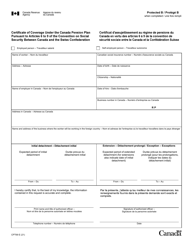

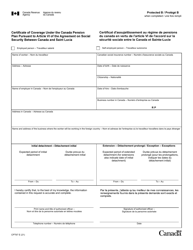

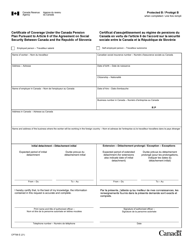

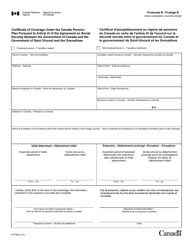

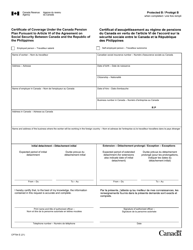

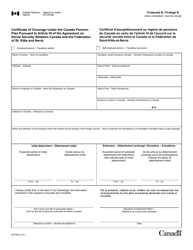

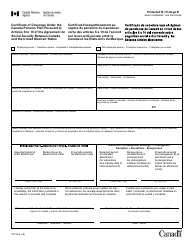

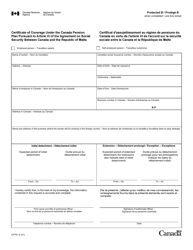

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC269

for the current year.

