This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1014

for the current year.

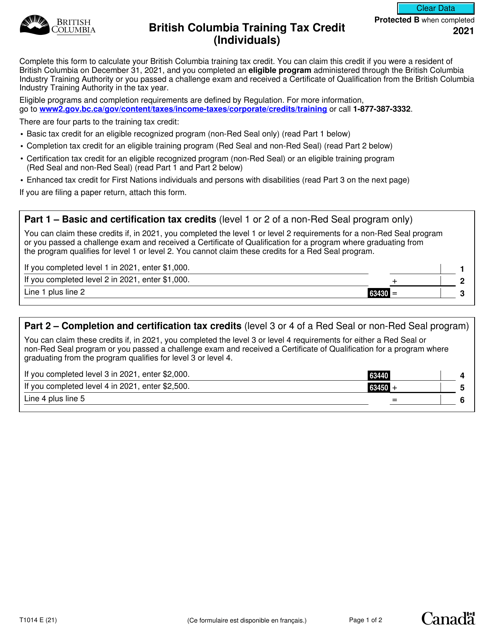

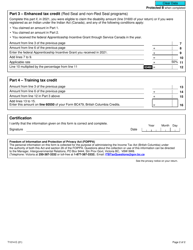

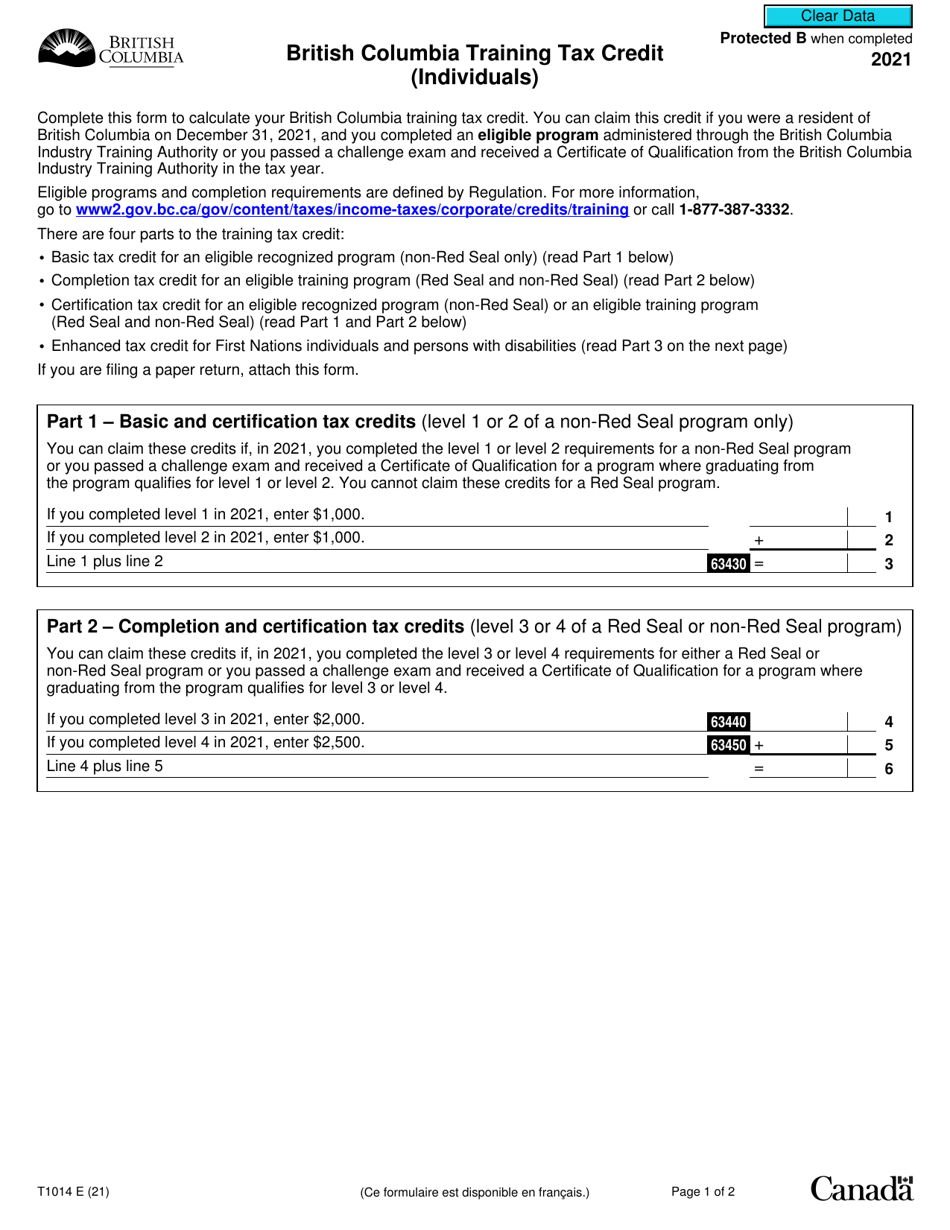

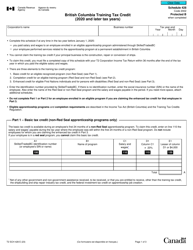

Form T1014 British Columbia Training Tax Credit (Individuals) - Canada

Form T1014 British Columbia Training Tax Credit (Individuals) is a tax form used in Canada, specifically in British Columbia, to claim a non-refundable tax credit for eligible training expenses. This tax credit is designed to encourage professional development and skills training for individuals residing in British Columbia.

The form T1014 British Columbia Training Tax Credit (Individuals) in Canada is filed by individuals who are eligible for this tax credit.

FAQ

Q: What is Form T1014?

A: Form T1014 is a tax form in Canada.

Q: What is the British Columbia Training Tax Credit?

A: The British Columbia Training Tax Credit is a tax credit available in the province of British Columbia.

Q: Who is eligible for the British Columbia Training Tax Credit?

A: Individuals who have incurred eligible training expenditures in British Columbia may be eligible for this tax credit.

Q: What are eligible training expenditures?

A: Eligible training expenditures are expenses incurred by individuals for qualifying training programs in British Columbia.

Q: How much is the British Columbia Training Tax Credit?

A: The tax credit is equal to 30% of the eligible training expenditures, up to a maximum of $10,000 per year.

Q: How do I claim the British Columbia Training Tax Credit?

A: To claim the tax credit, you need to complete and file Form T1014 along with your income tax return.

Q: Is the British Columbia Training Tax Credit refundable?

A: No, the tax credit is non-refundable and can only be used to reduce your income tax payable.

Q: Are there any deadlines for claiming the British Columbia Training Tax Credit?

A: Yes, the tax credit must be claimed on your tax return for the year in which the expenses were incurred, and the tax return must be filed by the deadline set by the CRA.