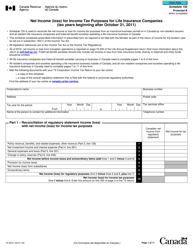

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T936

for the current year.

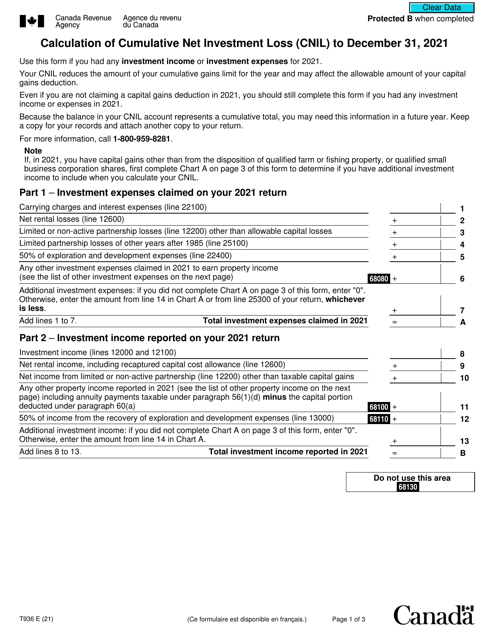

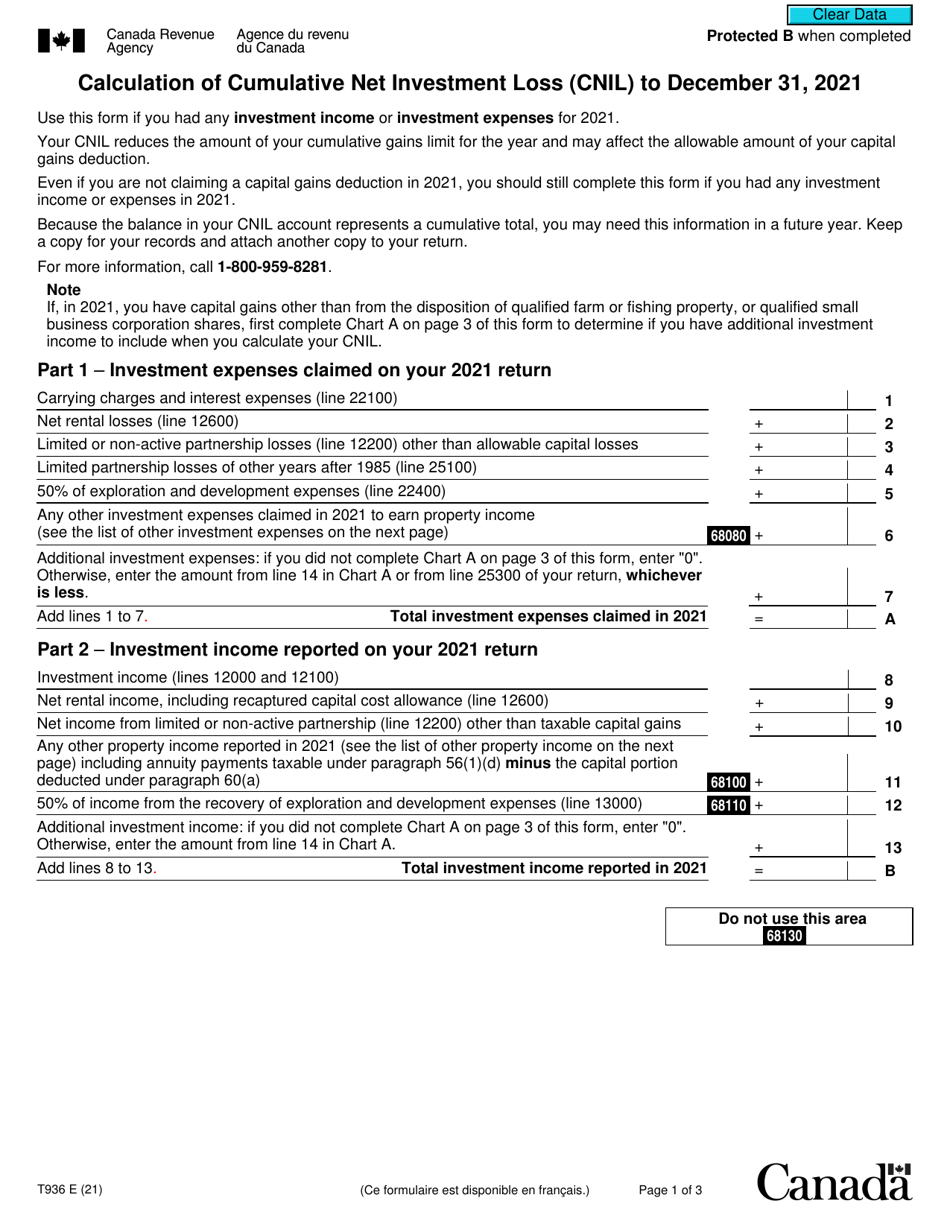

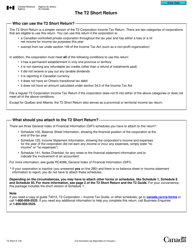

Form T936 Calculation of Cumulative Net Investment Loss (CNIL) - Canada

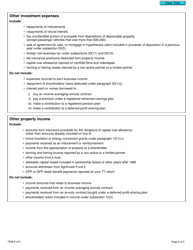

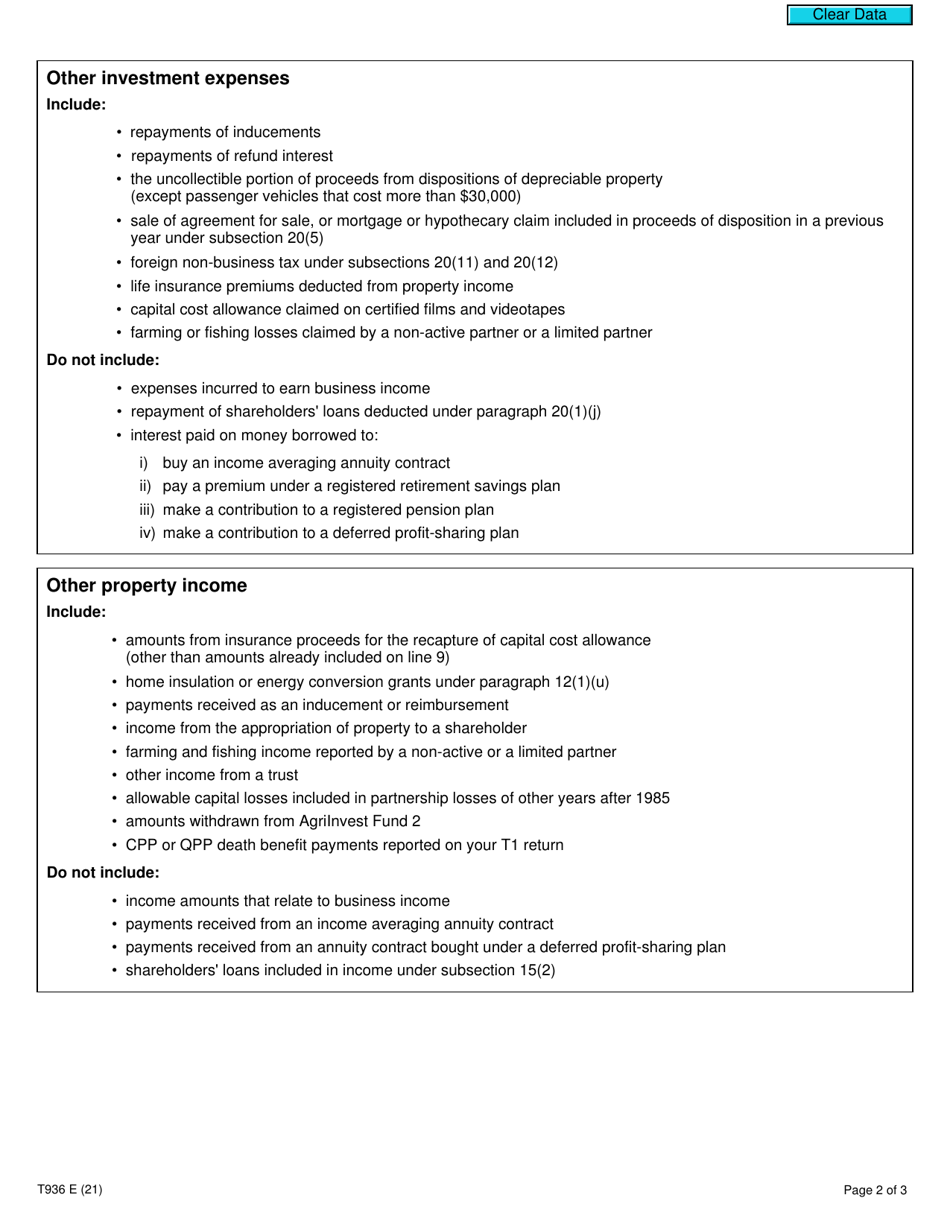

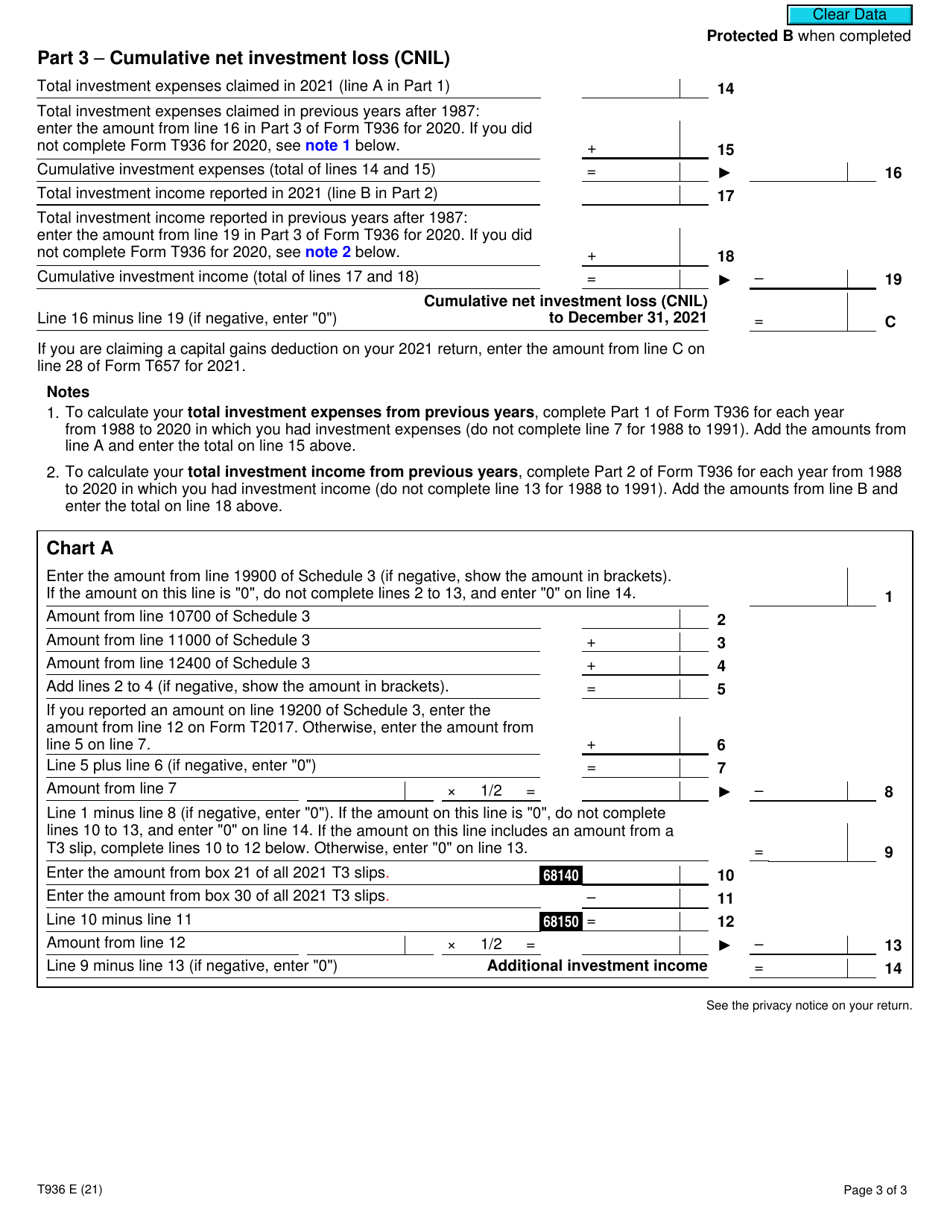

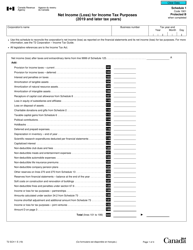

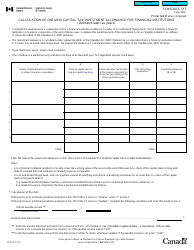

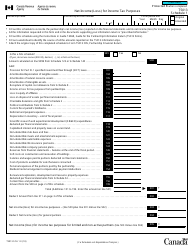

Form T936 Calculation of Cumulative Net Investment Loss (CNIL) in Canada is used to calculate the cumulative net investment loss (CNIL) of a taxpayer. CNIL is the cumulative amount of net investment loss that can be carried forward and deducted from future taxable capital gains. It helps taxpayers determine the amount of CNIL they can deduct from their capital gains in future years.

