This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5

for the current year.

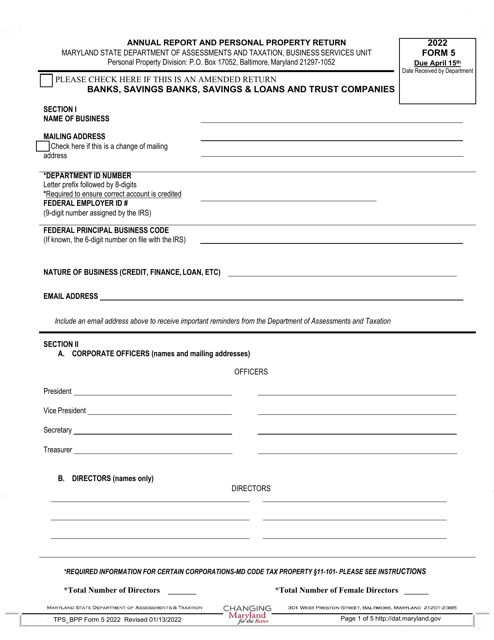

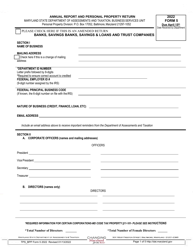

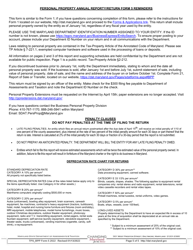

