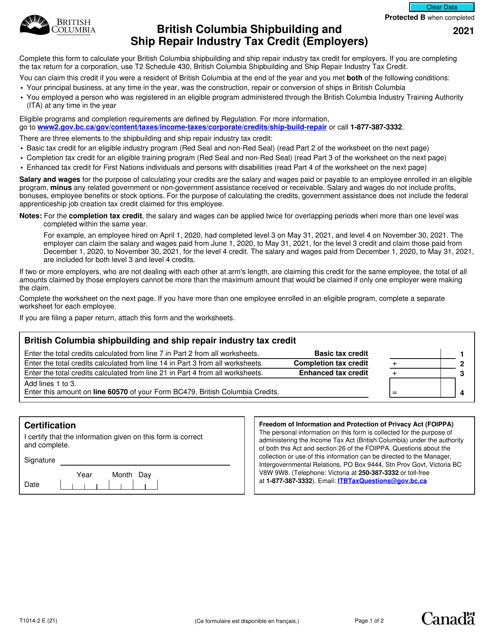

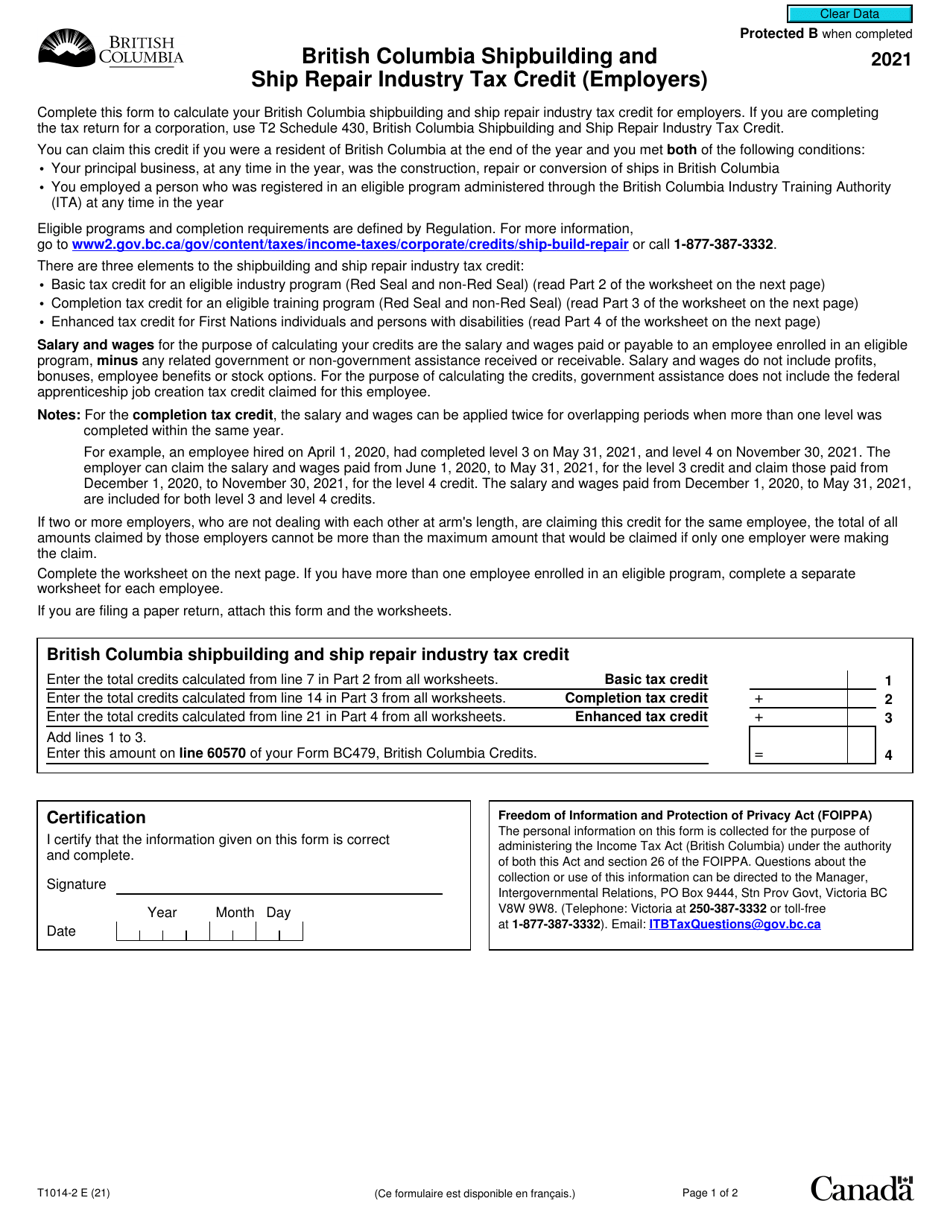

This version of the form is not currently in use and is provided for reference only. Download this version of

