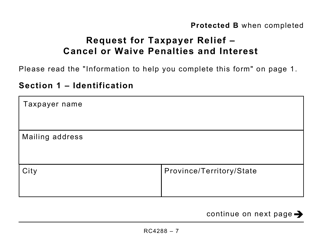

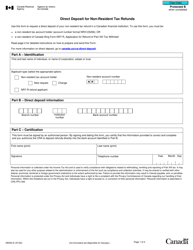

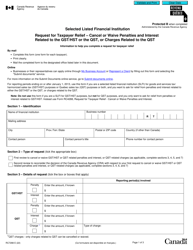

Form RC4288 Request for Taxpayer Relief - Cancel or Waive Penalties and Interest - Large Print - Canada

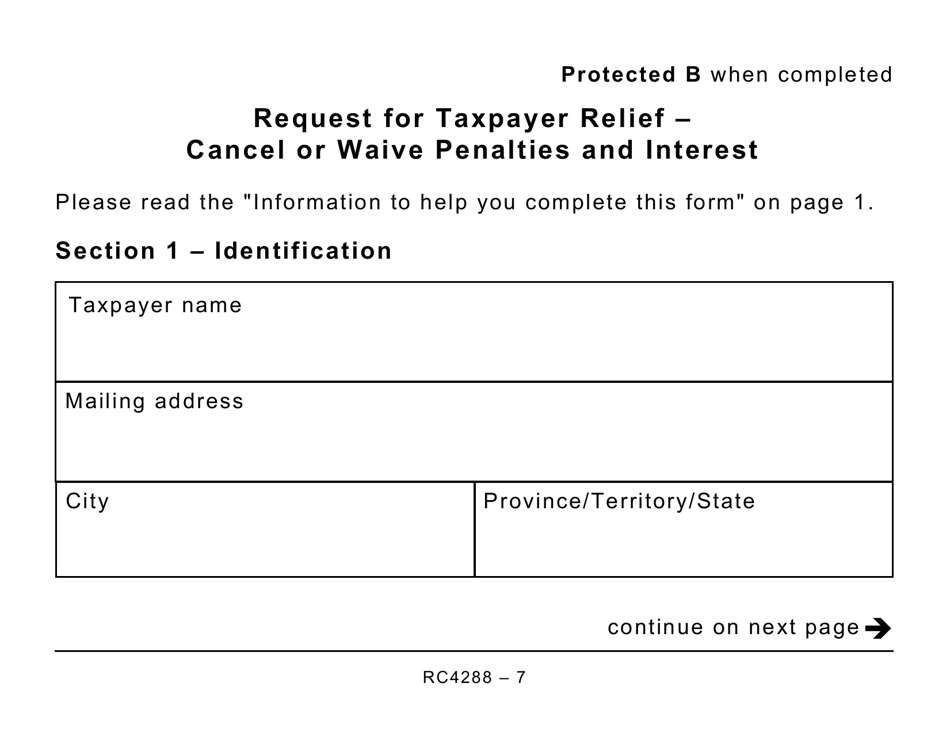

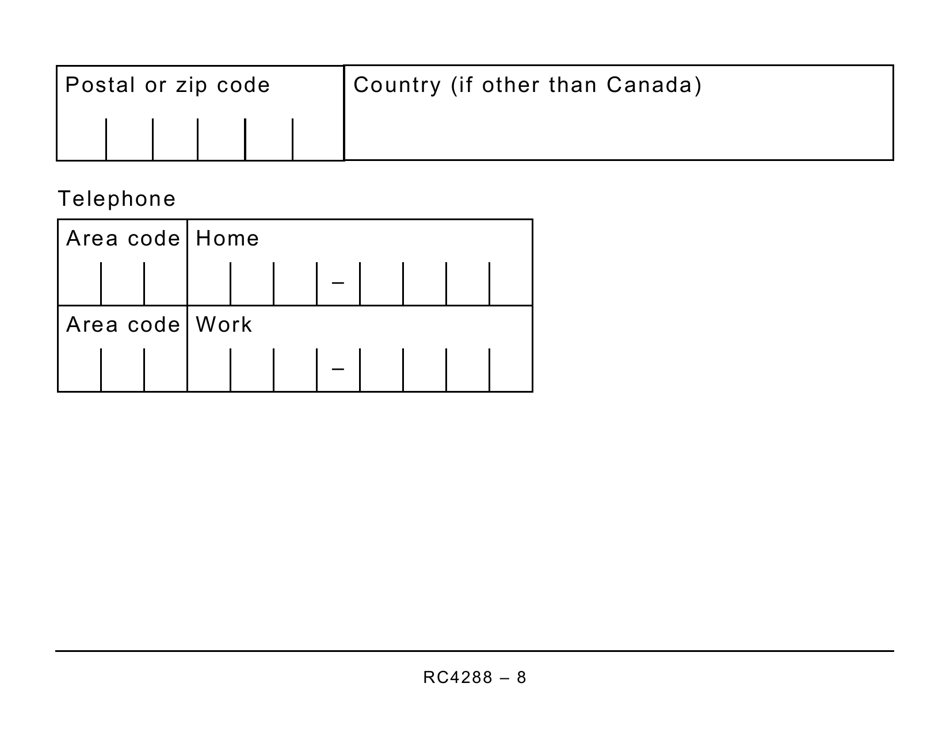

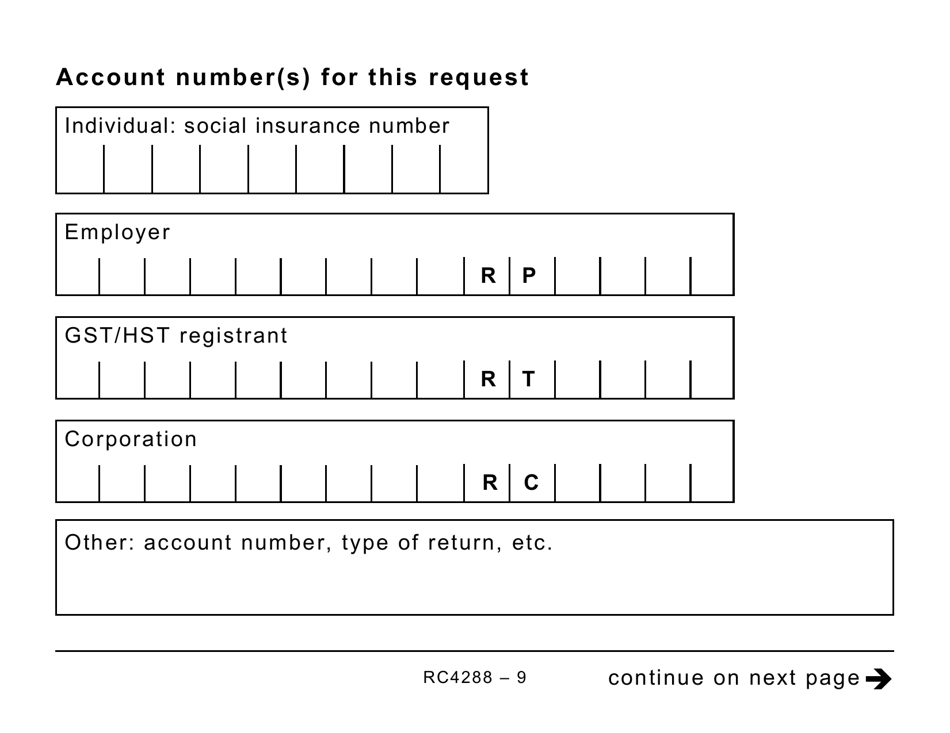

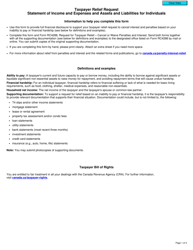

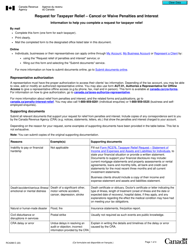

Form RC4288 Request forTaxpayer Relief - Cancel or Waive Penalties and Interest - Large Print - Canada is used by individuals or businesses in Canada to request cancellation or waiver of penalties and interest imposed by the Canada Revenue Agency (CRA). This form is specifically designed in large print format to accommodate those with visual impairments.

