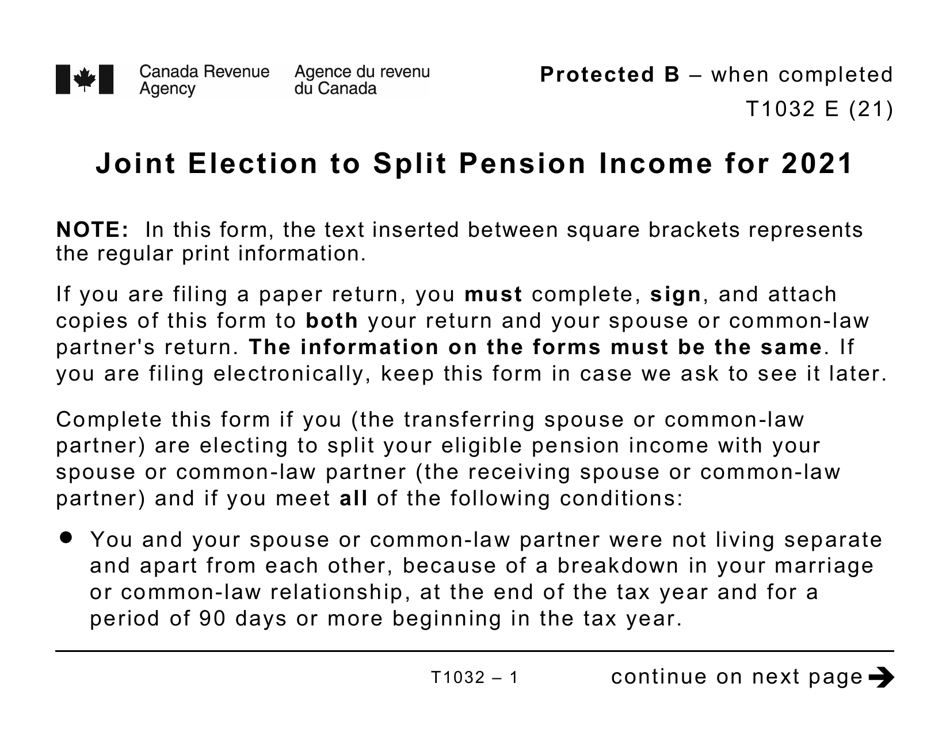

A: The purpose of Form T1032 is to allow eligible pensioners to split their pension income with their spouse or common-law partner.

Q: Who can use Form T1032?

A: Form T1032 can be used by Canadian pensioners who are eligible to split their pension income with their spouse or common-law partner.

Q: What is pension income splitting?

A: Pension income splitting is a tax strategy that allows eligible pensioners to allocate a portion of their pension income to their spouse or common-law partner for tax purposes.

Q: What are the benefits of pension income splitting?

A: Pension income splitting can help reduce the overall tax liability of a couple by transferring income from one spouse to another, potentially lowering the total tax owed.

Q: Is there a deadline for filing Form T1032?

A: Yes, Form T1032 should be filed with your annual income tax return for the year in which you want to split your pension income.

Q: Do I need to submit any supporting documents with Form T1032?

A: Typically, you do not need to submit any supporting documents with Form T1032. However, it is always a good idea to keep records and supporting documentation in case of an audit or review by the CRA.

Q: Can I use Form T1032 if I receive other types of income besides pensions?

A: No, Form T1032 specifically applies to pension income. If you receive other types of income, you may need to use different forms or methods to split that income.

Q: Is pension income splitting available in the United States?

A: No, pension income splitting is a tax strategy specific to Canada and is not available in the United States.