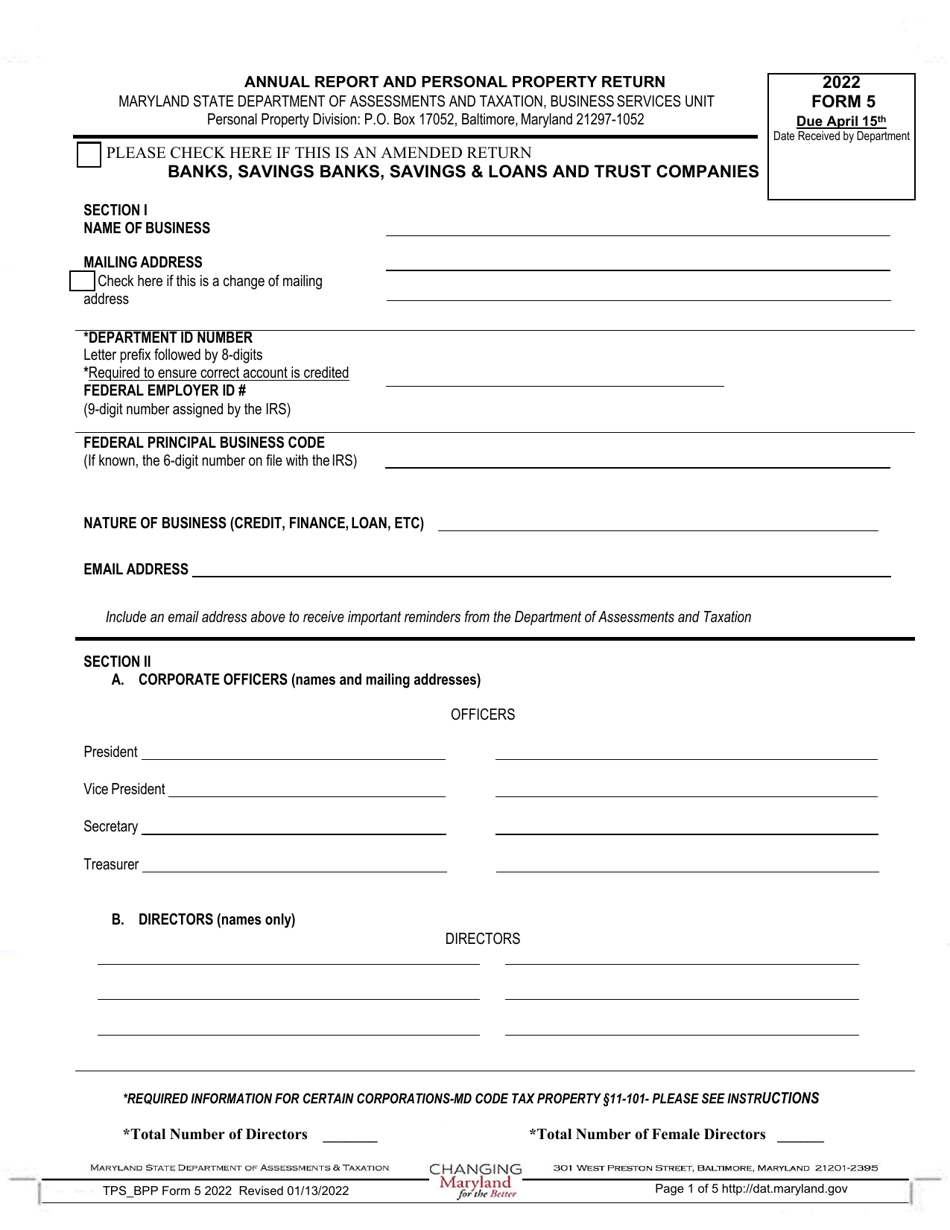

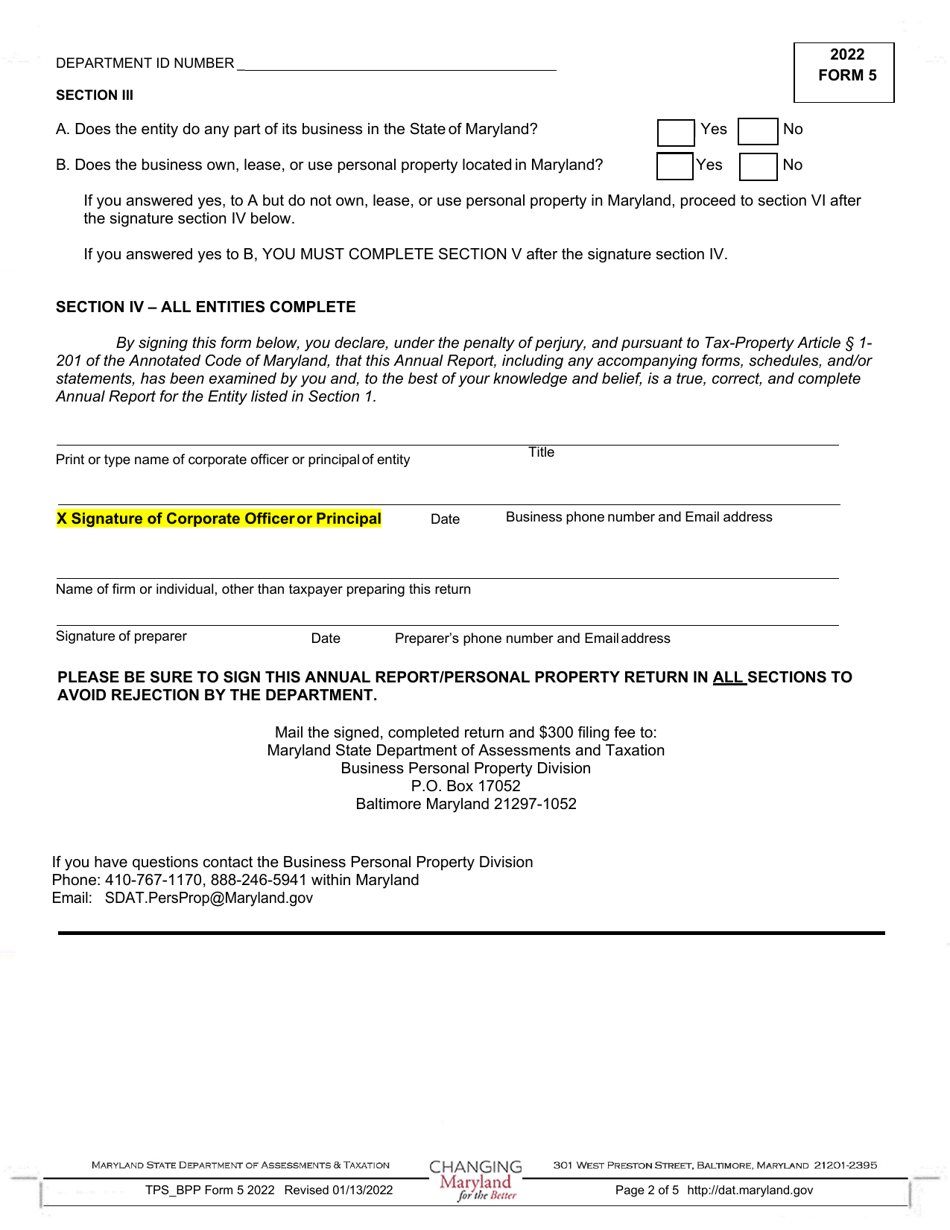

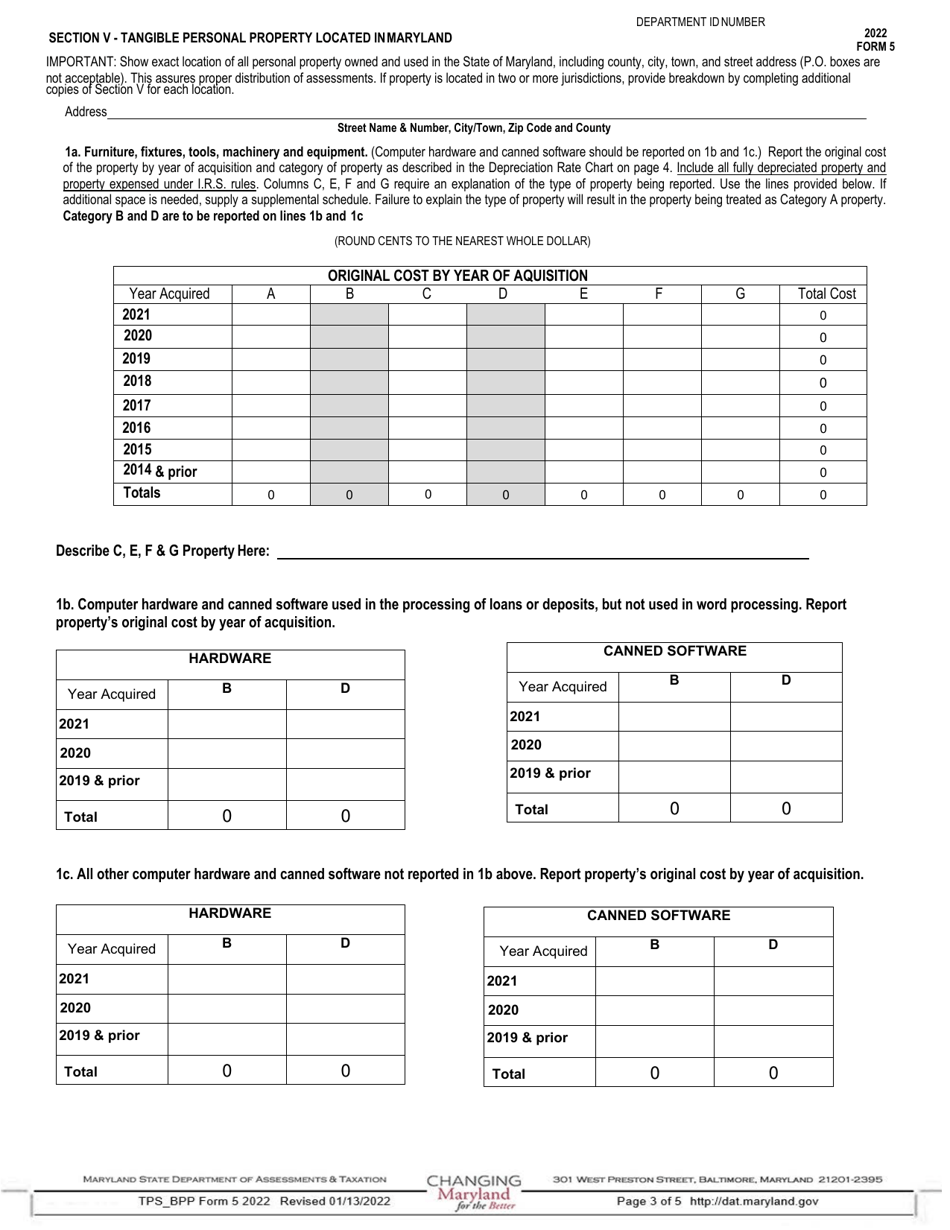

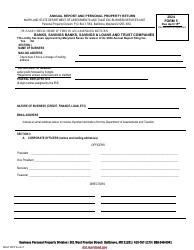

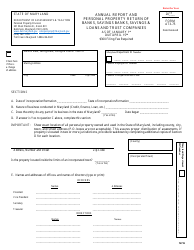

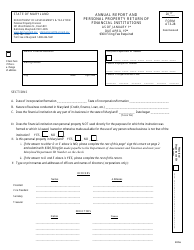

Form 5 Annual Report and Personal Property Return - Banks, Savings Banks, Savings & Loans and Trust Companies - Maryland

What Is Form 5?

