This version of the form is not currently in use and is provided for reference only. Download this version of

Form E911N

for the current year.

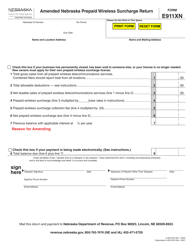

Form E911N Nebraska Prepaid Wireless Surcharge Return - Nebraska

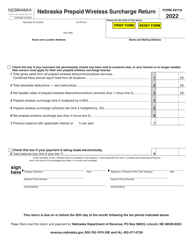

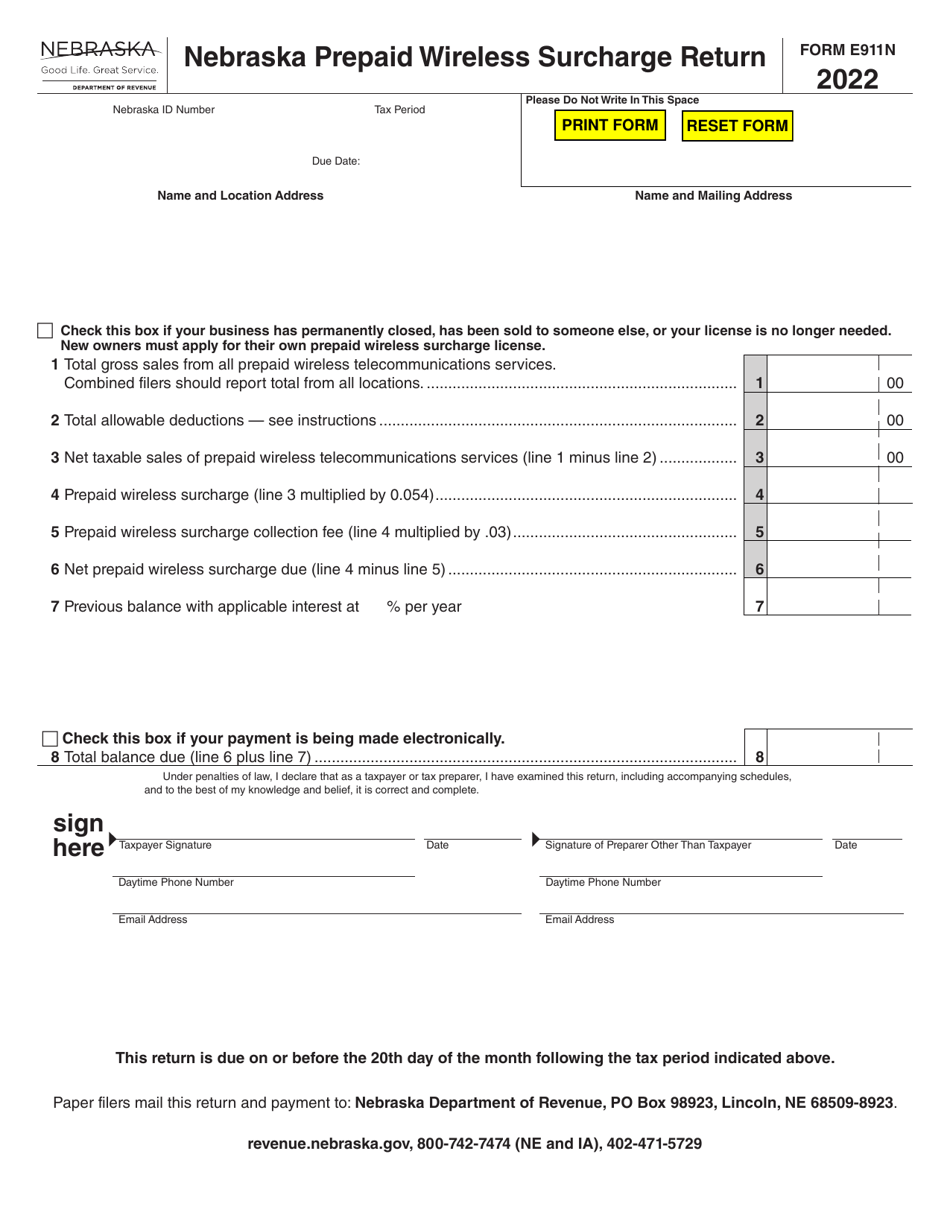

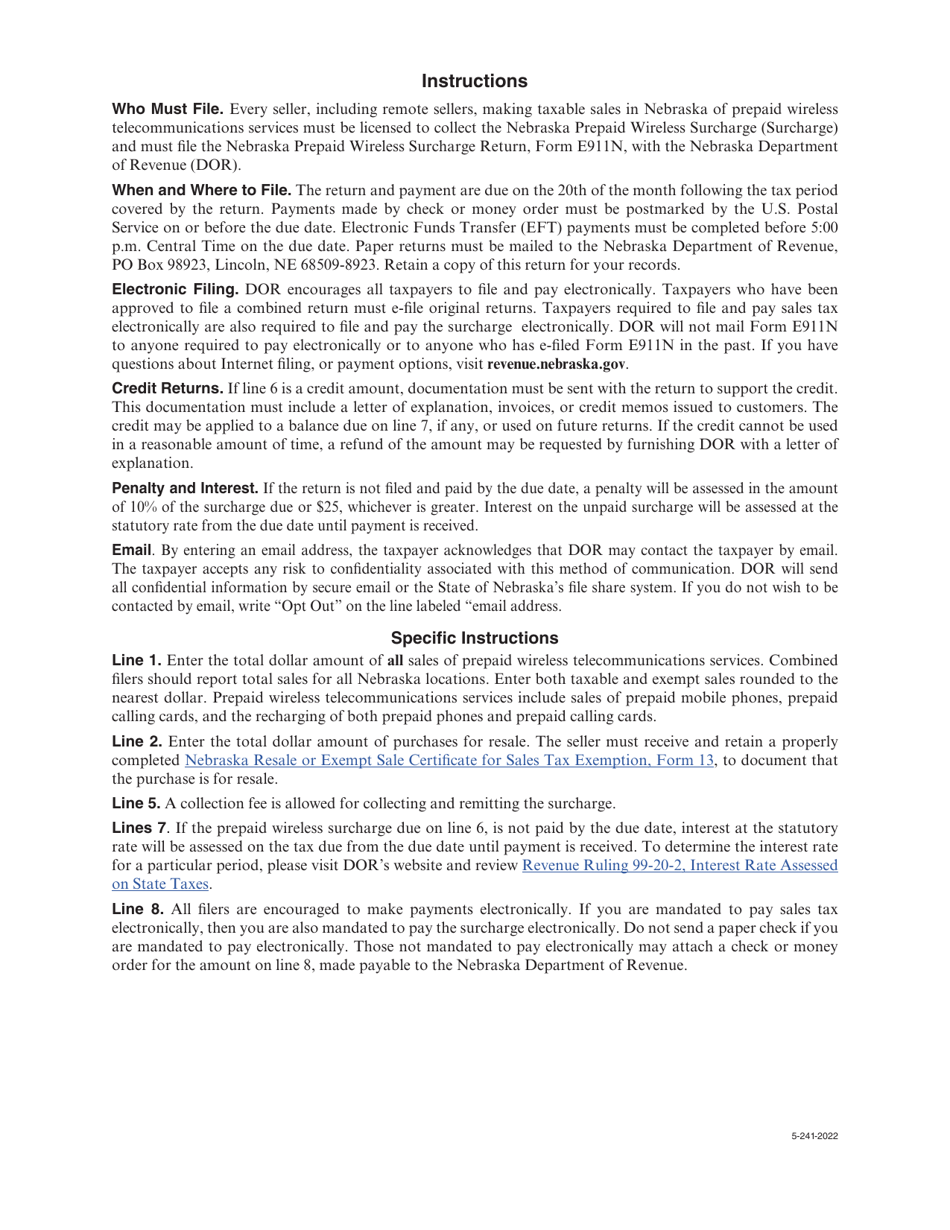

What Is Form E911N?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the E911N Nebraska Prepaid Wireless Surcharge Return?

A: The E911N Nebraska Prepaid Wireless Surcharge Return is a form used to report and pay the prepaid wireless surcharge in Nebraska.

Q: Who needs to file the E911N Nebraska Prepaid Wireless Surcharge Return?

A: Anyone who sells prepaid wireless services in Nebraska is required to file the E911N Nebraska Prepaid Wireless Surcharge Return.

Q: What is the purpose of the prepaid wireless surcharge in Nebraska?

A: The prepaid wireless surcharge is used to fund the Enhanced 911 services in Nebraska, which provide emergency assistance to wireless callers.

Q: How often is the E911N Nebraska Prepaid Wireless Surcharge Return filed?

A: The return must be filed on a monthly basis, even if there is no tax liability for the reporting period.

Q: What are the penalties for failing to file or pay the prepaid wireless surcharge in Nebraska?

A: Penalties for non-compliance with the prepaid wireless surcharge requirements in Nebraska can include fines and interest on unpaid amounts.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E911N by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.