This version of the form is not currently in use and is provided for reference only. Download this version of

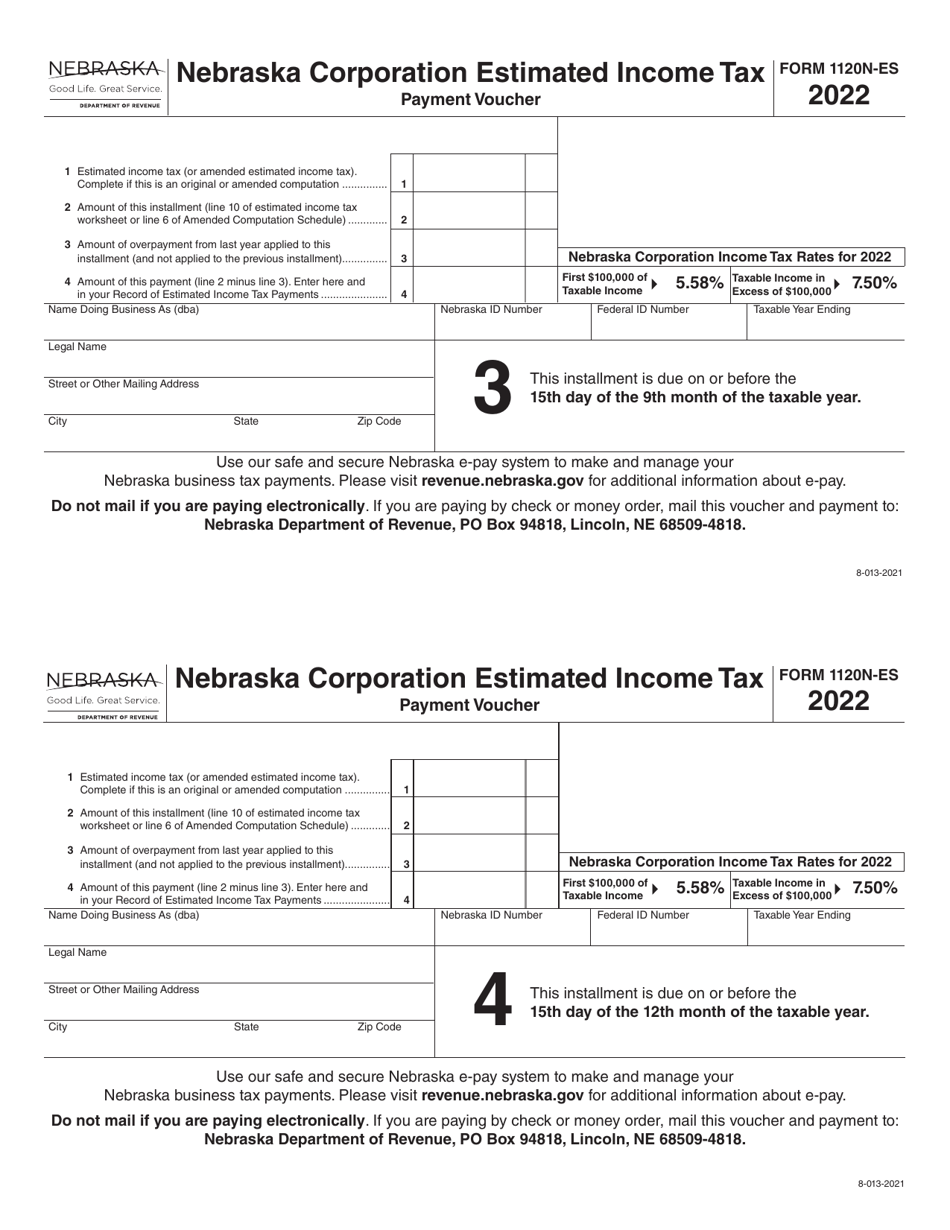

Form 1120N-ES

for the current year.

