This version of the form is not currently in use and is provided for reference only. Download this version of

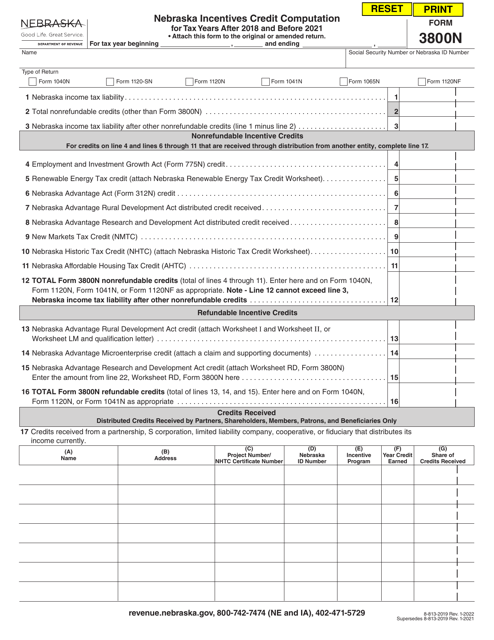

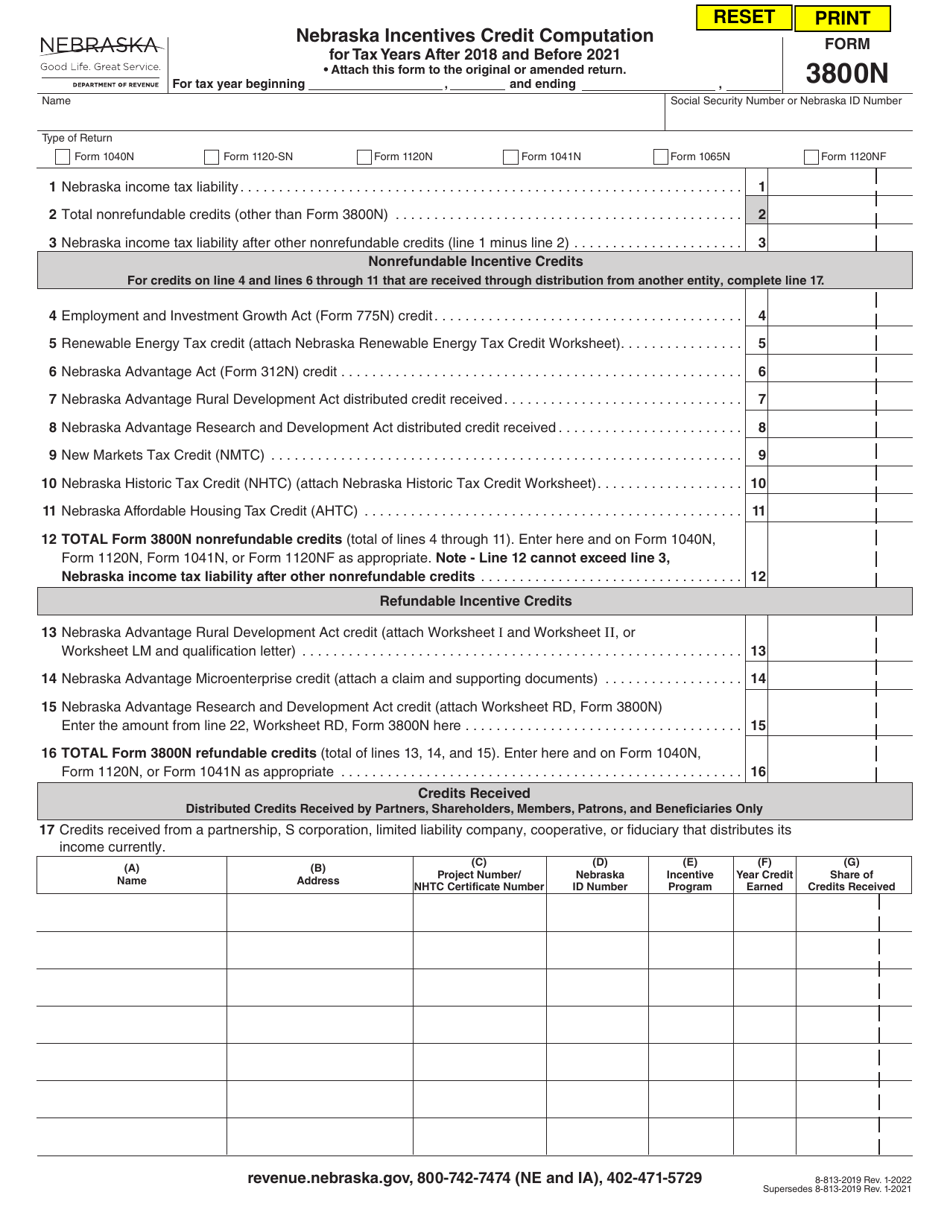

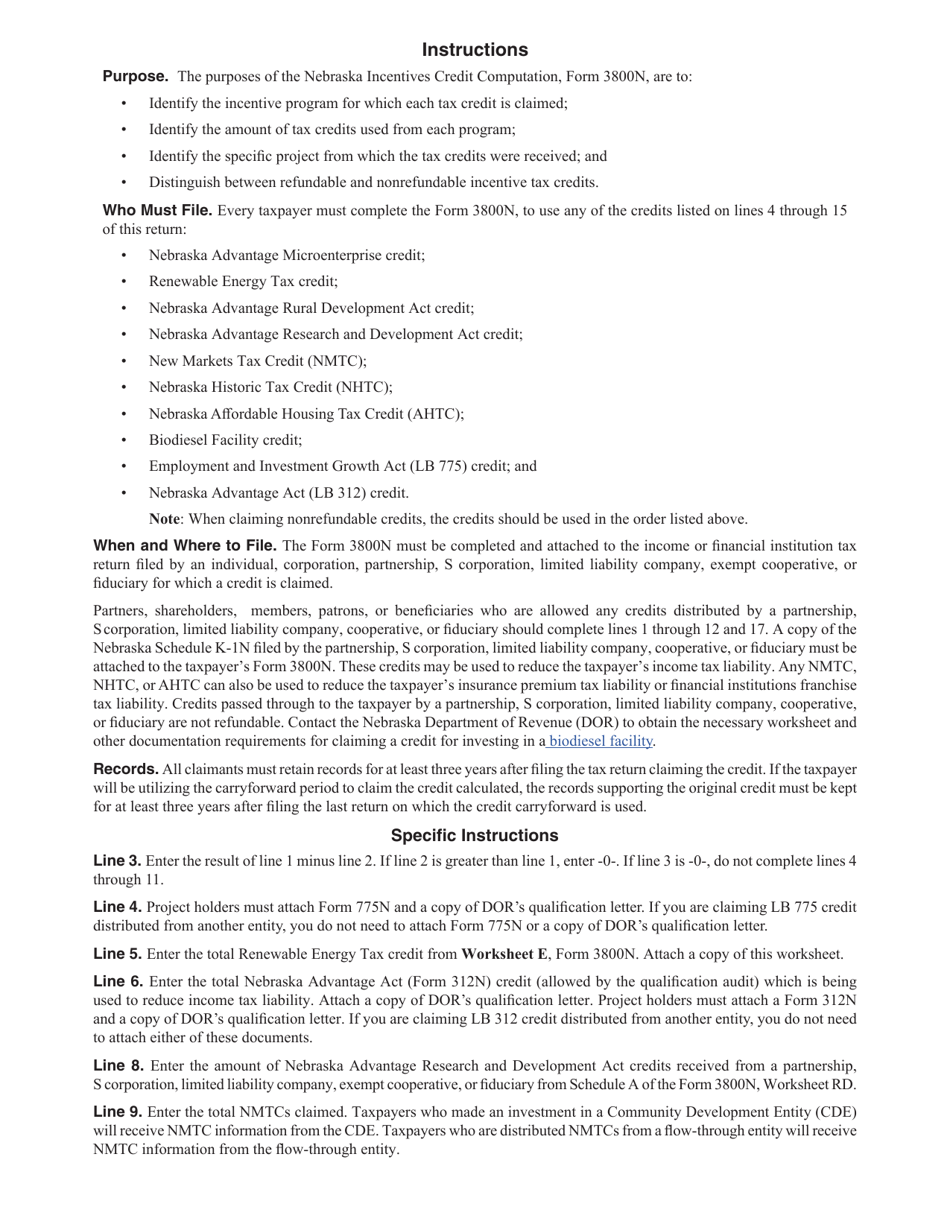

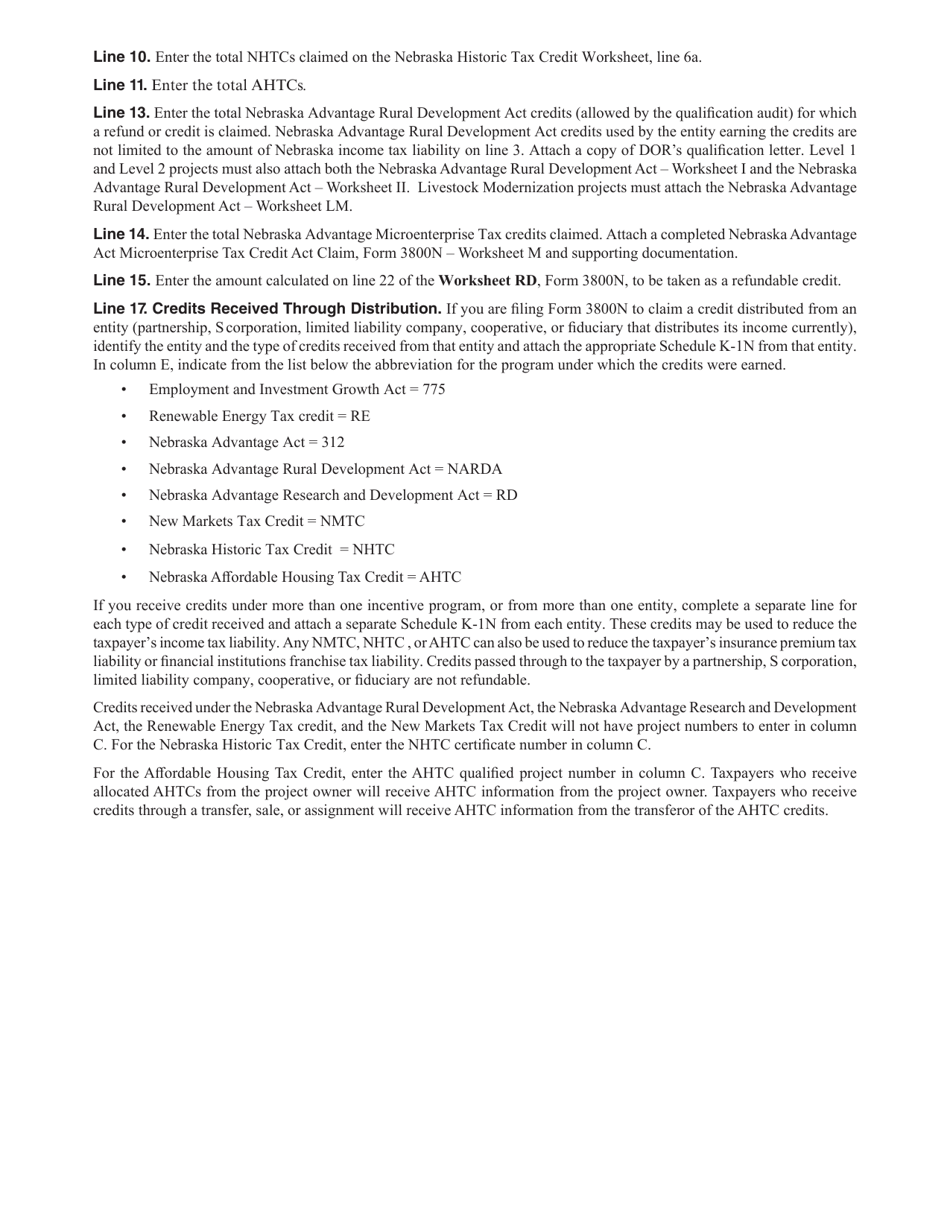

Form 3800N

for the current year.

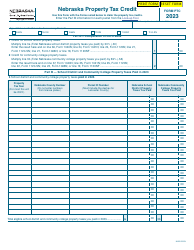

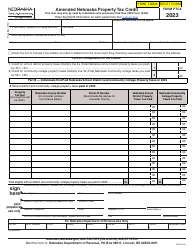

Form 3800N Nebraska Incentives Credit Computation for Tax Years After 2018 and Before 2021 - Nebraska

What Is Form 3800N?

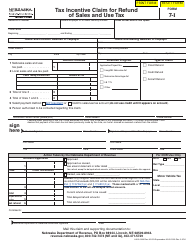

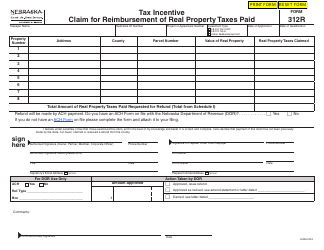

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3800N?

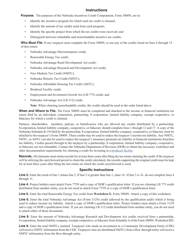

