This version of the form is not currently in use and is provided for reference only. Download this version of

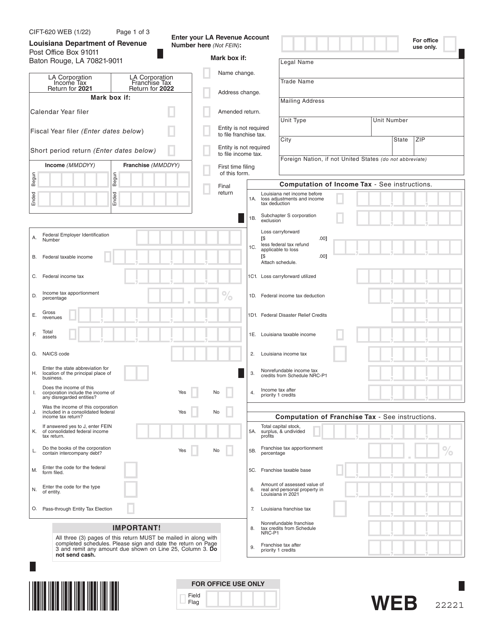

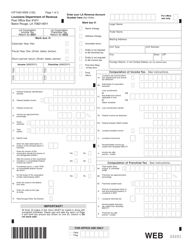

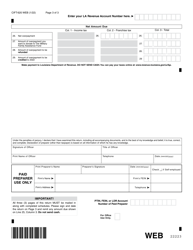

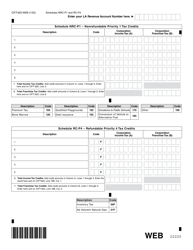