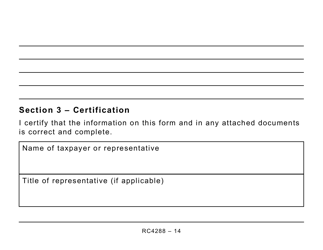

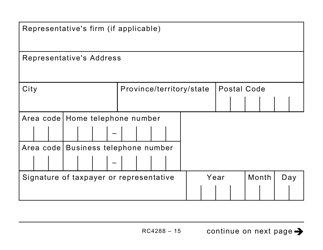

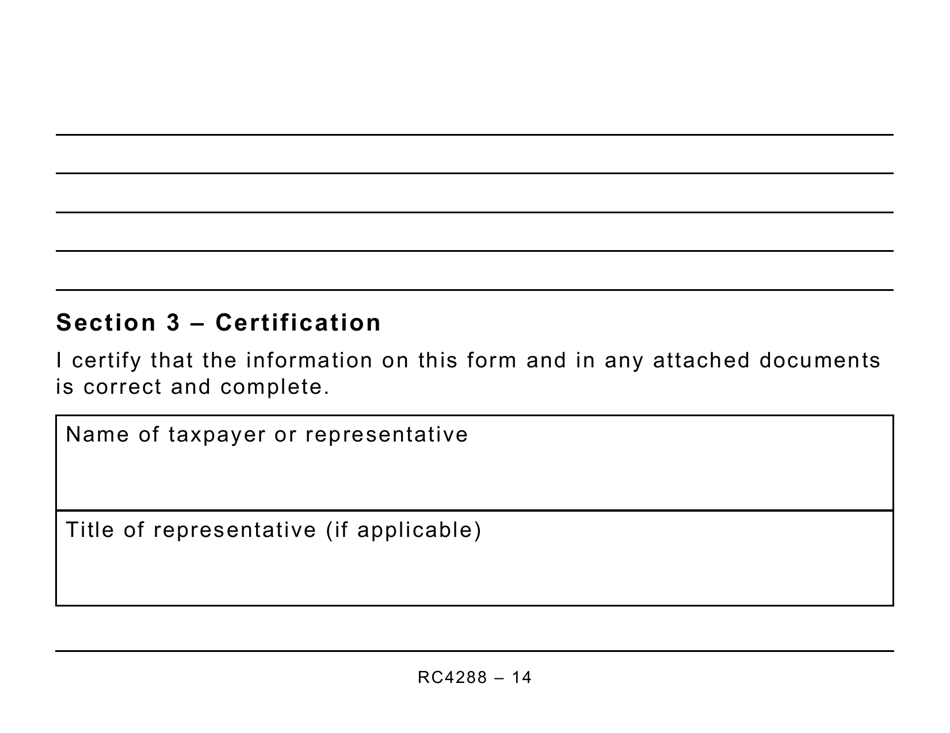

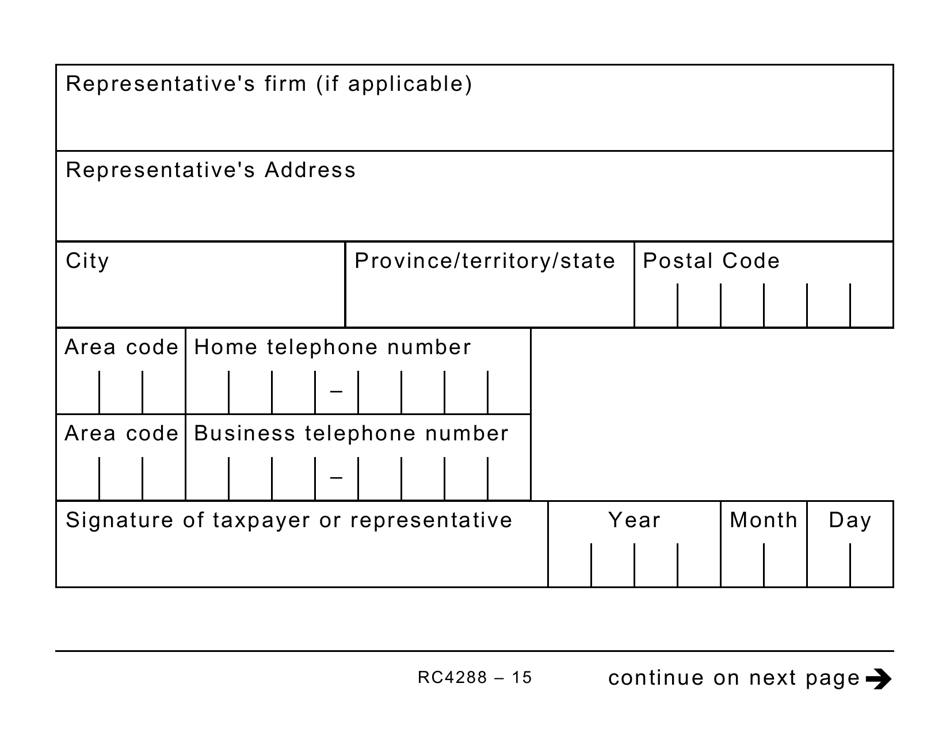

The taxpayer themselves files the Form RC4288 Request for Taxpayer Relief - Cancel or Waive Penalties and Interest - Large Print in Canada.

