This version of the form is not currently in use and is provided for reference only. Download this version of

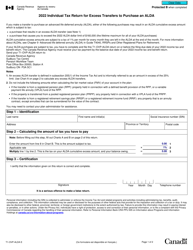

Form RC339

for the current year.

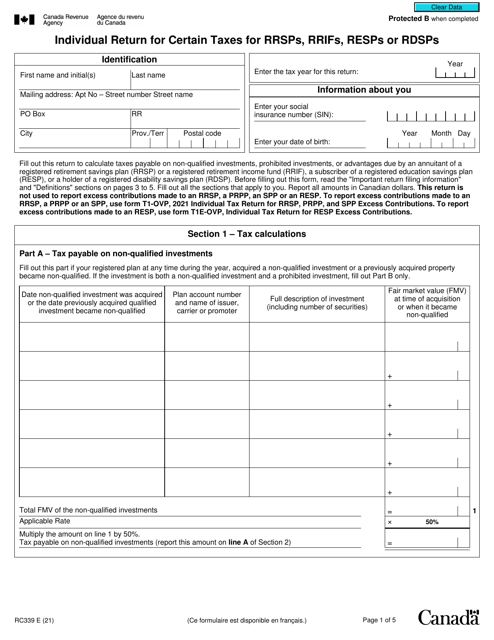

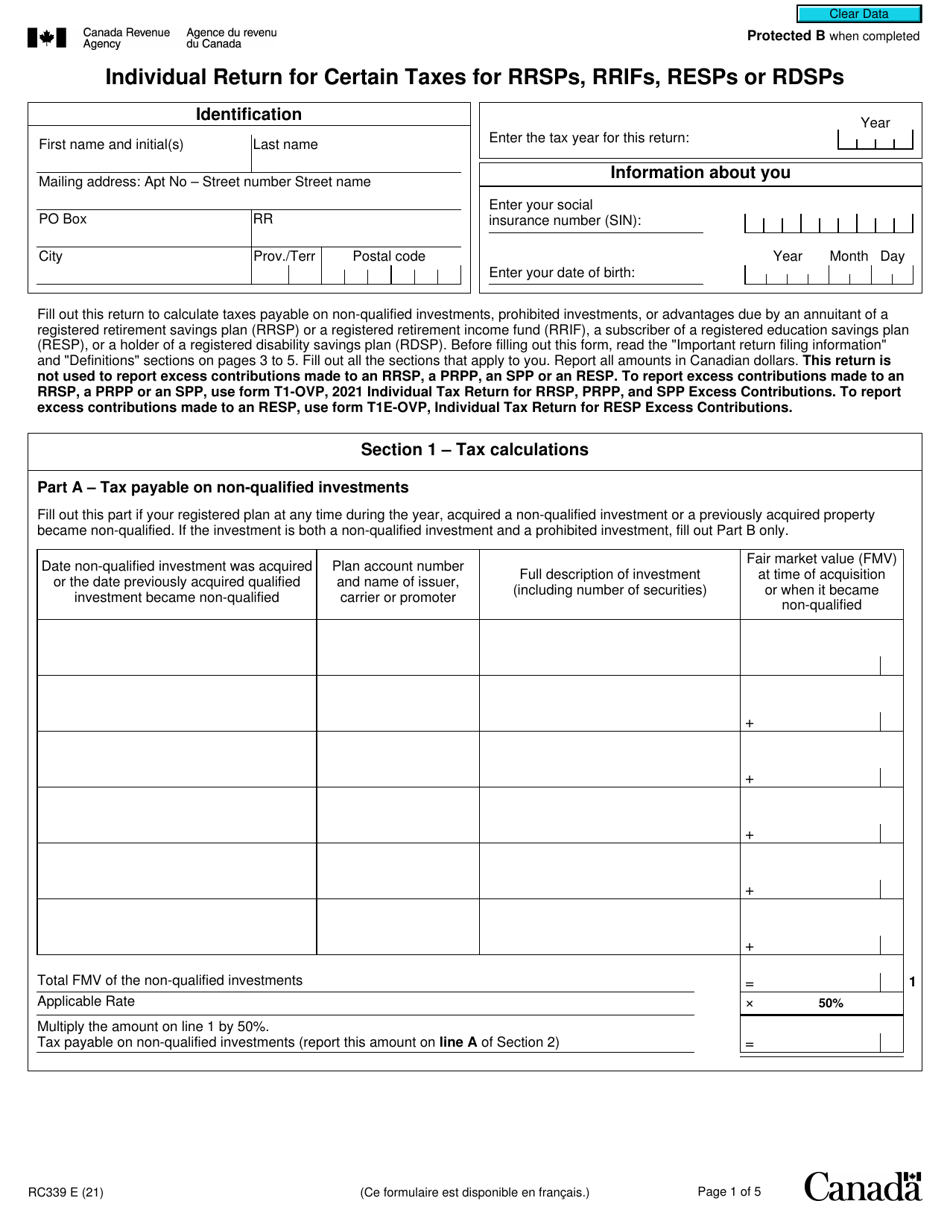

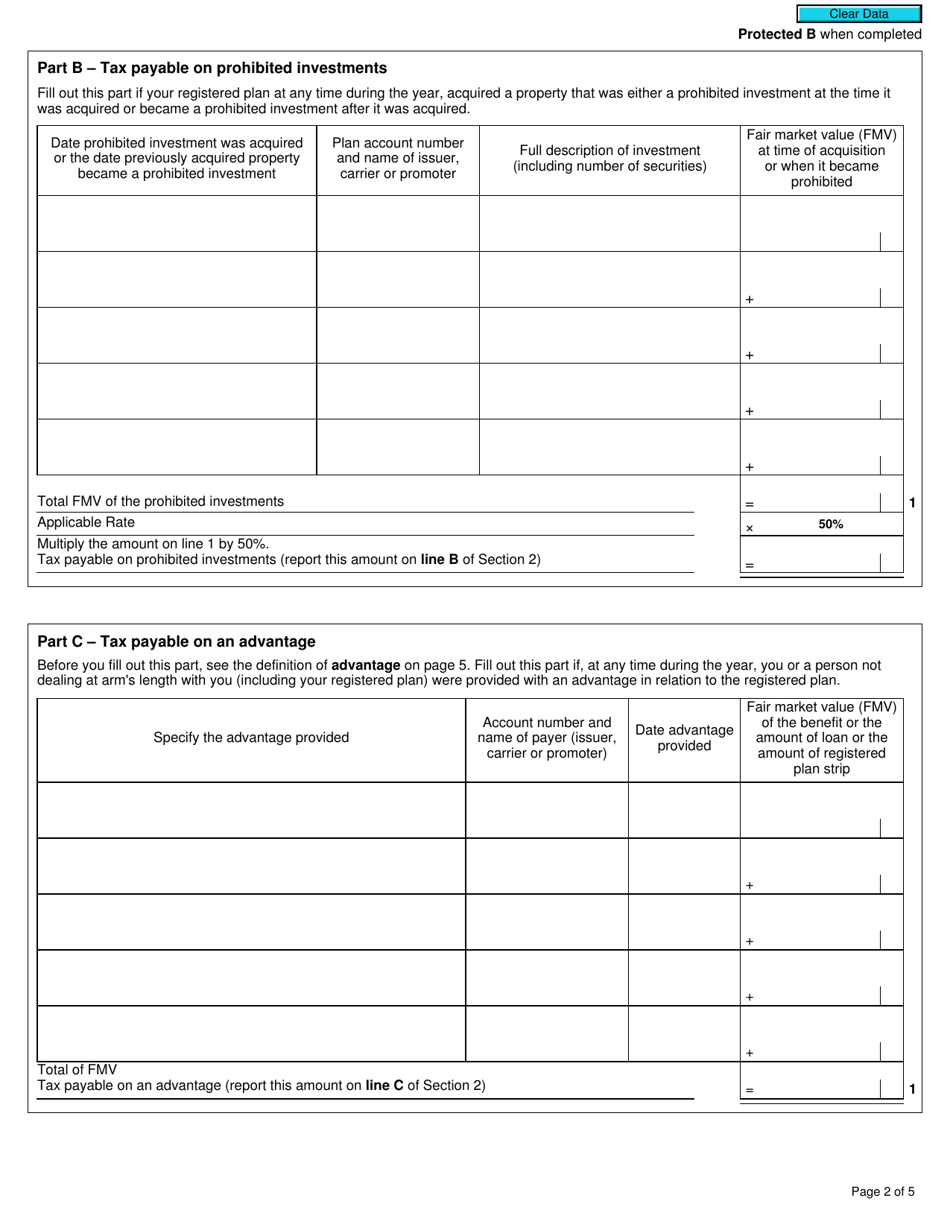

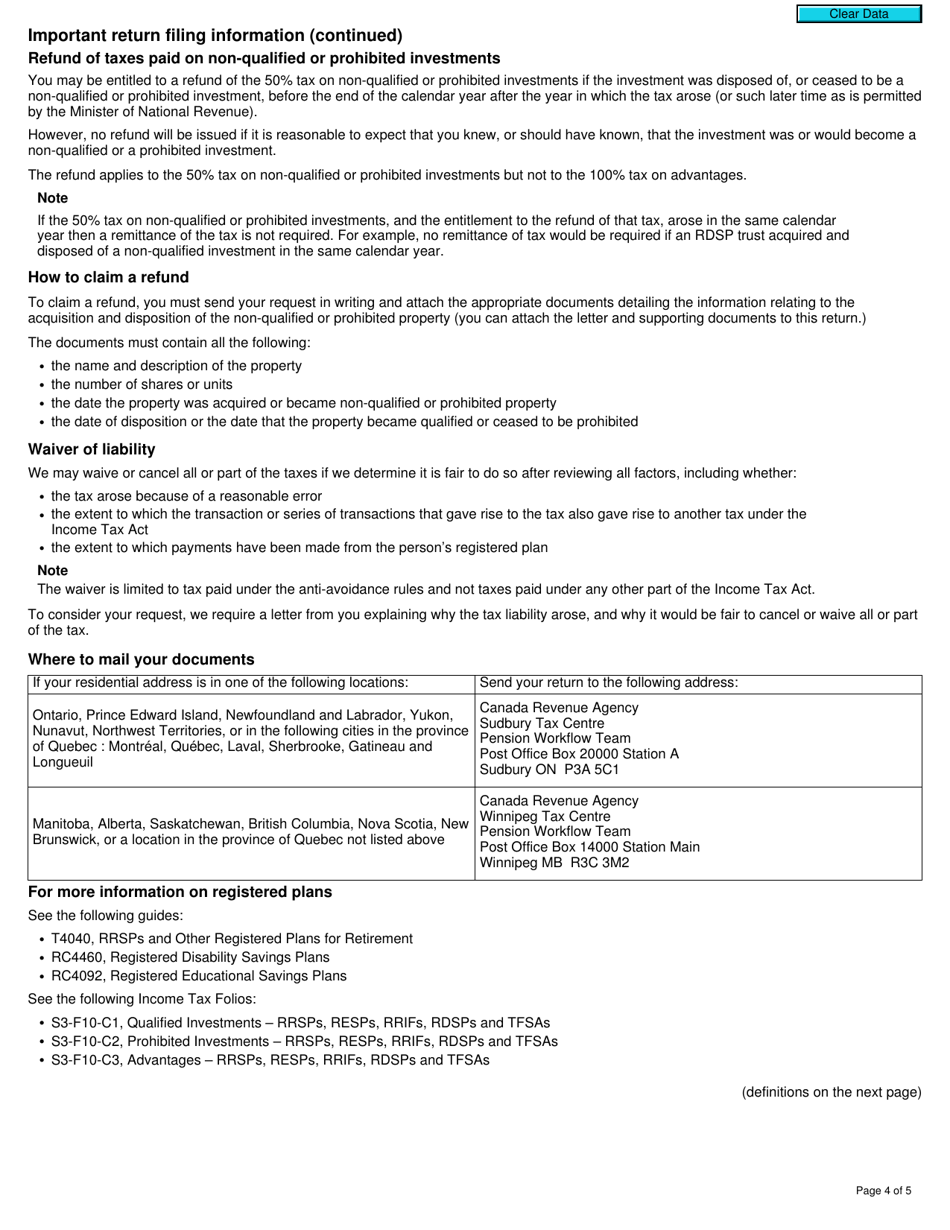

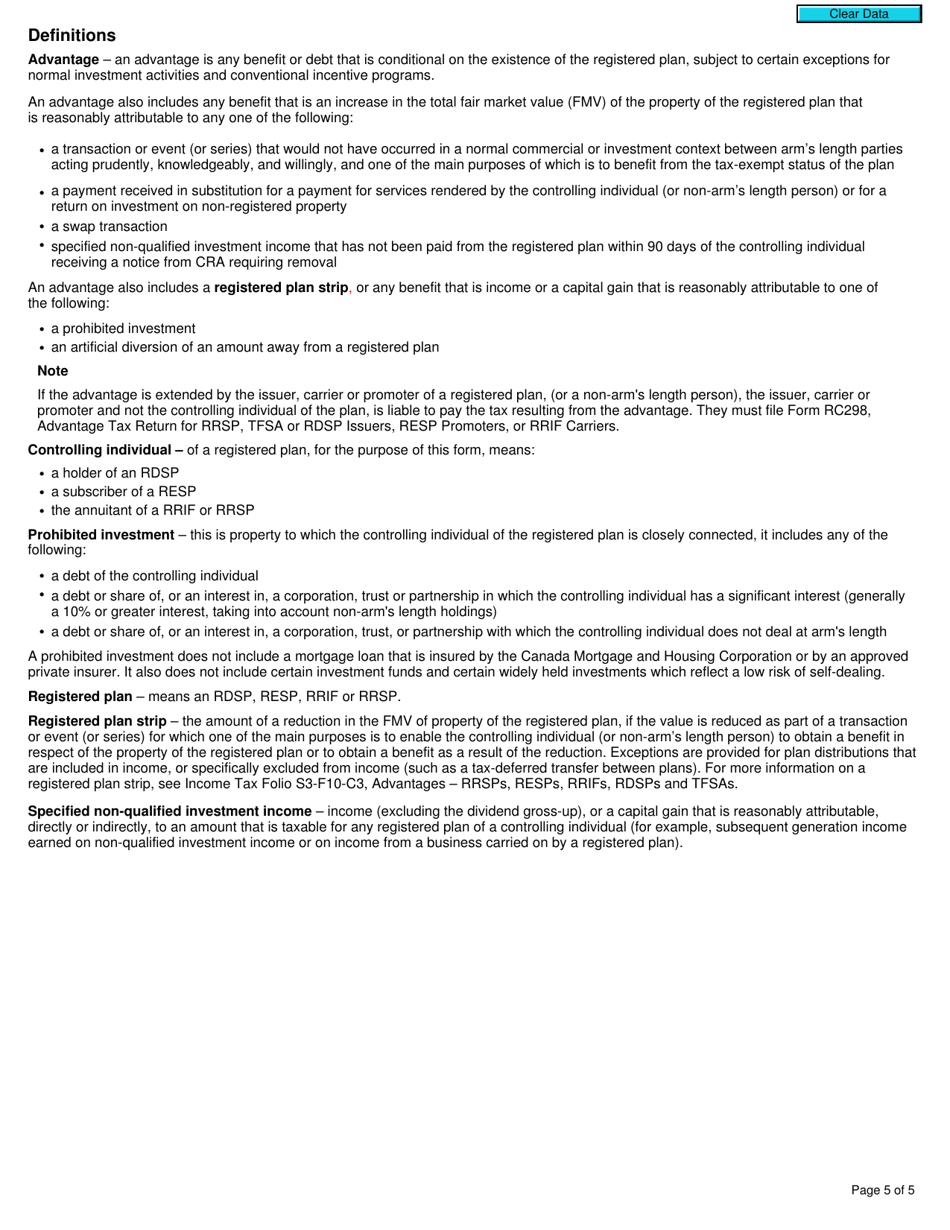