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

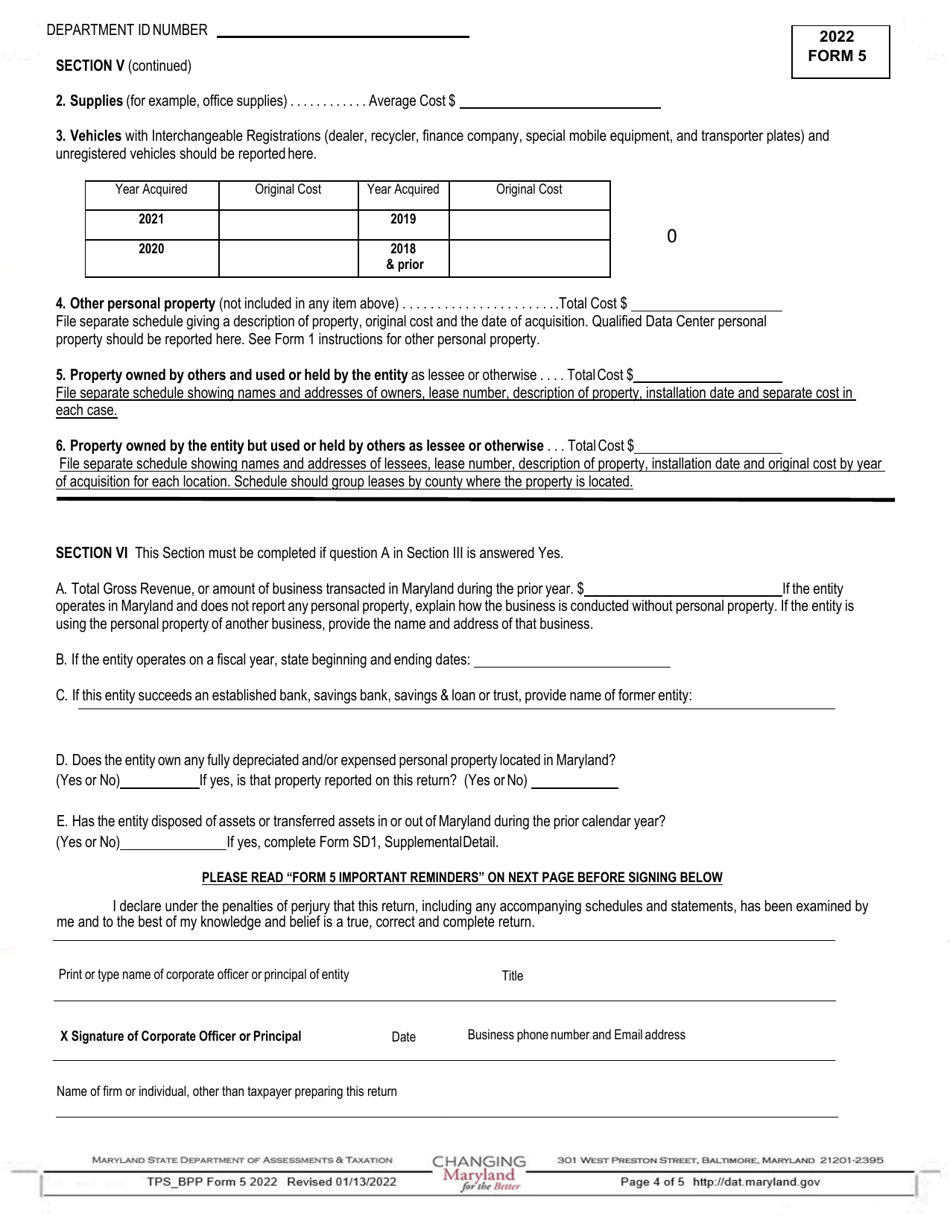

Q: What is the Form 5 Annual Report and Personal Property Return?

A: Form 5 is a report that banks, savings banks, savings & loans, and trust companies in Maryland must file annually to report their personal property holdings.

Q: Who needs to file the Form 5 Annual Report and Personal Property Return?

A: Banks, savings banks, savings & loans, and trust companies in Maryland need to file the Form 5 Annual Report and Personal Property Return.

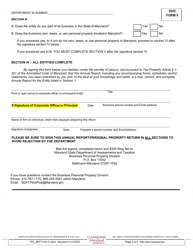

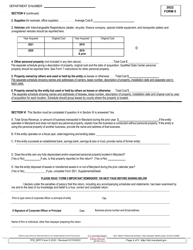

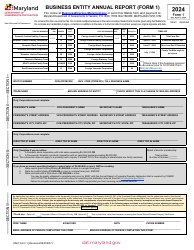

Q: What information needs to be provided in the Form 5 Annual Report and Personal Property Return?