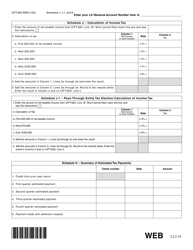

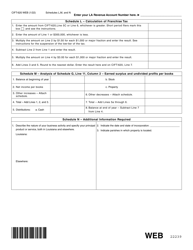

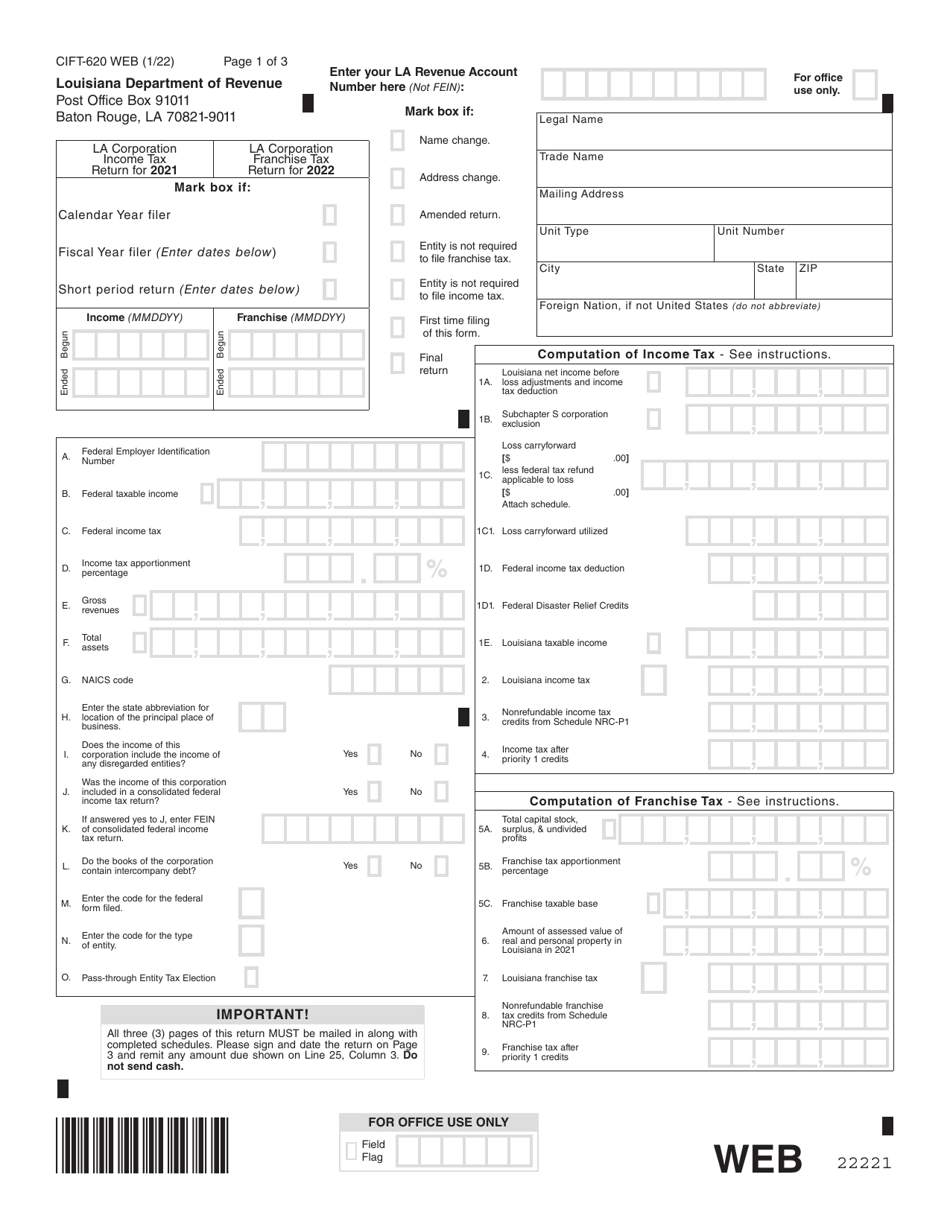

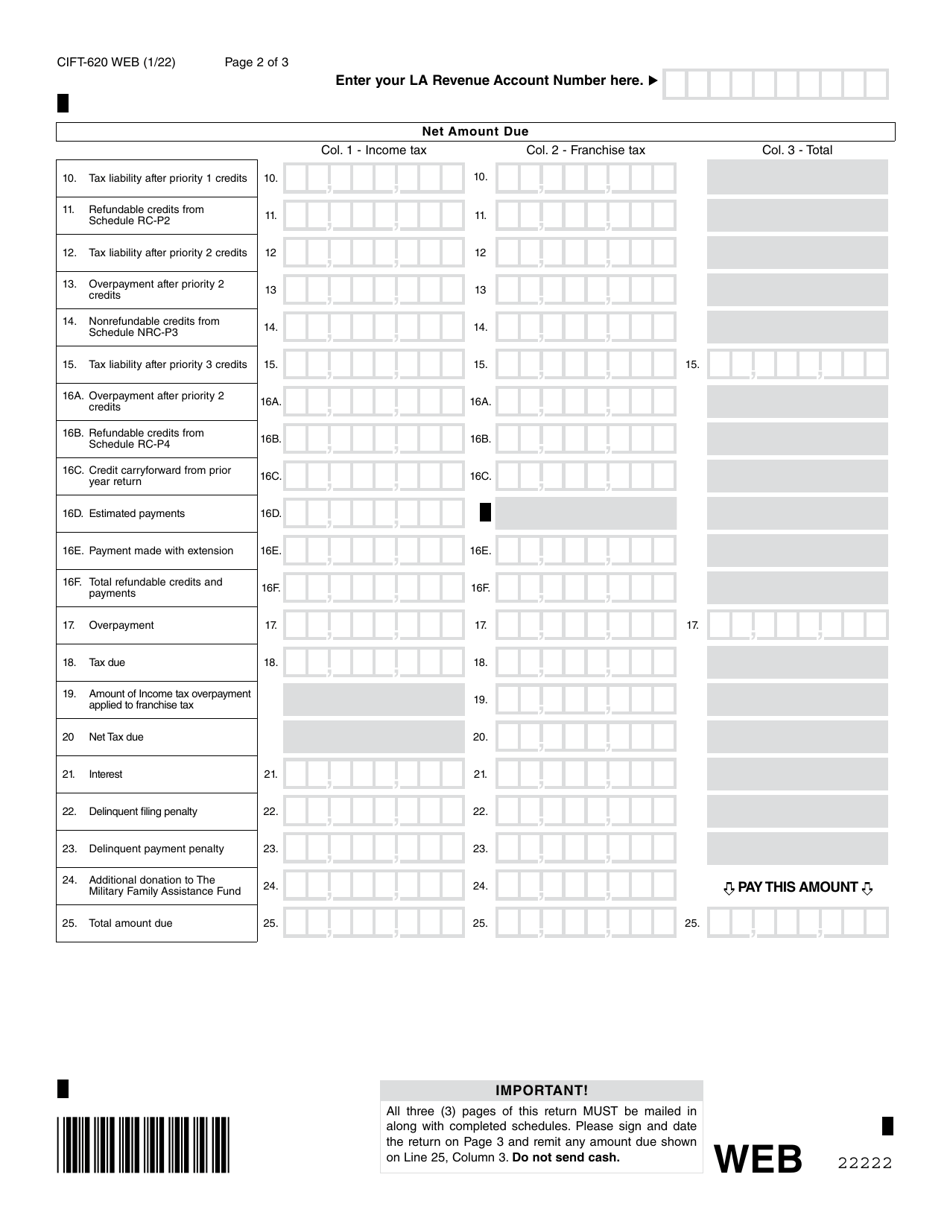

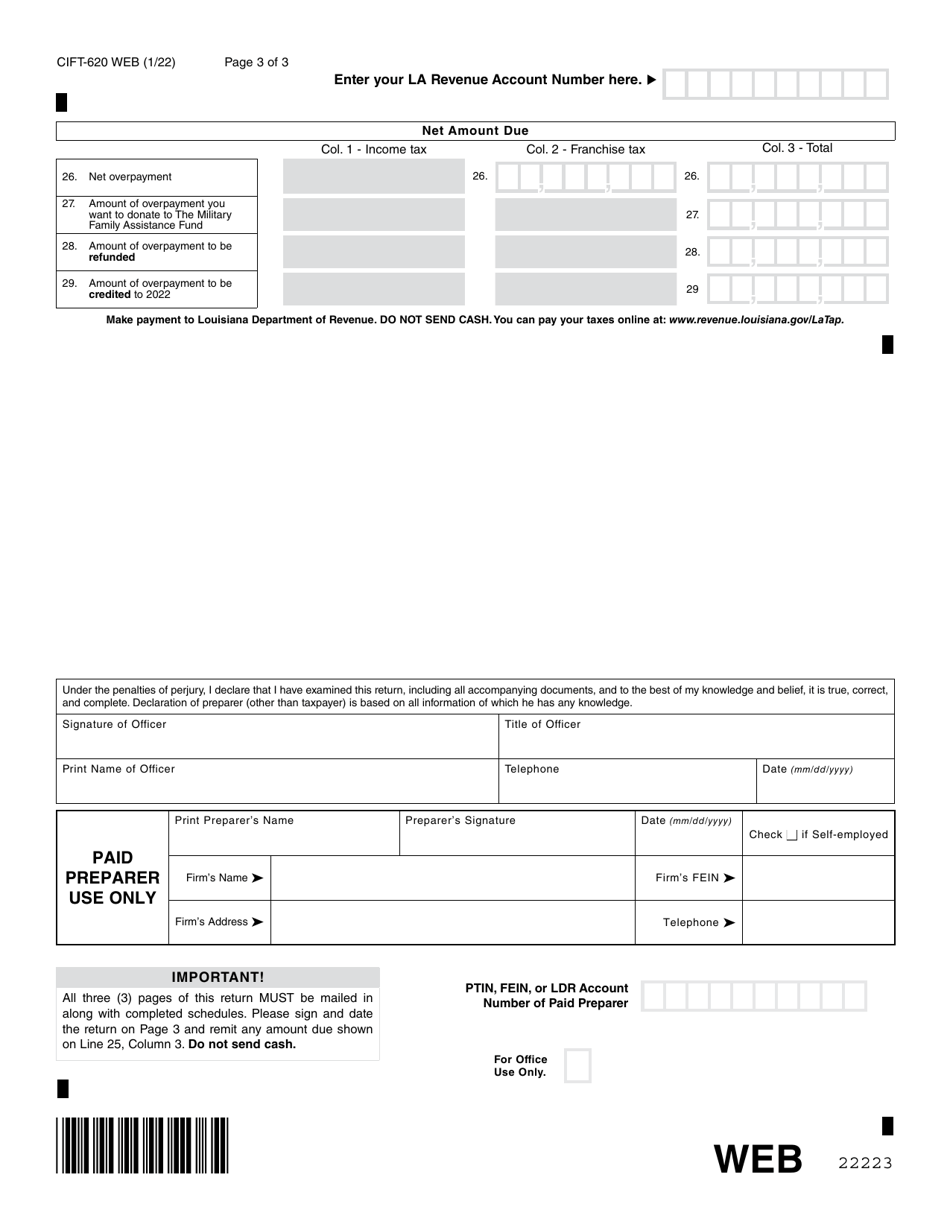

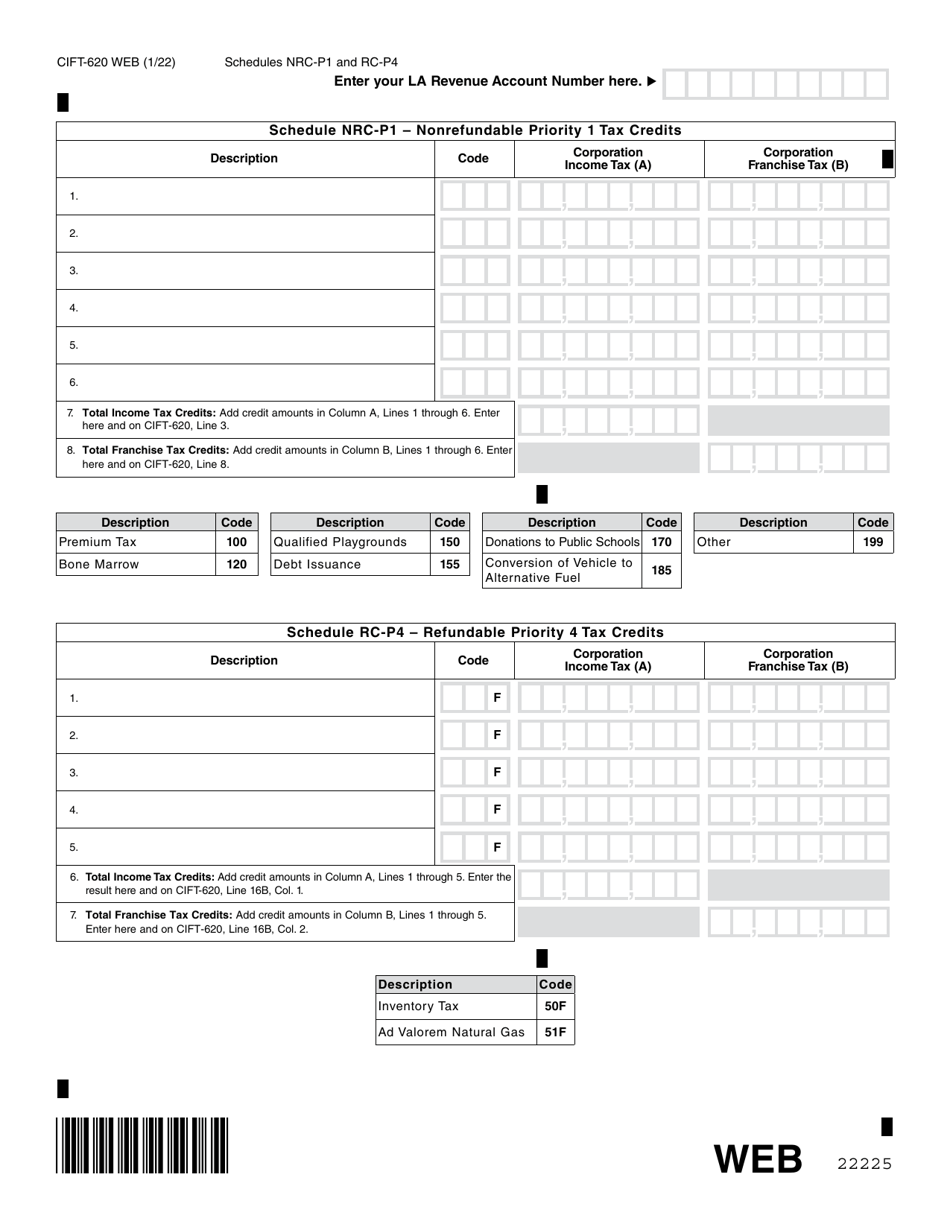

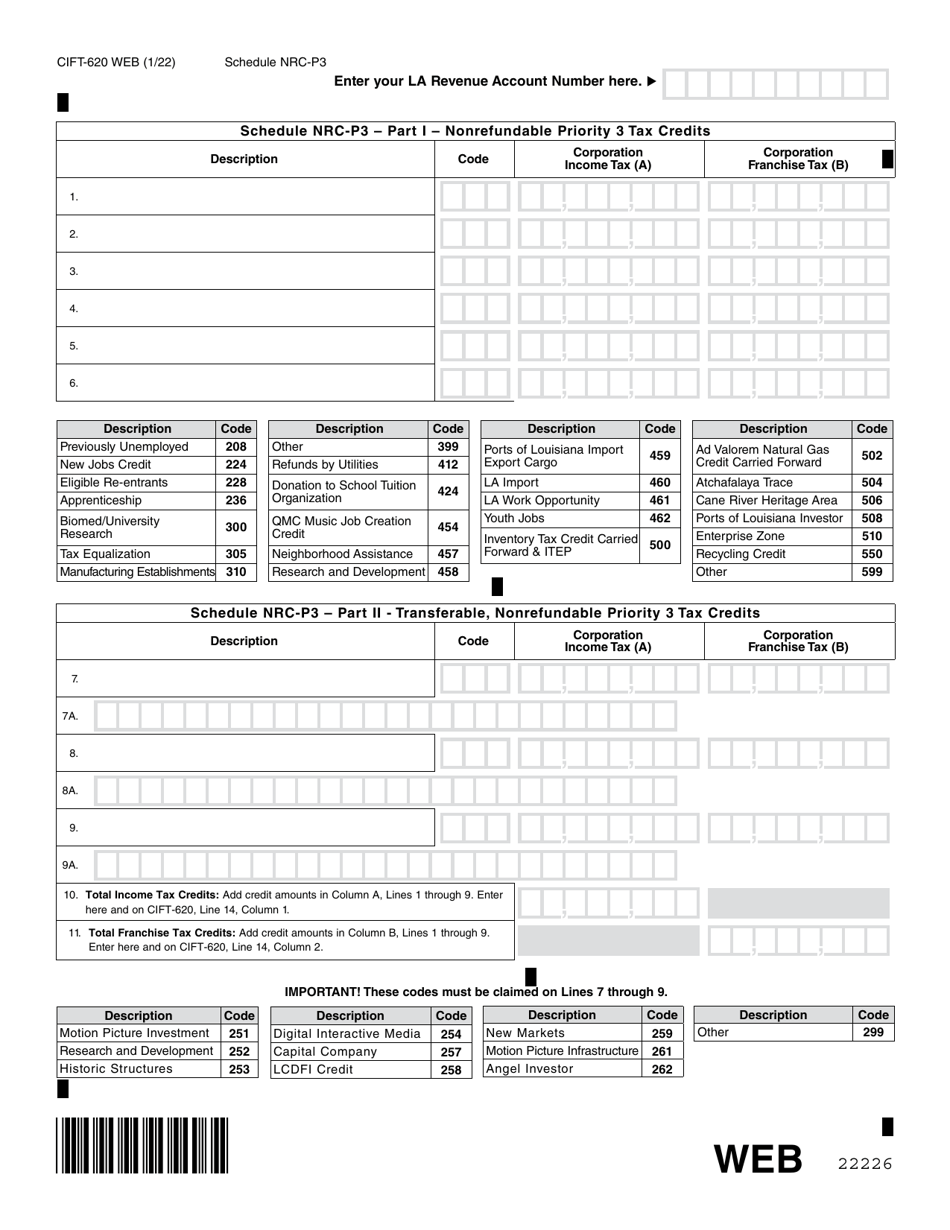