FAQ

Q: What is the Form RC4288?

A: The Form RC4288 is a Request for Taxpayer Relief.

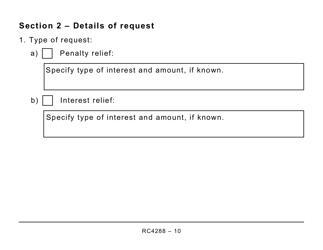

Q: What is the purpose of Form RC4288?

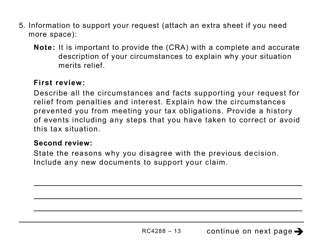

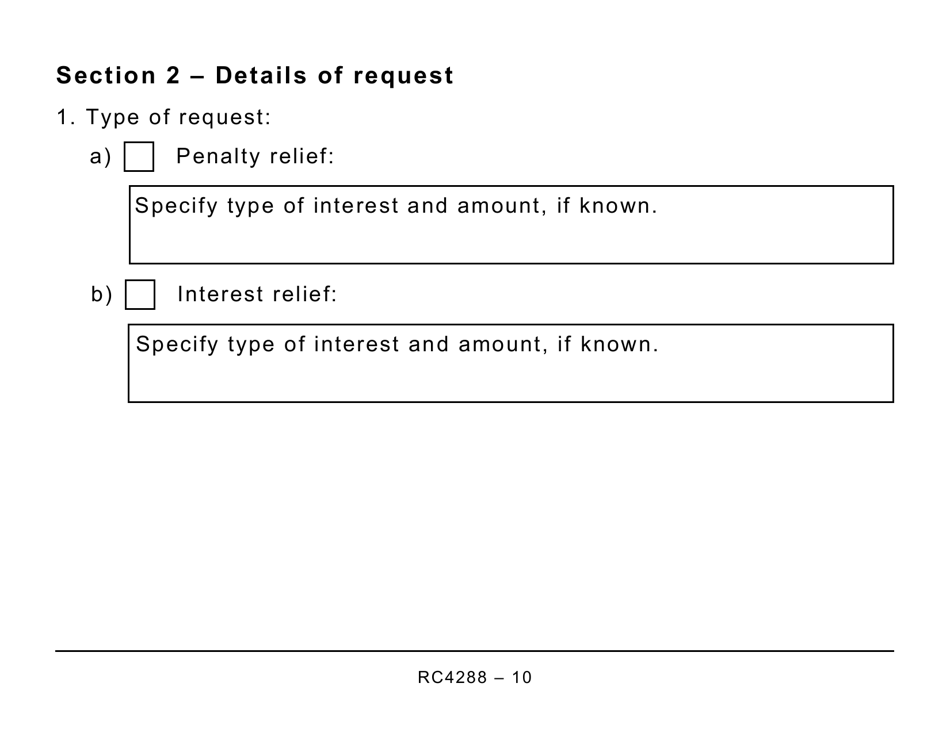

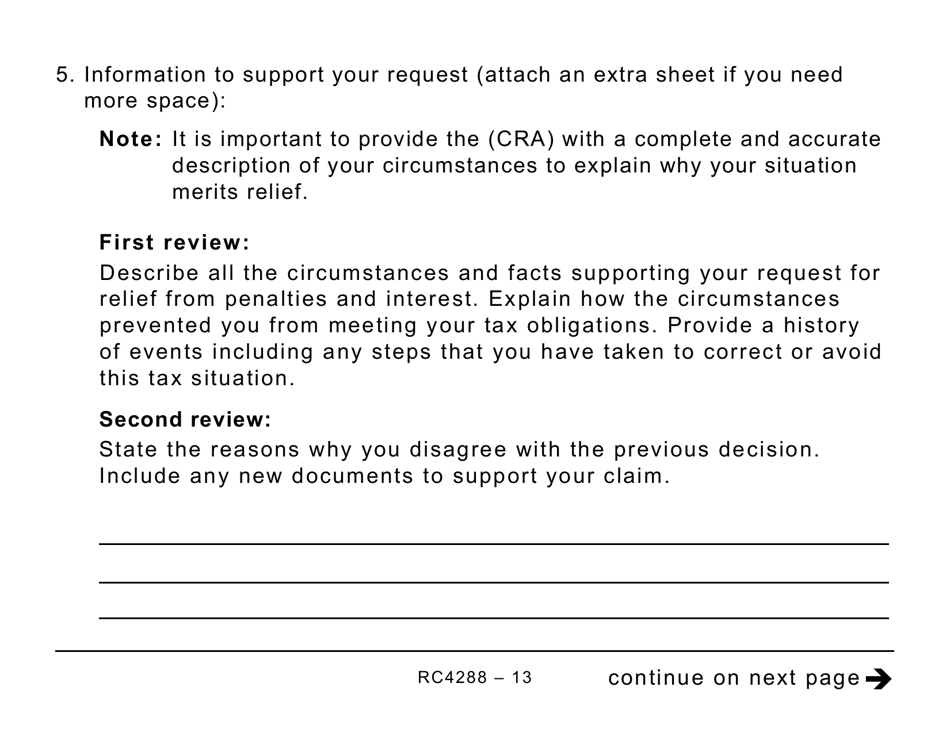

A: The purpose of Form RC4288 is to request the cancellation or waiver of penalties and interest on your taxes.

Q: Who can use Form RC4288?

A: Any taxpayer in Canada can use Form RC4288 to request taxpayer relief.