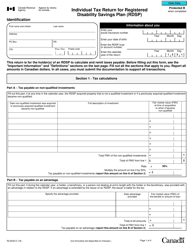

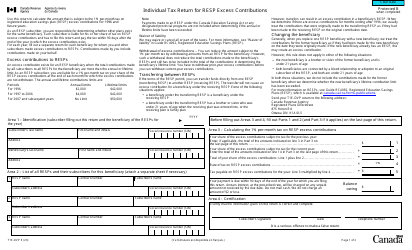

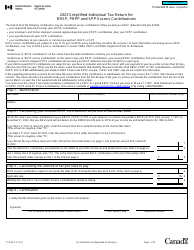

Form RC339 Individual Return for Certain Taxes for Rrsps, Rrifs, Resps or Rdsps - Canada

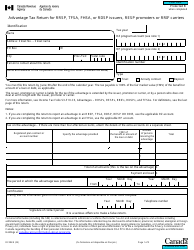

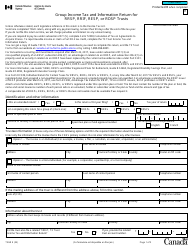

Form RC339 Individual Return for Certain Taxes for RRSPs, RRIFs, RESPs, or RDSPs in Canada is used to report and pay taxes on any income from registered pension plans or registered retirement savings plans. This form helps individuals fulfill their tax obligations related to these types of accounts.

The individual taxpayer files the Form RC339 for RRSPs, RRIFs, RESPs, or RDSPs in Canada.

FAQ

Q: What is Form RC339?

A: Form RC339 is a tax form used in Canada for reporting certain taxes related to RRSPs, RRIFs, RESPs, or RDSPs.

Q: Who needs to file Form RC339?

A: Individuals who have contributed to or received funds from RRSPs, RRIFs, RESPs, or RDSPs may need to file Form RC339.

Q: What taxes does Form RC339 cover?

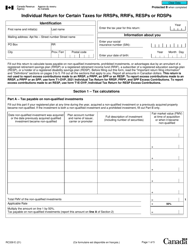

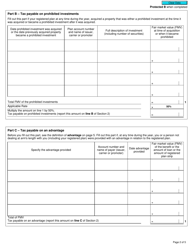

A: Form RC339 covers taxes related to RRSPs, RRIFs, RESPs, or RDSPs, including excess contributions tax, withholding tax, or taxes on excess RESP or RDSP amounts.

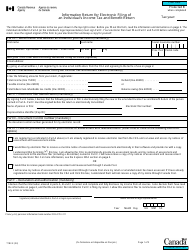

Q: How do I fill out Form RC339?

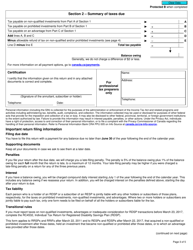

A: Form RC339 includes various sections that you need to fill out depending on your specific circumstances. It is important to read the instructions carefully and accurately report all the required information.