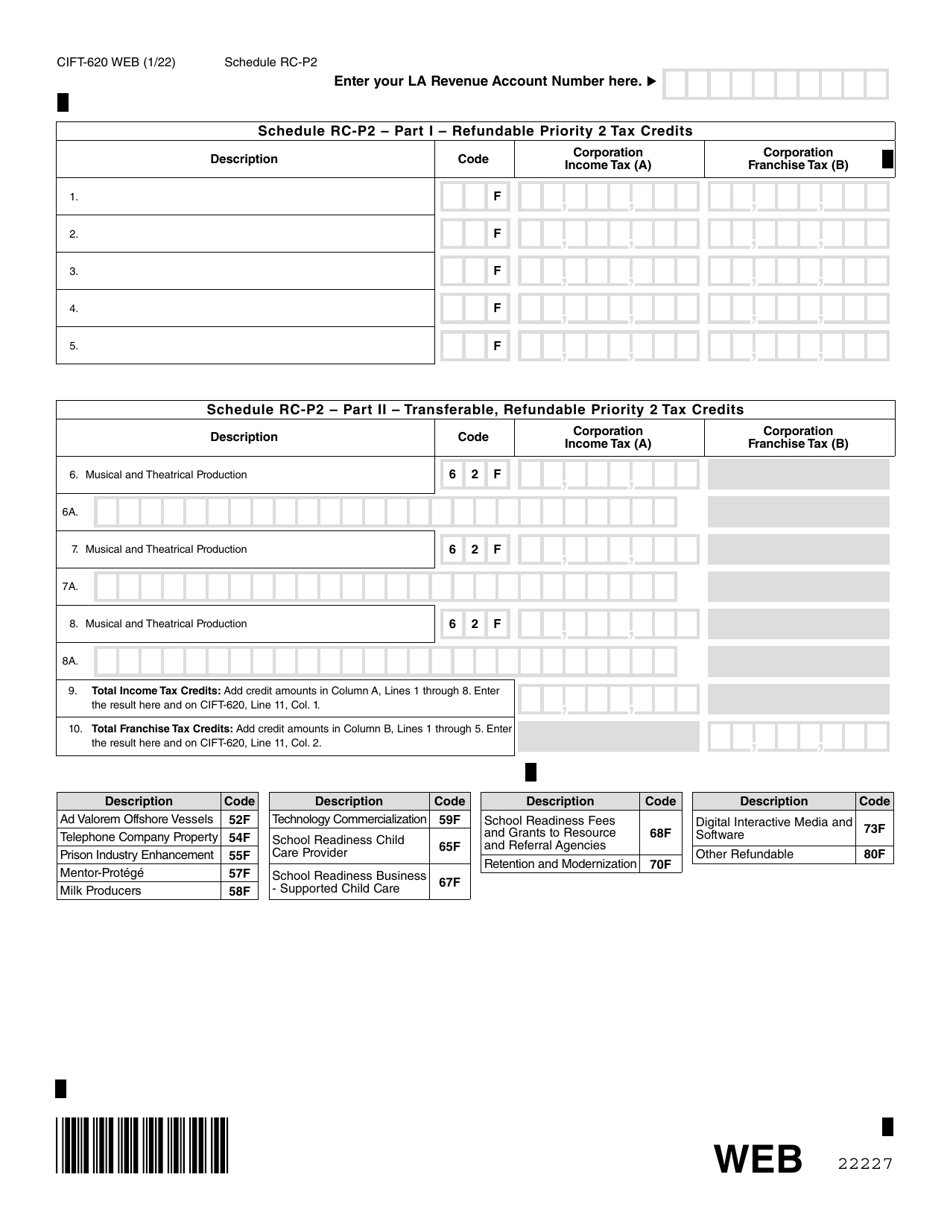

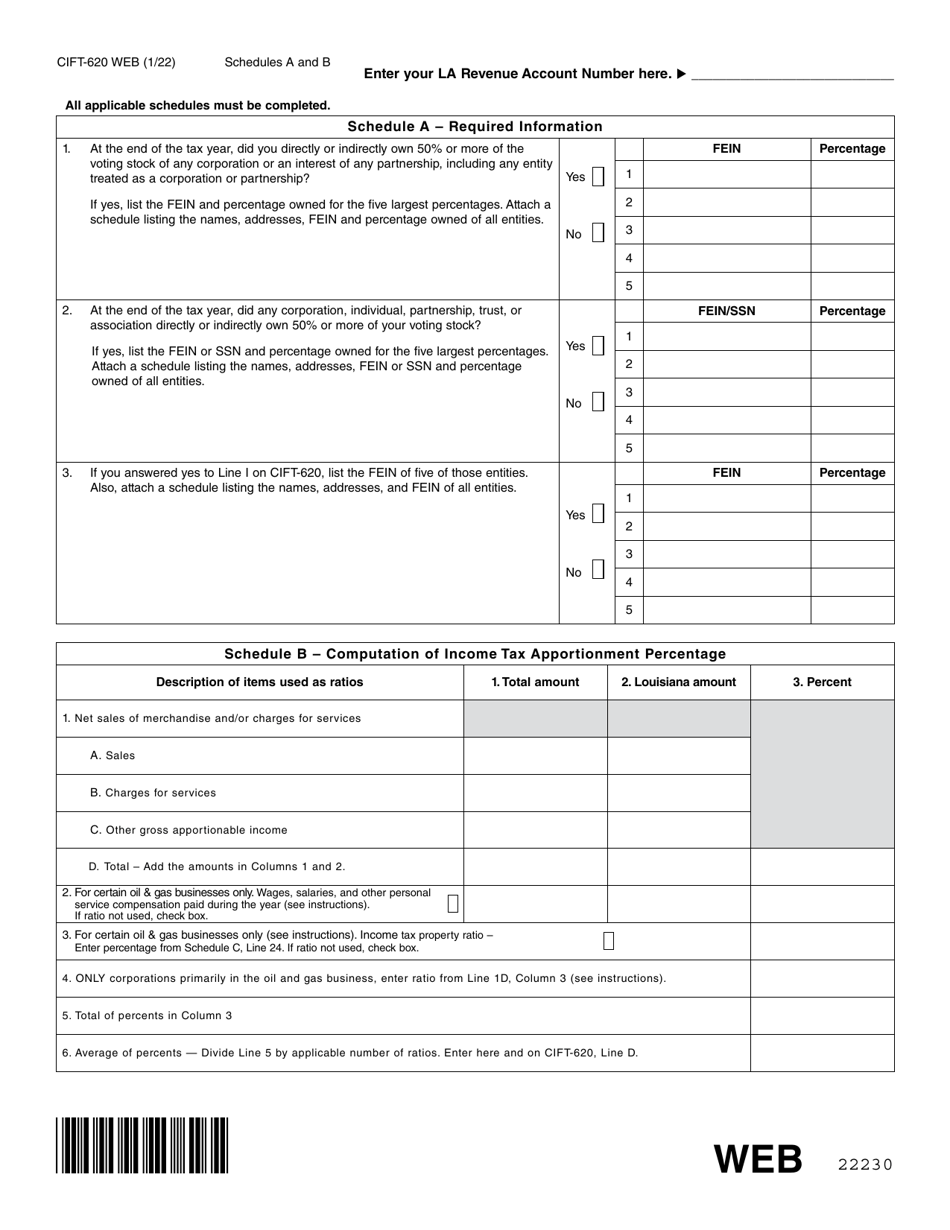

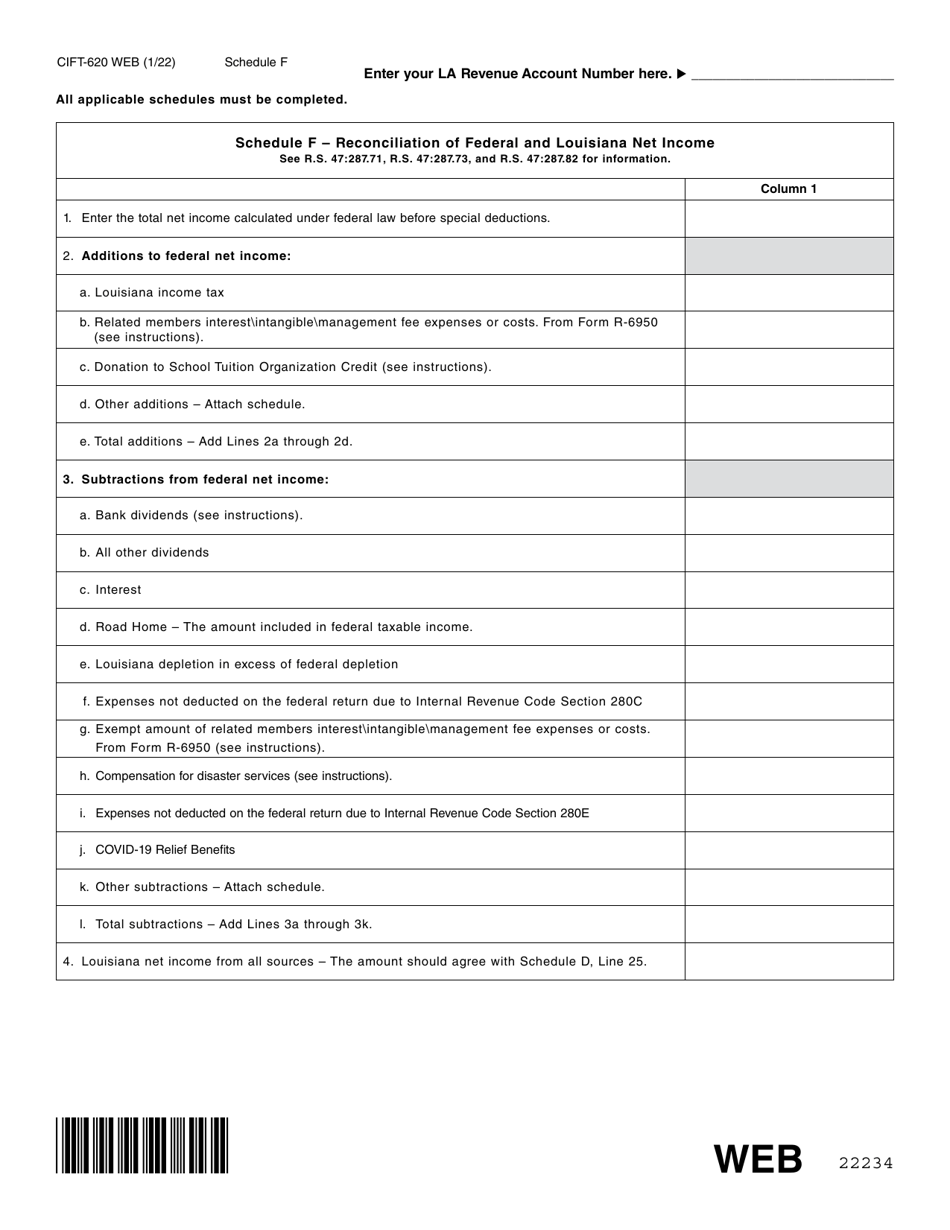

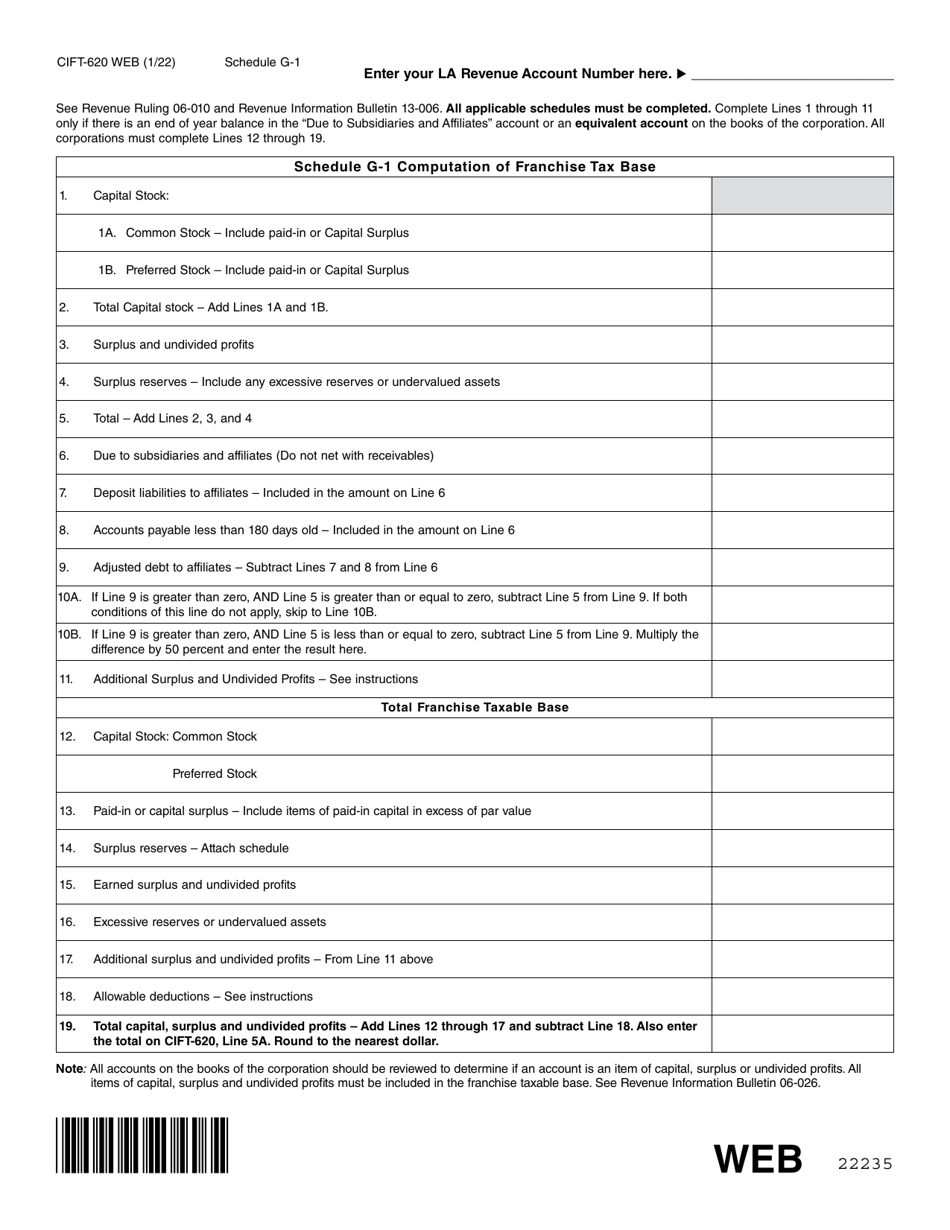

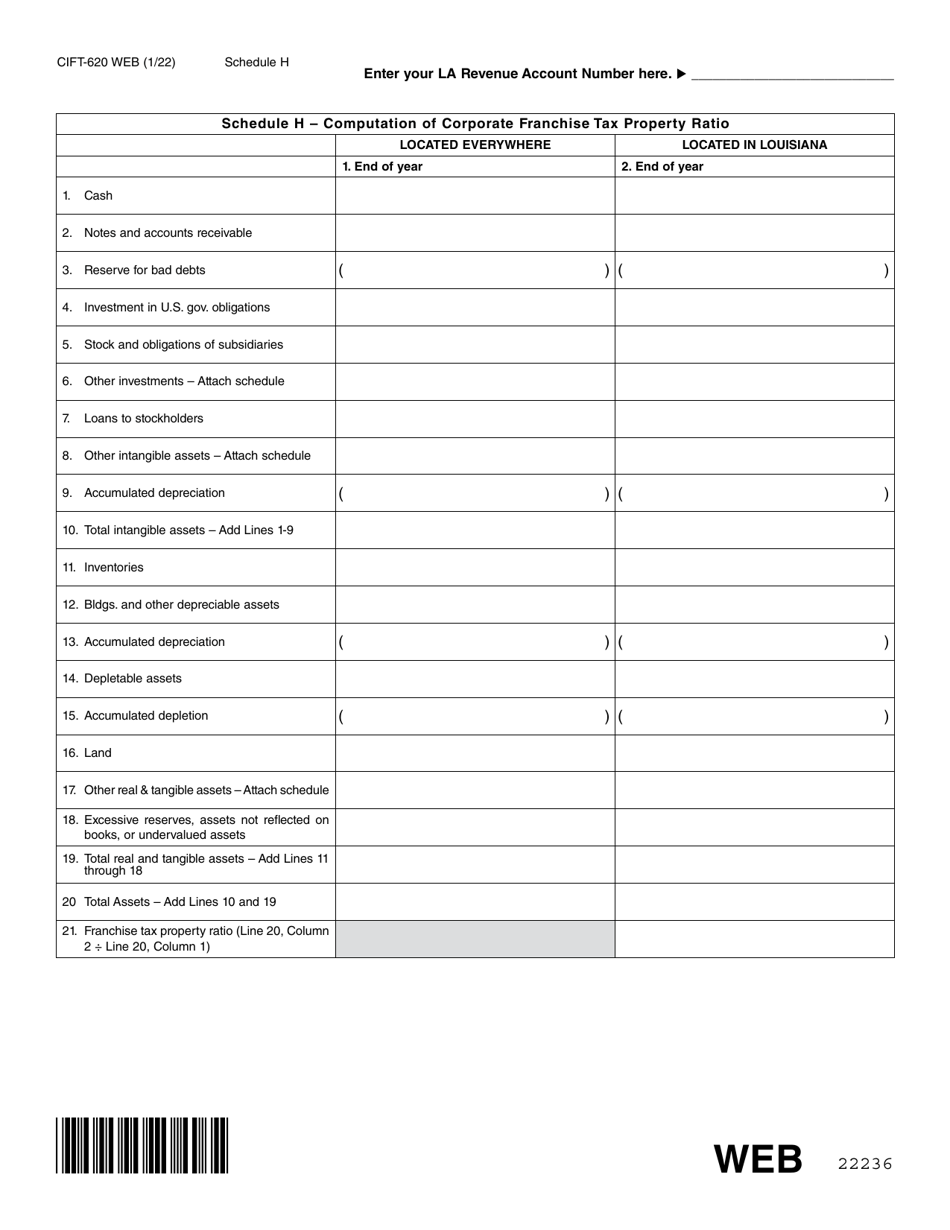

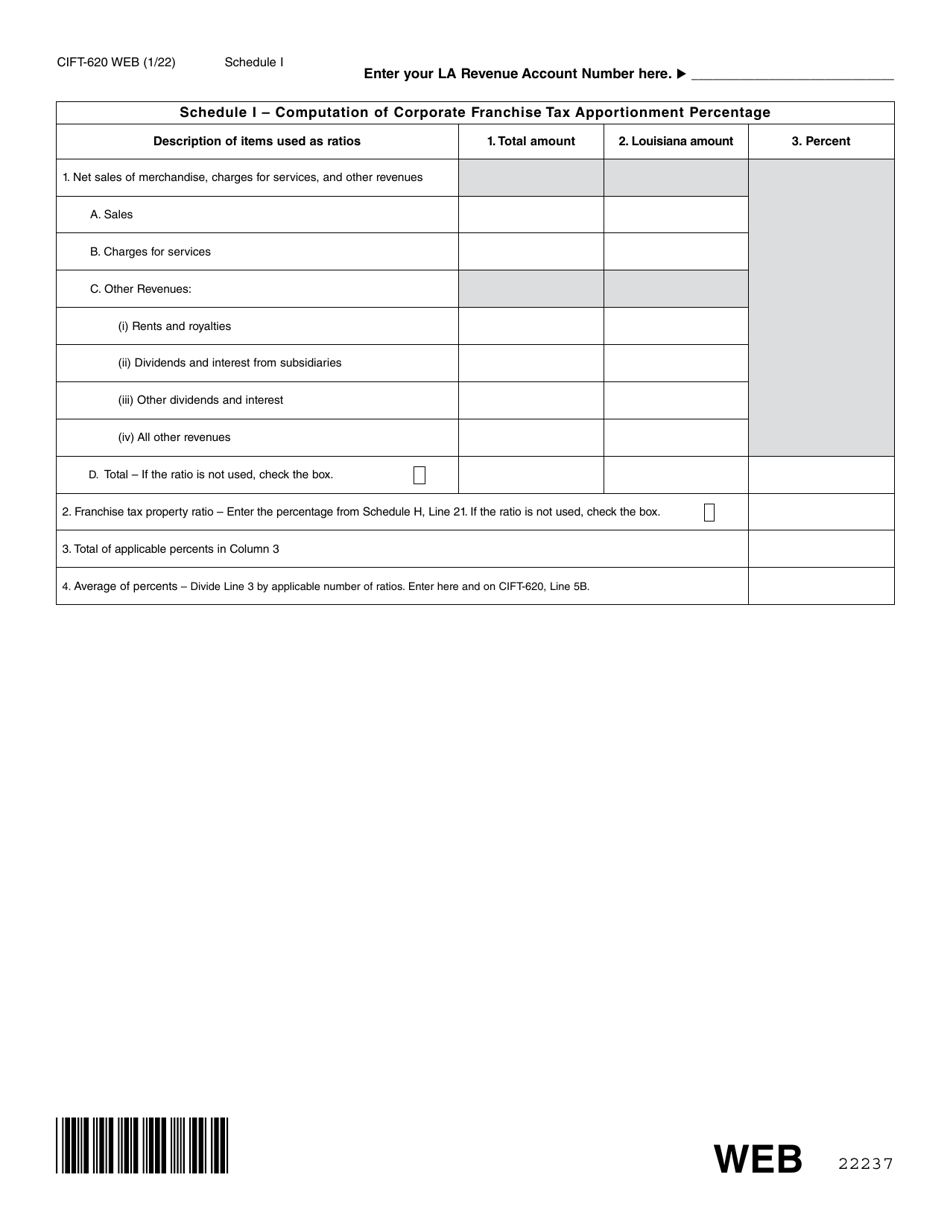