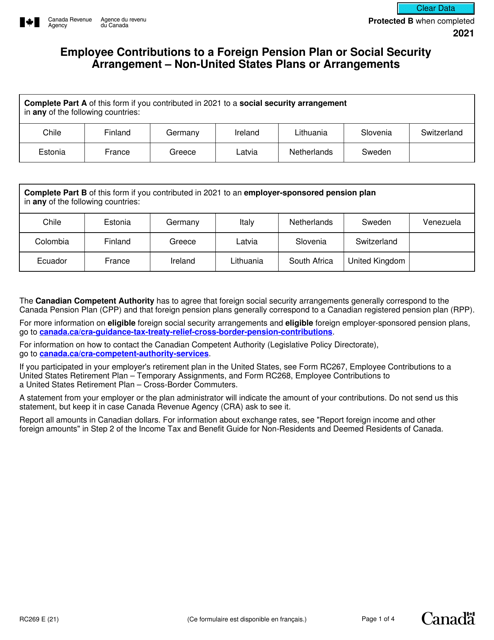

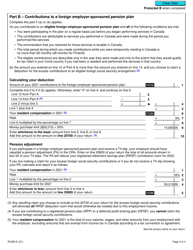

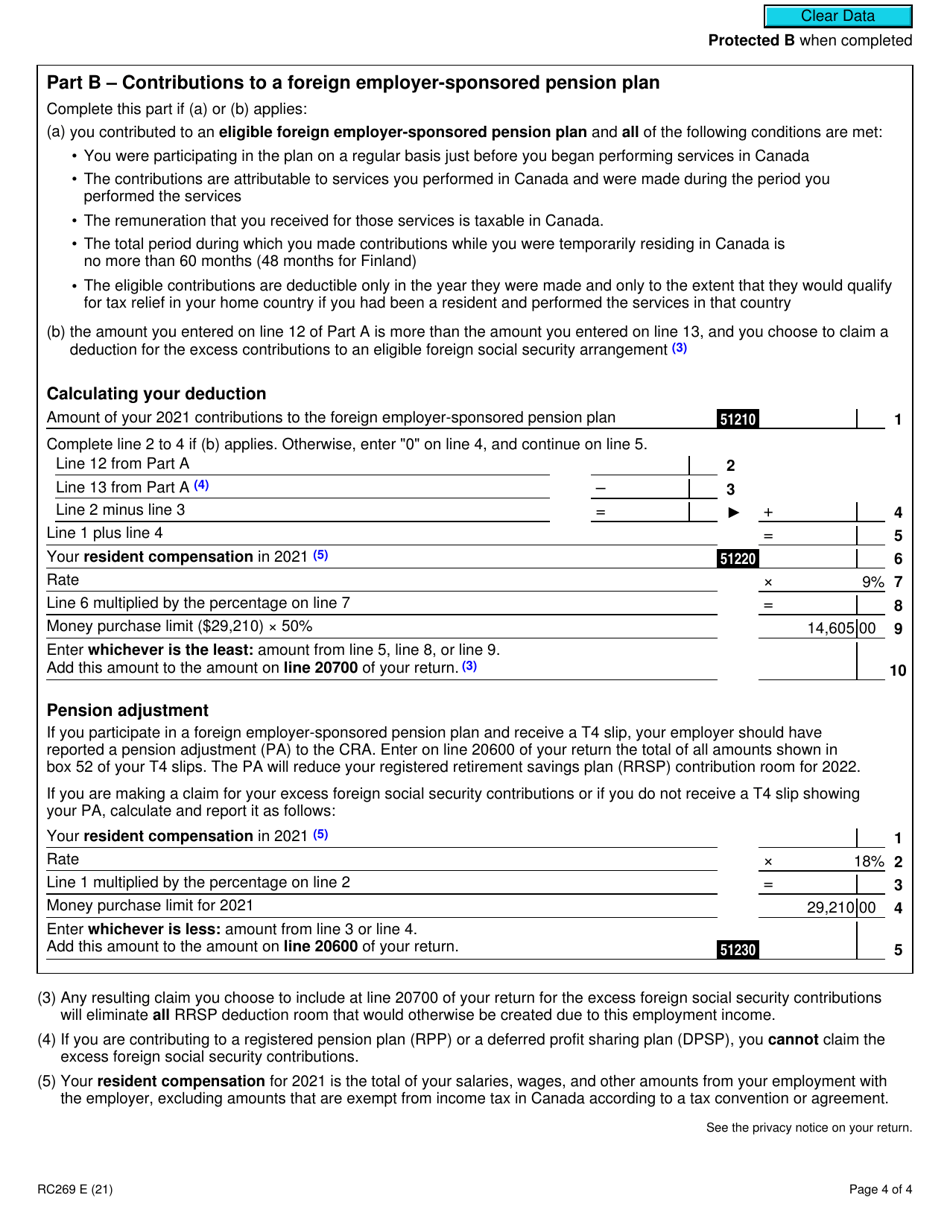

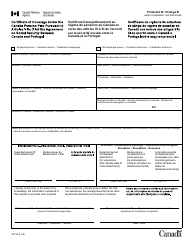

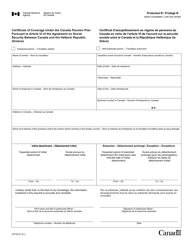

Form RC269 Employee Contributions to a Foreign Pension Plan or Social Security Arrangement - Non-united States Plans or Arrangements - Canada