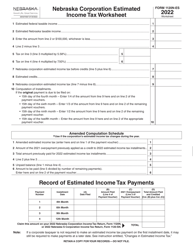

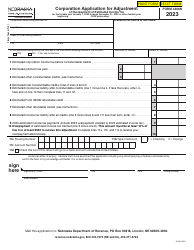

Form 1120N-ES Nebraska Corporation Estimated Income Tax Worksheet - Nebraska

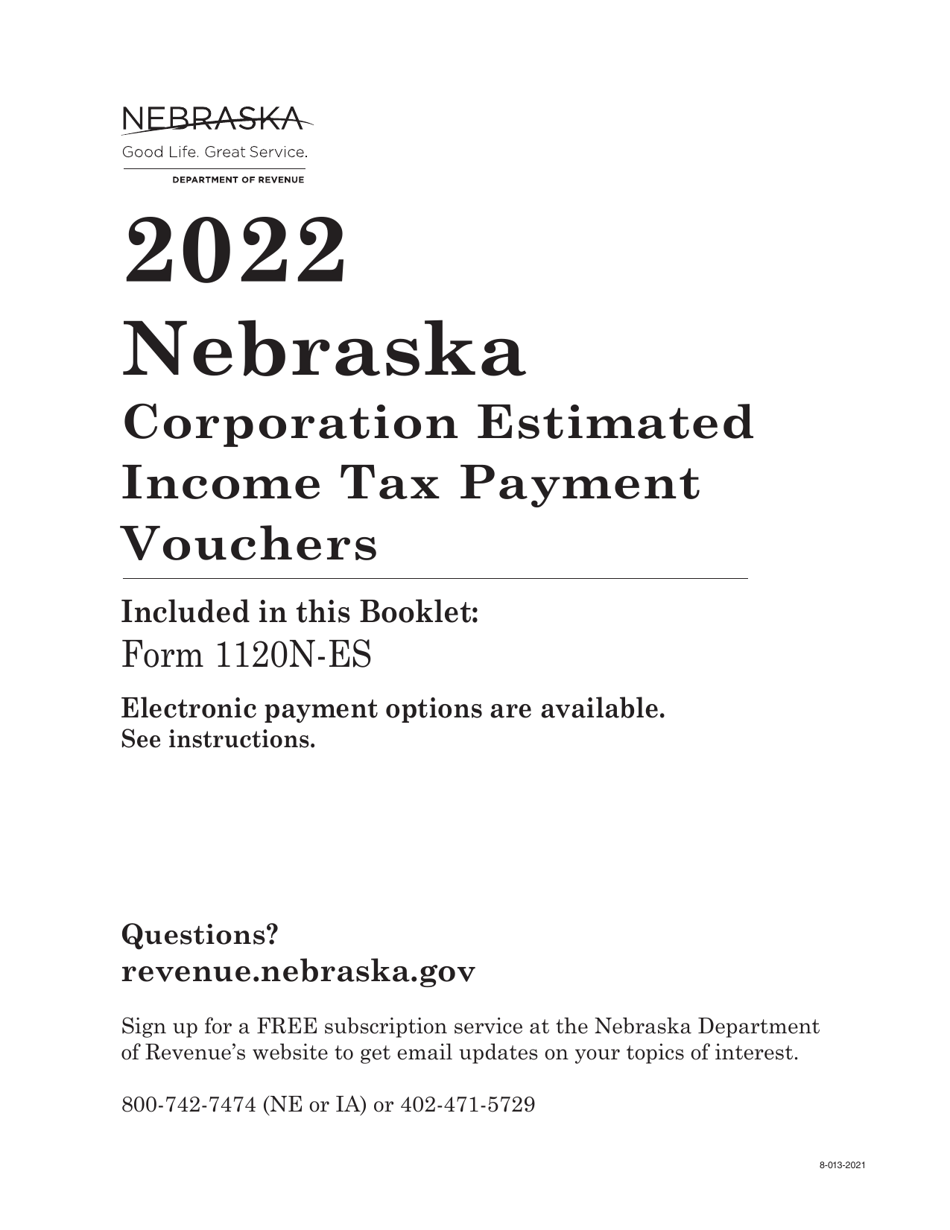

