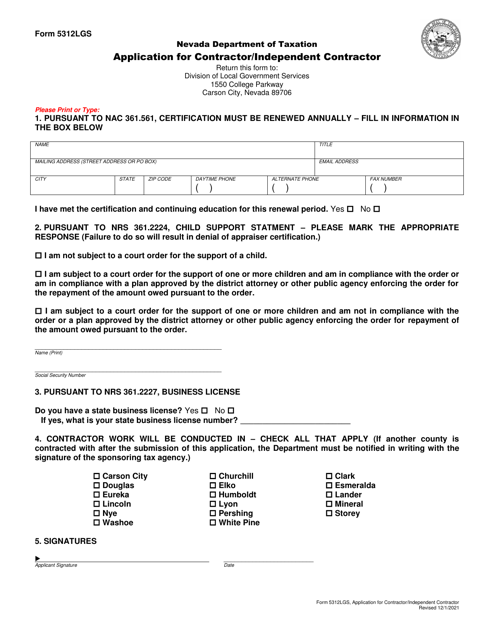

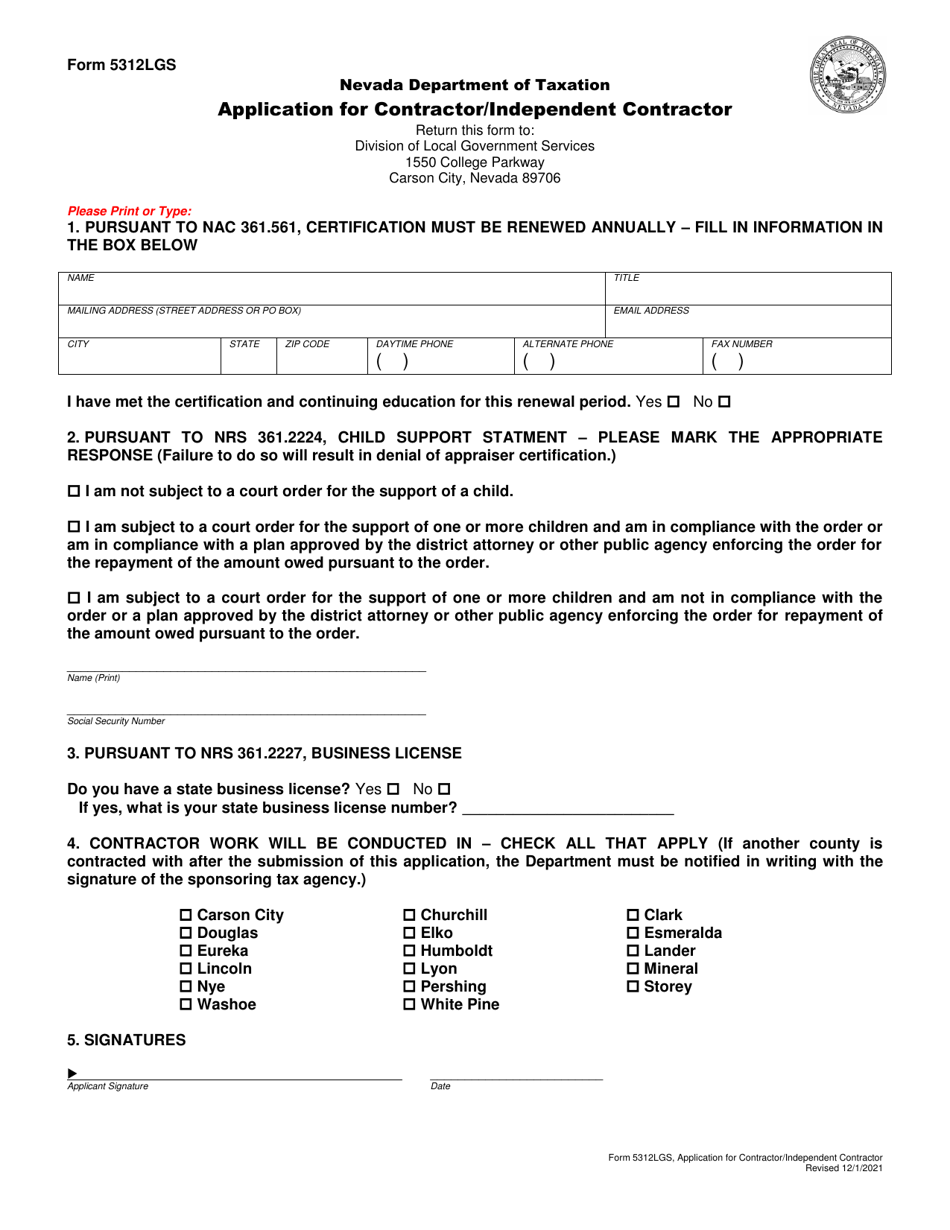

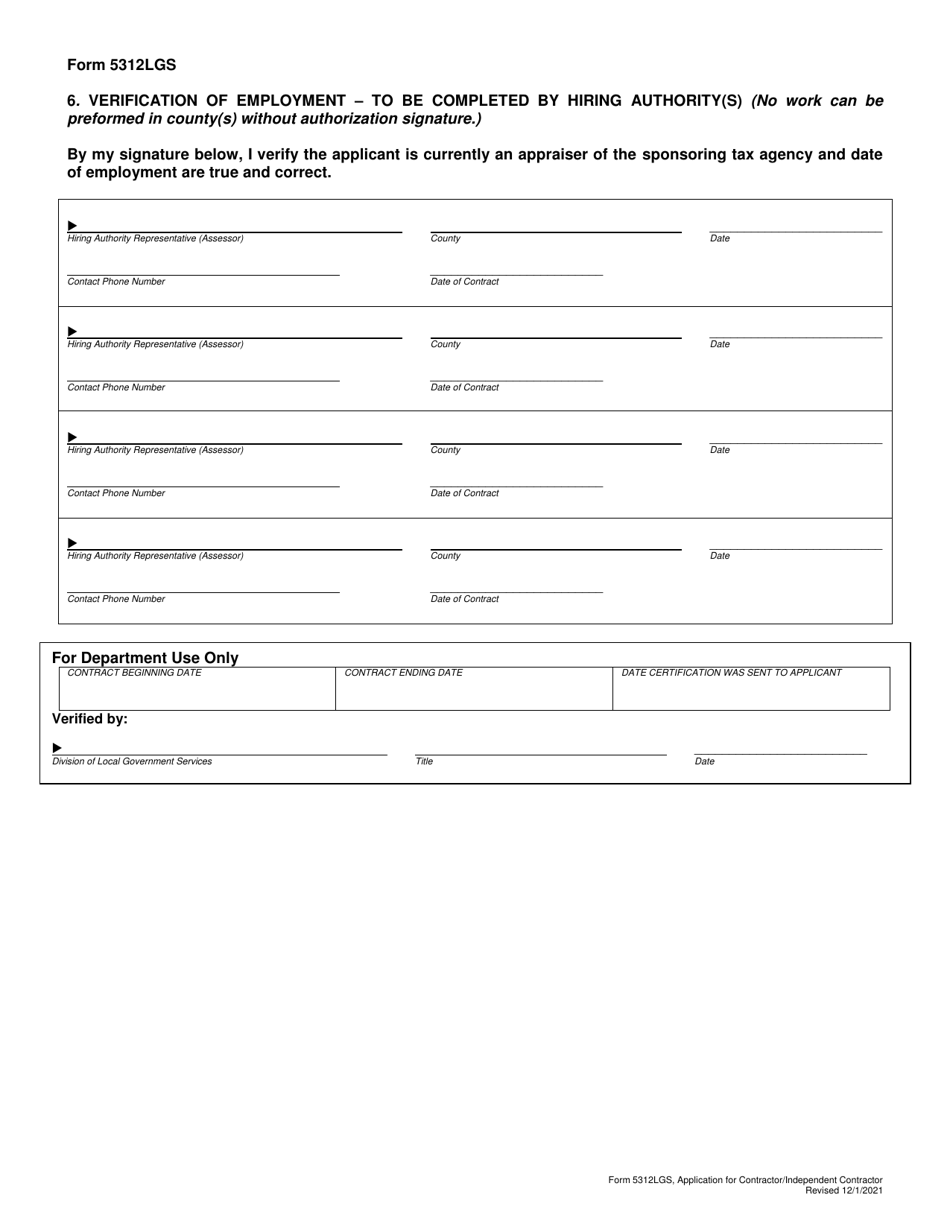

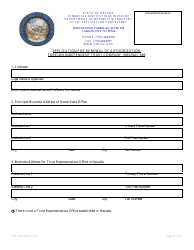

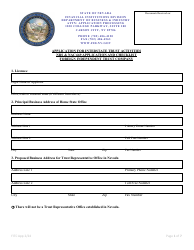

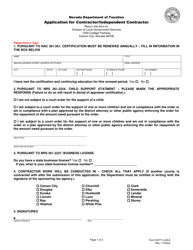

Form 5312LGS Application for Contractor / Independent Contractor - Nevada

What Is Form 5312LGS?

This is a legal form that was released by the Nevada Department of Taxation - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 5312LGS?

A: Form 5312LGS is an application for contractors and independent contractors in Nevada.

Q: Who is eligible to use form 5312LGS?

A: Contractors and independent contractors in Nevada can use form 5312LGS.

Q: What is the purpose of form 5312LGS?

A: The purpose of form 5312LGS is to apply for contractor or independent contractor status in Nevada.

Q: Is form 5312LGS mandatory?

A: Yes, form 5312LGS is mandatory for contractors and independent contractors in Nevada.

Q: What information is required on form 5312LGS?

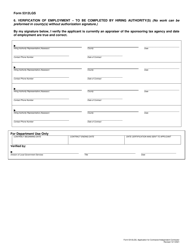

A: Form 5312LGS requires information such as personal and business details, license information, and tax identification numbers.

Q: Are there any fees associated with form 5312LGS?

A: Yes, there is a fee required when submitting form 5312LGS.

Q: What should I do after submitting form 5312LGS?

A: After submitting form 5312LGS, you should wait for approval from the Nevada Department of Taxation.

Q: Can I appeal if my application on form 5312LGS is denied?

A: Yes, you can appeal if your application on form 5312LGS is denied by the Nevada Department of Taxation. Contact the department for more information.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Nevada Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5312LGS by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.