A: Form 3800N is a Nebraska tax form used to compute the Nebraska Incentives Credit for tax years after 2018 and before 2021.

Q: What is the Nebraska Incentives Credit?

A: The Nebraska Incentives Credit is a tax credit offered by the state of Nebraska to incentivize certain activities or investments.

Q: What tax years does Form 3800N apply to?

A: Form 3800N applies to tax years after 2018 and before 2021.

Q: Who is eligible for the Nebraska Incentives Credit?

A: Eligibility for the Nebraska Incentives Credit depends on the specific incentives or activities being claimed.

Q: How do I compute the Nebraska Incentives Credit?

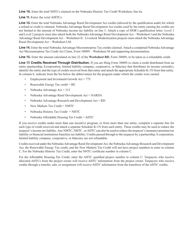

A: You need to fill out the appropriate sections of Form 3800N and follow the instructions provided to calculate the credit.

Q: Are there any restrictions or limitations on the Nebraska Incentives Credit?

A: Yes, there may be specific restrictions or limitations for each type of incentive or activity that you are claiming.

Q: Can I claim the Nebraska Incentives Credit for previous tax years?

A: No, Form 3800N is specifically for tax years after 2018 and before 2021.

Q: What should I do if I have questions about Form 3800N or the Nebraska Incentives Credit?

A: If you have questions, it is best to contact the Nebraska Department of Revenue or consult with a tax professional for guidance.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3800N by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.