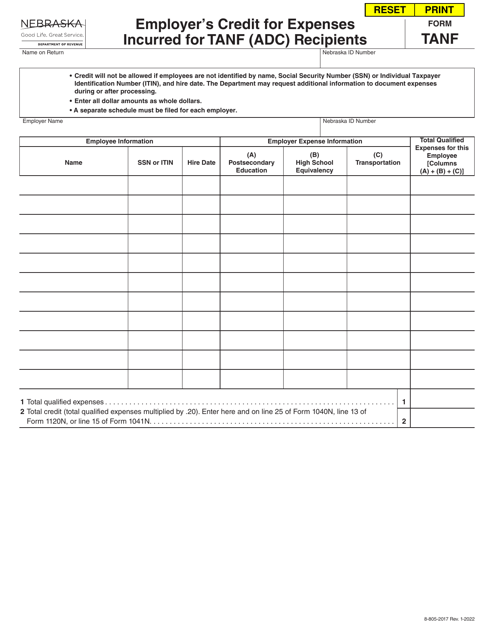

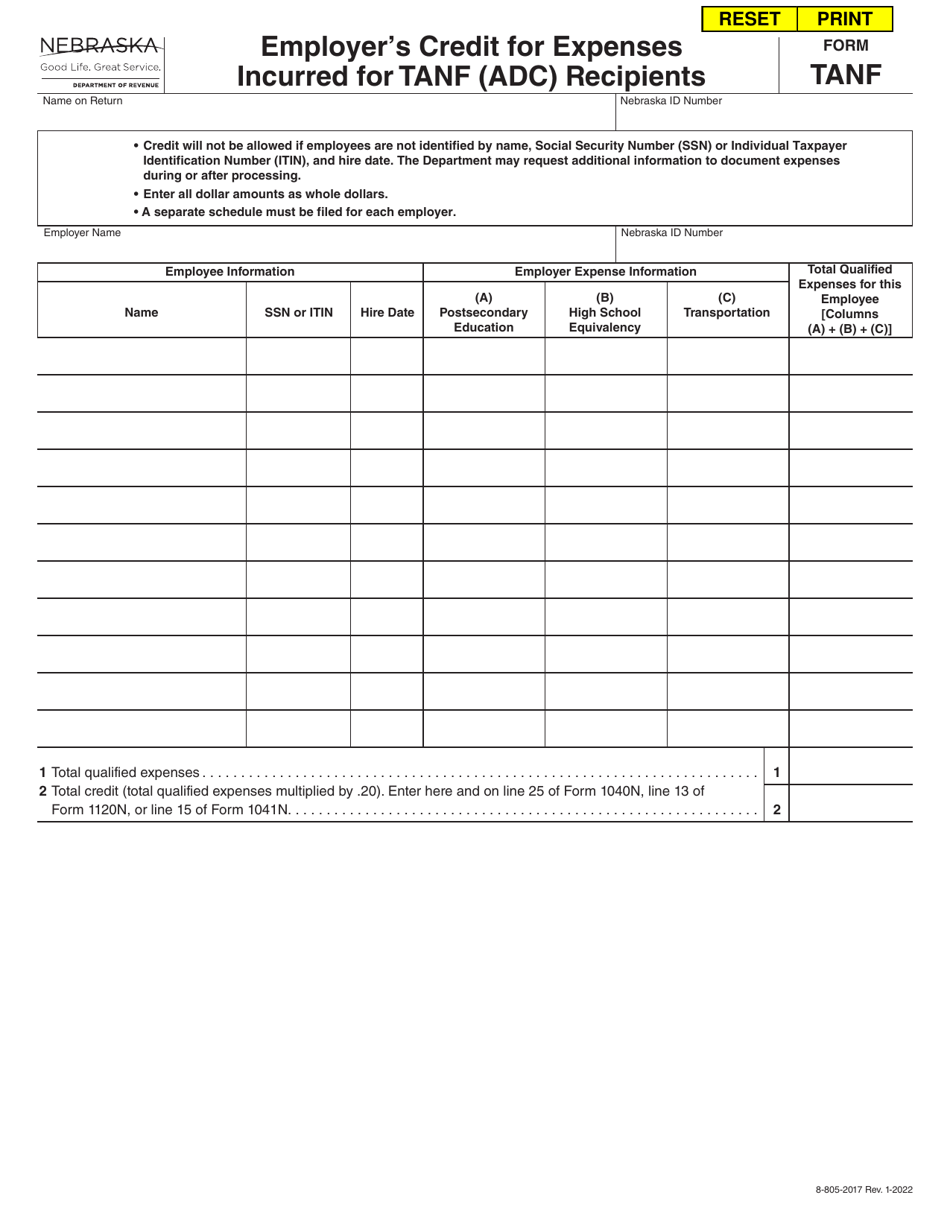

Form TANF Employer's Credit for Expenses Incurred for TANF (Adc) Recipients - Nebraska

What Is Form TANF?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TANF Employer's Credit?

A: Form TANF Employer's Credit is a tax form related to the credit for employers who hire recipients of TANF (Adc) in Nebraska.

Q: What is TANF?

A: TANF stands for Temporary Assistance for Needy Families. It is a government program that provides financial assistance to low-income families.

Q: What is ADC?

A: ADC stands for Aid to Dependent Children, which is a subgroup of TANF assistance. It provides cash assistance to families with dependent children.

Q: Who can claim the TANF Employer's Credit?

A: Employers in Nebraska who hire recipients of TANF (Adc) can claim the TANF Employer's Credit.

Q: What expenses can be claimed for the TANF Employer's Credit?

A: Employers can claim a credit for allowable expenses incurred in employing TANF (Adc) recipients, such as wages and training costs.

Q: Is there a maximum credit amount for the TANF Employer's Credit?

A: Yes, there is a maximum credit amount that can be claimed per qualified employee. The amount is specified on the tax form.

Q: How do employers claim the TANF Employer's Credit?

A: Employers must complete Form TANF Employer's Credit and include it with their Nebraska income tax return.

Q: Are there any eligibility requirements for employers to claim the TANF Employer's Credit?

A: Yes, employers must meet certain requirements to be eligible for the TANF Employer's Credit. These requirements are outlined on the tax form.

Q: Is the TANF Employer's Credit refundable?

A: No, the TANF Employer's Credit is not refundable. It can only be used to offset the employer's tax liability.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TANF by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.