This version of the form is not currently in use and is provided for reference only. Download this version of

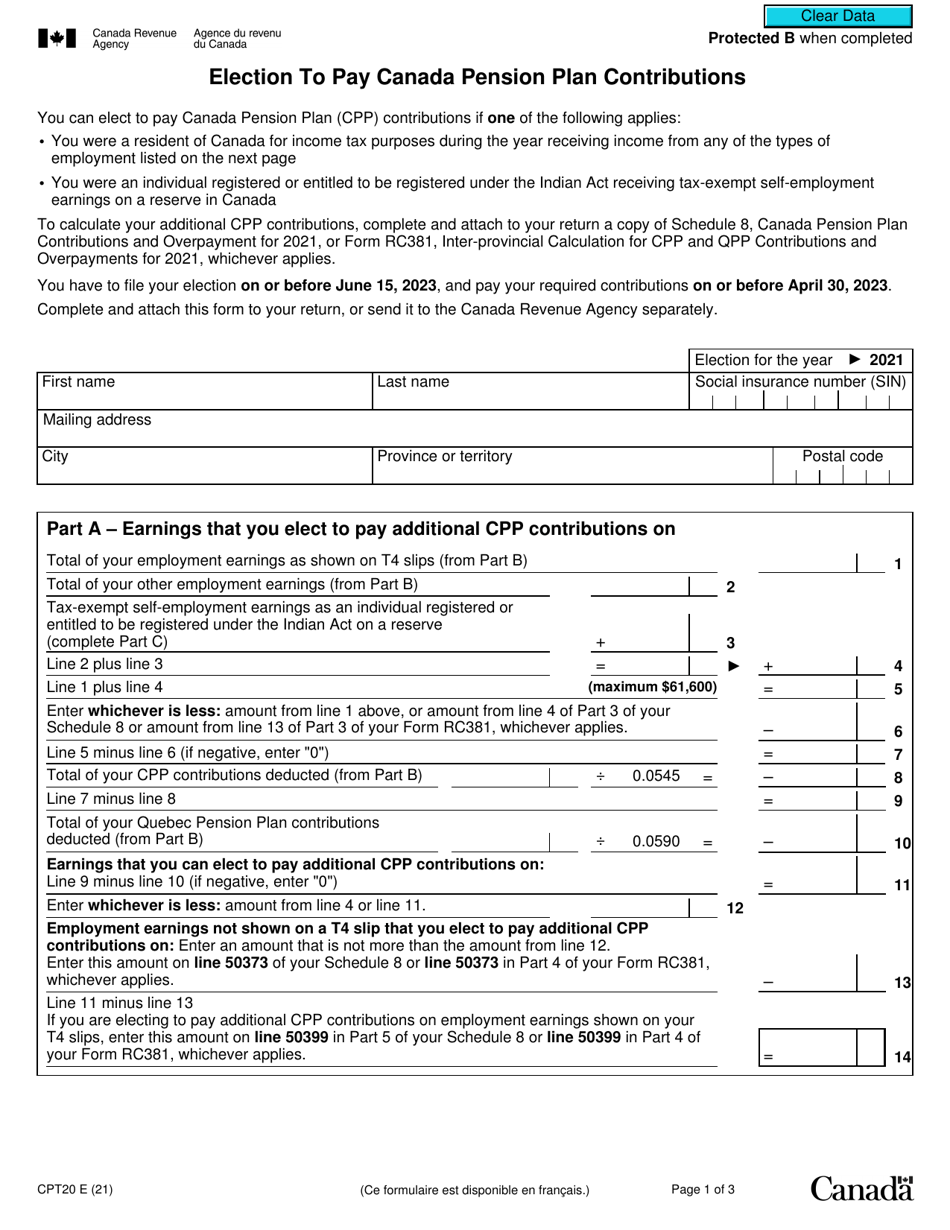

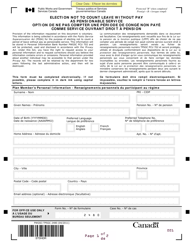

Form CPT20

for the current year.