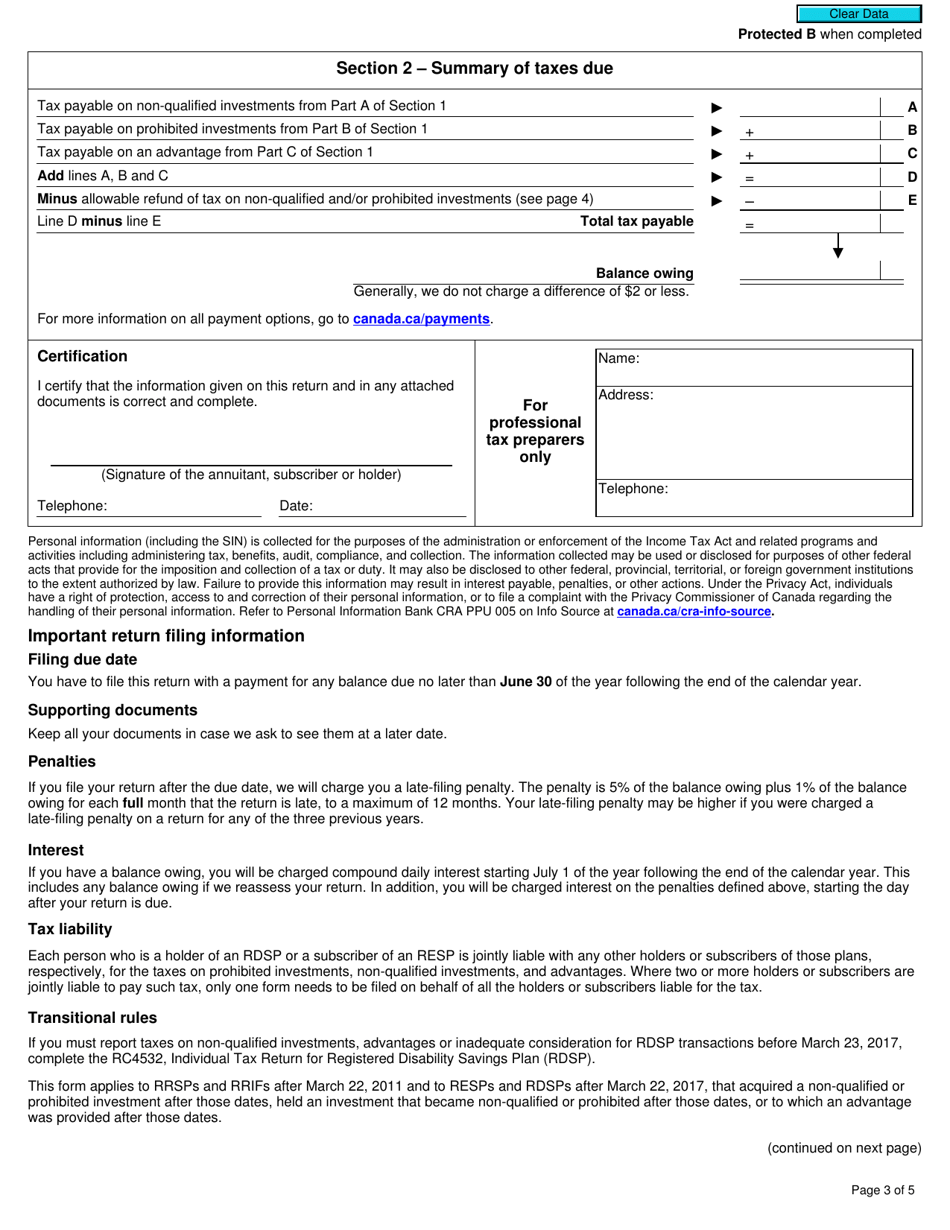

Q: When is the deadline for filing Form RC339?

A: The deadline for filing Form RC339 is typically the same as the deadline for filing your income tax return, which is April 30th for most individuals in Canada.

Q: Do I need to include any supporting documents with Form RC339?

A: Depending on your situation, you may need to include supporting documents such as receipts or statements. The instructions provided with Form RC339 will specify which documents are required.

Q: What happens if I don't file Form RC339?

A: If you are required to file Form RC339 and fail to do so, you may face penalties or interest charges imposed by the Canada Revenue Agency.