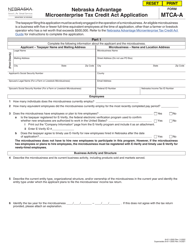

This version of the form is not currently in use and is provided for reference only. Download this version of

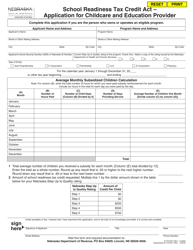

Form MTCA-A

for the current year.

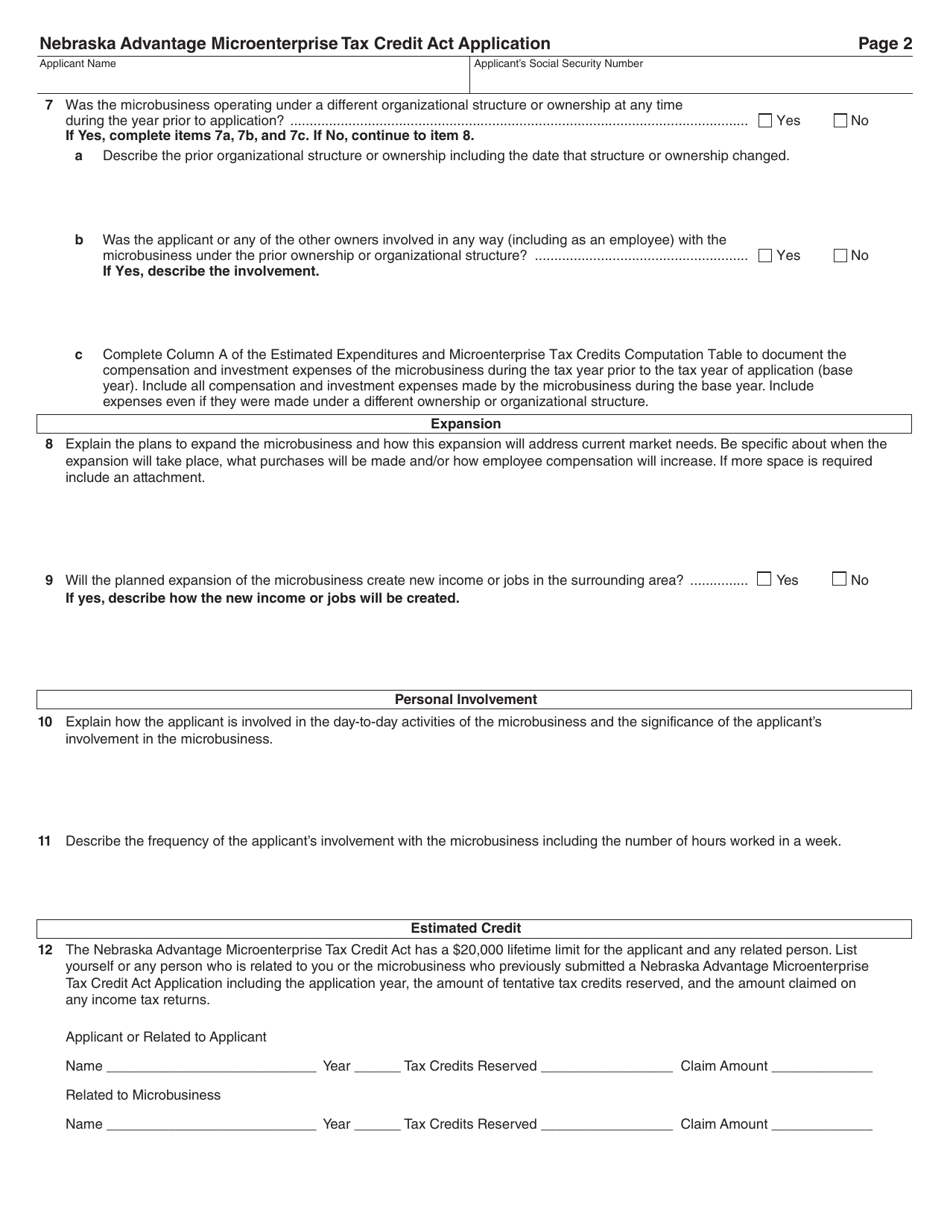

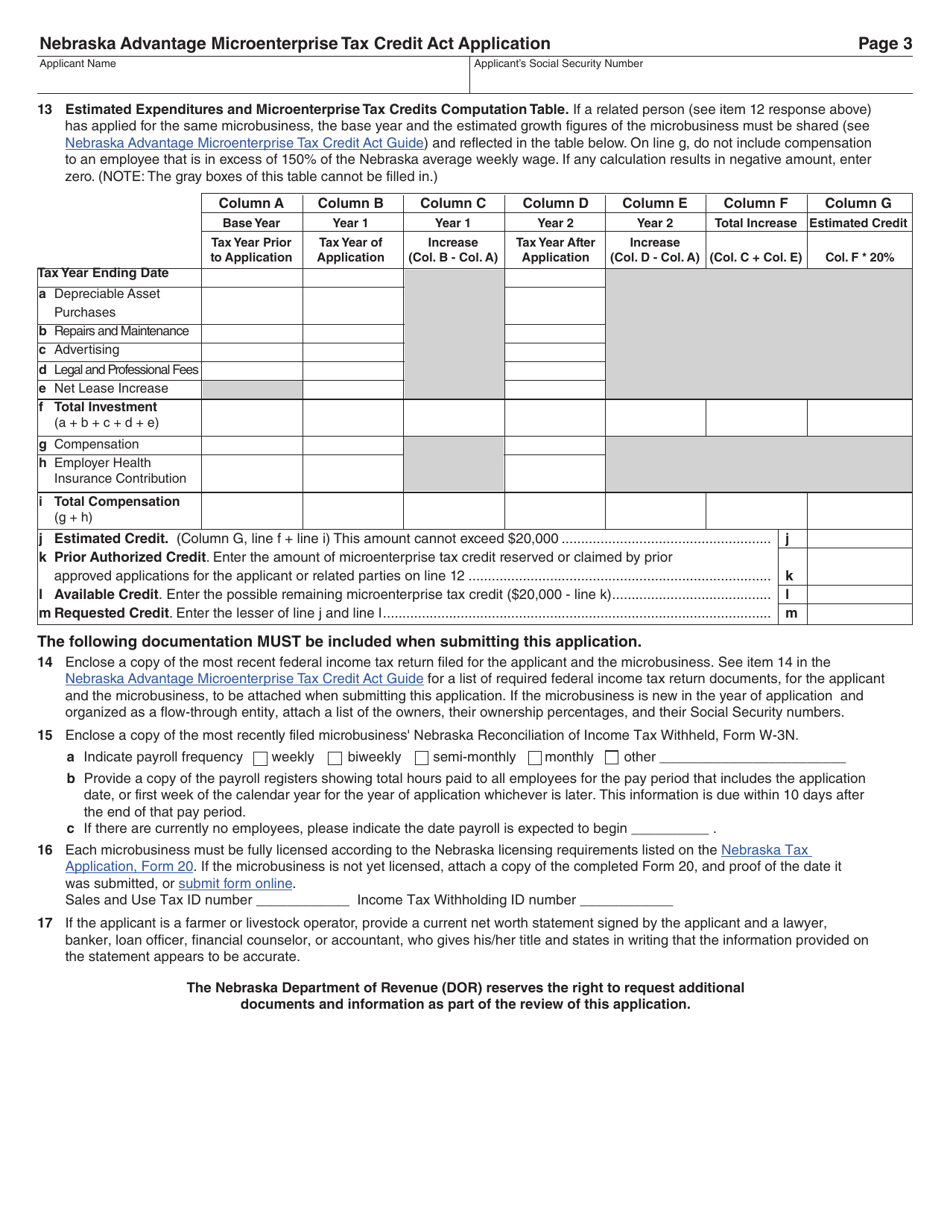

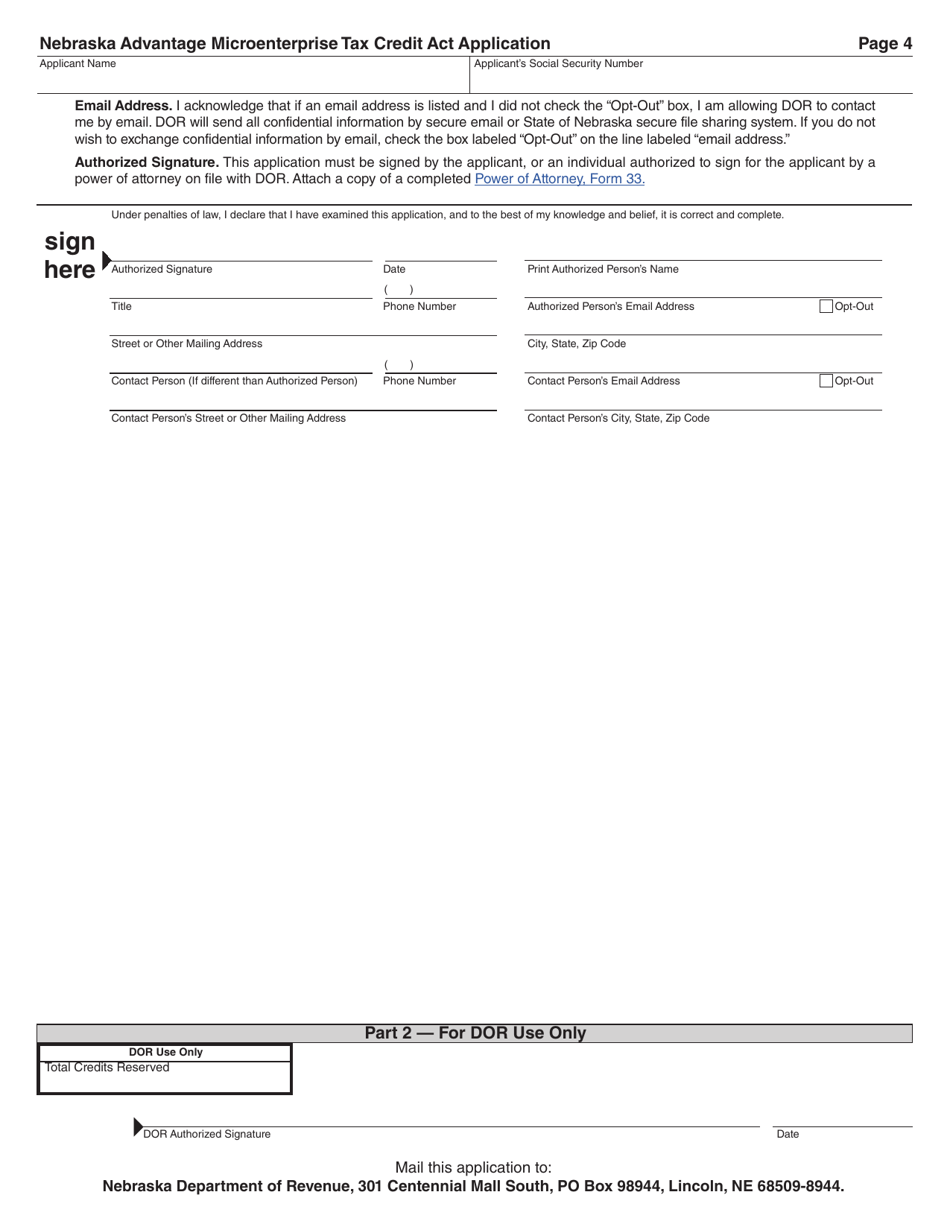

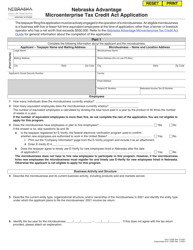

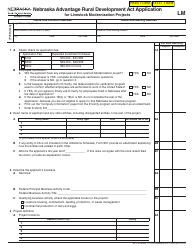

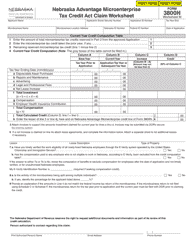

Form MTCA-A Nebraska Advantage Microenterprise Tax Credit Act Application - Nebraska

What Is Form MTCA-A?