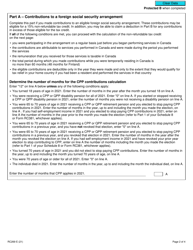

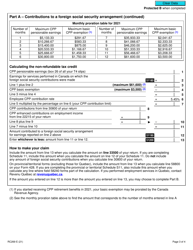

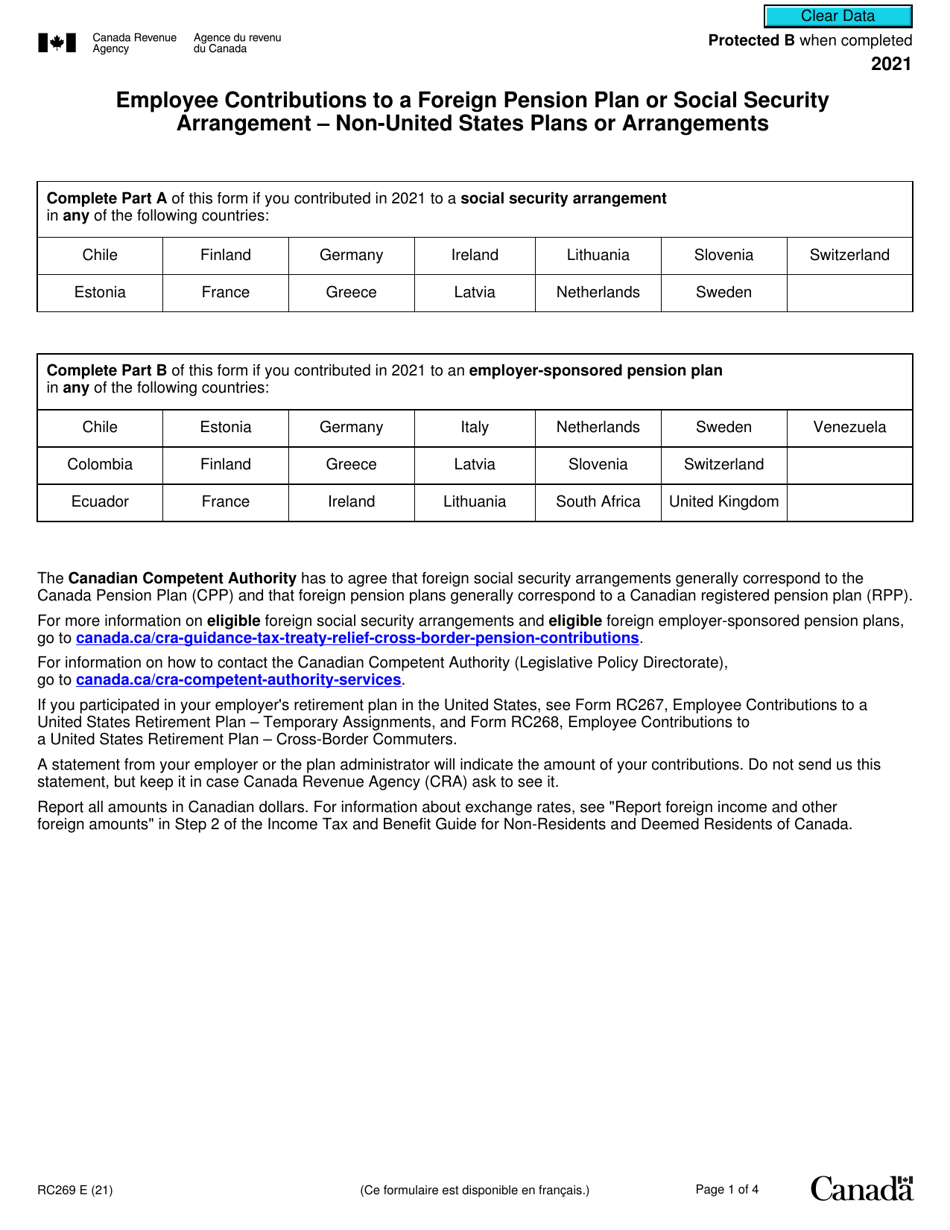

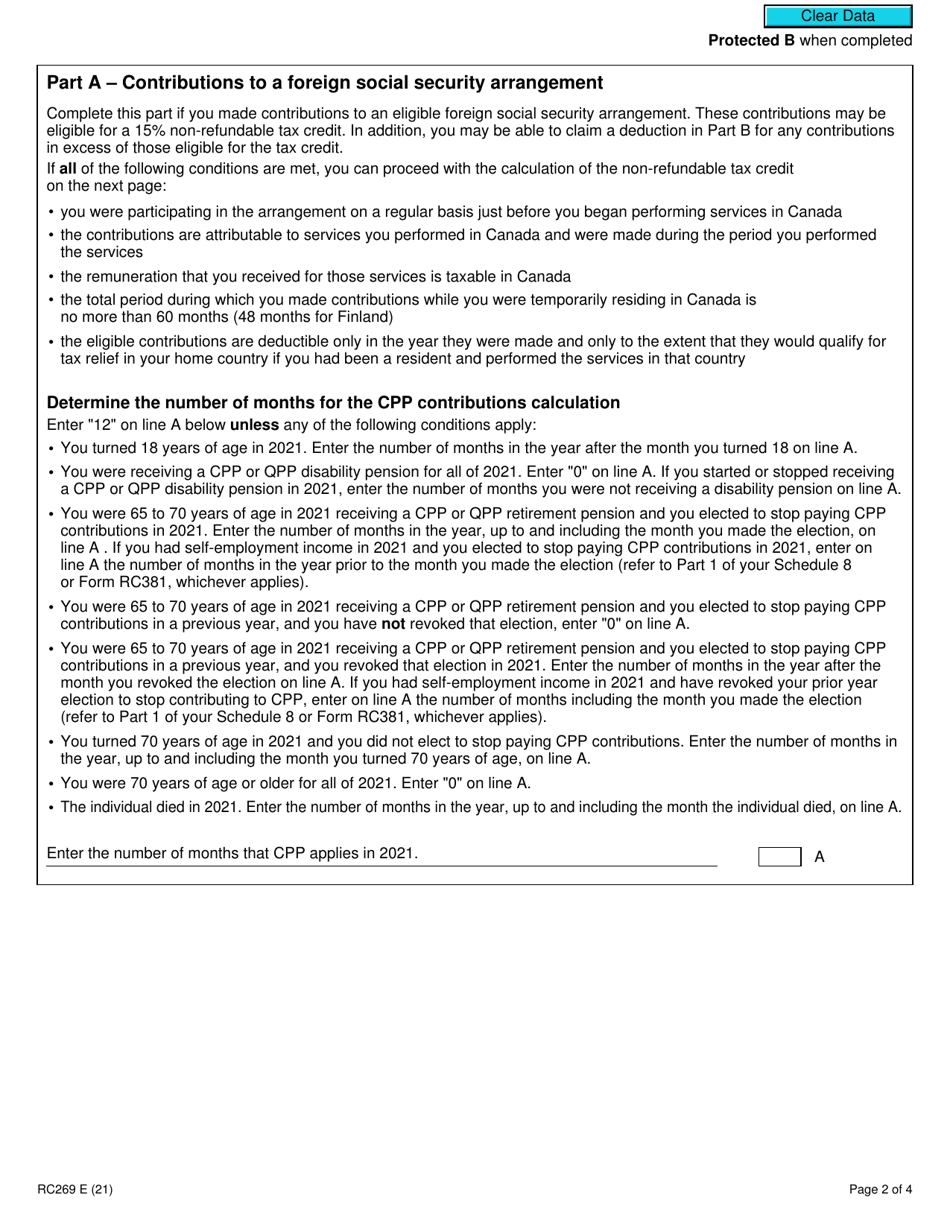

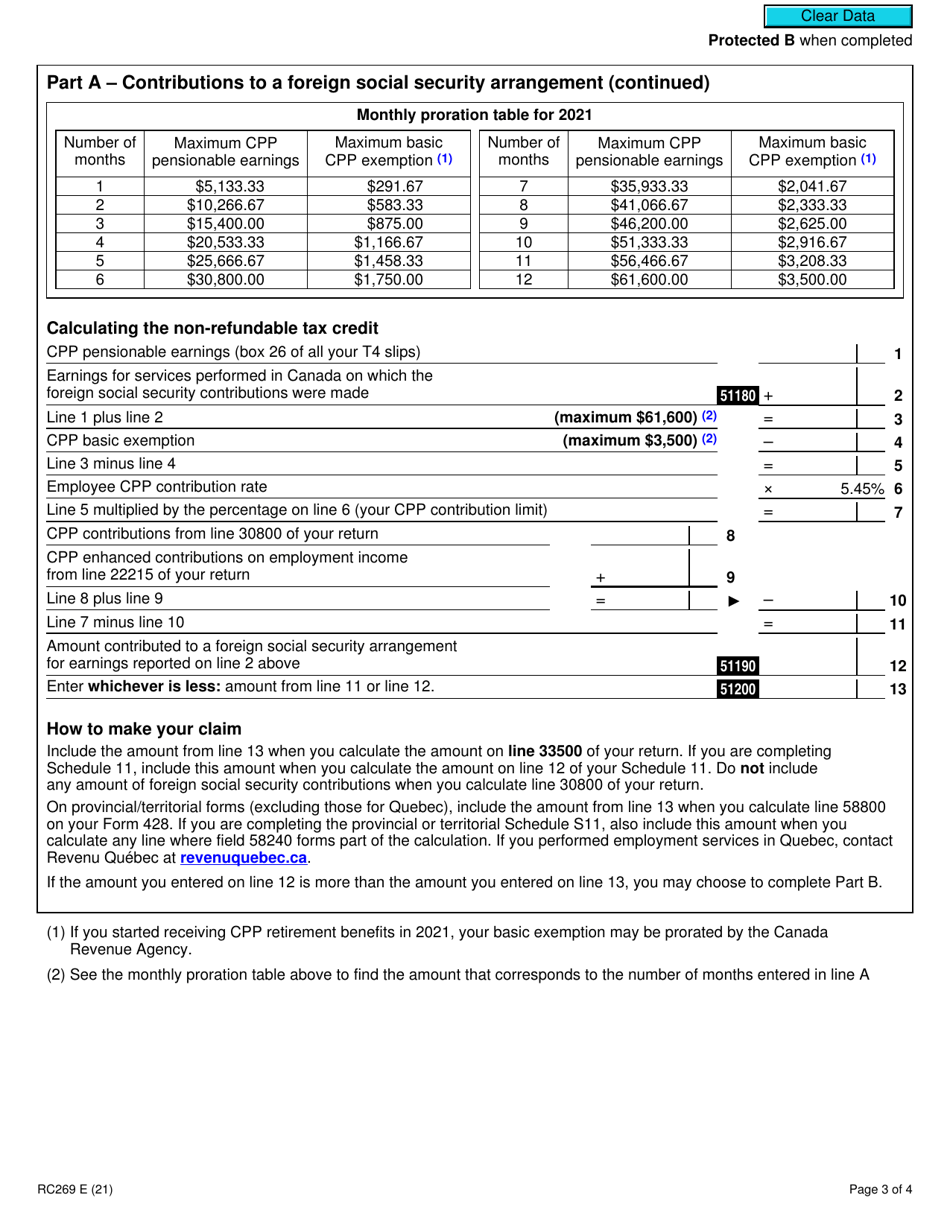

Form RC269 is used by residents of Canada who contribute to a foreign pension plan or social security arrangement outside the United States. This form is used to provide information about these contributions to the Canada Revenue Agency for tax purposes.

FAQ

Q: What is Form RC269?

A: Form RC269 is a tax form used to report employee contributions to a foreign pension plan or social security arrangement in Canada.

Q: Who needs to file Form RC269?

A: Any individual who contributed to a foreign pension plan or social security arrangement in Canada needs to file Form RC269.

Q: What kind of plans or arrangements does Form RC269 cover?

A: Form RC269 covers non-United States plans or arrangements in Canada.

Q: What information is required on Form RC269?

A: Form RC269 requires information about the foreign pension plan or social security arrangement, including the type of plan, contributions made, and any benefits received.

Q: When is Form RC269 due?

A: Form RC269 is generally due on or before your personal incometax filing deadline, which is usually April 30th.