This version of the form is not currently in use and is provided for reference only. Download this version of

Form R-6981

for the current year.

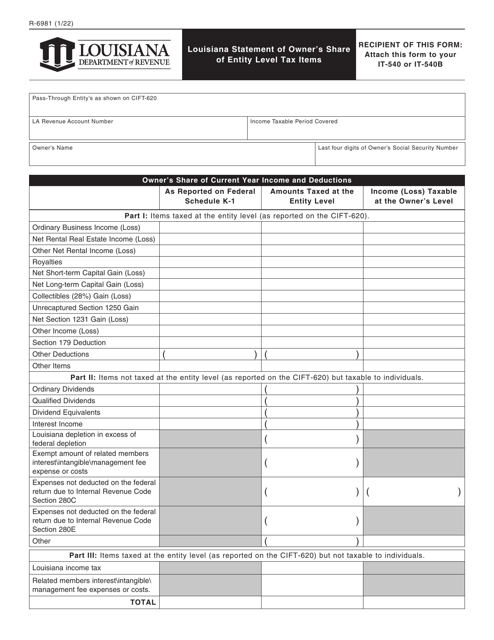

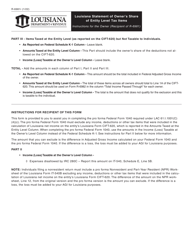

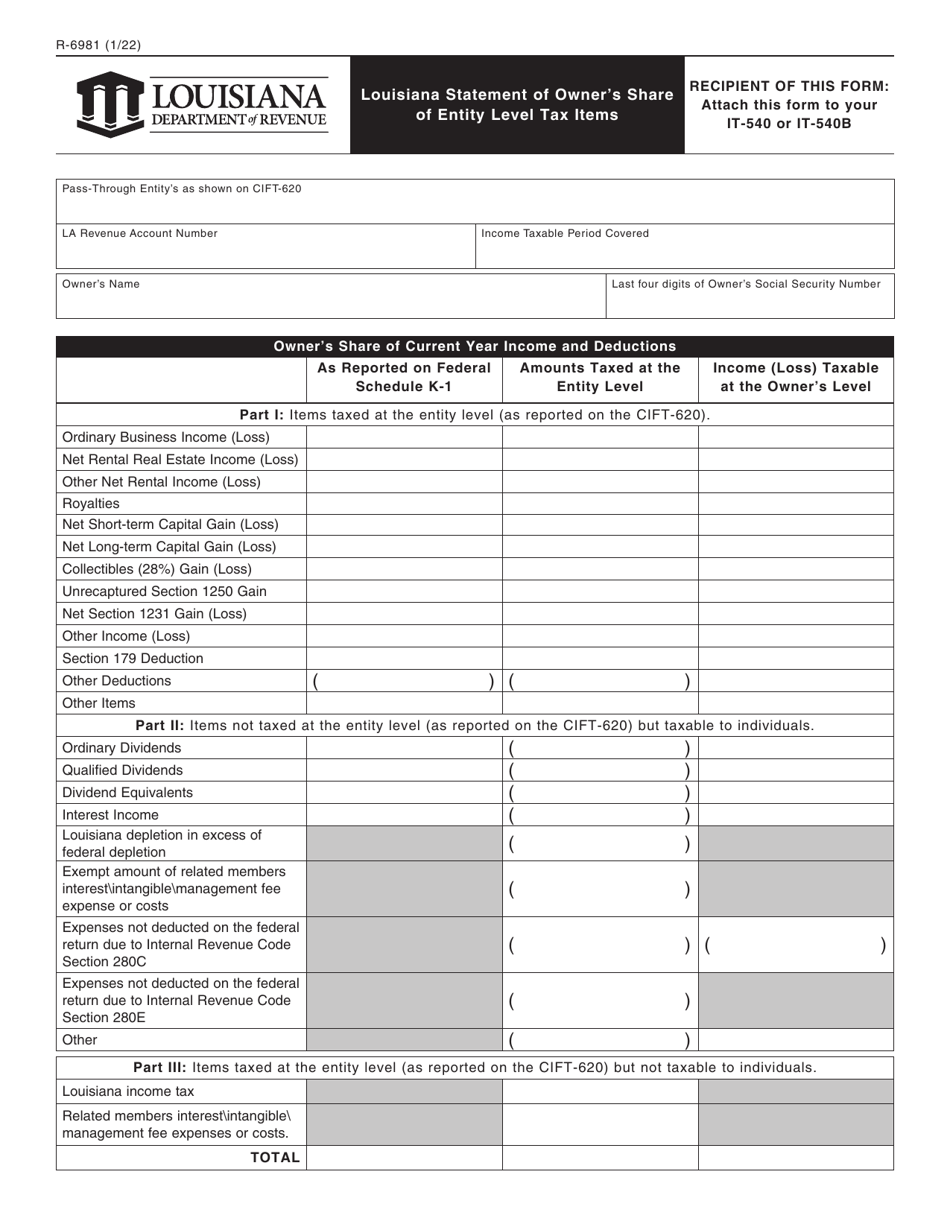

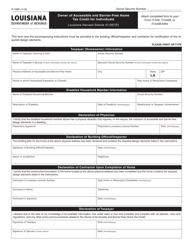

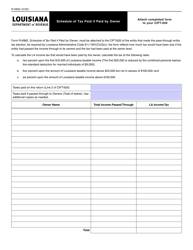

Form R-6981 Louisiana Statement of Owner's Share of Entity Level Tax Items - Louisiana

What Is Form R-6981?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6981?

A: Form R-6981 is the Louisiana Statement of Owner's Share of Entity Level Tax Items.

Q: Who needs to file Form R-6981?

A: Form R-6981 must be filed by owners or partners of an entity that pays entity-level taxes in Louisiana.

Q: What is the purpose of Form R-6981?

A: The purpose of Form R-6981 is to report an owner's share of entity level tax items for Louisiana tax purposes.

Q: What are the tax items reported on Form R-6981?

A: The tax items reported on Form R-6981 include credits, deductions, and exemptions related to entity-level taxes in Louisiana.

Q: When is Form R-6981 due?

A: Form R-6981 is due on the same date as the entity's Louisiana franchise tax return, which is generally due by May 15th each year.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6981 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.