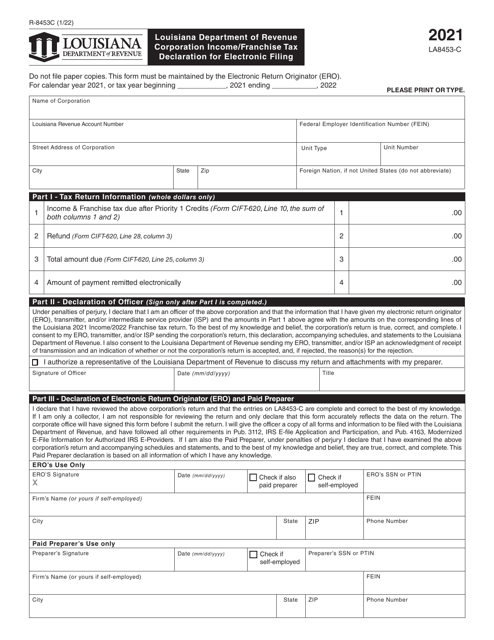

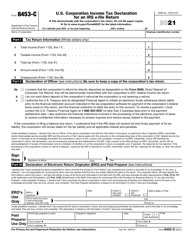

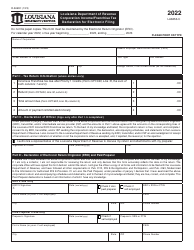

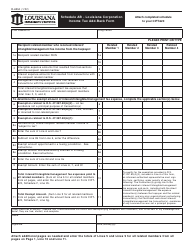

Form R-8453C Corporation Income / Franchise Tax Declaration for Electronic Filing - Louisiana

What Is Form R-8453C?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-8453C?

A: Form R-8453C is the Corporation Income/Franchise Tax Declaration for Electronic Filing for Louisiana.

Q: Who needs to file Form R-8453C?

A: Corporations that are filing their income or franchise tax electronically in Louisiana need to file Form R-8453C.

Q: What is the purpose of Form R-8453C?

A: Form R-8453C is used to declare that the corporation has authorized the electronic filing of their income or franchise tax return.

Q: When is Form R-8453C due?

A: Form R-8453C is generally due on the same date as the corporation's income or franchise tax return.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-8453C by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.