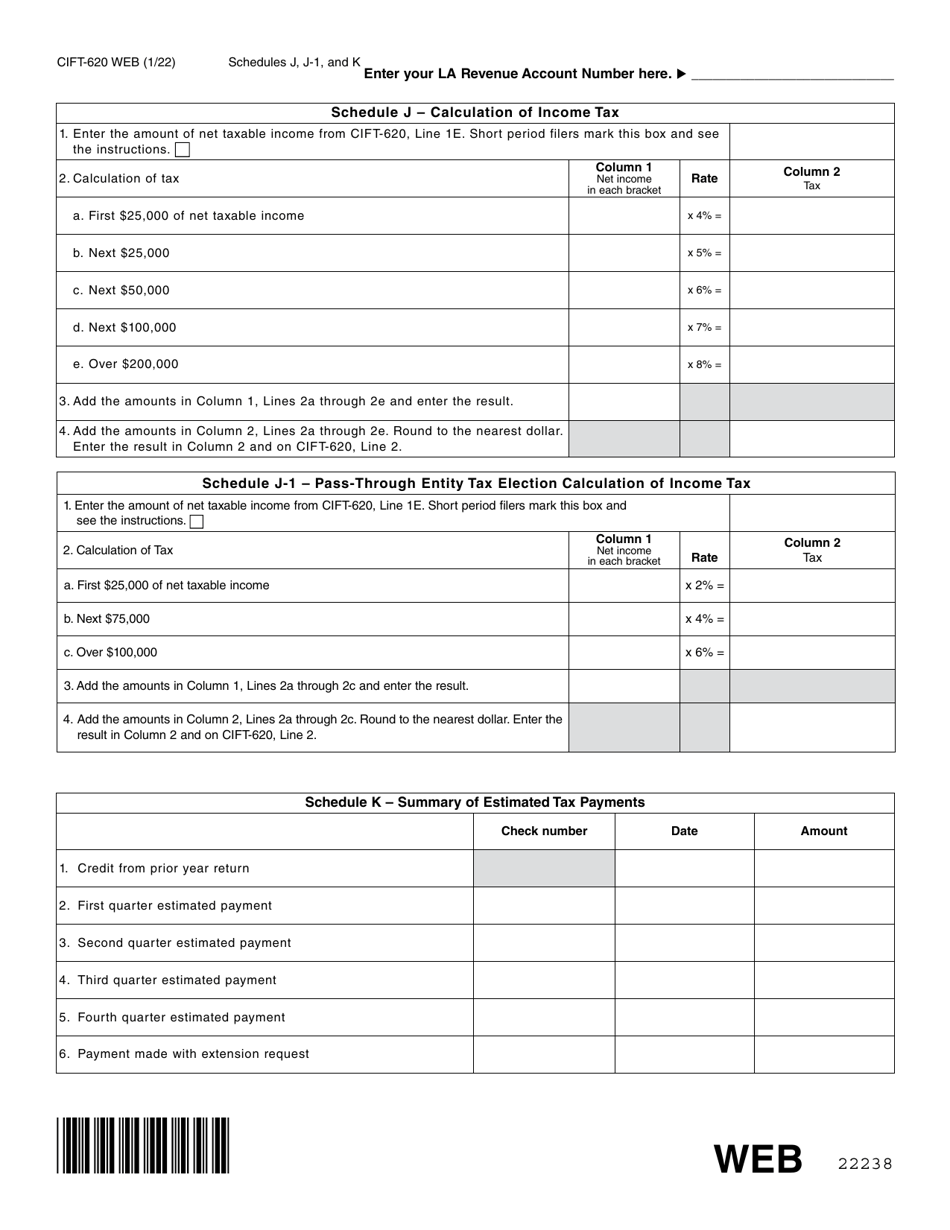

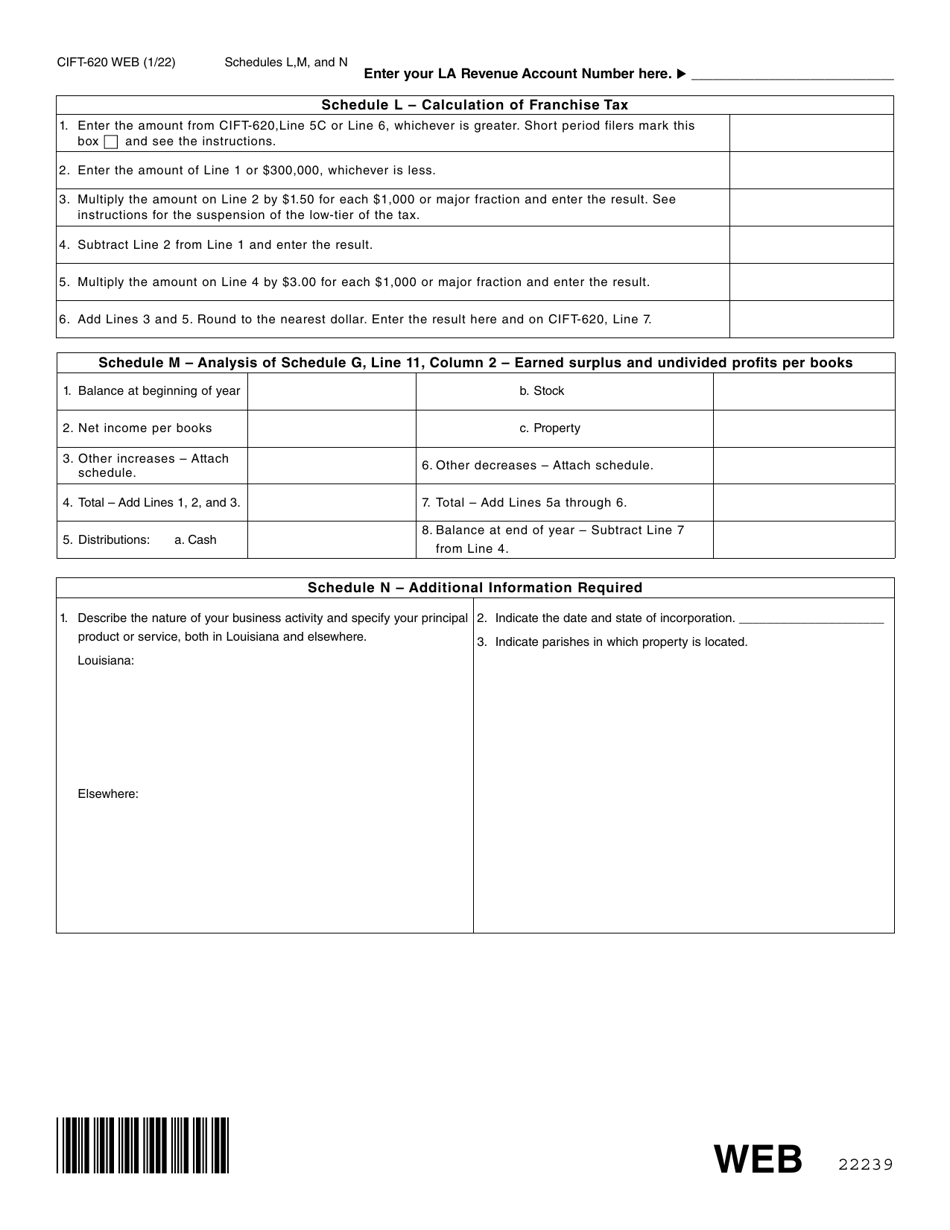

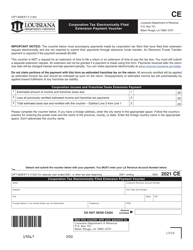

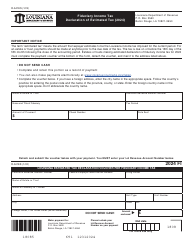

Form CIFT-620

for the current year.

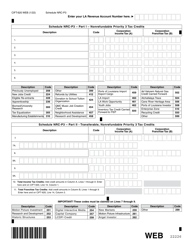

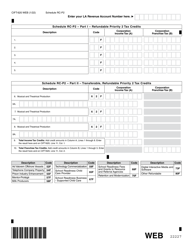

