This version of the form is not currently in use and is provided for reference only. Download this version of

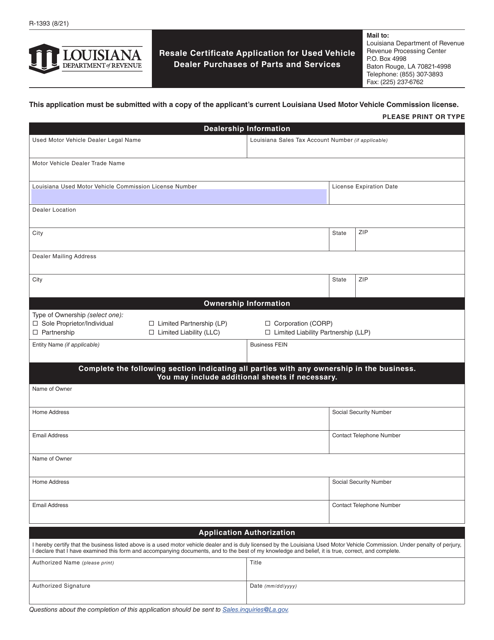

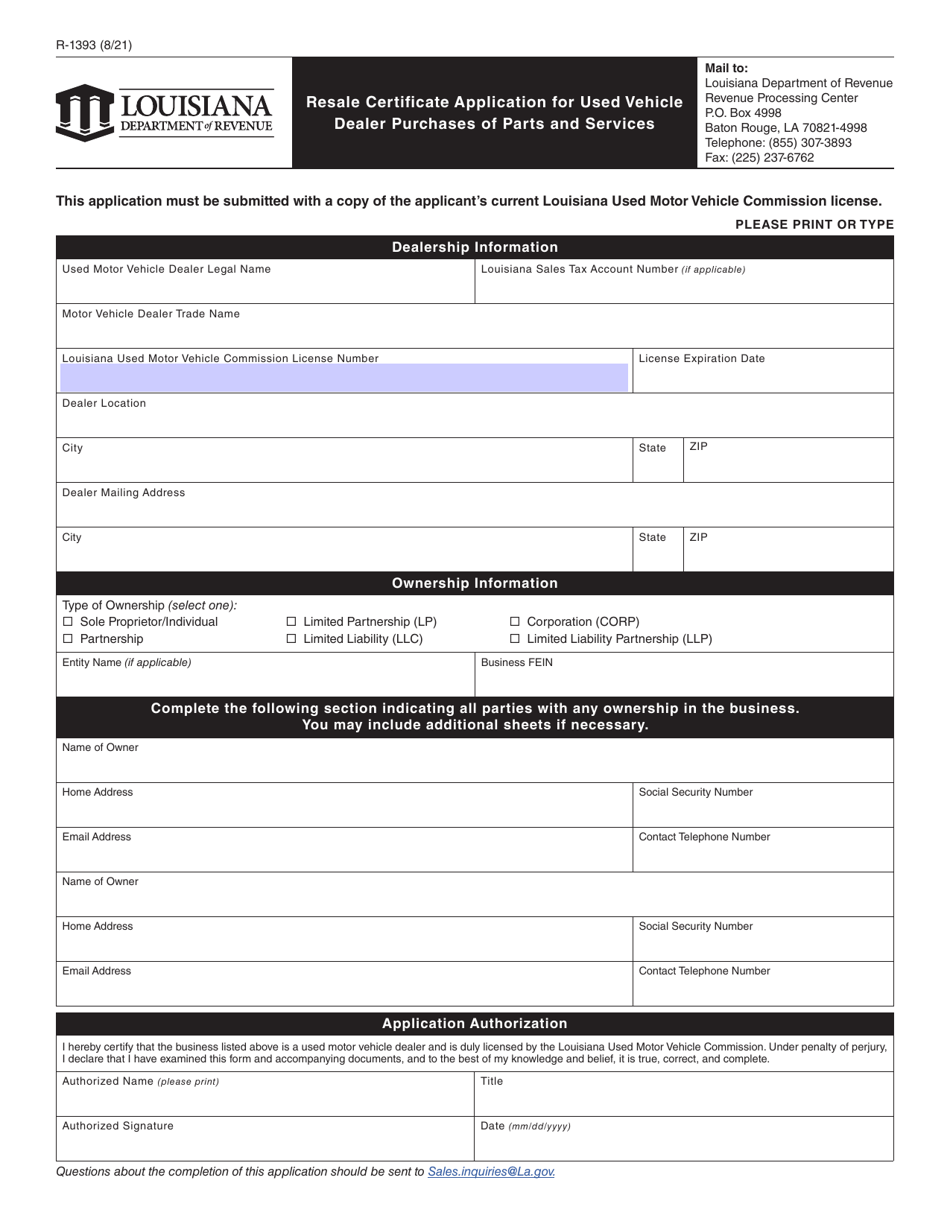

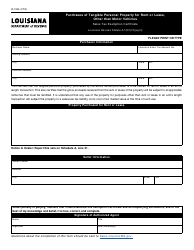

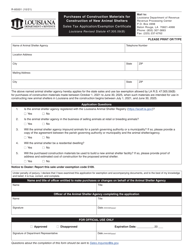

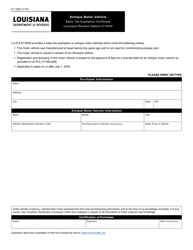

Form R-1393

for the current year.

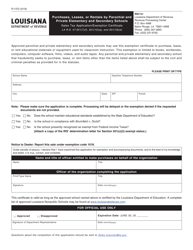

Form R-1393 Resale Certificate Application for Used Vehicle Dealer Purchases of Parts and Services - Louisiana

What Is Form R-1393?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1393?

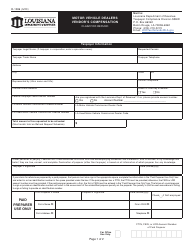

A: Form R-1393 is the Resale Certificate Application for Used Vehicle Dealer Purchases of Parts and Services in Louisiana.

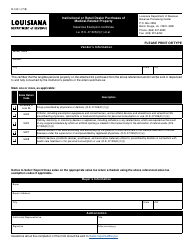

Q: Who needs to use Form R-1393?

A: Used vehicle dealers in Louisiana who want to make tax-exempt purchases of parts and services for resale purposes.

Q: What is the purpose of Form R-1393?

A: The purpose of Form R-1393 is to certify that the purchases made by used vehicle dealers are intended for resale and therefore eligible for exemption from sales tax.

Q: How do I fill out Form R-1393?

A: You must provide your dealer number, vehicle identification number (VIN), and other relevant information about the purchases and business.

Q: When should I submit Form R-1393?

A: Form R-1393 should be submitted at the time of purchase, or within 60 days of the purchase date.

Q: Are there any fees associated with Form R-1393?

A: No, there are no fees associated with Form R-1393.

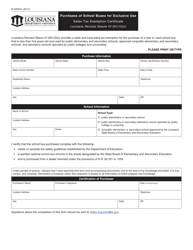

Q: Can I use Form R-1393 for all purchases?

A: No, Form R-1393 is specifically for purchases of parts and services by used vehicle dealers.

Q: What happens after I submit Form R-1393?

A: If your application is approved, you will receive a resale certificate which can be presented to vendors to make tax-exempt purchases.

Q: Can I use the resale certificate for personal purchases?

A: No, the resale certificate can only be used for purchases intended for resale.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1393 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.