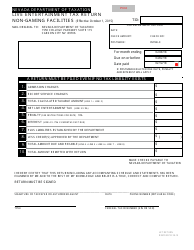

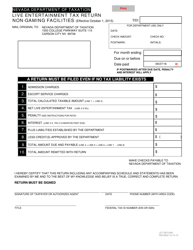

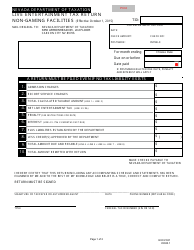

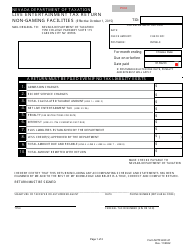

Live Entertainment Tax Return - Non-gaming Facilities - Nevada

Live Entertainment Tax Return - Non-gaming Facilities is a legal document that was released by the Nevada Department of Taxation - a government authority operating within Nevada.

FAQ

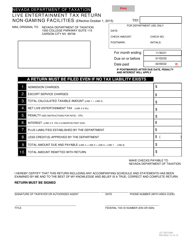

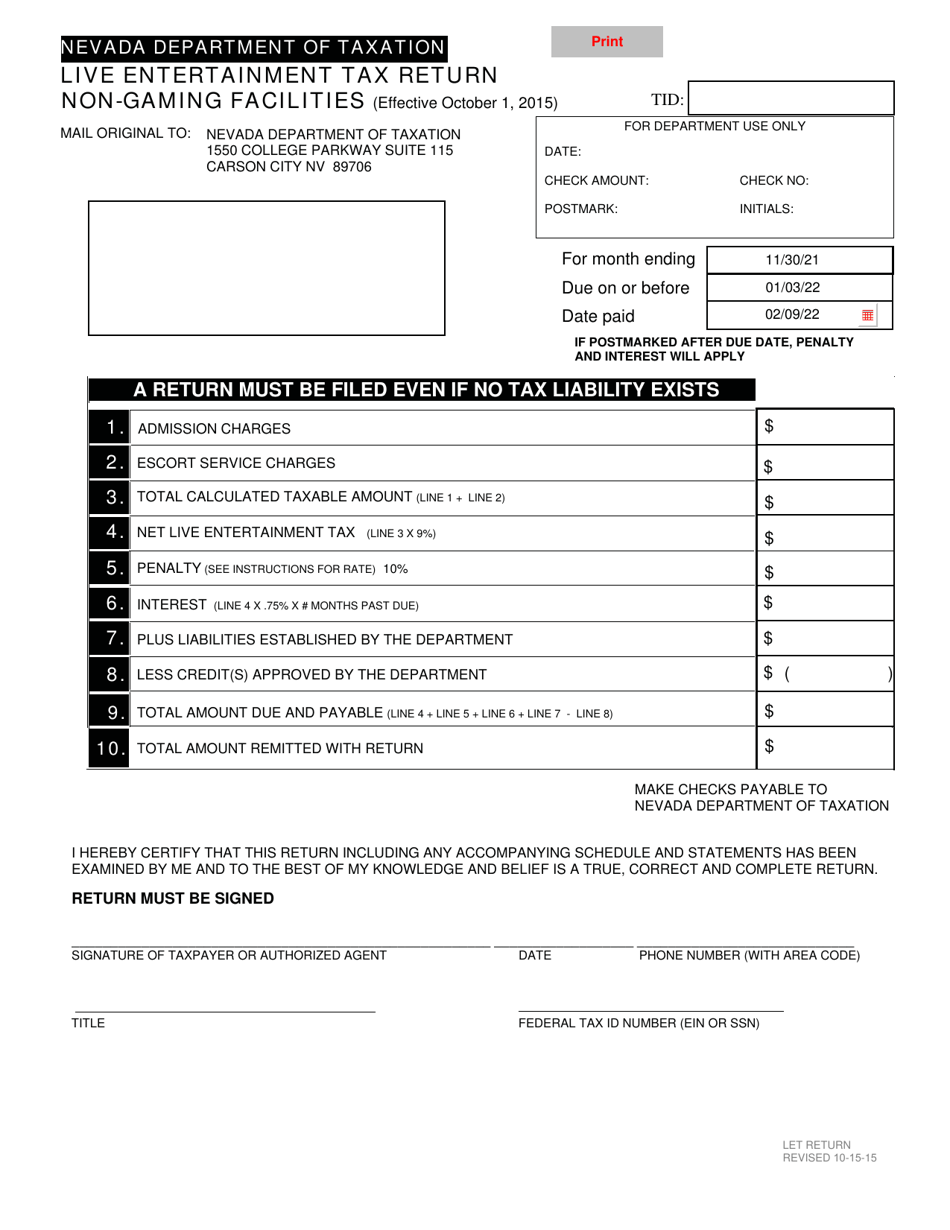

Q: What is a Live Entertainment Tax Return?

A: A Live Entertainment Tax Return is a form that businesses in Nevada must file to report and pay taxes on live entertainment events.

