This version of the form is not currently in use and is provided for reference only. Download this version of

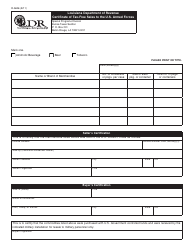

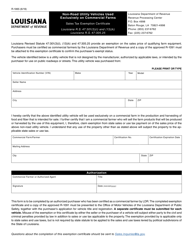

Form R-5806

for the current year.

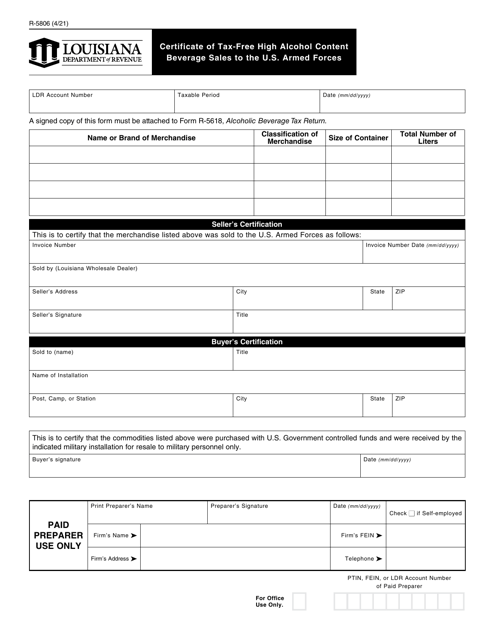

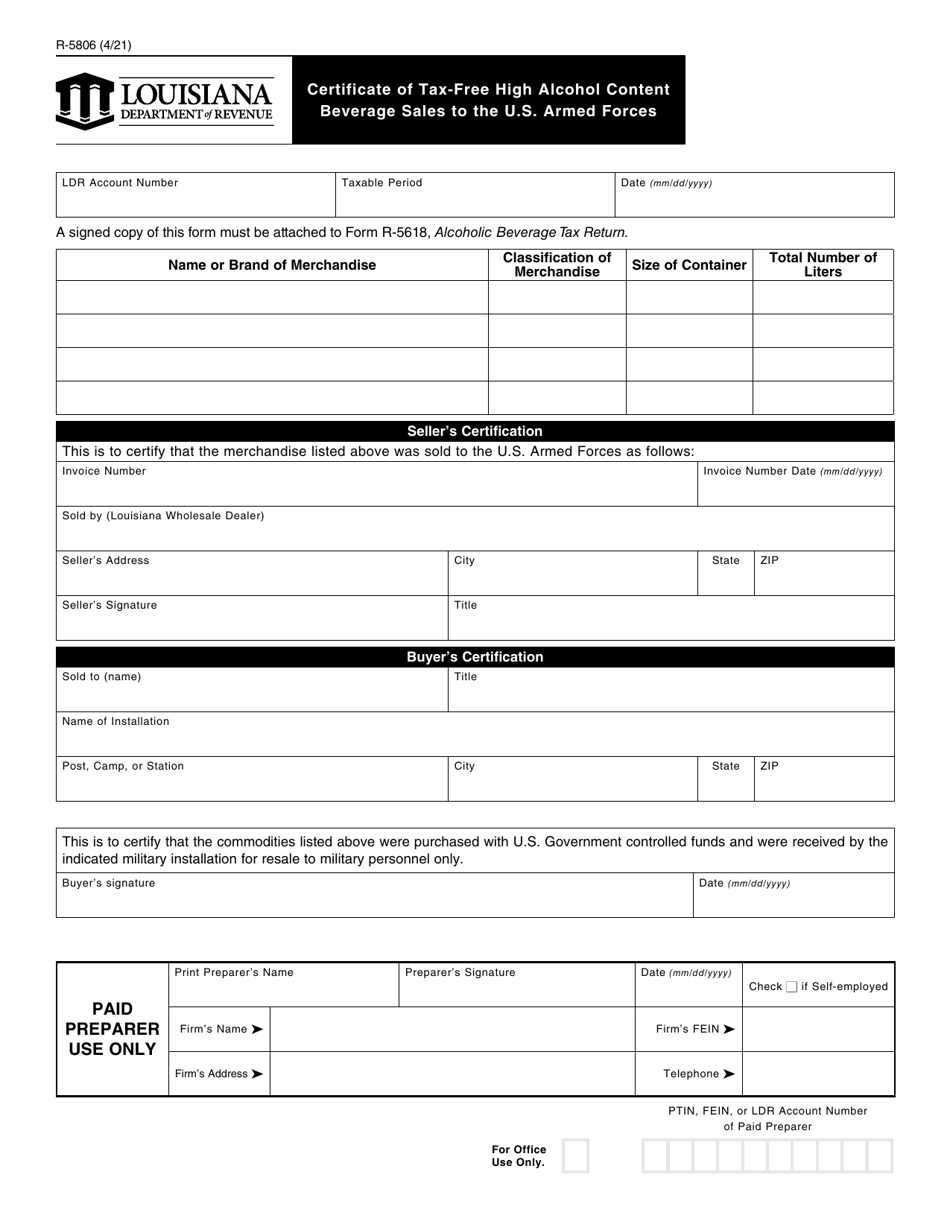

Form R-5806 Certificate of Tax-Free High Alcohol Content Beverage Sales to the U.S. Armed Forces - Louisiana

What Is Form R-5806?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-5806?

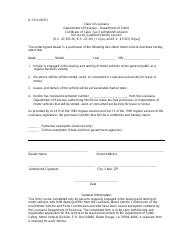

A: Form R-5806 is a certificate used for tax-free high alcohol content beverage sales to the U.S. Armed Forces in Louisiana.

Q: Who uses Form R-5806?

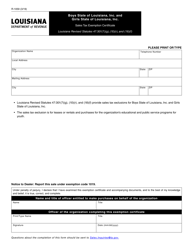

A: Form R-5806 is used by sellers of high alcohol content beverages who wish to make tax-free sales to the U.S. Armed Forces in Louisiana.

Q: What is considered a high alcohol content beverage?

A: High alcohol content beverages typically refer to alcoholic beverages with an alcohol content of 7% or higher.

Q: What is the purpose of Form R-5806?

A: The purpose of Form R-5806 is to certify that a sale of high alcohol content beverages is eligible for tax exemption when sold to the U.S. Armed Forces in Louisiana.

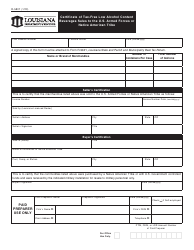

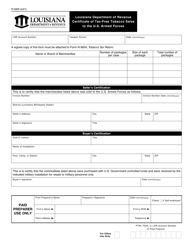

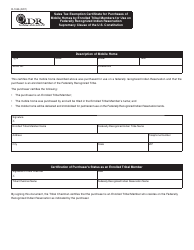

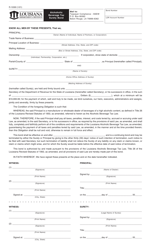

Q: What information is required on Form R-5806?

A: Form R-5806 requires information such as the seller's name and address, the purchaser's name, quantity and description of the high alcohol content beverages, and the reason for exemption.

Q: Are there any restrictions on tax-free sales to the U.S. Armed Forces?

A: Yes, there are restrictions. The high alcohol content beverages must be delivered directly to the U.S. Armed Forces installation in Louisiana and cannot be resold or used for personal consumption.

Q: Is there a fee for filing Form R-5806?

A: There is no fee for filing Form R-5806.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-5806 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.