This version of the form is not currently in use and is provided for reference only. Download this version of

Form TL2

for the current year.

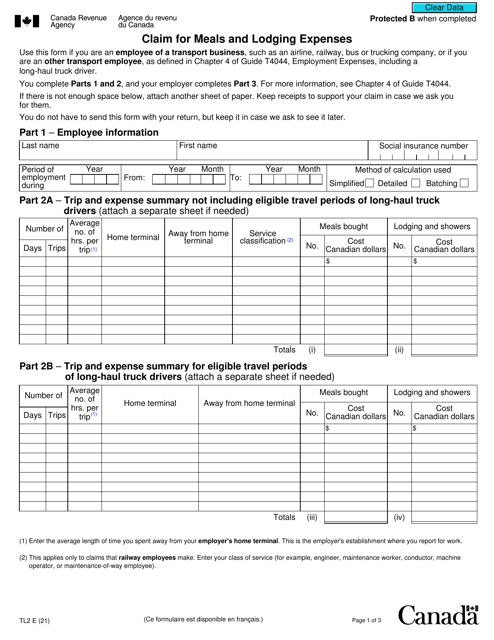

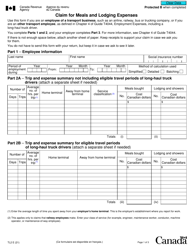

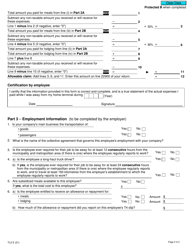

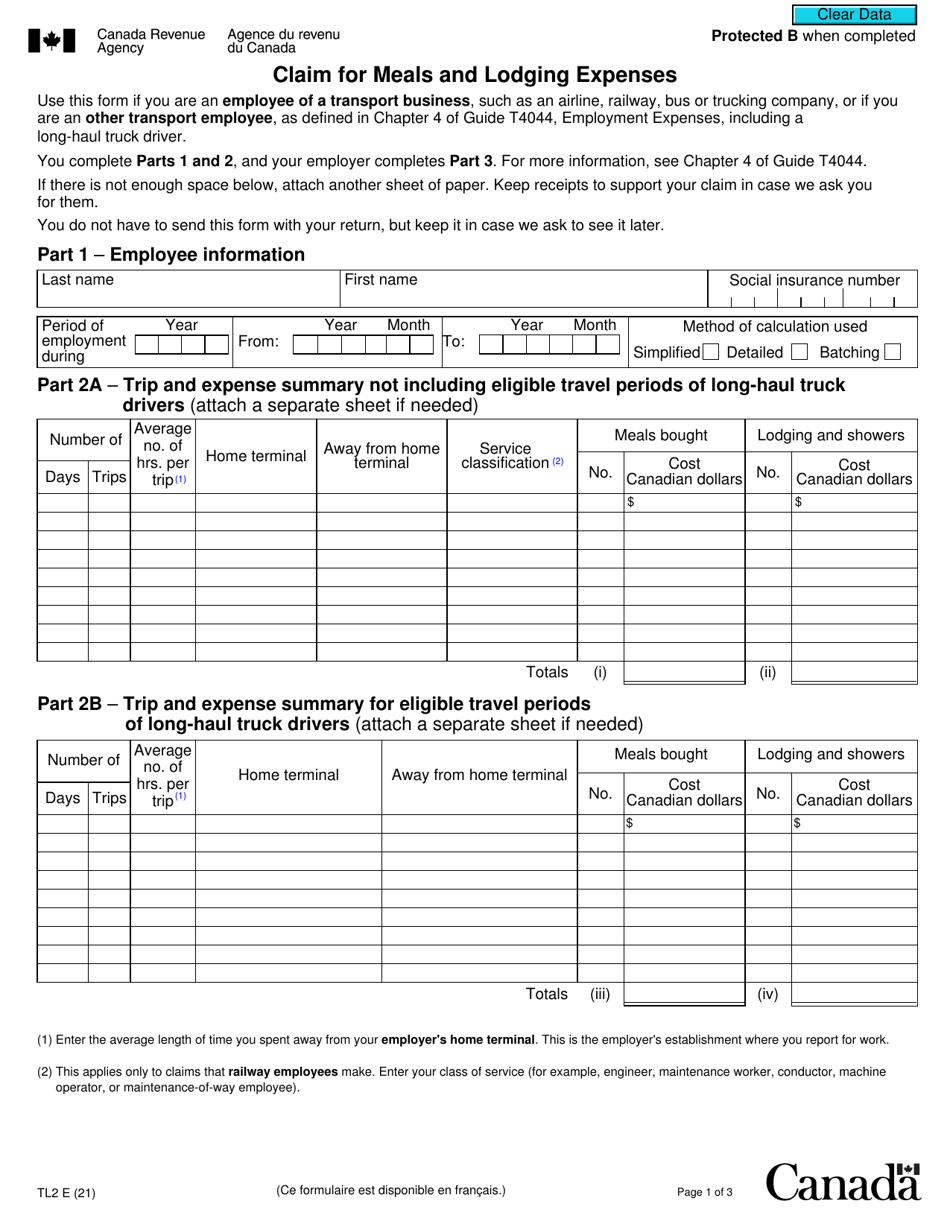

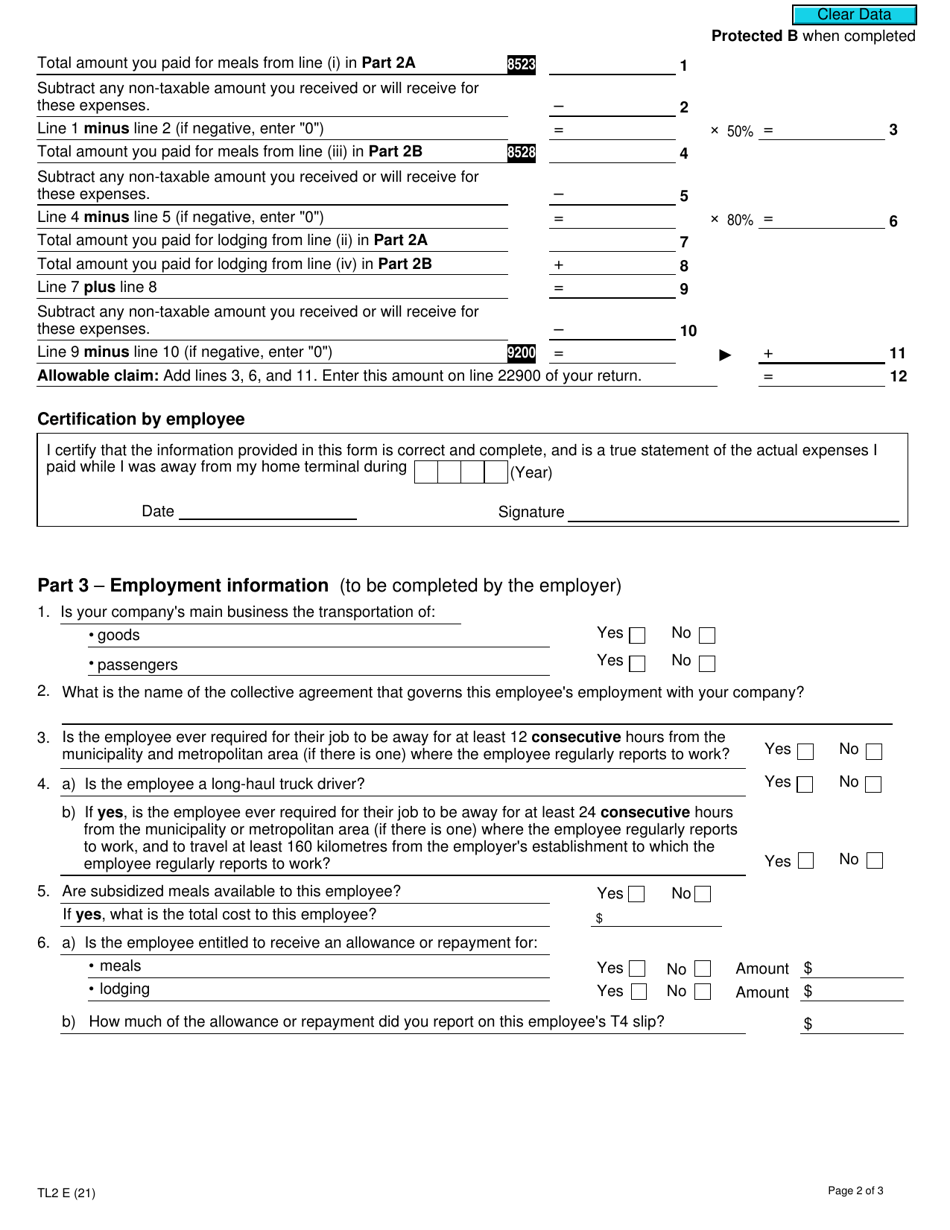

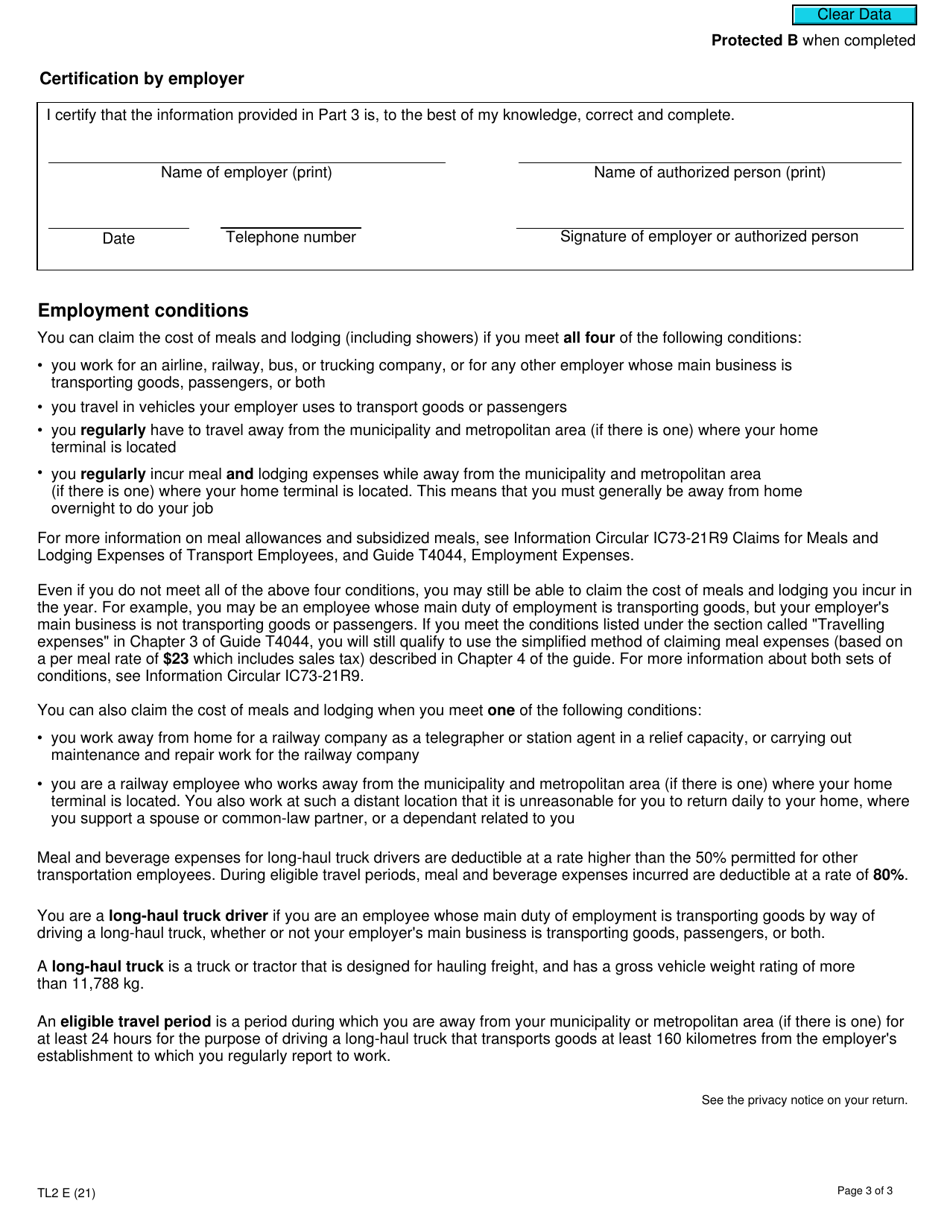

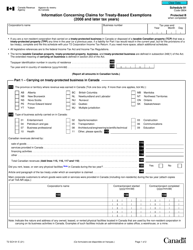

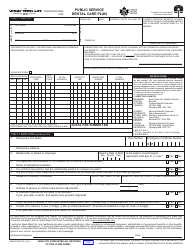

Form TL2 Claim for Meals and Lodging Expenses - Canada

Form TL2 Claim for Meals and Lodging Expenses in Canada is used to claim deductions for business-related travel expenses incurred by employees. It helps individuals who are required to be away from their usual place of employment to recover some of the costs associated with meals and accommodations during their business trips.

