This version of the form is not currently in use and is provided for reference only. Download this version of

Form 2

for the current year.

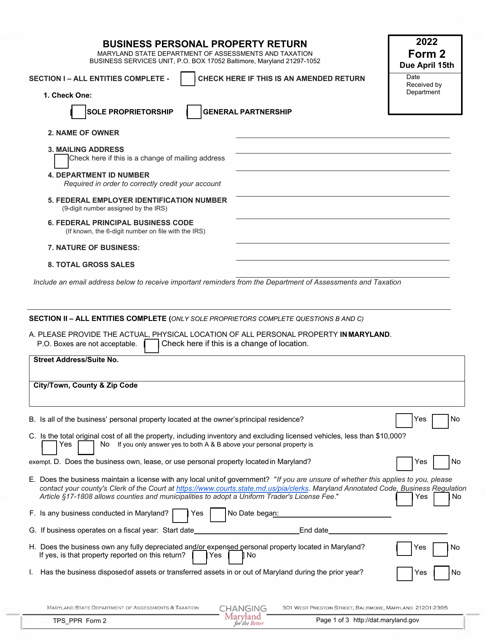

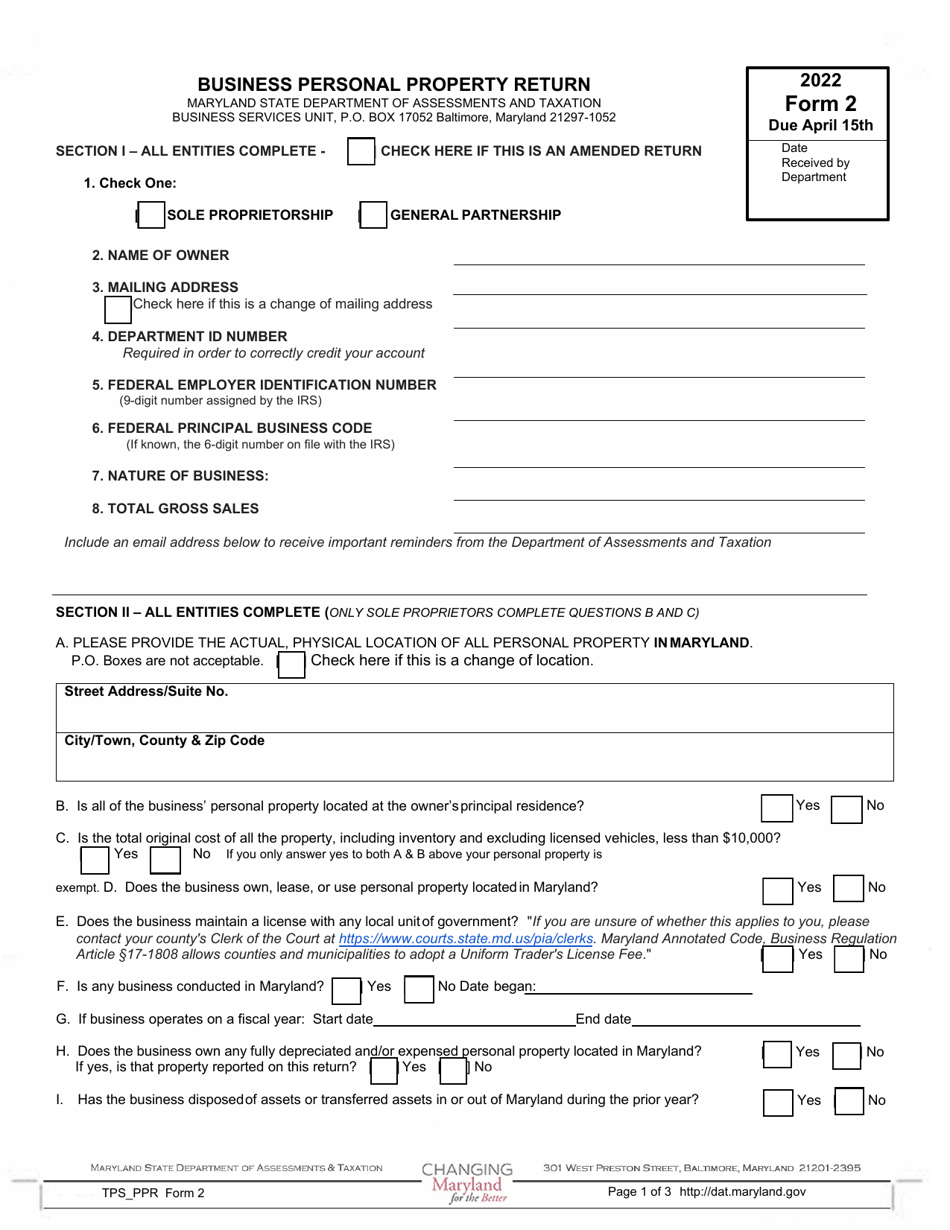

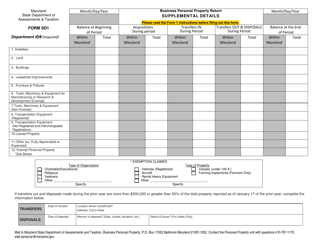

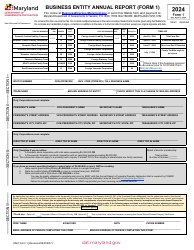

Form 2 Business Personal Property Tax Return - Sole Proprietorship and General Partnerships - Maryland

What Is Form 2?

