This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC240

for the current year.

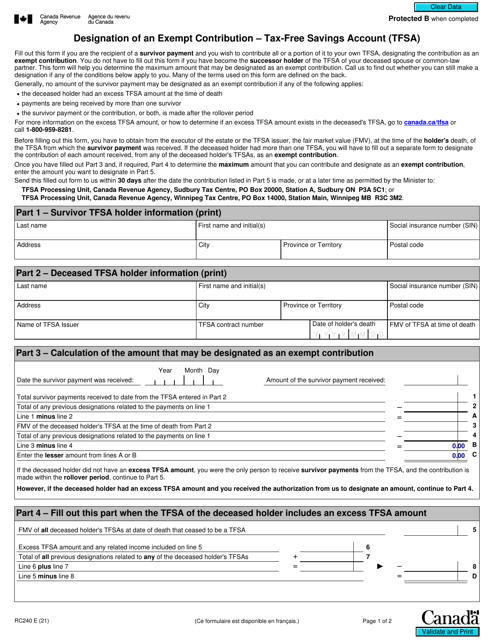

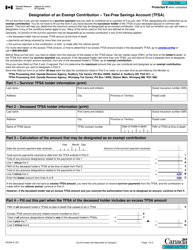

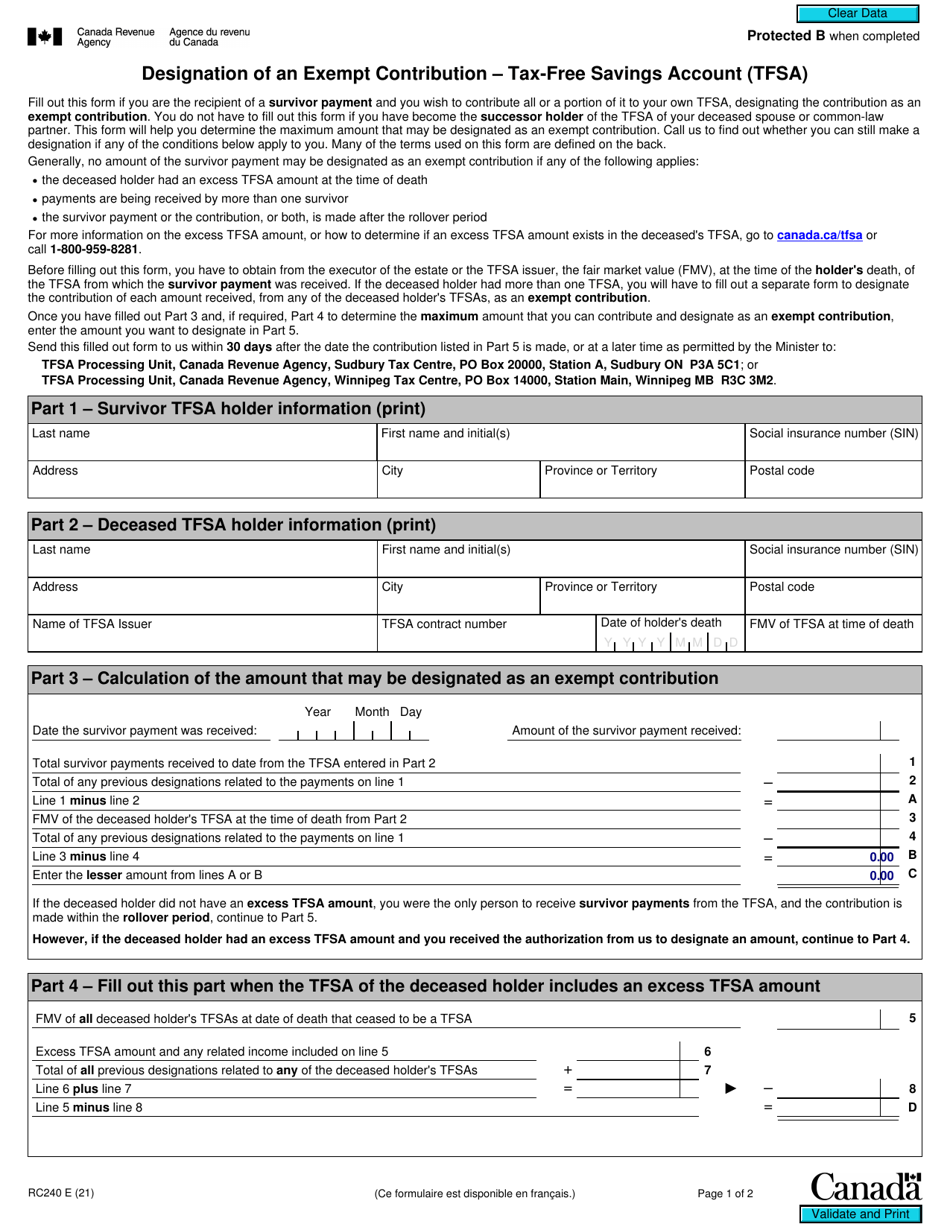

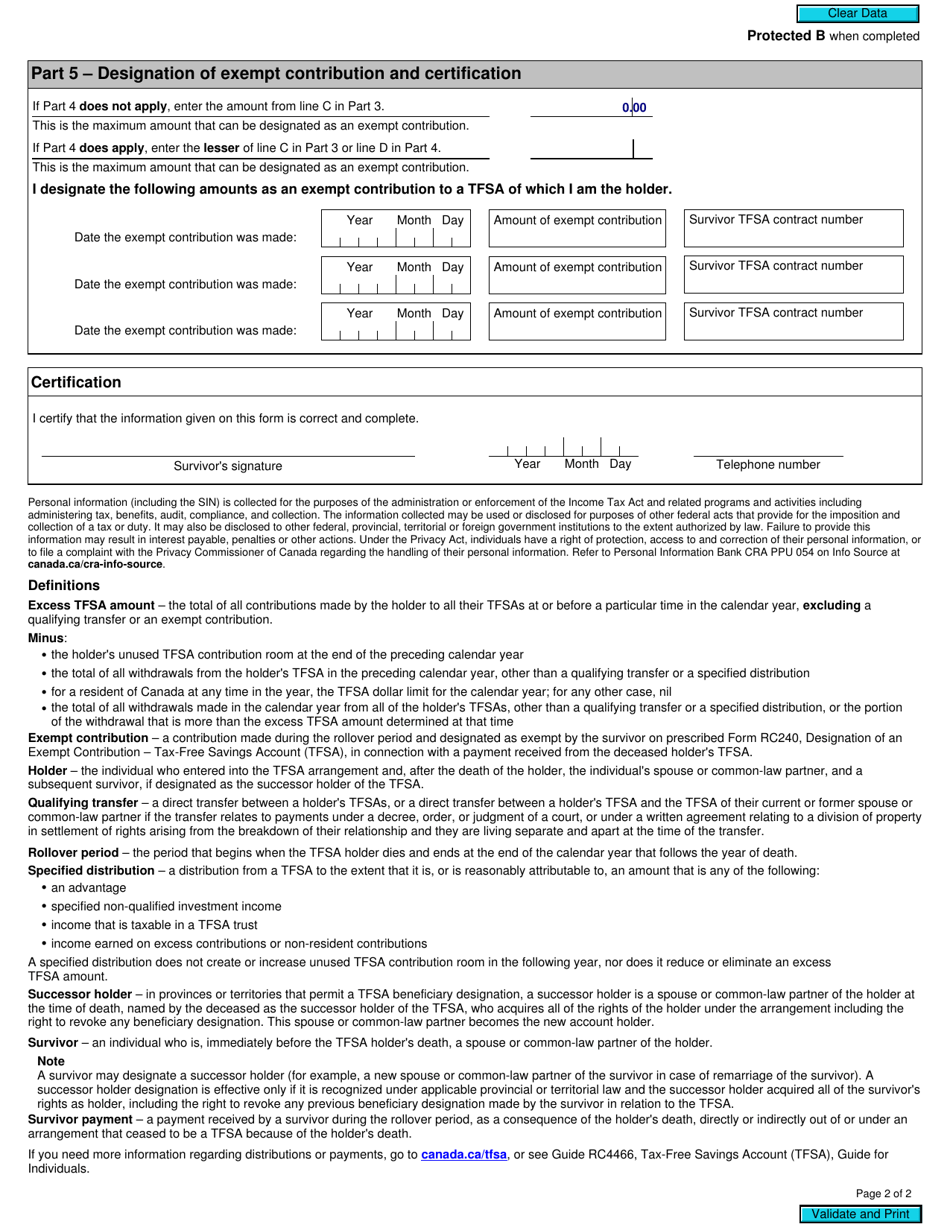

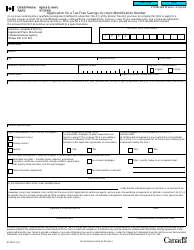

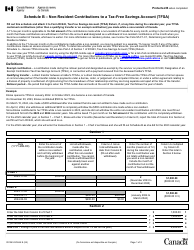

Form RC240 Designation of an Exempt Contribution - Tax-Free Savings Account (Tfsa) - Canada

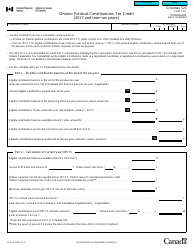

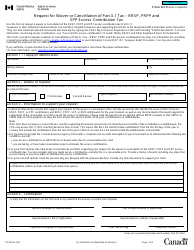

Form RC240, Designation of an Exempt Contribution - Tax-Free Savings Account (TFSA) - Canada, is used to designate a contribution made to a Tax-Free Savings Account as an exempt contribution for tax purposes. This form allows individuals to notify the Canada Revenue Agency (CRA) that their TFSA contribution should not be subject to any penalties or taxes.

The form RC240 Designation of an Exempt Contribution for Tax-Free Savings Account (TFSA) in Canada is filed by the individual making the contribution to their TFSA.

FAQ

Q: What is Form RC240?

A: Form RC240 is Designation of an Exempt Contribution - Tax-Free Savings Account (TFSA) form.

Q: What is a Tax-Free Savings Account (TFSA)?

A: A Tax-Free Savings Account (TFSA) is a registered account that allows Canadians to earn tax-free investment income.

Q: What is the purpose of Form RC240?

A: The purpose of Form RC240 is to designate the contributions made to a TFSA as exempt from taxes.

Q: Who needs to fill out Form RC240?

A: Individuals who have made contributions to a TFSA and want to designate those contributions as exempt from taxes need to fill out Form RC240.

Q: What information is required on Form RC240?

A: Form RC240 requires information such as your name, social insurance number, TFSA account number, contribution amounts, and designation details.

Q: When should Form RC240 be submitted?

A: Form RC240 should be submitted by the deadline for filing your income tax return for the year in which the contributions were made.

Q: Are there any penalties for not filing Form RC240?

A: Failure to file Form RC240 may result in penalties, including a penalty of 1% per month on the excess TFSA amount.

Q: Is there a fee for filing Form RC240?

A: There is no fee for filing Form RC240.

Q: Can Form RC240 be amended?

A: Yes, if you need to make changes to your designation or correct any errors, you can amend Form RC240 by submitting a new form with the updated information.