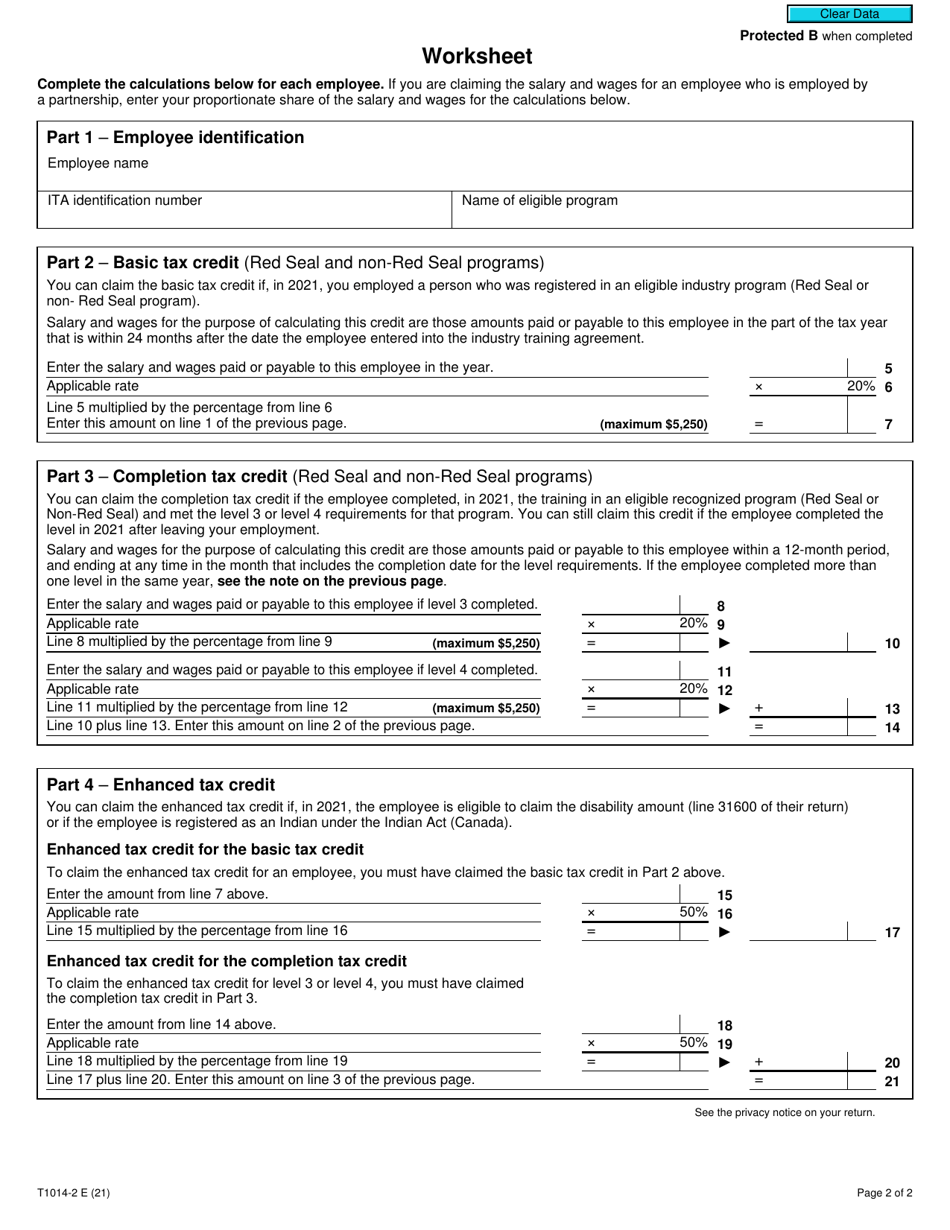

Form T1014-2

for the current year.

Form T1014-2 British Columbia Shipbuilding and Ship Repair Industry Tax Credit (Employers) - Canada

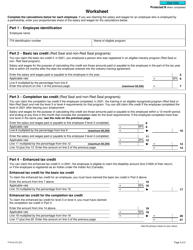

The Form T1014-2 is a tax credit form specifically for employers in the British Columbia Shipbuilding and Ship Repair Industry in Canada. It is used to claim tax credits related to hiring and training employees in this industry.

Employers in the British Columbia Shipbuilding and Ship Repair industry file the Form T1014-2 for the Tax Credit in Canada.

FAQ

Q: What is the T1014-2 form?

A: T1014-2 is a form used to claim the British Columbia Shipbuilding and Ship Repair Industry Tax Credit in Canada.

Q: Who is eligible to claim the tax credit?

A: Employers in the shipbuilding and ship repair industry in British Columbia are eligible to claim the tax credit.

Q: What is the purpose of the tax credit?

A: The tax credit is meant to provide financial support to the shipbuilding and ship repair industry in British Columbia.

Q: How do I claim the tax credit?

A: You need to fill out the T1014-2 form and include it with your annual tax return.

Q: Is there a deadline to claim the tax credit?

A: Yes, the tax credit must be claimed within 18 months after the end of the tax year.