This version of the form is not currently in use and is provided for reference only. Download this version of

Form RP-61

for the current year.

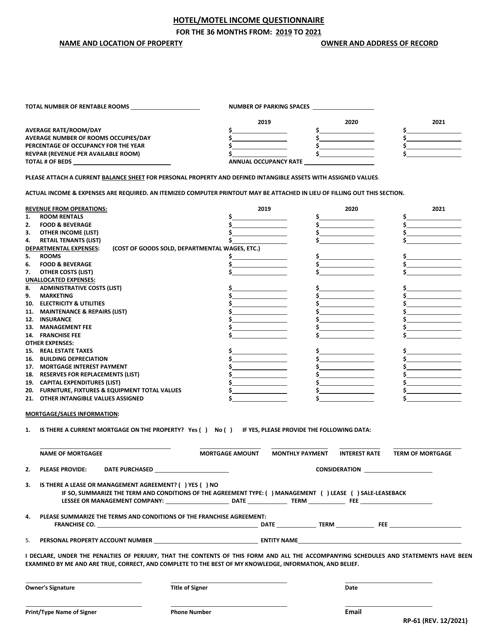

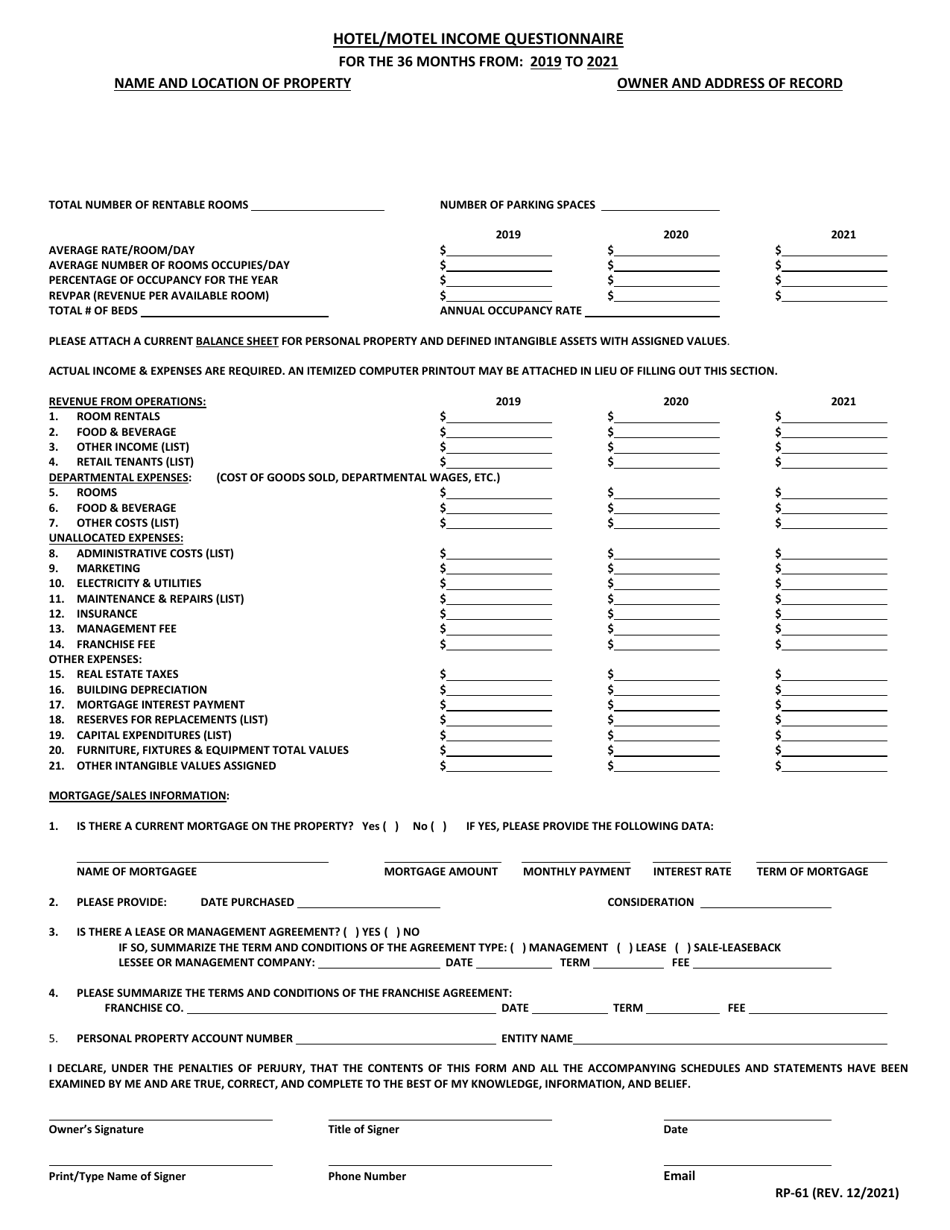

Form RP-61 Hotel / Motel Income Questionnaire - Maryland

What Is Form RP-61?

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RP-61 Hotel/Motel Income Questionnaire?

A: The RP-61 Hotel/Motel Income Questionnaire is a form used in the state of Maryland to report income from hotel or motel operations.

Q: Who needs to fill out the RP-61 form?

A: Owners of hotels or motels in Maryland need to fill out the RP-61 form.

Q: What information is required on the RP-61 form?

A: The RP-61 form requires information about the income generated from hotel or motel operations, such as gross receipts, rooms rented, and expenses.

Q: How often do I need to file the RP-61 form?

A: The RP-61 form needs to be filed annually by January 31st.

Q: Are there any penalties for not filing the RP-61 form?

A: Yes, there can be penalties for not filing the RP-61 form or for providing false or misleading information.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RP-61 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.