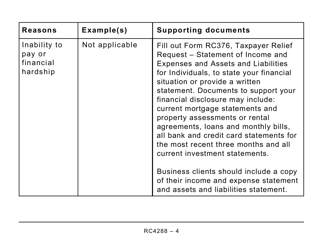

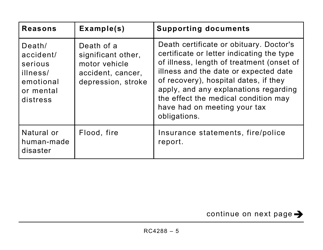

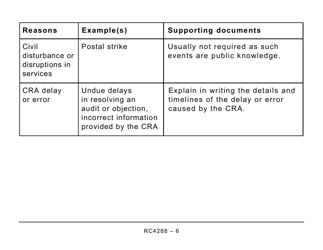

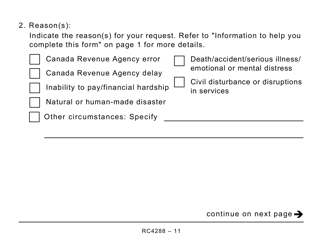

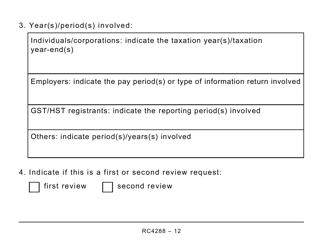

