This version of the form is not currently in use and is provided for reference only. Download this version of

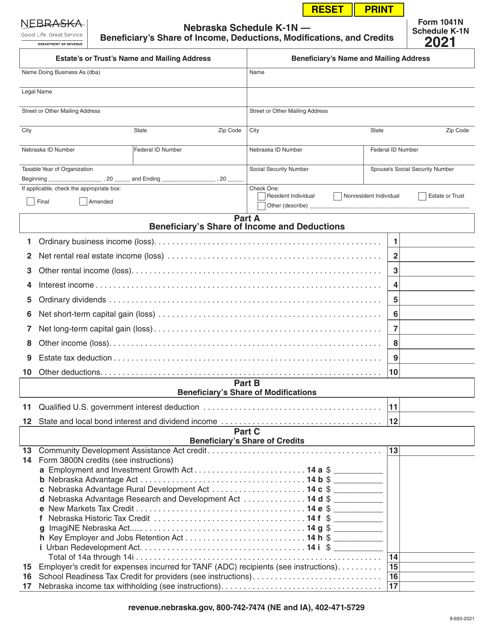

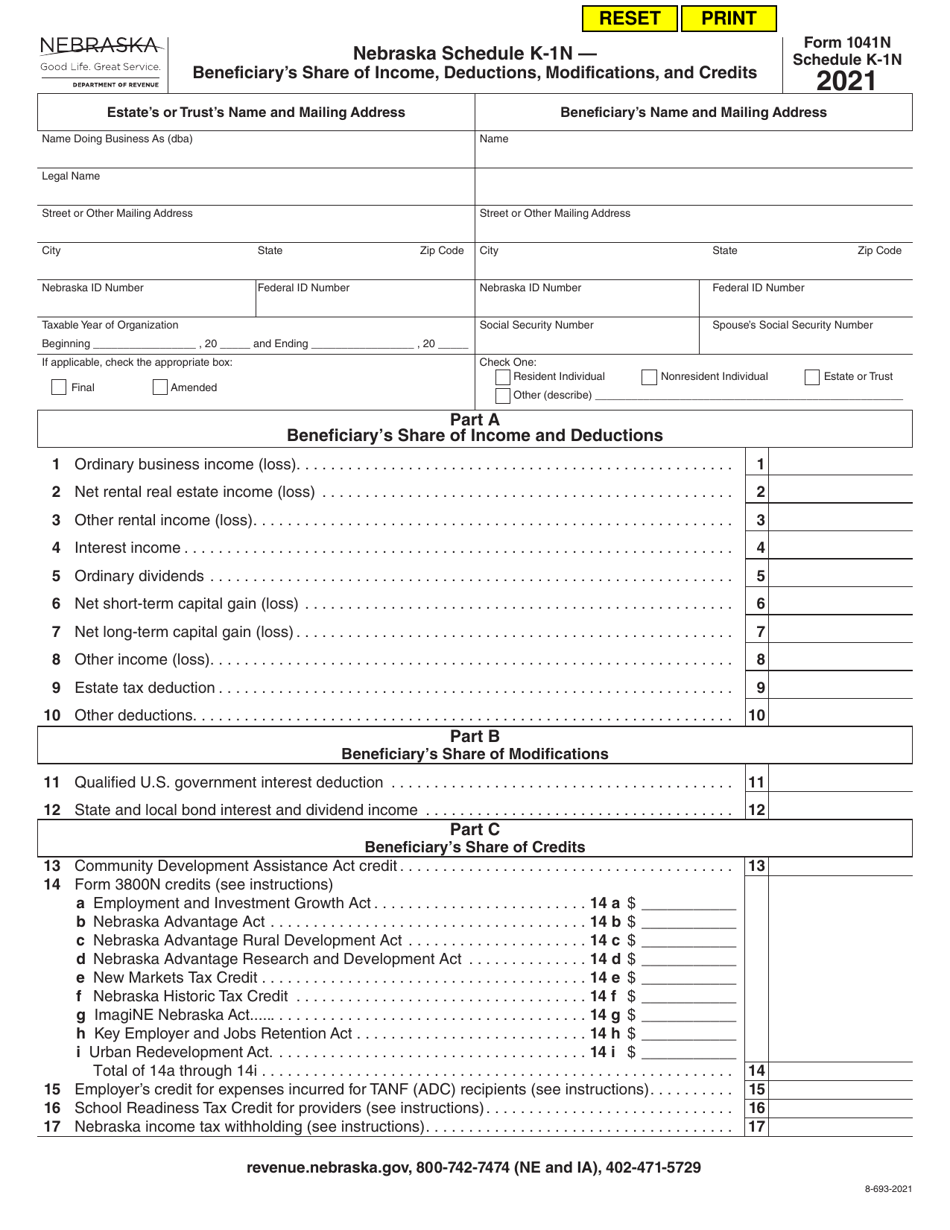

Form 1041N Schedule K-1N

for the current year.

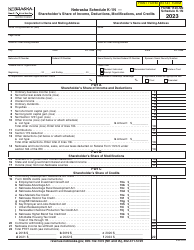

Form 1041N Schedule K-1N Beneficiary's Share of Income, Deductions, Modifications, and Credits - Nebraska

What Is Form 1041N Schedule K-1N?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.The document is a supplement to Form 1041N, Electing Small Business Trust (Esbt) Tax Calculation Worksheet. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1041N Schedule K-1N?

A: Form 1041N Schedule K-1N is a tax form used to report a beneficiary's share of income, deductions, modifications, and credits from a trust or estate in the state of Nebraska.

Q: Who needs to file Form 1041N Schedule K-1N?

A: Beneficiaries who receive income or deductions from a trust or estate in Nebraska need to file Form 1041N Schedule K-1N.

Q: What information does Form 1041N Schedule K-1N include?

A: Form 1041N Schedule K-1N includes information about a beneficiary's share of income, deductions, modifications, and credits from a trust or estate, specifically in Nebraska.

Q: When is the deadline for filing Form 1041N Schedule K-1N?

A: The deadline for filing Form 1041N Schedule K-1N is typically April 15th, but it may vary depending on the tax year.

Q: Is there a fee for filing Form 1041N Schedule K-1N?

A: There is currently no fee for filing Form 1041N Schedule K-1N in Nebraska.

Q: What if I make a mistake on Form 1041N Schedule K-1N?

A: If you make a mistake on Form 1041N Schedule K-1N, you should correct it as soon as possible by filing an amended form with the Nebraska Department of Revenue.

Q: Do I need to include Form 1041N Schedule K-1N with my federal tax return?

A: No, Form 1041N Schedule K-1N is not required to be included with your federal tax return. It is specific to the state of Nebraska.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1041N Schedule K-1N by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.