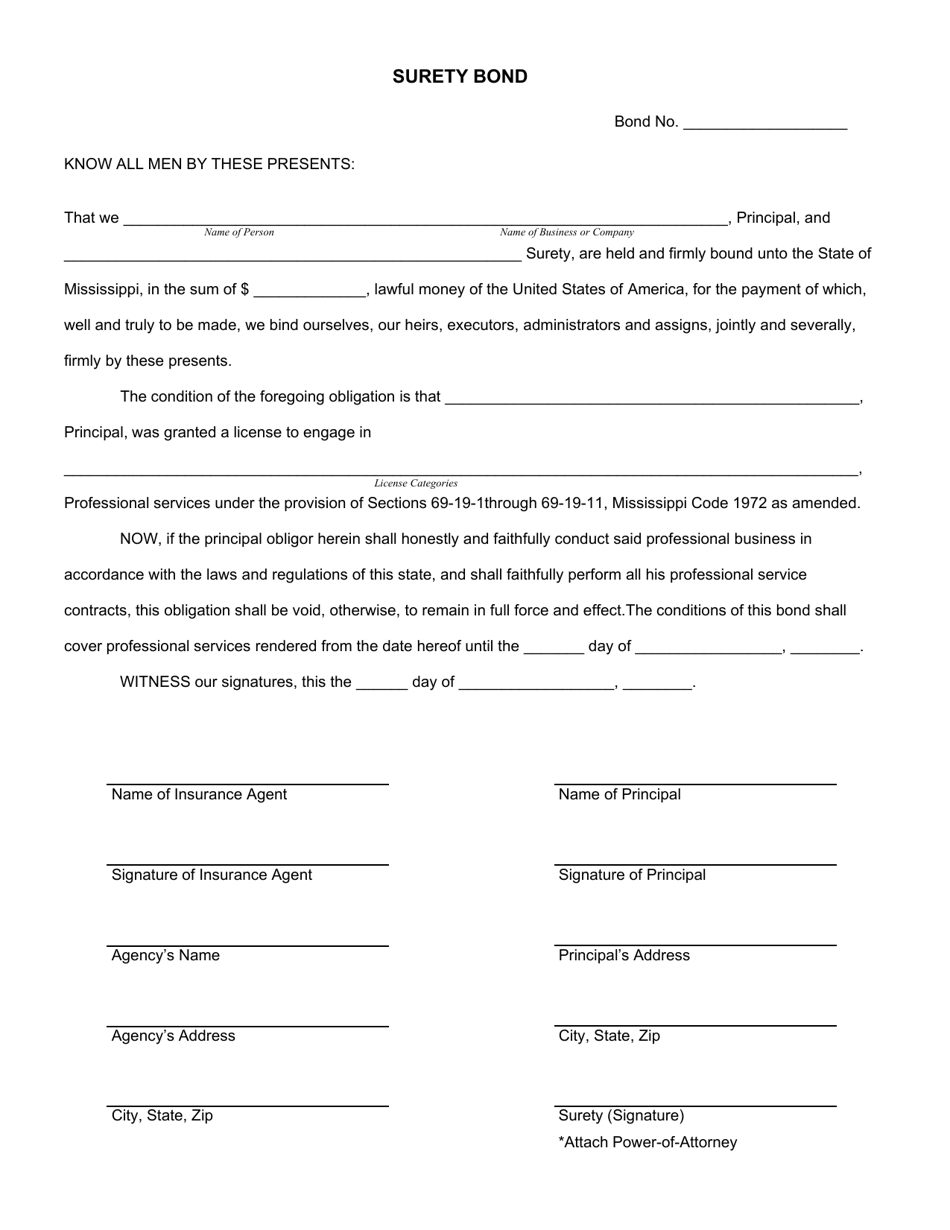

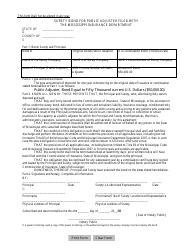

Surety Bond - Mississippi

Surety Bond is a legal document that was released by the Mississippi Department of Agriculture and Commerce - a government authority operating within Mississippi.

FAQ

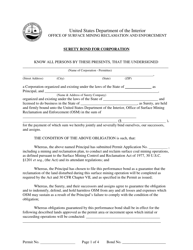

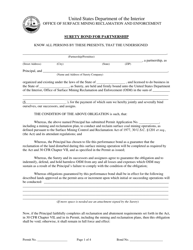

Q: What is a surety bond?

A: A surety bond is a legally binding agreement that ensures one party, called the principal, will fulfill their obligations to another party, called the obligee.

Q: Why would someone need a surety bond in Mississippi?

A: There are many reasons why someone in Mississippi may need a surety bond. Some common reasons include licensing requirements for certain professions, guaranteeing payment of taxes or other financial obligations, and providing protection against fraudulent or dishonest actions.

Q: Who are the parties involved in a surety bond?

A: The parties involved in a surety bond are the principal, the obligee, and the surety. The principal is the party who needs the bond, the obligee is the party who requires the bond, and the surety is the company that provides the bond.

Q: How much does a surety bond cost in Mississippi?

A: The cost of a surety bond in Mississippi varies depending on the type of bond and the amount of coverage required. Typically, the cost is a percentage of the bond amount, ranging from 1% to 15%.

Q: How can I get a surety bond in Mississippi?

A: To get a surety bond in Mississippi, you can contact a licensed surety bond provider or work with an insurance agent who specializes in surety bonds. They will guide you through the application process and help you obtain the bond you need.

Q: What happens if the principal fails to fulfill their obligations?

A: If the principal fails to fulfill their obligations, the obligee can make a claim on the surety bond. The surety then has the responsibility to investigate the claim and determine if it is valid. If the claim is valid, the surety will compensate the obligee up to the amount of the bond.

Q: How long does a surety bond last in Mississippi?

A: The duration of a surety bond in Mississippi depends on the specific requirements of the bond. Some bonds are valid for a specific period of time, while others are continuous and must be renewed annually.

Q: Can I cancel a surety bond in Mississippi?

A: Yes, it is possible to cancel a surety bond in Mississippi. However, the process and requirements for cancellation may vary depending on the type of bond and the specific circumstances. It is important to carefully review the terms and conditions of the bond before seeking cancellation.

Q: Are surety bonds the same as insurance?

A: No, surety bonds are not the same as insurance. While both involve risk mitigation, insurance policies protect the insured party from potential losses, while surety bonds protect the obligee by guaranteeing the performance or payment of the principal.

Q: Can I get a surety bond with bad credit?

A: Getting a surety bond with bad credit can be more challenging, but it is still possible. Some surety bond providers offer options for individuals with less-than-perfect credit, although the terms and conditions may be stricter and the cost of the bond may be higher.

Form Details:

- Released on November 1, 2021;

- The latest edition currently provided by the Mississippi Department of Agriculture and Commerce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Mississippi Department of Agriculture and Commerce.