A: The form requires information about the bank's or trust company's personal property holdings, including real estate, loans, investments, and other assets.

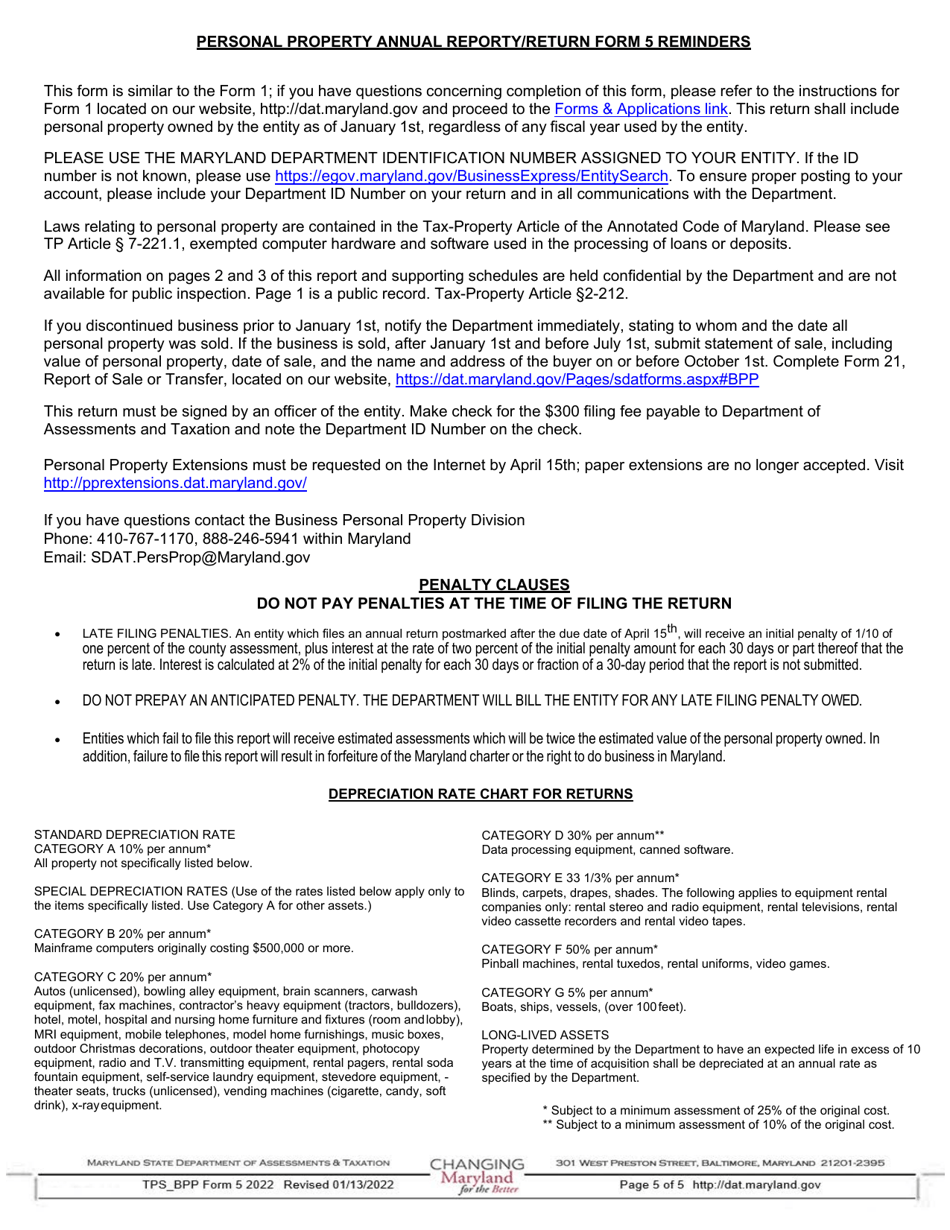

Q: When is the deadline to file the Form 5 Annual Report and Personal Property Return?

A: The deadline to file the Form 5 Annual Report and Personal Property Return is typically April 15th each year.

Q: Are there any penalties for late filing or failure to file the Form 5 Annual Report and Personal Property Return?

A: Yes, there are penalties for late filing or failure to file the Form 5 Annual Report and Personal Property Return, including potentially having the bank's or trust company's charter revoked.

Form Details:

- Released on January 13, 2022;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.