What Is Form 1120N-ES?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

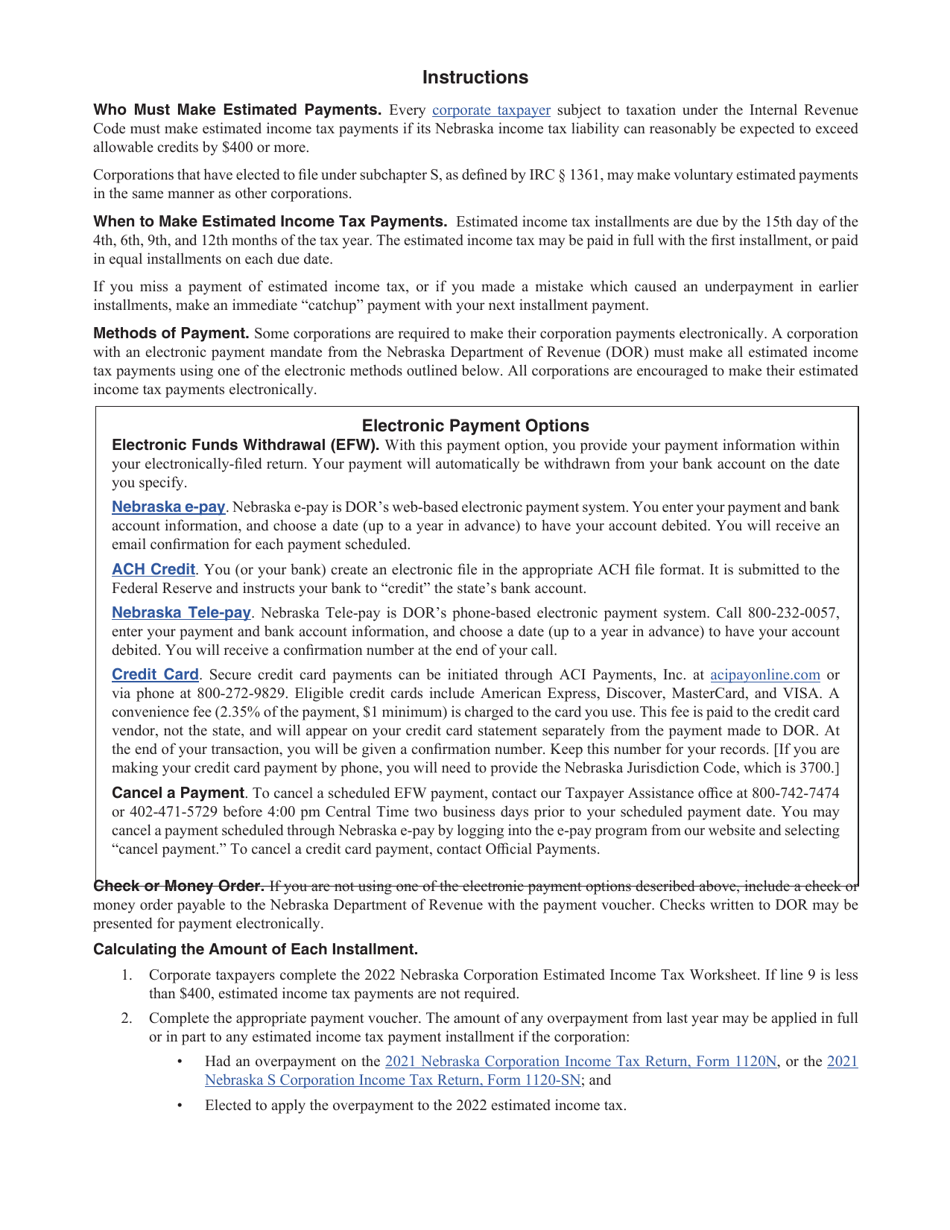

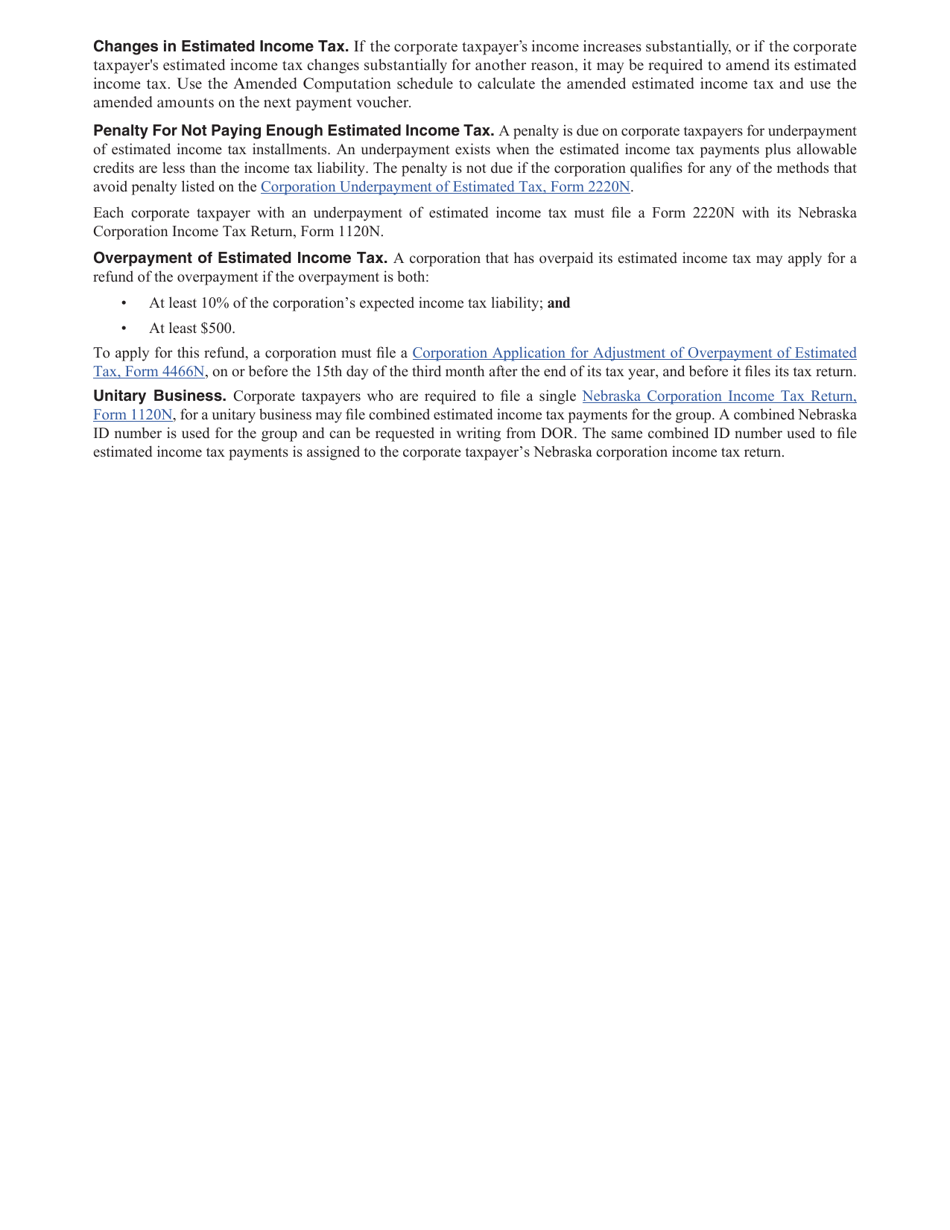

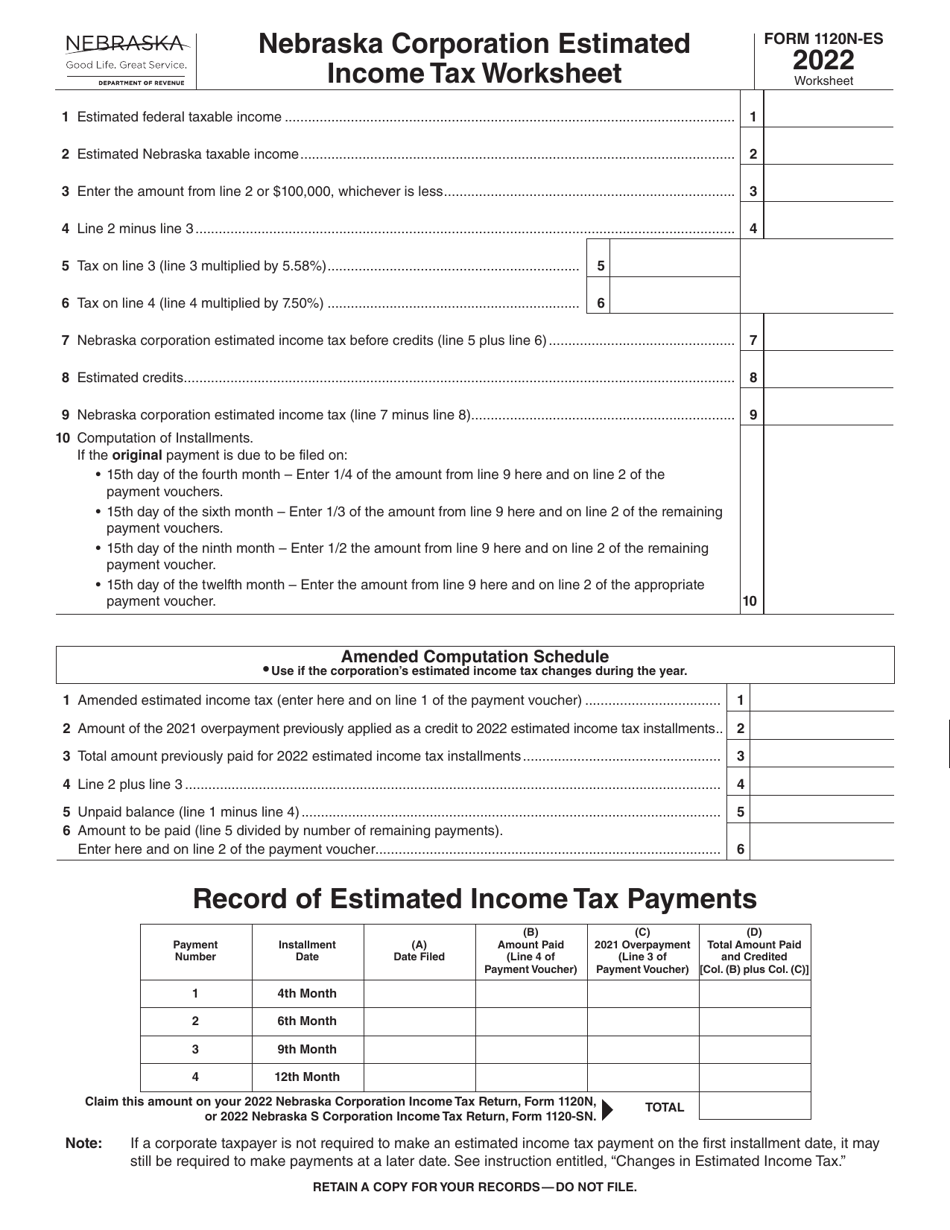

Q: What is Form 1120N-ES?

A: Form 1120N-ES is a worksheet used for calculating estimated income tax for Nebraska corporations.

Q: Who should file Form 1120N-ES?

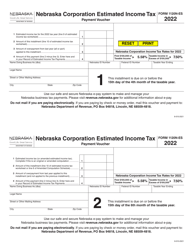

A: Nebraska corporations should file Form 1120N-ES if they need to make estimated income tax payments.

Q: What is the purpose of Form 1120N-ES?

A: The purpose of Form 1120N-ES is to calculate and pay estimated income tax throughout the year, rather than waiting until the end of the tax year.