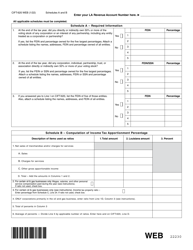

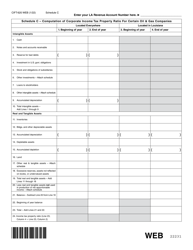

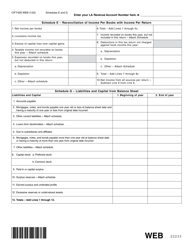

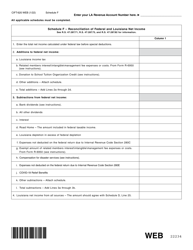

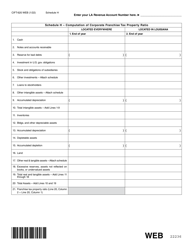

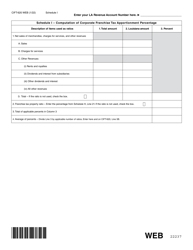

Form CIFT-620 Estimated Tax Voucher for Corporations - Louisiana

What Is Form CIFT-620?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CIFT-620?

A: Form CIFT-620 is the estimated tax voucher for corporations in Louisiana.

Q: Who should use Form CIFT-620?

A: Corporations in Louisiana should use Form CIFT-620 to make estimated tax payments.

Q: What is the purpose of Form CIFT-620?

A: The purpose of Form CIFT-620 is to submit estimated tax payments for corporations in Louisiana.

Q: When is Form CIFT-620 due?

A: Form CIFT-620 is due on the 15th day of the 4th, 6th, 9th, and 12th month of the corporation's tax year.

Q: Is Form CIFT-620 mandatory?

A: Yes, corporations in Louisiana are required to submit estimated tax payments using Form CIFT-620.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CIFT-620 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.