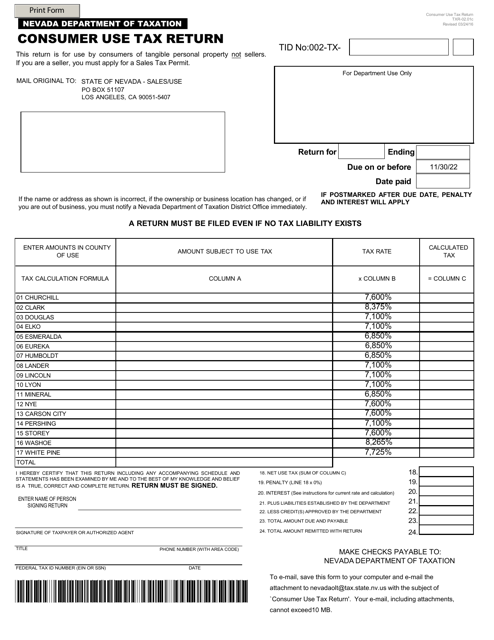

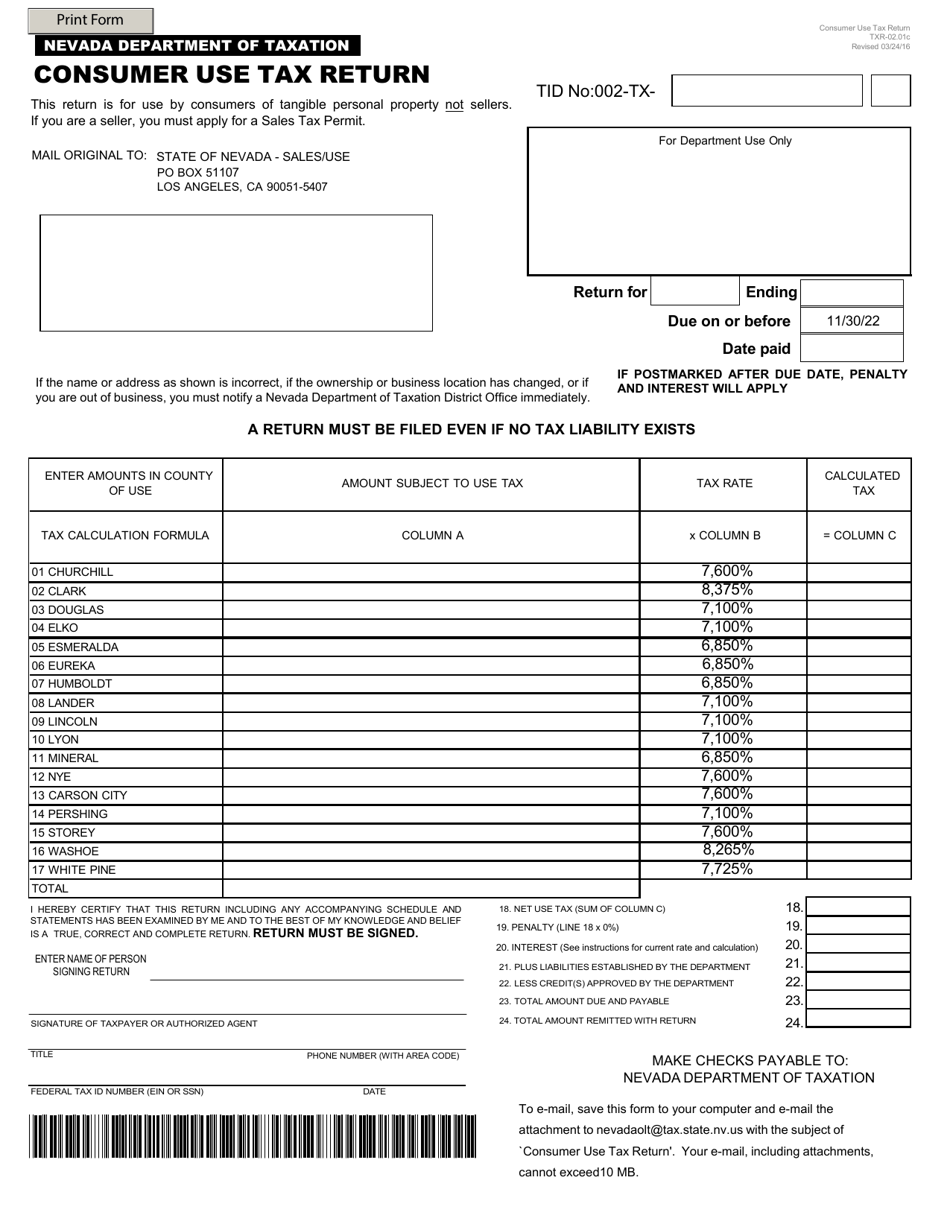

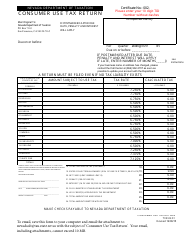

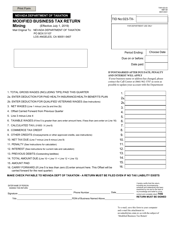

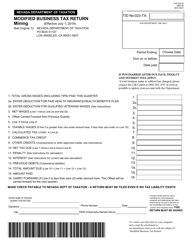

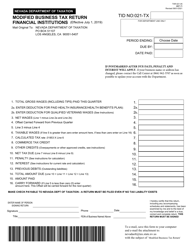

Form TXR-02.01C Consumer Use Tax Return - Nevada

What Is Form TXR-02.01C?