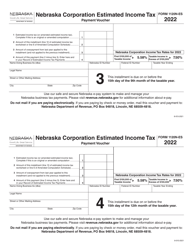

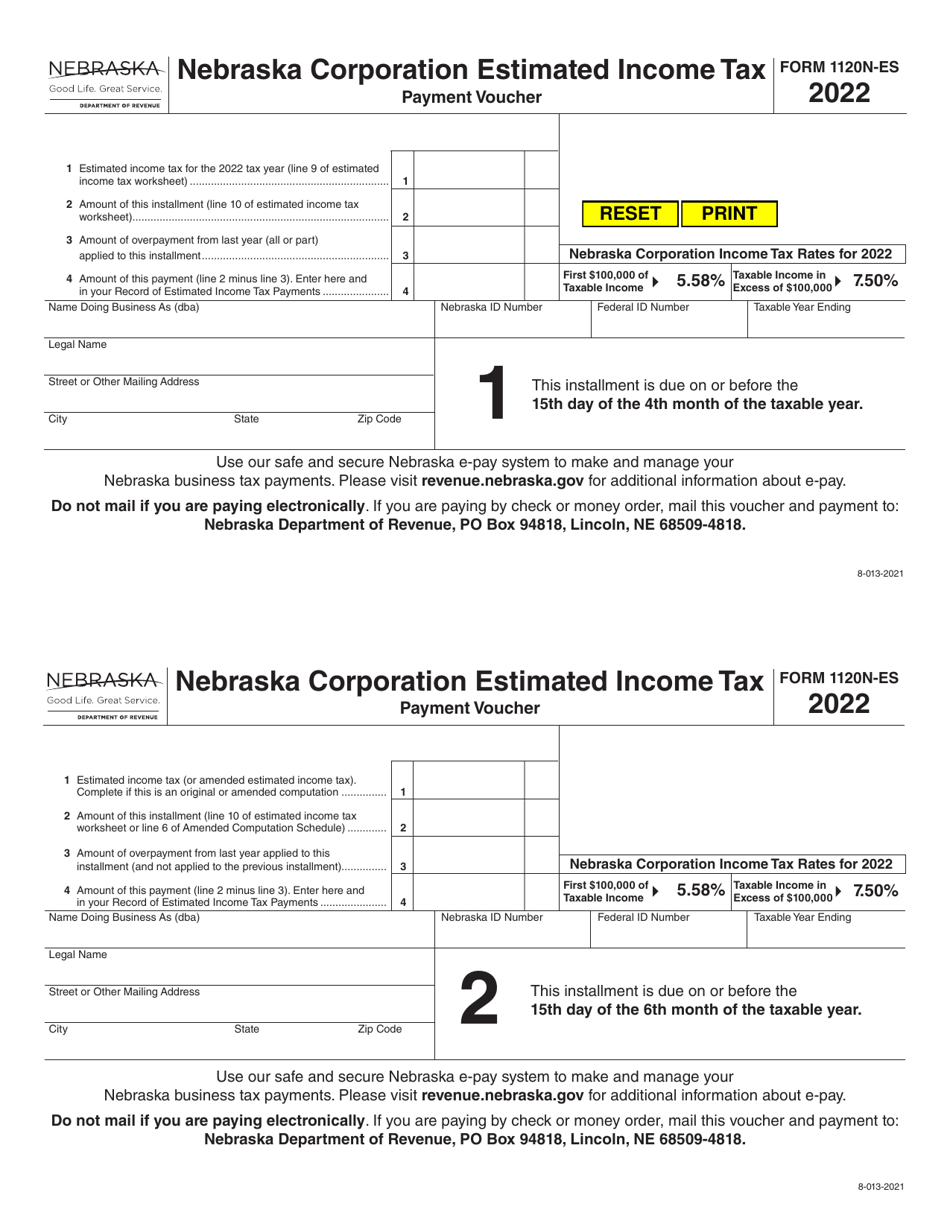

Q: How often should I file Form 1120N-ES?

A: Form 1120N-ES should be filed quarterly, with payments due on April 15th, June 15th, September 15th, and December 15th.

Q: What information is needed to complete Form 1120N-ES?

A: To complete Form 1120N-ES, you will need to know your estimated taxable income for the year, as well as any credits and other adjustments.

Q: Are there any penalties for not filing Form 1120N-ES?

A: Yes, there may be penalties for not filing Form 1120N-ES or for underpaying estimated tax amounts.

Q: When is the final tax return for a Nebraska corporation due?

A: The final tax return for a Nebraska corporation is due on the 15th day of the fourth month following the close of the tax year.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1120N-ES by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.