Q: Which facilities need to file a Live Entertainment Tax Return?

A: Non-gaming facilities in Nevada, such as theaters, concert venues, and amusement parks, need to file a Live Entertainment Tax Return.

Q: What is considered live entertainment?

A: Live entertainment includes any performance or event that is presented to an audience, such as concerts, plays, dance shows, or comedy performances.

Q: How often do businesses need to file a Live Entertainment Tax Return?

A: Businesses need to file a Live Entertainment Tax Return on a monthly basis.

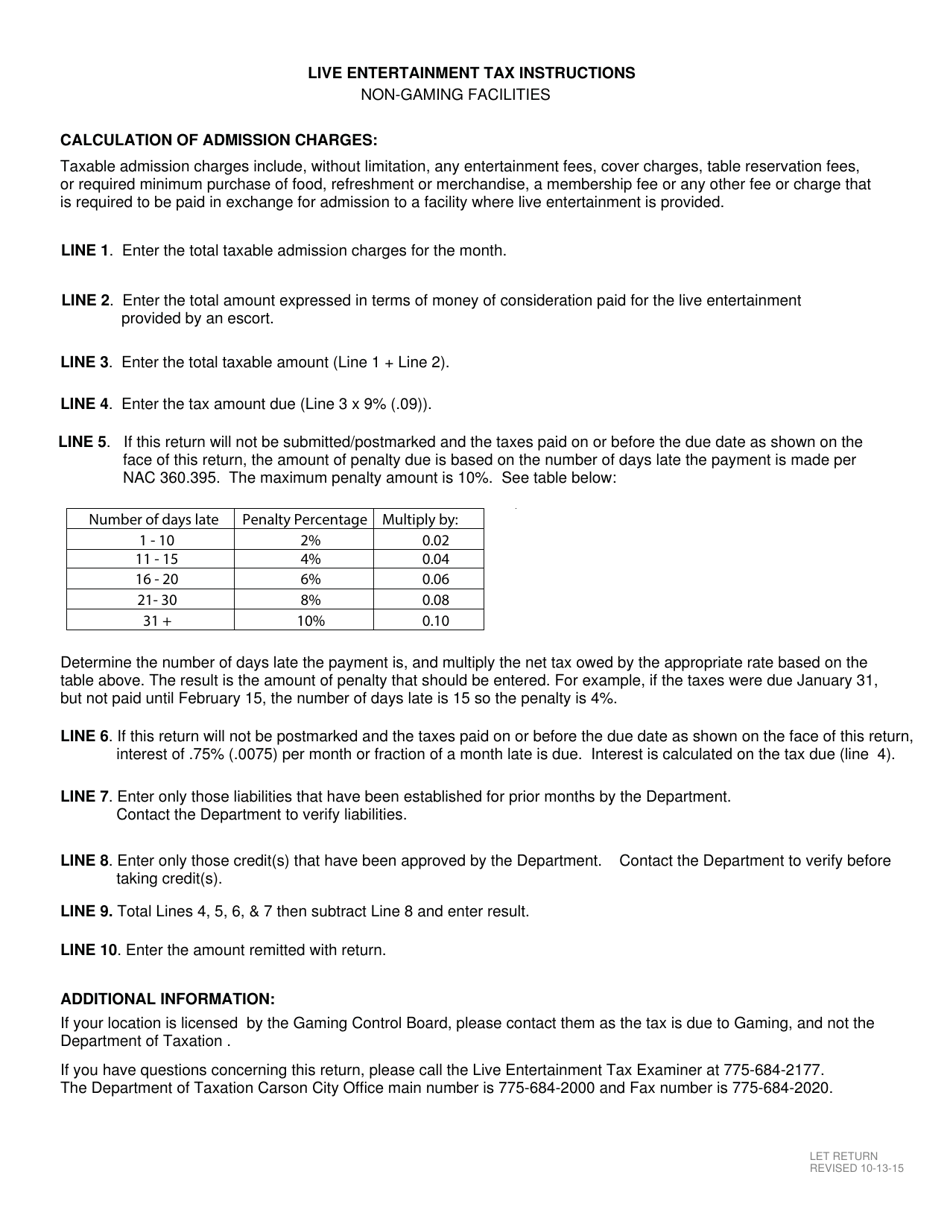

Q: What information needs to be reported on the Live Entertainment Tax Return?

A: The Live Entertainment Tax Return requires businesses to report the gross receipts from live entertainment events, as well as any exemptions or deductions.

Q: How much is the Live Entertainment Tax in Nevada?

A: The Live Entertainment Tax rate in Nevada varies depending on the location and type of event, ranging from 5% to 10% of the gross receipts.

Q: When is the deadline to file a Live Entertainment Tax Return?

A: The Live Entertainment Tax Return must be filed and the payment must be submitted by the last day of the month following the month in which the live entertainment event took place.

Form Details:

- Released on October 15, 2015;

- The latest edition currently provided by the Nevada Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.