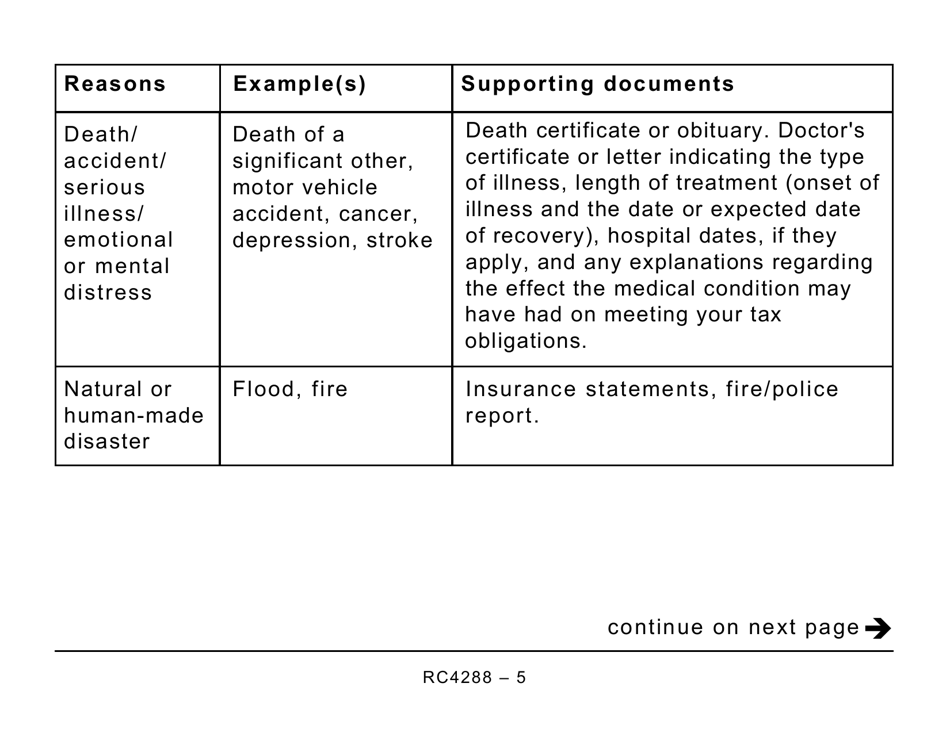

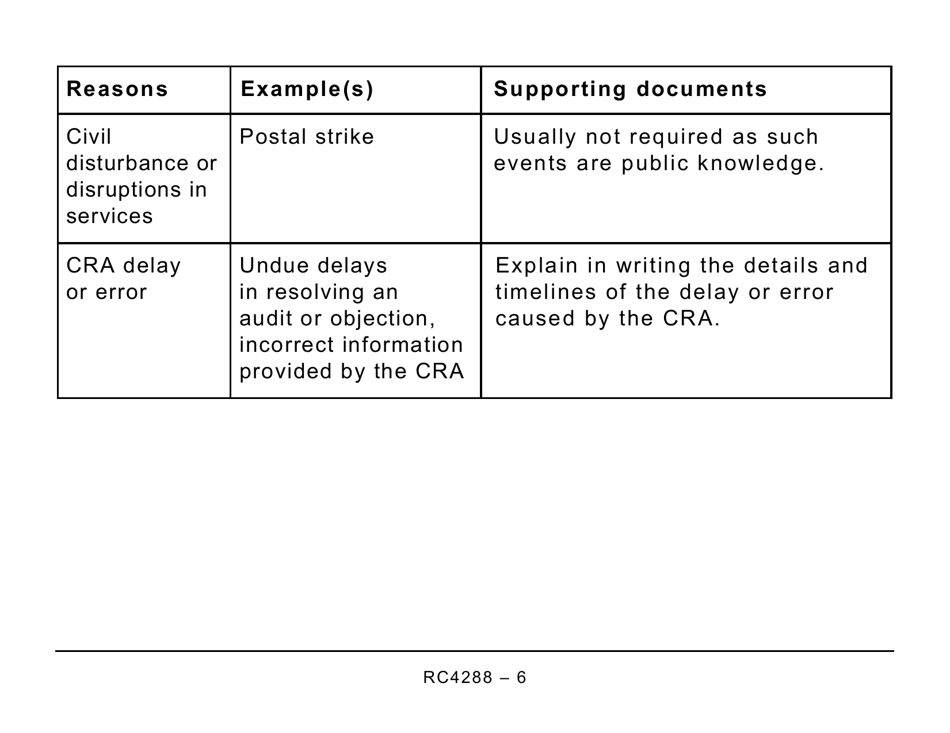

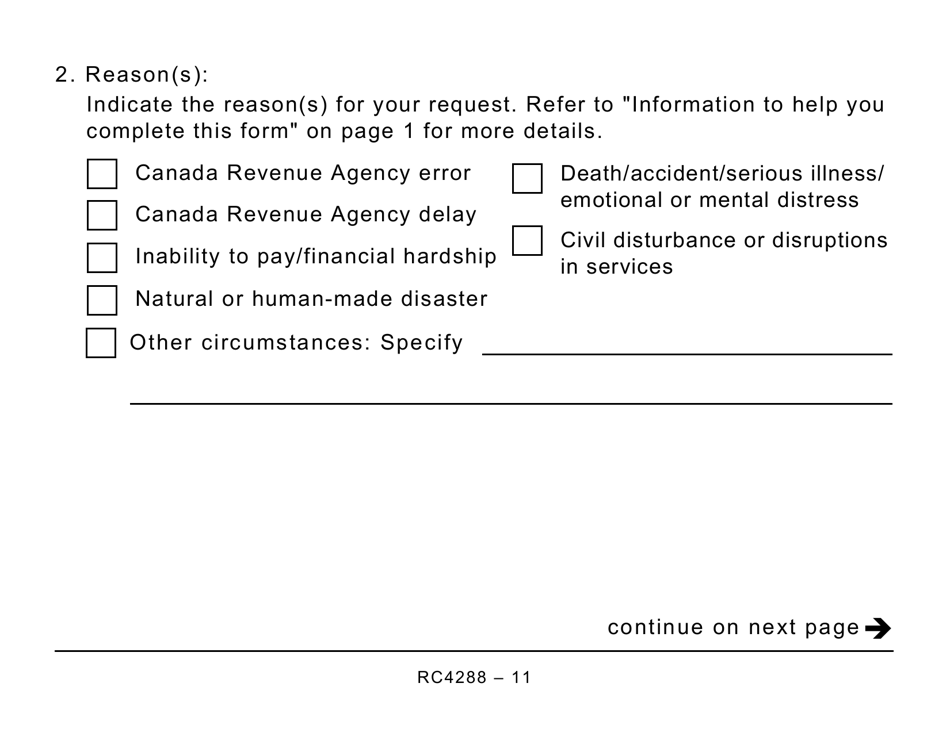

Q: What are the criteria for requesting taxpayer relief?

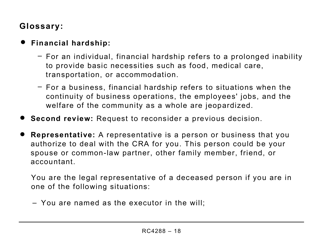