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form 2 Business Personal Property Tax Return?

A: Form 2 is a tax return used to report business personal property owned by sole proprietorships and general partnerships in Maryland.

Q: Who needs to file the Form 2 Business Personal Property Tax Return?

A: Sole proprietorships and general partnerships in Maryland need to file the Form 2 Business Personal Property Tax Return.

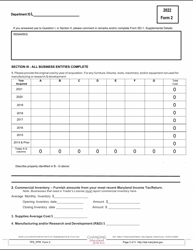

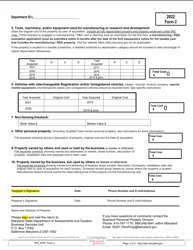

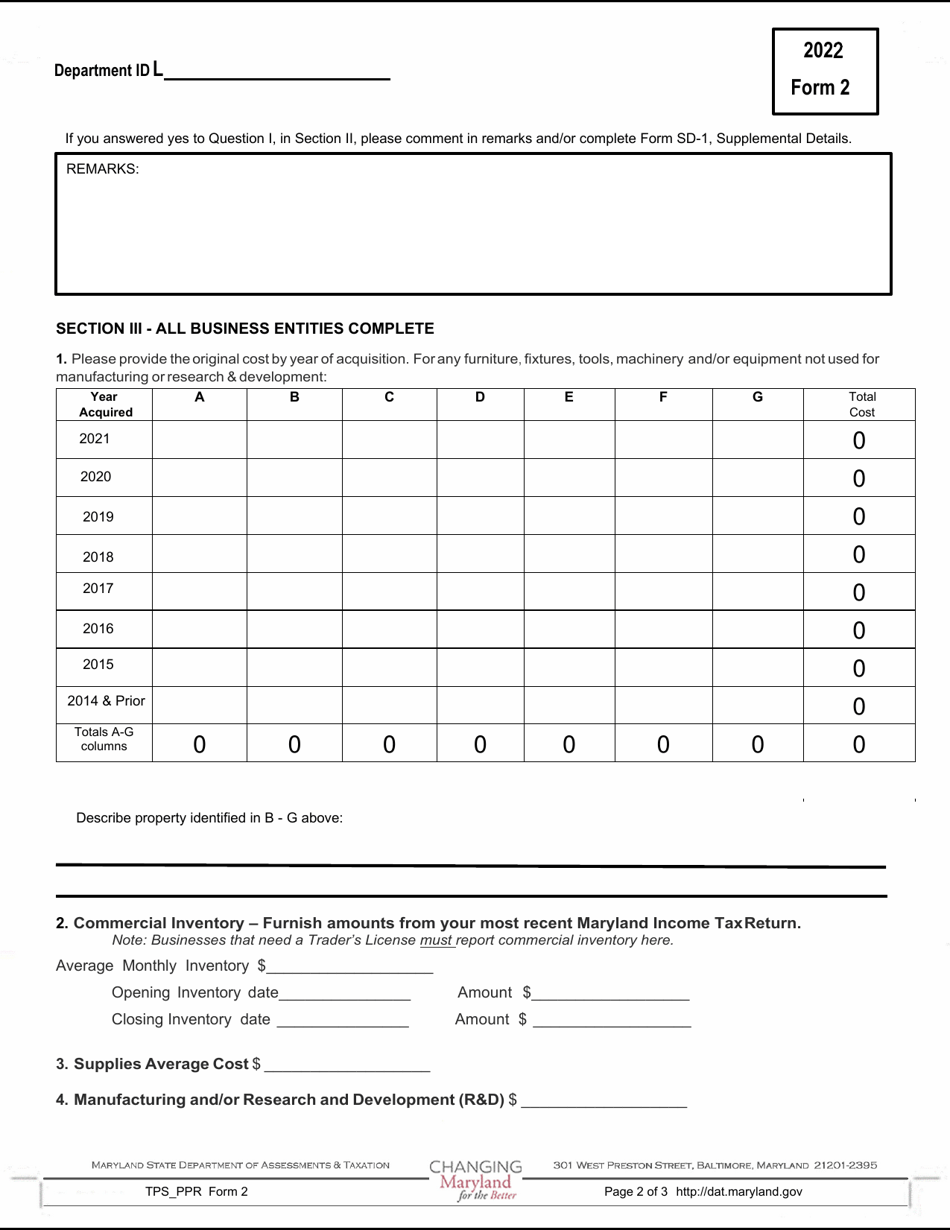

Q: What is business personal property?

A: Business personal property includes items such as furniture, equipment, machinery, and supplies that are used for business purposes.

Q: When is the Form 2 Business Personal Property Tax Return due?

A: The Form 2 Business Personal Property Tax Return is due by April 15th of each year.

Q: Are there any exemptions to filing the Form 2 Business Personal Property Tax Return?

A: Yes, certain businesses may be exempt from filing the Form 2 Business Personal Property Tax Return. It is best to consult with the Maryland Department of Assessments and Taxation for specific exemption details.

Q: Are there any penalties for late filing of the Form 2 Business Personal Property Tax Return?

A: Yes, there may be penalties for late filing of the Form 2 Business Personal Property Tax Return. It is important to file the return by the due date to avoid any penalties or interest charges.

Form Details:

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.