This is a legal form that was released by the Nevada Department of Taxation - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TXR-02.01C?

A: Form TXR-02.01C is the Consumer Use Tax Return for Nevada.

Q: What is the purpose of Form TXR-02.01C?

A: The purpose of Form TXR-02.01C is to report and pay consumer use tax in Nevada.

Q: Who needs to file Form TXR-02.01C?

A: Anyone who has made purchases without paying sales tax in Nevada may be required to file Form TXR-02.01C.

Q: When is Form TXR-02.01C due?

A: Form TXR-02.01C is typically due on a monthly, quarterly, or annual basis, depending on your reporting frequency.

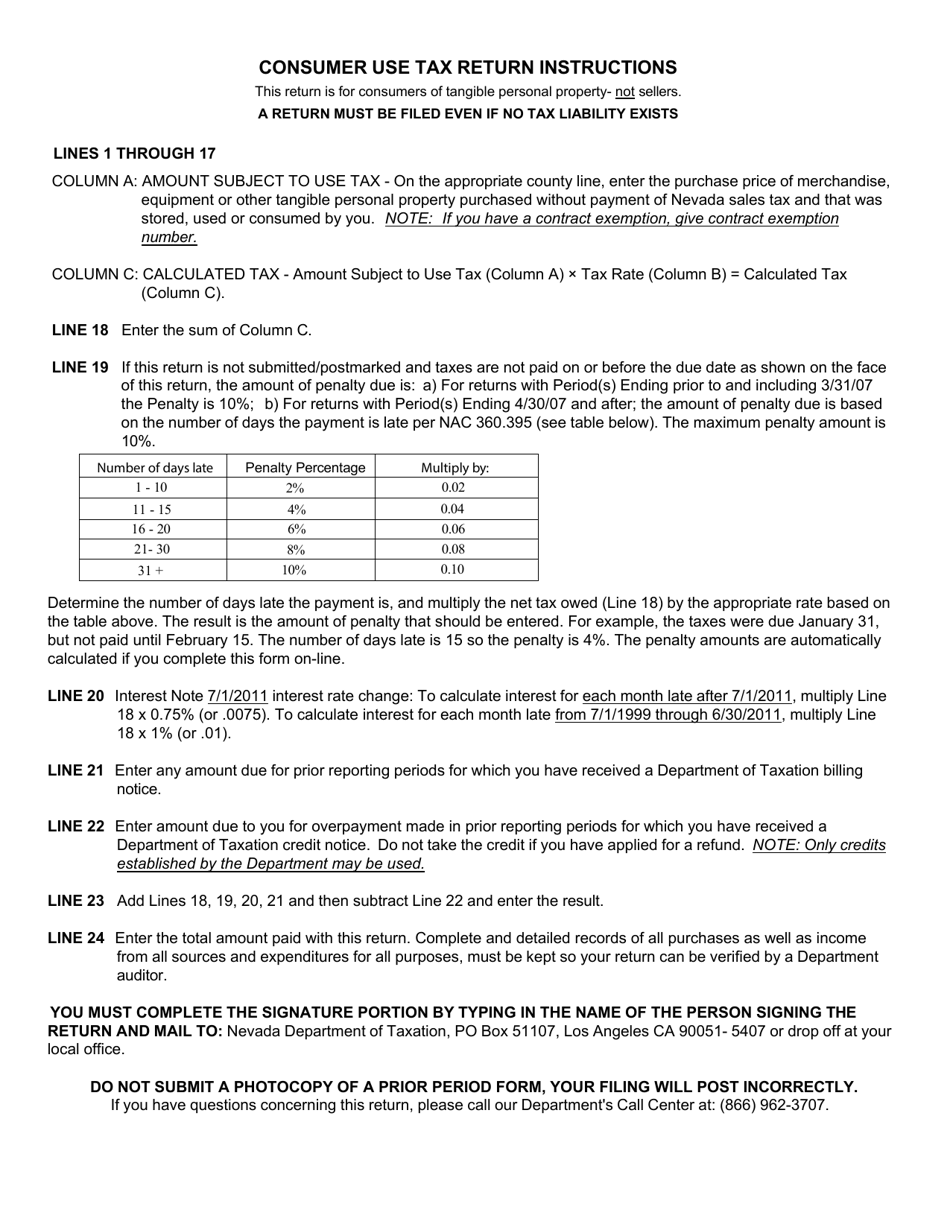

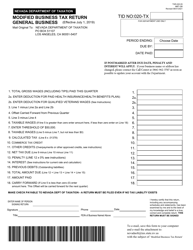

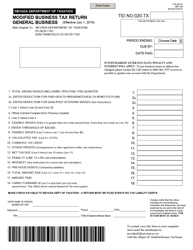

Q: How do I fill out Form TXR-02.01C?

A: You will need to provide information about your purchases subject to consumer use tax and calculate the tax owed.

Q: Are there any penalties for late filing or non-filing of Form TXR-02.01C?

A: Yes, there can be penalties for late filing or non-filing of Form TXR-02.01C, including interest on unpaid tax.

Q: Is there a minimum threshold for reporting consumer use tax on Form TXR-02.01C?

A: Yes, there is a minimum threshold for reporting consumer use tax on Form TXR-02.01C. Please refer to the instructions for the specific threshold amount.

Form Details:

- Released on March 24, 2016;

- The latest edition provided by the Nevada Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TXR-02.01C by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.