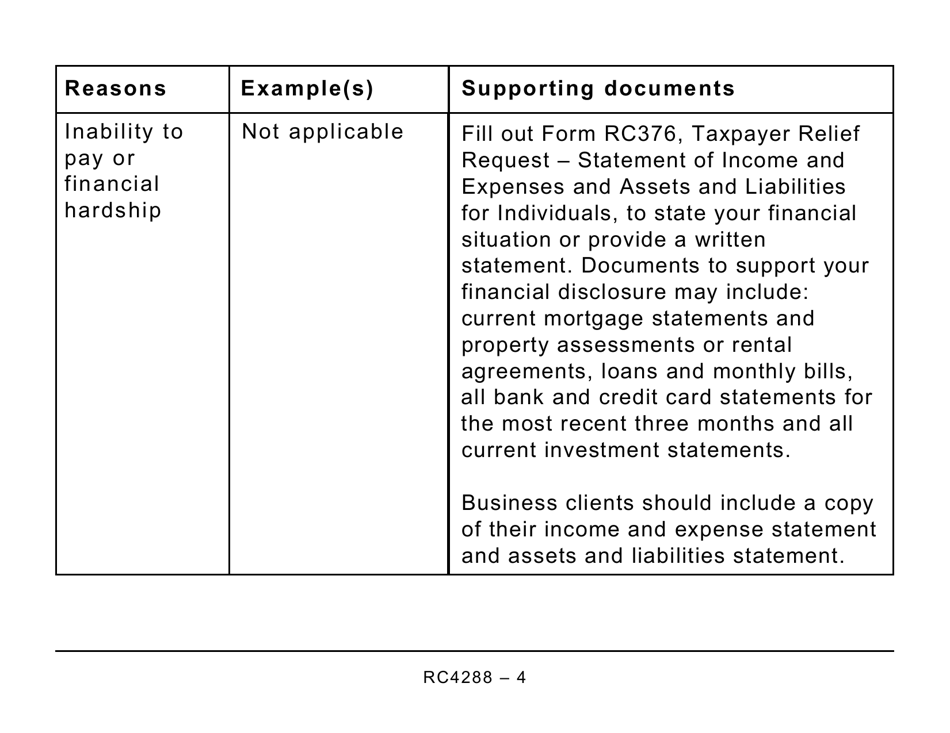

A: The criteria for requesting taxpayer relief include extraordinary circumstances, actions of the Canada Revenue Agency (CRA), inability to pay, financial hardship, or other circumstances.

