This version of the form is not currently in use and is provided for reference only. Download this version of

Form 3

for the current year.

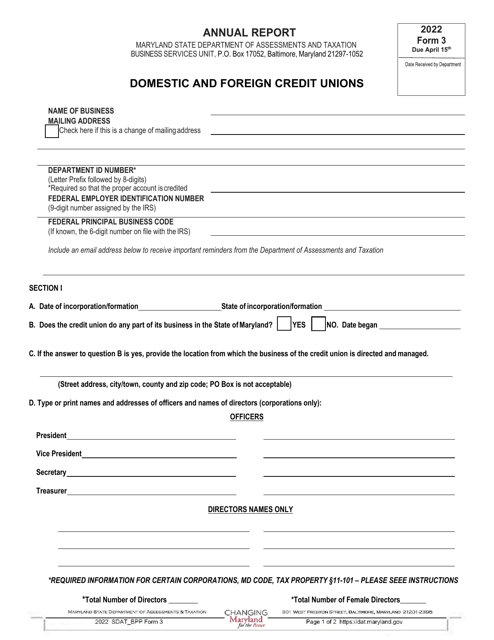

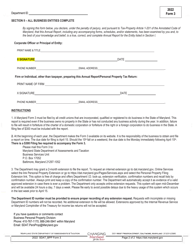

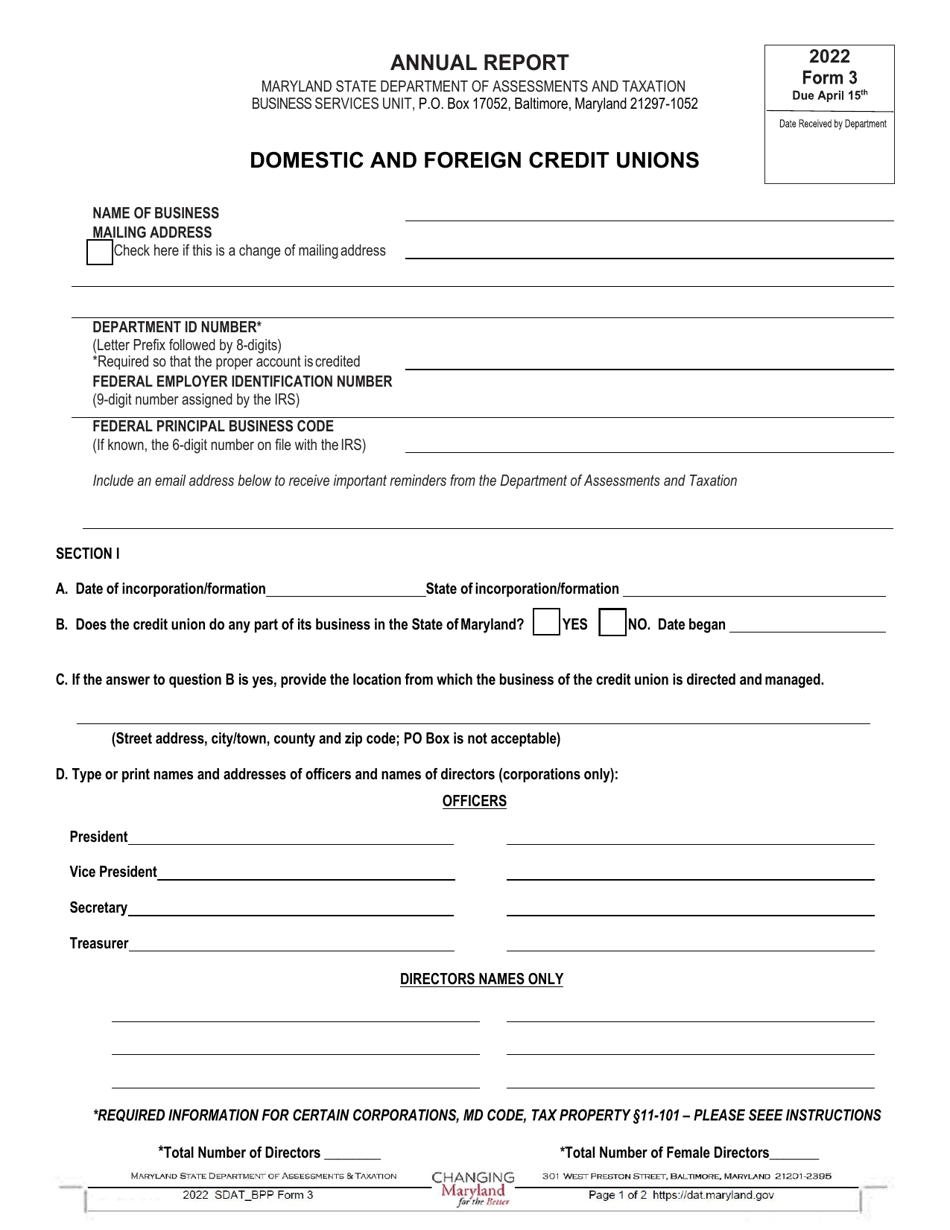

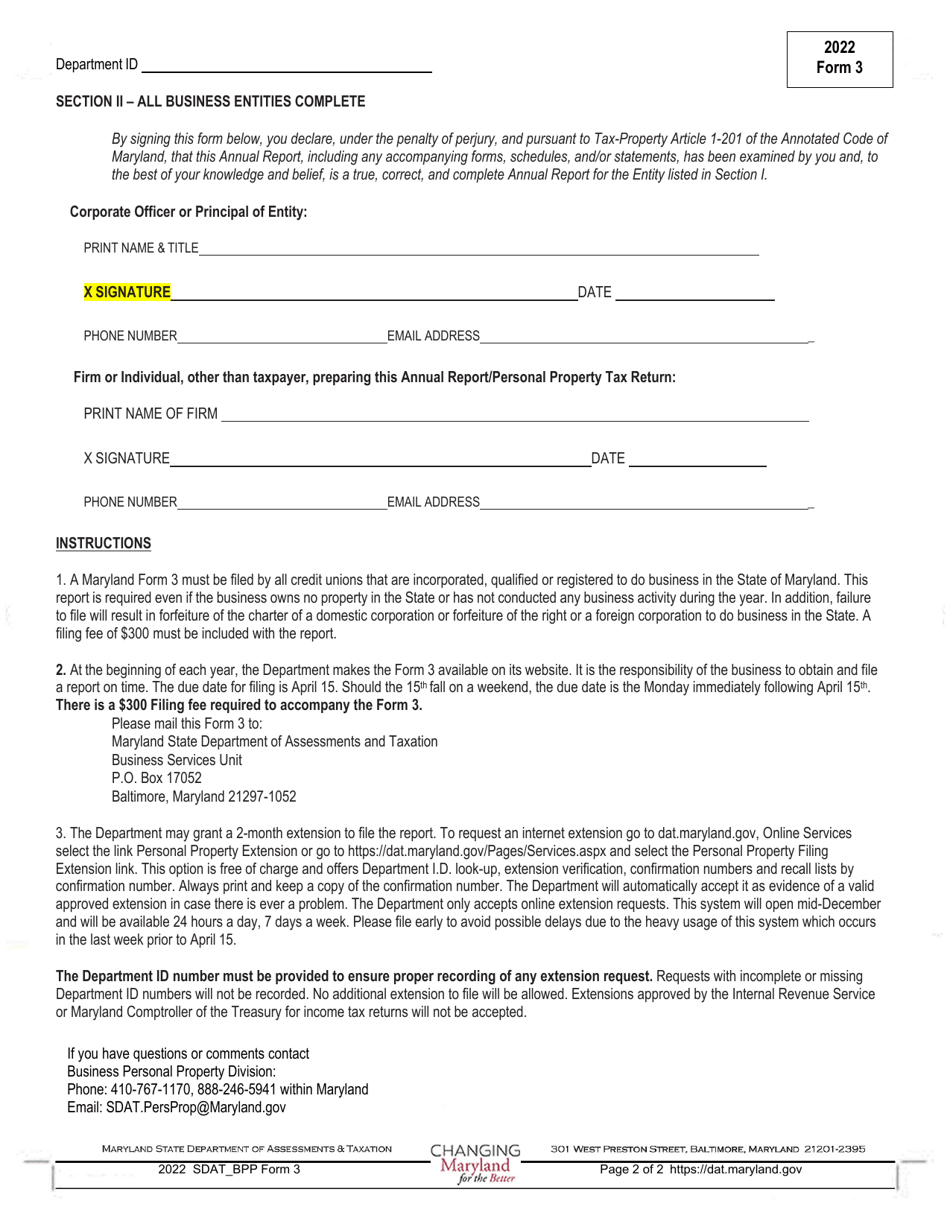

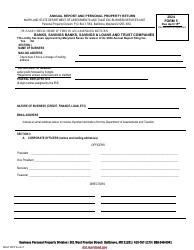

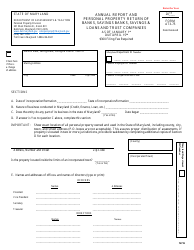

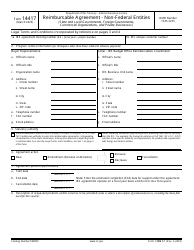

Form 3 Domestic and Foreign Credit Unions Annual Report - Maryland

What Is Form 3?

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3?

A: Form 3 is the Annual Report for Domestic and Foreign Credit Unions in Maryland.

Q: Who needs to file Form 3?

A: Domestic and Foreign Credit Unions operating in Maryland need to file Form 3.

Q: What information is included in Form 3?

A: Form 3 includes information about the credit union's financial condition, operations, and membership.

Q: When is Form 3 due?

A: Form 3 is due on or before March 31st of each year.

Q: Is there a fee to file Form 3?

A: Yes, there is a fee to file Form 3. The fee amount may vary.

Q: What happens if Form 3 is not filed?

A: Failure to file Form 3 may result in penalties or other consequences for the credit union.

Q: Can Form 3 be amended?

A: Yes, Form 3 can be amended if there are errors or changes in the information provided.

Form Details:

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.