This version of the form is not currently in use and is provided for reference only. Download this version of

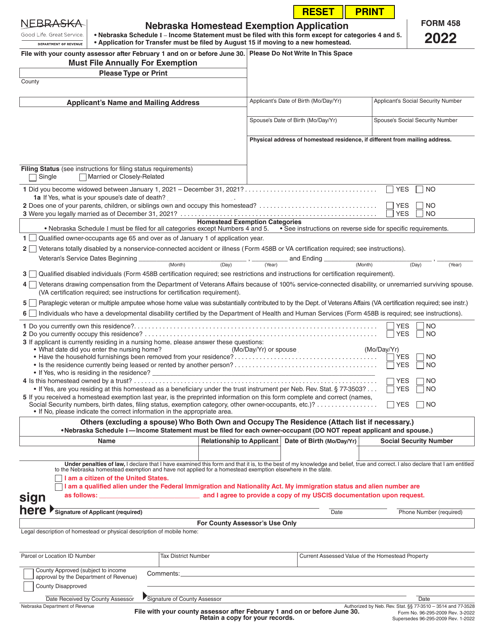

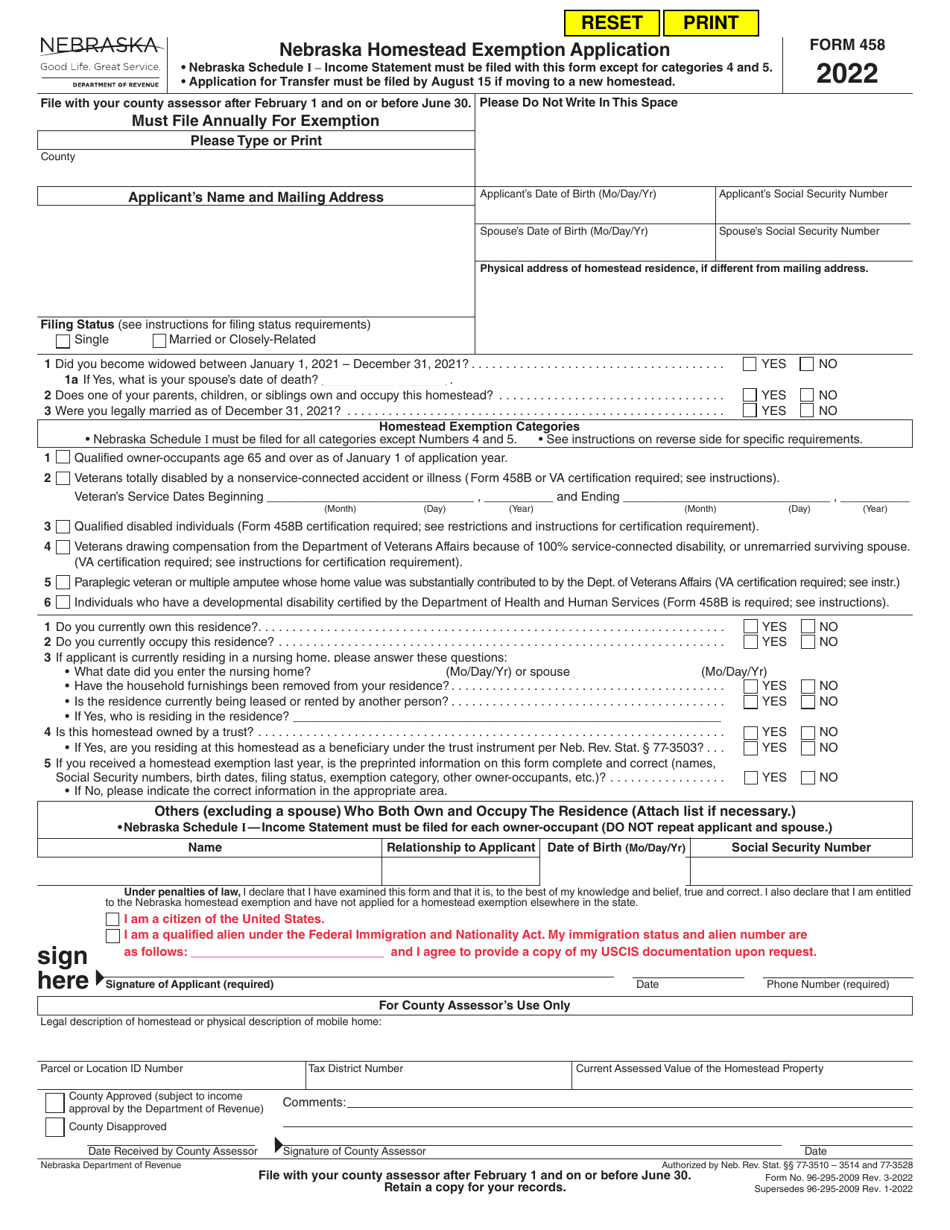

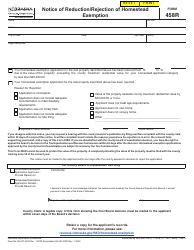

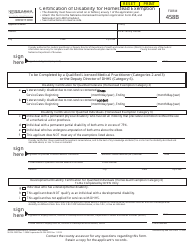

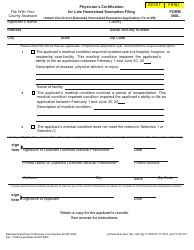

Form 458

for the current year.