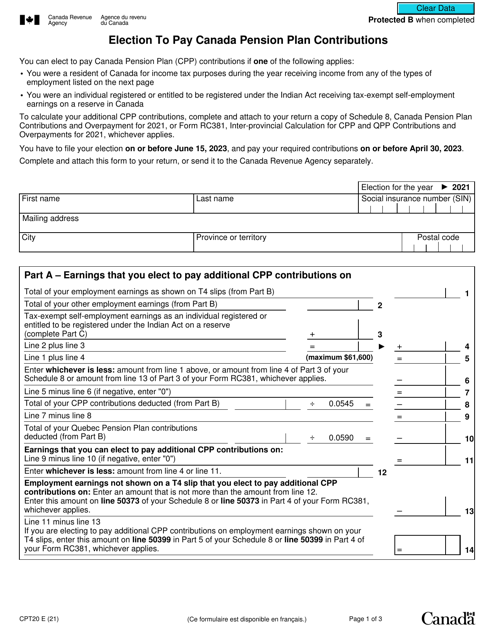

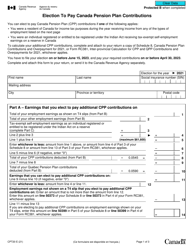

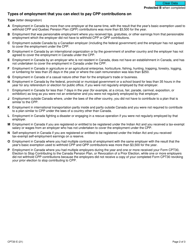

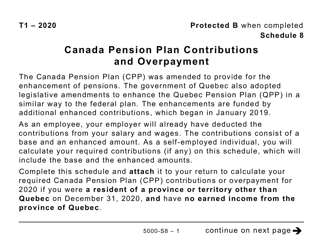

Form CPT20 Election to Pay Canada Pension Plan Contributions - Canada

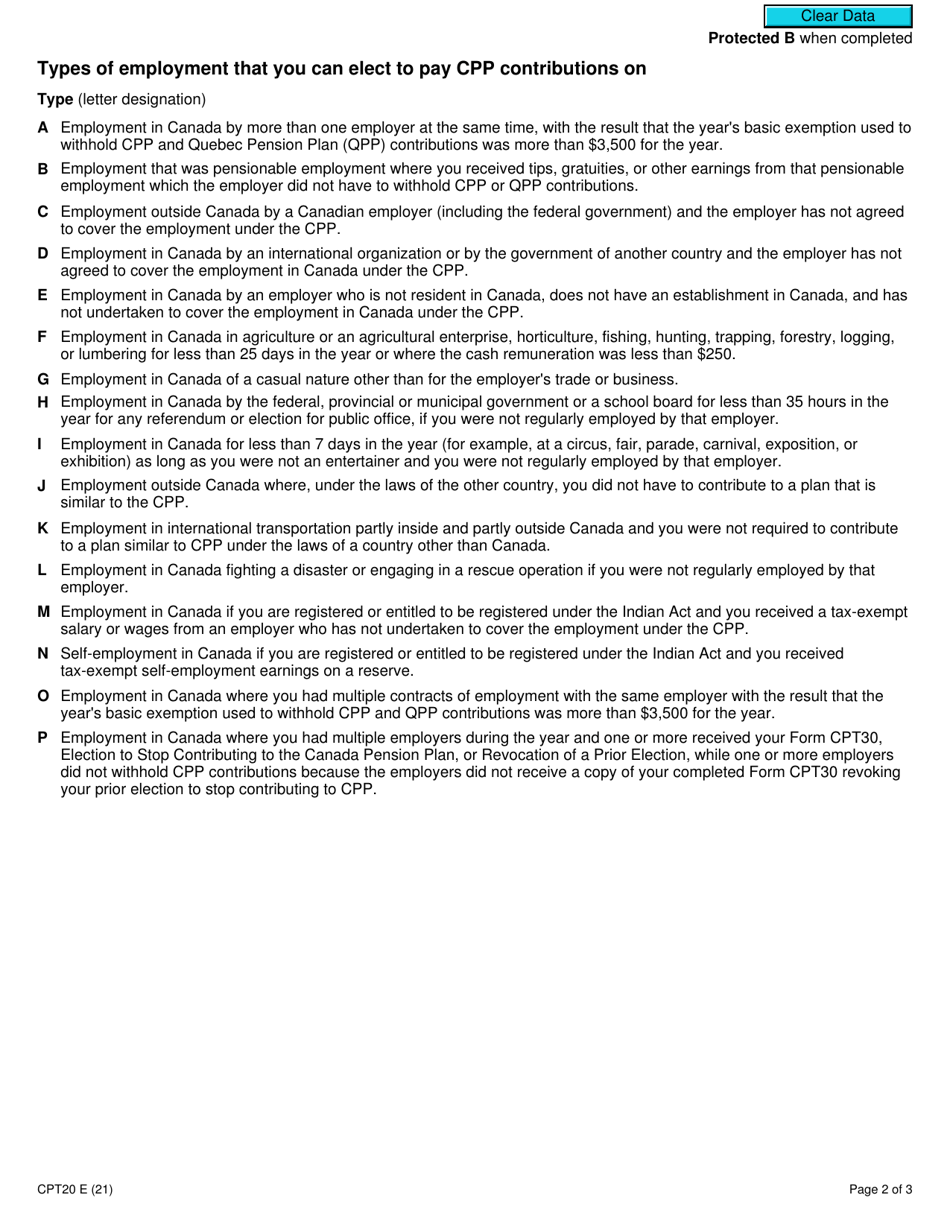

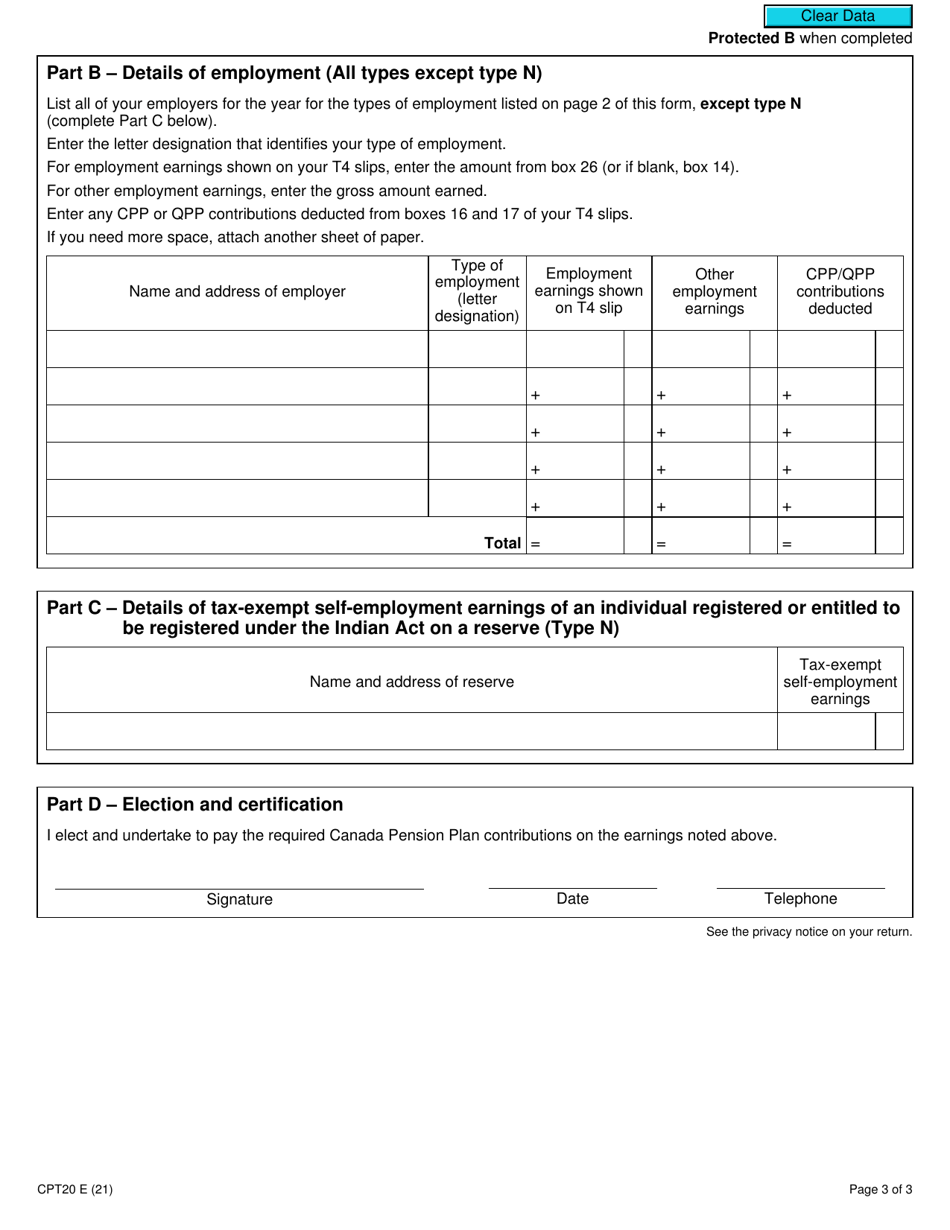

Form CPT20 Election to Pay Canada Pension Plan Contributions is used by individuals who are employed or self-employed in Canada and wish to choose to contribute to the Canada Pension Plan (CPP) even if they are already contributing to a comparable social security system in another country. This form allows them to make an election to pay CPP contributions and receive CPP benefits in the future.

The employer files the Form CPT20 Election to Pay Canada Pension Plan Contributions in Canada.

FAQ

Q: What is Form CPT20?

A: Form CPT20 is a form used to elect to pay Canadian Pension Plan (CPP) contributions in Canada.

Q: Who can use Form CPT20?

A: Anyone who is eligible to contribute to the Canada Pension Plan (CPP) can use Form CPT20.

Q: Why would I want to use Form CPT20?

A: You might want to use Form CPT20 if you are a resident of the United States and want to continue contributing to the Canada Pension Plan (CPP).

Q: How do I use Form CPT20?

A: To use Form CPT20, you need to complete the form and submit it to the Canada Revenue Agency (CRA) along with any required documentation.

Q: Is there a deadline for submitting Form CPT20?

A: Yes, there is a deadline for submitting Form CPT20. The deadline is generally 60 days from the date you become eligible to contribute to the Canada Pension Plan (CPP).

Q: What happens after I submit Form CPT20?

A: After you submit Form CPT20, the Canada Revenue Agency (CRA) will review your form and notify you of the next steps.

Q: Can I change my election after submitting Form CPT20?

A: Yes, you can change your election after submitting Form CPT20. However, there are specific rules and procedures for doing so.

Q: Are there any tax implications for using Form CPT20?

A: There may be tax implications for using Form CPT20. It is recommended to consult with a tax professional or the Canada Revenue Agency (CRA) for more information.