In Canada, employees who incur meals and lodging expenses for business travel can file the Form TL2 to claim these expenses.

FAQ

Q: What is TL2?

A: TL2 is a form used to claim meals and lodging expenses in Canada.

Q: When should I use the TL2 form?

A: You should use the TL2 form if you need to claim meals and lodging expenses incurred as part of your employment.

Q: What information do I need to complete the TL2 form?

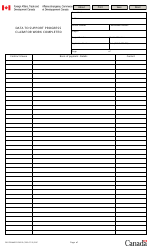

A: You will need to provide details such as the dates of travel, the location of the expenses, the purpose of the trip, and the amount spent on meals and lodging.

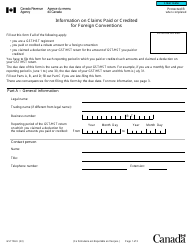

Q: Can I claim all meals and lodging expenses on the TL2 form?

A: No, the TL2 form is specifically for claiming expenses that are not eligible for a tax deduction or reimbursement from your employer.

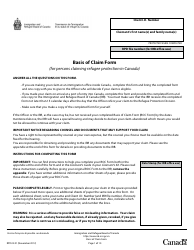

Q: Do I need to submit receipts with the TL2 form?

A: Yes, you should keep and submit all receipts for meals and lodging expenses along with your TL2 form.

Q: How do I submit the TL2 form?

A: You can submit the completed TL2 form along with your income tax return or send it separately to the CRA.

Q: When is the deadline for submitting the TL2 form?

A: The deadline for submitting the TL2 form is the same as the deadline for filing your income tax return, which is usually April 30th of each year.

Q: Can I claim expenses for both Canada and the US on the TL2 form?

A: No, the TL2 form is only for expenses incurred within Canada. If you have expenses for both countries, you may need to use different forms or consult a tax professional.