This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC4609

for the current year.

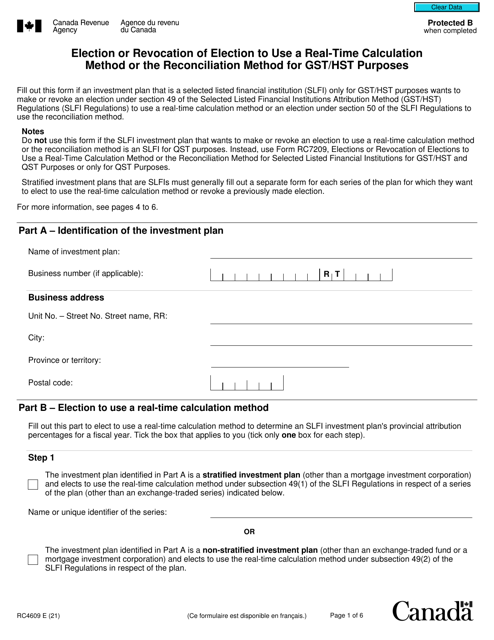

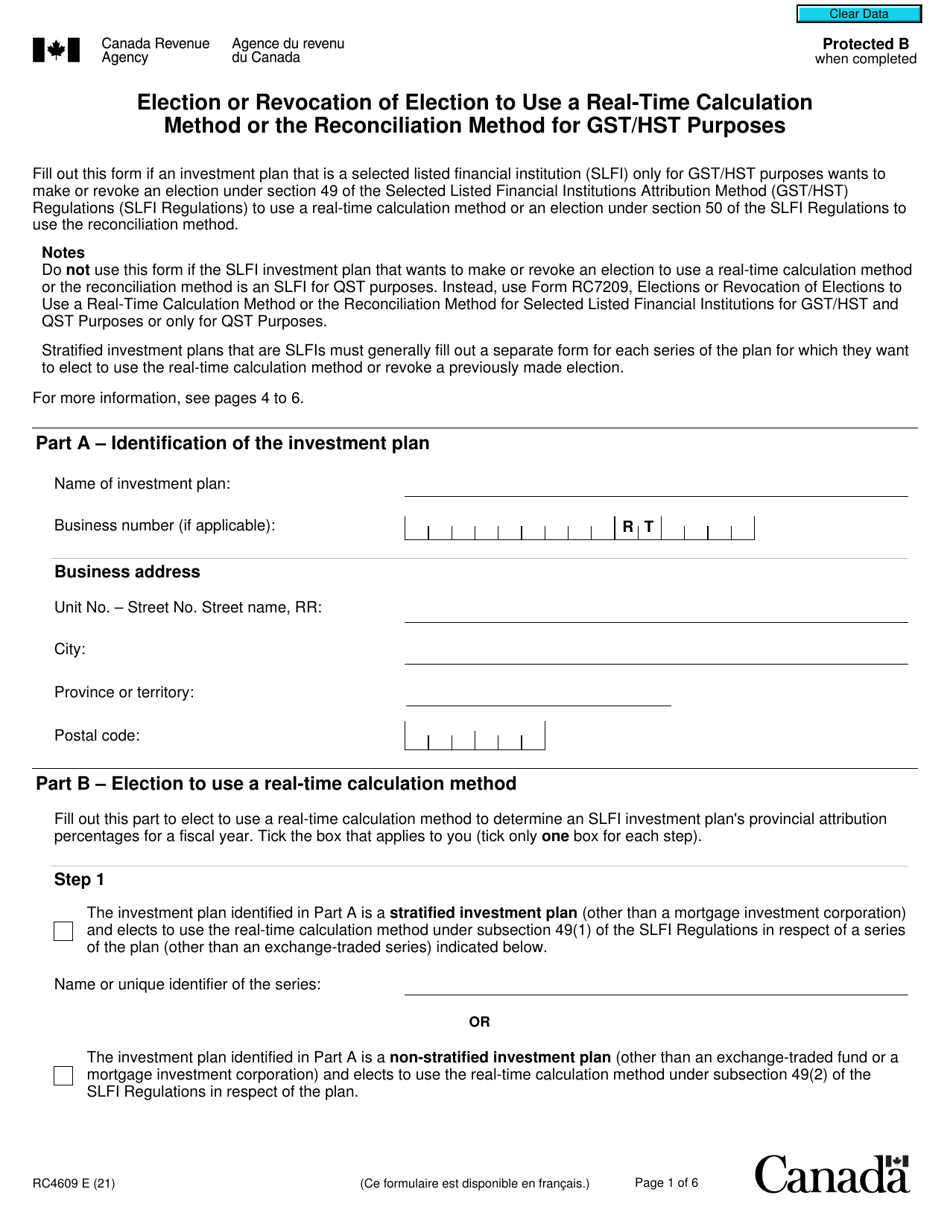

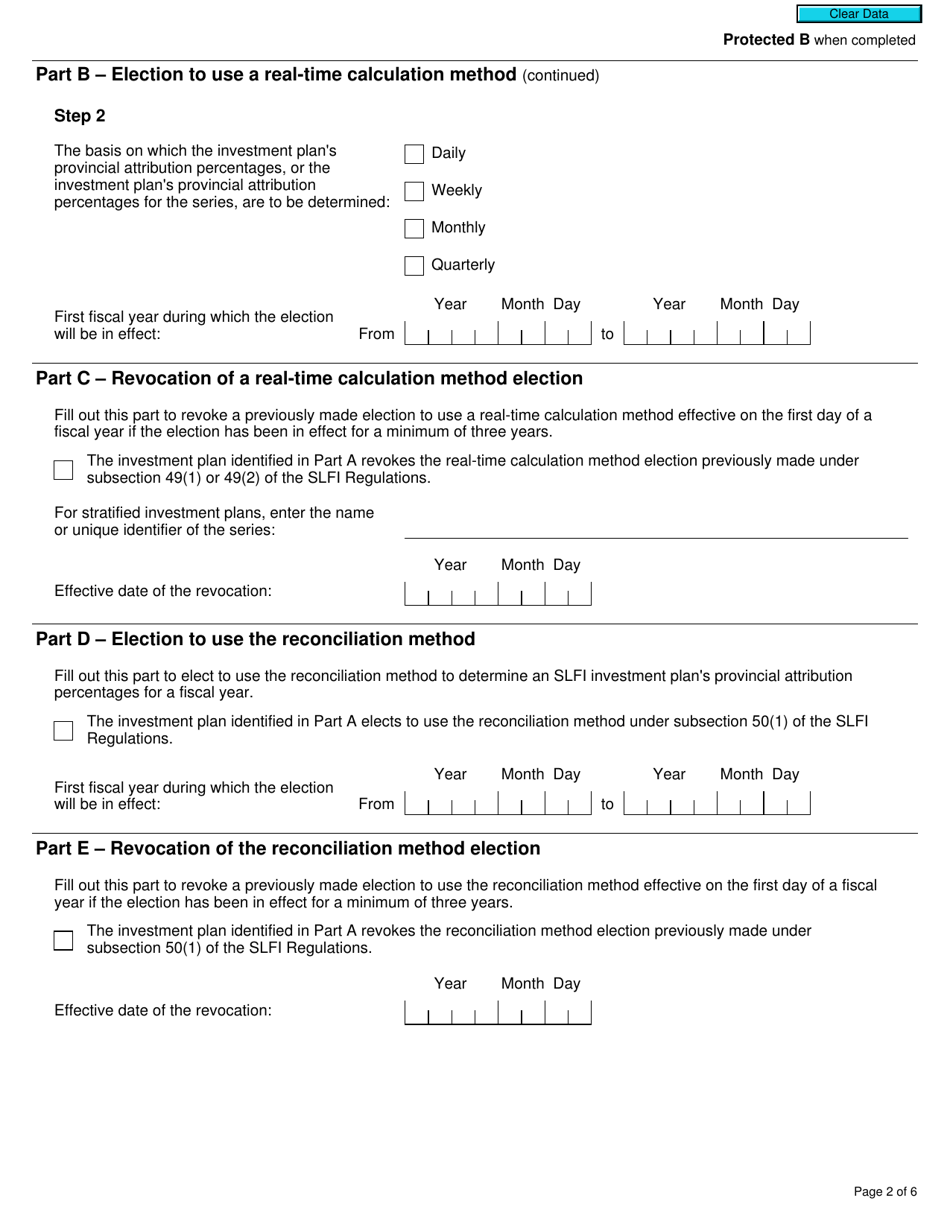

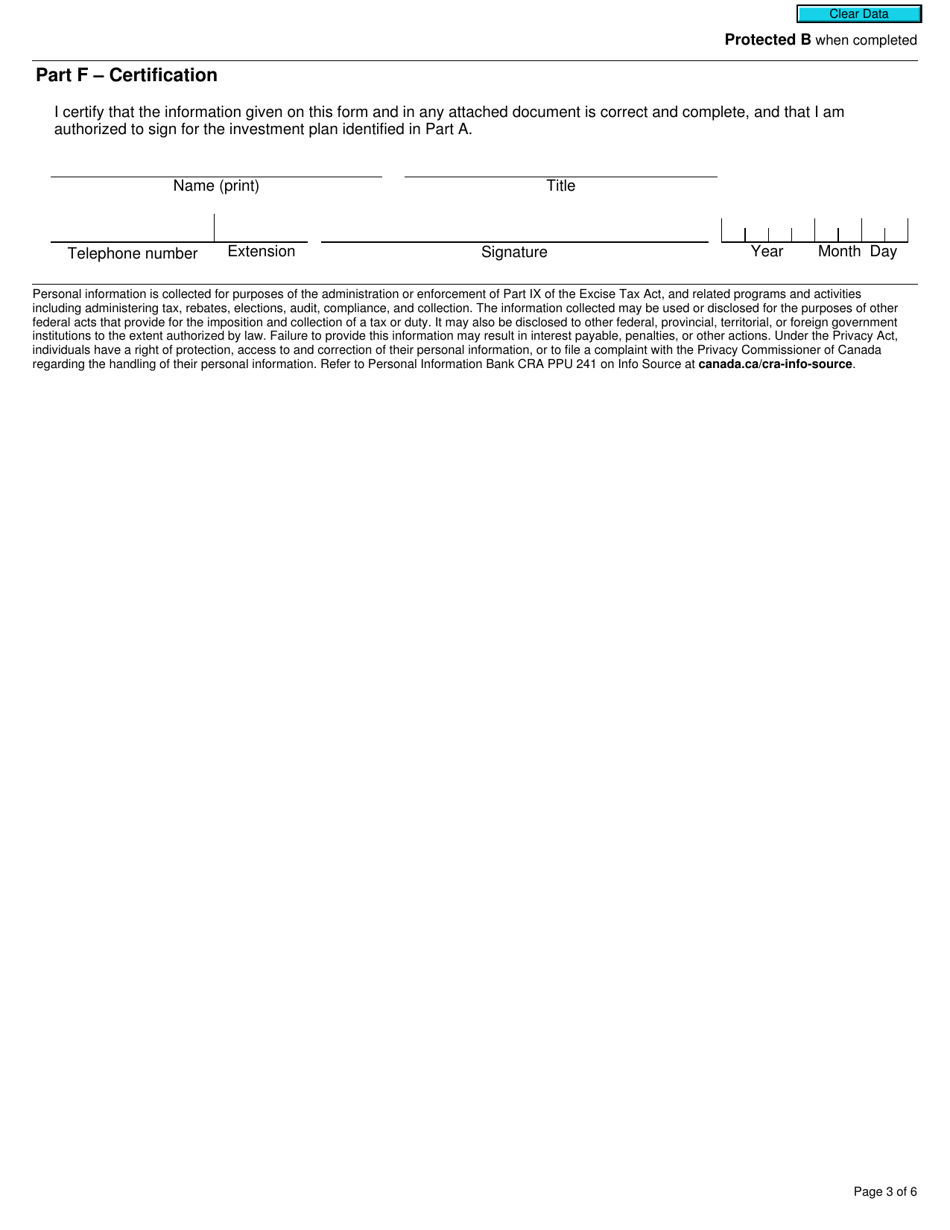

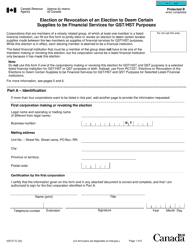

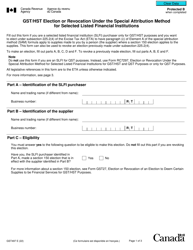

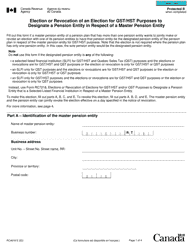

Form RC4609 Election or Revocation of Election to Use a Real-Time Calculation Method or the Reconciliation Method for Gst / Hst Purposes - Canada

Form RC4609 is used in Canada to either elect or revoke the election to use a real-time calculation method or the reconciliation method for GST/HST