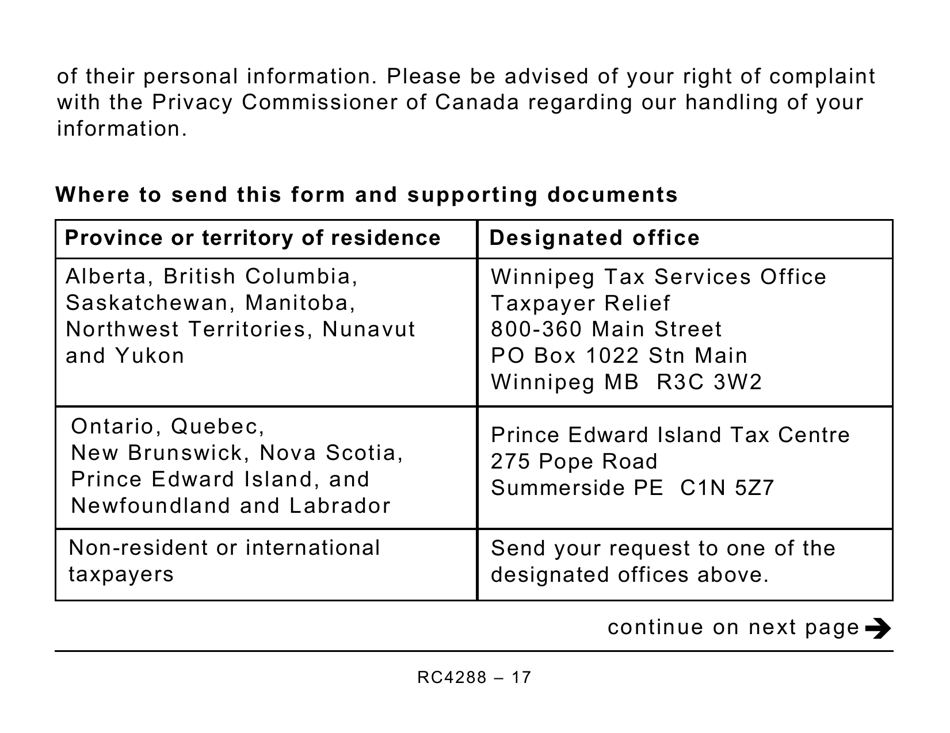

Q: What should I include with my Form RC4288?

A: You should include any supporting documents or explanations that demonstrate your eligibility for taxpayer relief.

Q: How long does it take for the Canada Revenue Agency (CRA) to process a request for taxpayer relief?

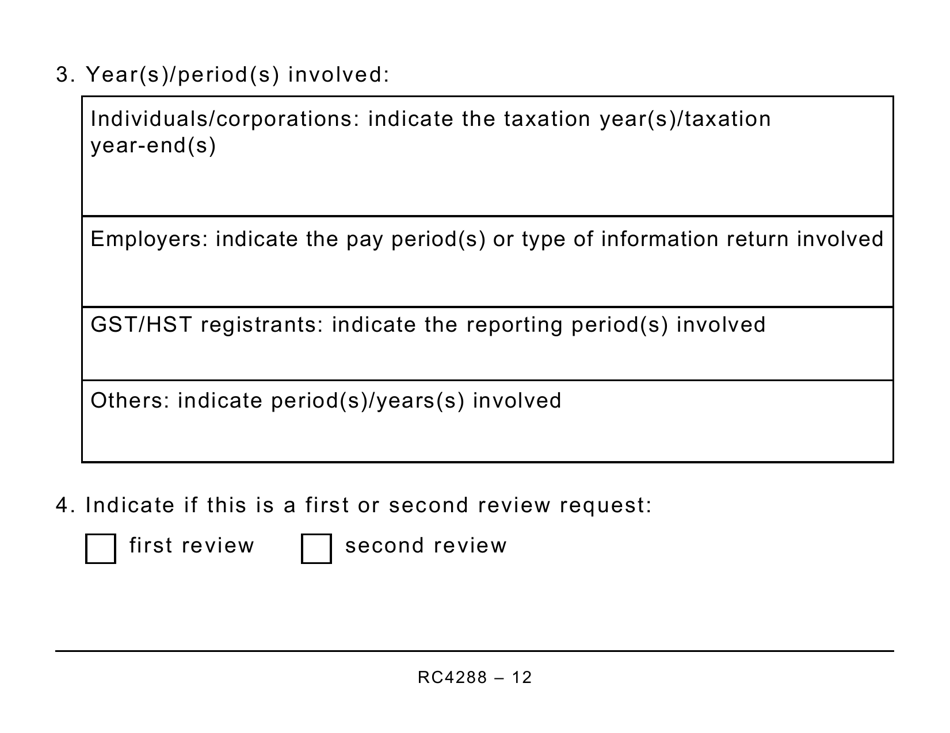

A: The processing time for a request for taxpayer relief can vary, but it typically takes several weeks or months.

Q: Can I appeal the Canada Revenue Agency's decision on my taxpayer relief request?

A: Yes, you can appeal the Canada Revenue Agency's decision on your taxpayer relief request if you disagree with their decision.

Q: Is there a deadline for submitting a request for taxpayer relief?

A: There is no specific deadline for submitting a request for taxpayer relief, but it is best to submit your request as soon as possible.