Form 458 Nebraska Homestead Exemption Application - Nebraska

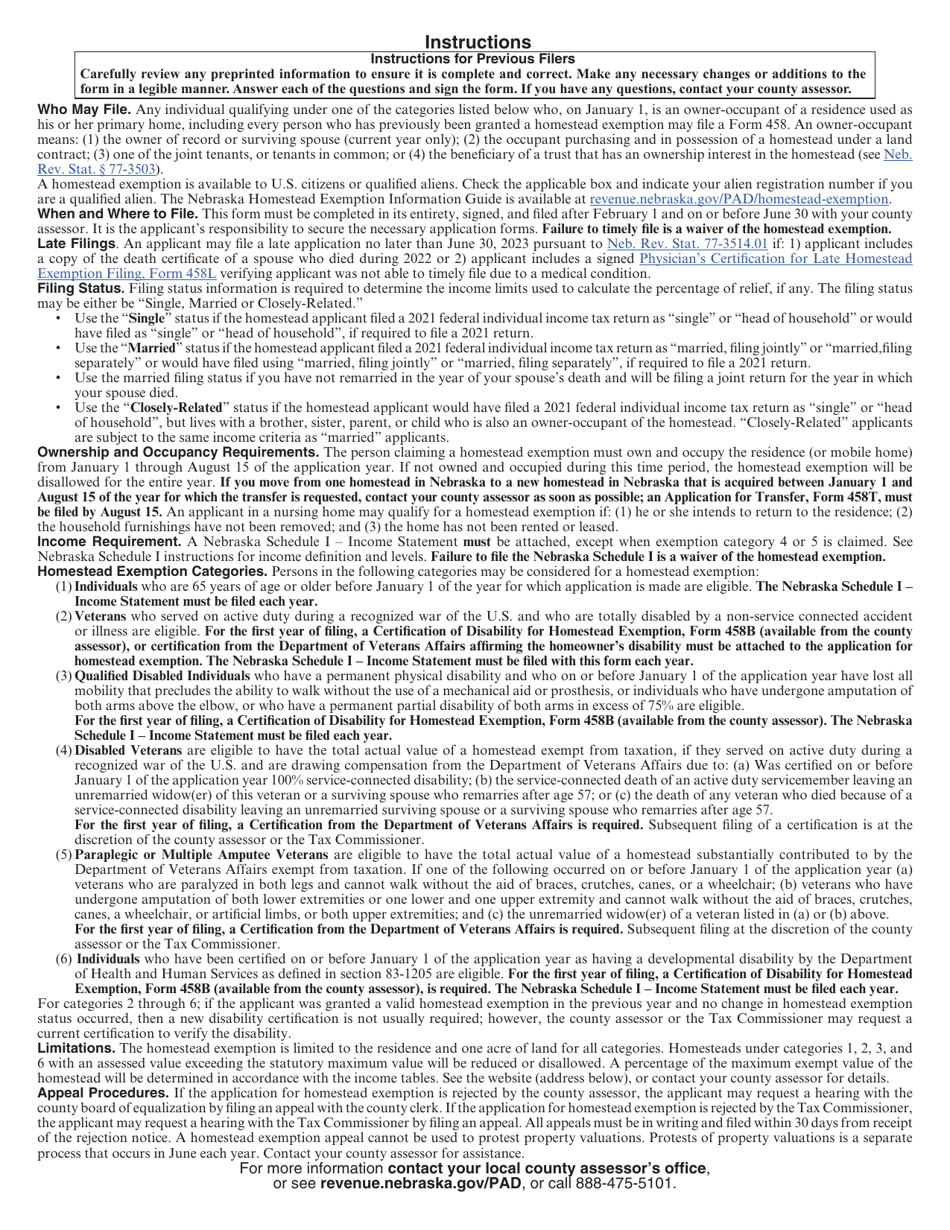

What Is Form 458?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 458?

A: Form 458 is the Nebraska Homestead Exemption Application.

Q: What is the purpose of Form 458?

A: The purpose of Form 458 is to apply for the Nebraska Homestead Exemption.

Q: Who is eligible for the Nebraska Homestead Exemption?

A: Property owners who use their residential property as their primary residence are eligible for the Nebraska Homestead Exemption.

Q: What are the benefits of the Nebraska Homestead Exemption?

A: The Nebraska Homestead Exemption reduces the taxable value of a property, resulting in lower property taxes for eligible homeowners.

Q: Are there any deadlines to submit Form 458?

A: Yes, the deadline to submit Form 458 is July 1st of each year.

Q: Is there a fee to file Form 458?

A: No, there is no fee to file Form 458.

Q: Do I need to renew the Nebraska Homestead Exemption every year?

A: No, once you are approved for the Nebraska Homestead Exemption, it does not need to be renewed unless there are changes to your property ownership or primary residence status.

Q: What documents do I need to submit with Form 458?

A: You will need to submit proof of ownership and residency, such as a copy of the deed and a utility bill.

Q: Who should I contact for any further questions or assistance with Form 458?

A: You can contact the Nebraska Department of Revenue for any further questions or assistance with Form 458.

Form Details:

- Released on March 1, 2022;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 458 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.