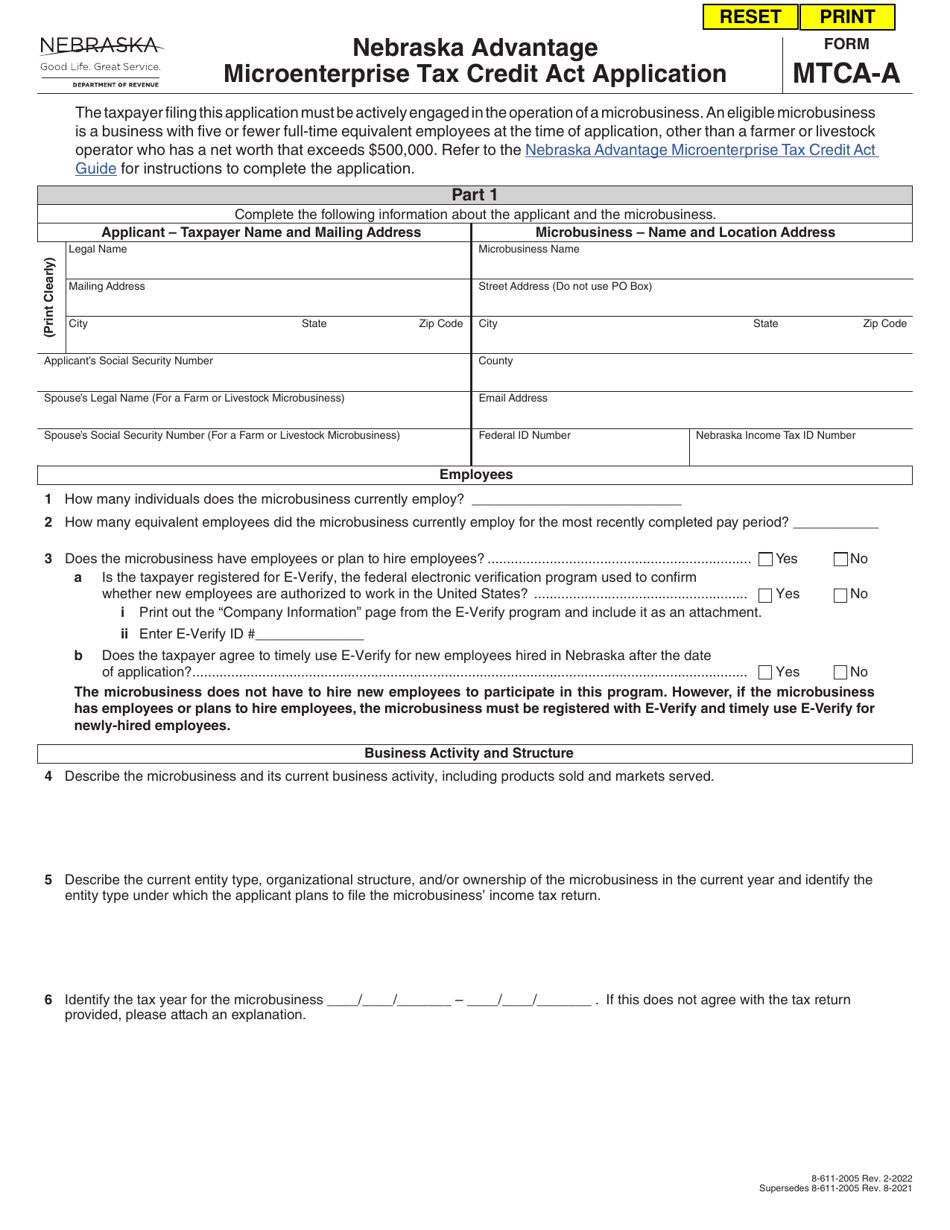

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MTCA-A Nebraska Advantage Microenterprise Tax Credit Act Application?

A: MTCA-A Nebraska Advantage Microenterprise Tax Credit Act Application is a form used in Nebraska to apply for the Microenterprise Tax Credit under the Nebraska Advantage Microenterprise Tax Credit Act.

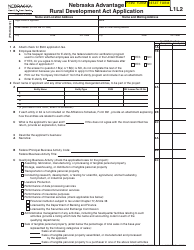

Q: What is the Microenterprise Tax Credit?

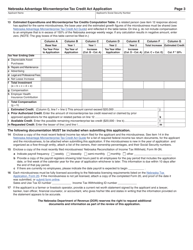

A: The Microenterprise Tax Credit is a tax incentive program in Nebraska that provides credits to eligible microenterprises.

Q: Who is eligible for the Microenterprise Tax Credit?

A: Eligibility for the Microenterprise Tax Credit is determined by meeting certain criteria, such as having a business with a gross income of $50,000 or less.

Q: What are the benefits of the Microenterprise Tax Credit?

A: The benefits of the Microenterprise Tax Credit include receiving tax credits for qualified investments made in the business.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MTCA-A by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.