The Form T936 Calculation of Cumulative Net Investment Loss (CNIL) in Canada is typically filed by individuals who have incurred losses from their investments and wish to carry forward those losses to offset future gains.

FAQ

Q: What is Form T936?

A: Form T936 is a form used in Canada to calculate the Cumulative Net Investment Loss (CNIL).

Q: What is Cumulative Net Investment Loss (CNIL)?

A: Cumulative Net Investment Loss (CNIL) is a balance that represents the cumulative losses incurred by an individual or corporation from certain investment activities.

Q: Why is CNIL important?

A: CNIL is important because it can be used to offset future gains from investment activities, reducing the taxes owed on those gains.

Q: Who needs to complete Form T936?

A: Individuals or corporations who have incurred losses from investment activities and wish to calculate their CNIL need to complete Form T936.

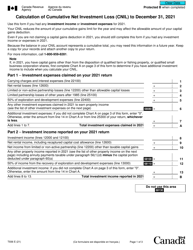

Q: How do I complete Form T936?

A: To complete Form T936, you need to gather information about your investment activities and calculate the cumulative losses. The form provides specific instructions on how to do this.

Q: When is the deadline to file Form T936?

A: The deadline to file Form T936 is the same as the deadline for filing your income tax return, which is usually April 30th for most individuals.

Q: Are there any penalties for late or incorrect filing of Form T936?

A: Yes, there can be penalties for late or incorrect filing of Form T936, such as interest charges on any unpaid taxes or potential audits by the CRA.