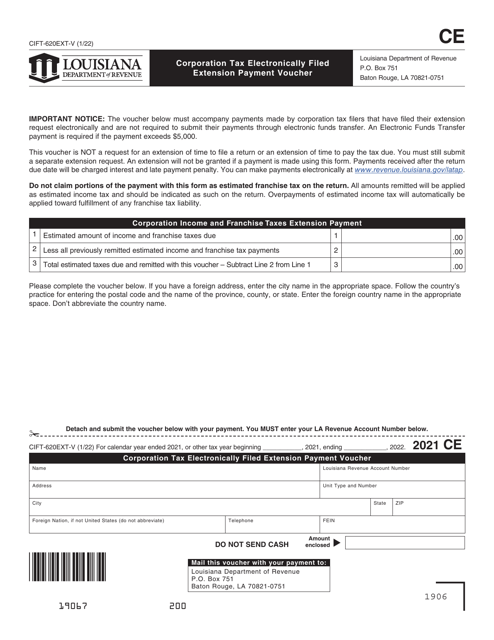

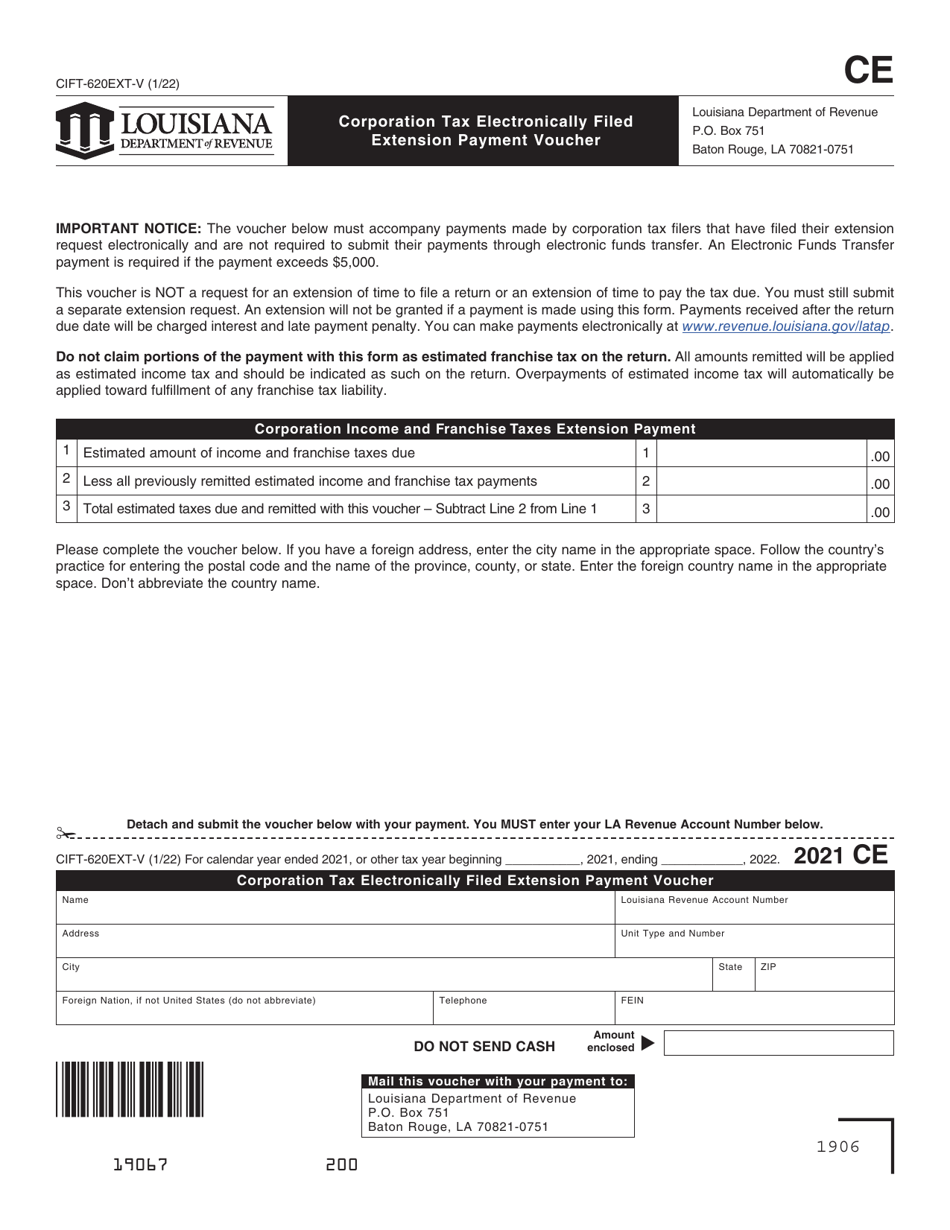

Form CIFT-620EXT-V Corporation Tax Electronically Filed Extension Payment Voucher - Louisiana

What Is Form CIFT-620EXT-V?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CIFT-620EXT-V?

A: Form CIFT-620EXT-V is the Corporation Tax Electronically Filed Extension Payment Voucher specifically for the state of Louisiana.

Q: What is the purpose of Form CIFT-620EXT-V?

A: The purpose of Form CIFT-620EXT-V is to make a payment for an electronically filed extension for corporation tax in Louisiana.

Q: Who needs to use Form CIFT-620EXT-V?

A: Any corporation that has filed for an extension for filing their tax return electronically in Louisiana needs to use Form CIFT-620EXT-V to make a payment.

Q: How do I fill out Form CIFT-620EXT-V?

A: You need to provide your corporation's name, address, federal employer identification number, extension payment amount, and the tax year for which the extension is being filed.

Q: When is Form CIFT-620EXT-V due?

A: Form CIFT-620EXT-V must be submitted with the extension payment by the original due date of the corporation tax return in Louisiana.

Q: What happens if I don't submit Form CIFT-620EXT-V?

A: If you fail to submit Form CIFT-620EXT-V with the extension payment, you may be subject to penalties and interest on the late payment.

Q: Is Form CIFT-620EXT-V only for corporations?

A: Yes, Form CIFT-620EXT-V is specifically designed for corporations filing for an extension for tax returns in Louisiana.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CIFT-620EXT-V by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.