This version of the form is not currently in use and is provided for reference only. Download this version of

Form E414

for the current year.

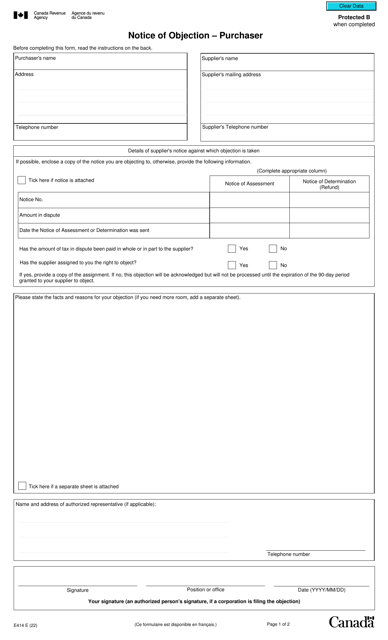

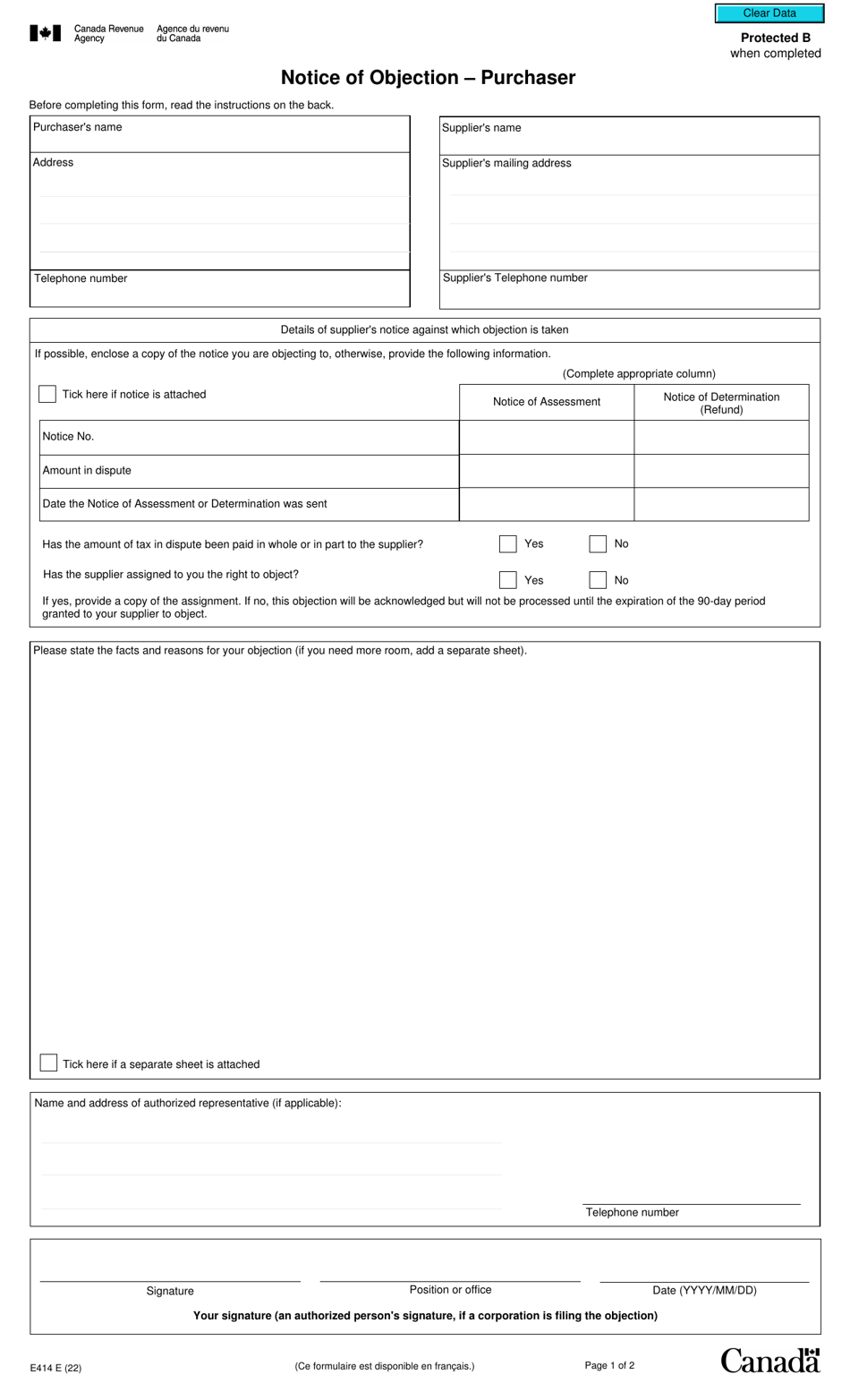

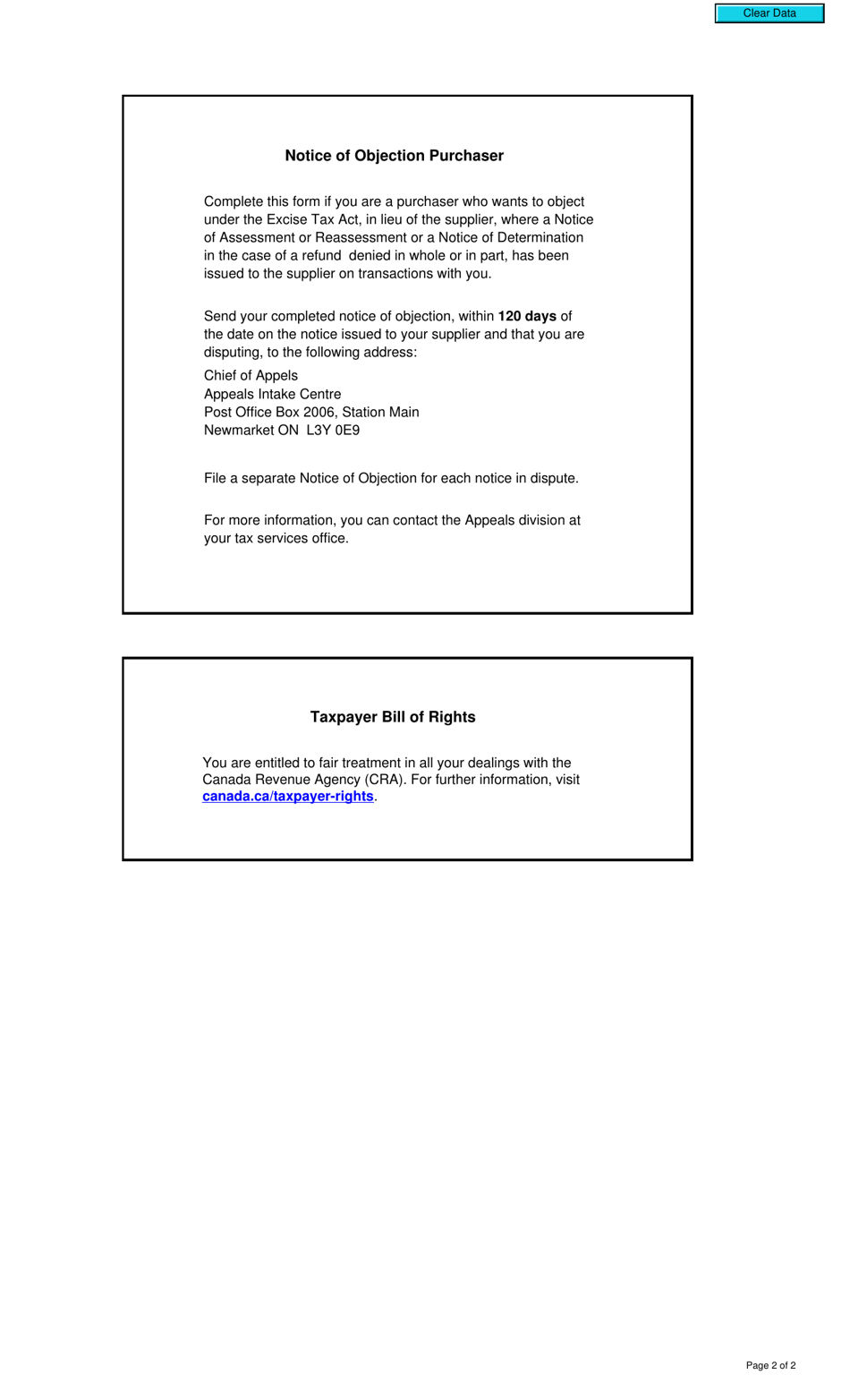

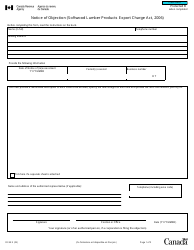

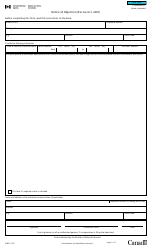

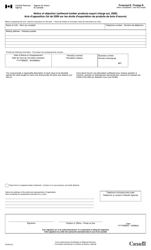

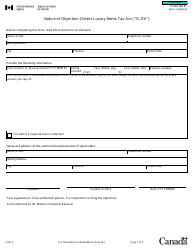

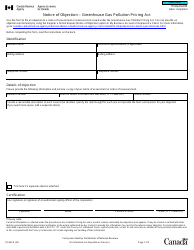

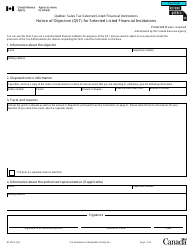

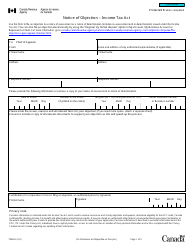

Form E414 Notice of Objection - Purchaser - Canada

Form E414 Notice of Objection - Purchaser is used in Canada to file a formal objection against the determination of a goods and services tax/harmonized sales tax (GST/HST) assessment. It allows a purchaser to dispute the amount of GST/HST that they have been assessed by the Canada Revenue Agency (CRA).

The Form E414 Notice of Objection is typically filed by the purchaser in Canada.

FAQ

Q: What is Form E414?

A: Form E414 is a Notice of Objection for purchasers in Canada.

Q: Who files Form E414?

A: The purchaser files Form E414.

Q: What is the purpose of Form E414?

A: The purpose of Form E414 is to object to the amount of tax payable or tax refund claimed by the purchaser.

Q: When should Form E414 be filed?

A: Form E414 should be filed within 90 days after the notification of assessment.

Q: Is there a fee for filing Form E414?

A: No, there is no fee for filing Form E414.