purposes. This form allows businesses to choose the preferred method for calculating and reporting their GST/HST obligations.

The Form RC4609, Election or Revocation of Election to Use a Real-Time Calculation Method or the Reconciliation Method for GST/HST Purposes, is filed by businesses and charities registered for Goods and Services Tax (GST) or Harmonized Sales Tax (HST) in Canada.

FAQ

Q: What is Form RC4609?

A: Form RC4609 is a tax form used in Canada to elect or revoke the election to use a real-time calculation method or the reconciliation method for GST/HST purposes.

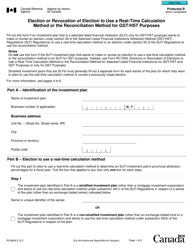

Q: What is the real-time calculation method?

A: The real-time calculation method is a method used to calculate GST/HST payable or refundable on a periodic basis, such as monthly or quarterly, based on actual sales and purchases.

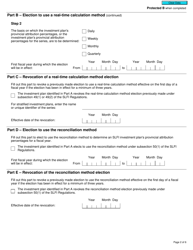

Q: What is the reconciliation method?

A: The reconciliation method is a method used to calculate GST/HST payable or refundable on an annual basis, based on the difference between actual sales and purchases and the amounts previously remitted or claimed.

Q: When should I use Form RC4609?

A: You should use Form RC4609 if you want to elect or revoke the election to use either the real-time calculation method or the reconciliation method for GST/HST purposes.