This version of the form is not currently in use and is provided for reference only. Download this version of

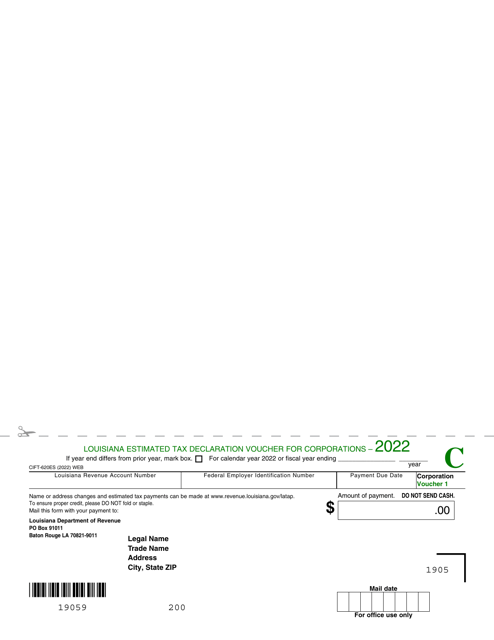

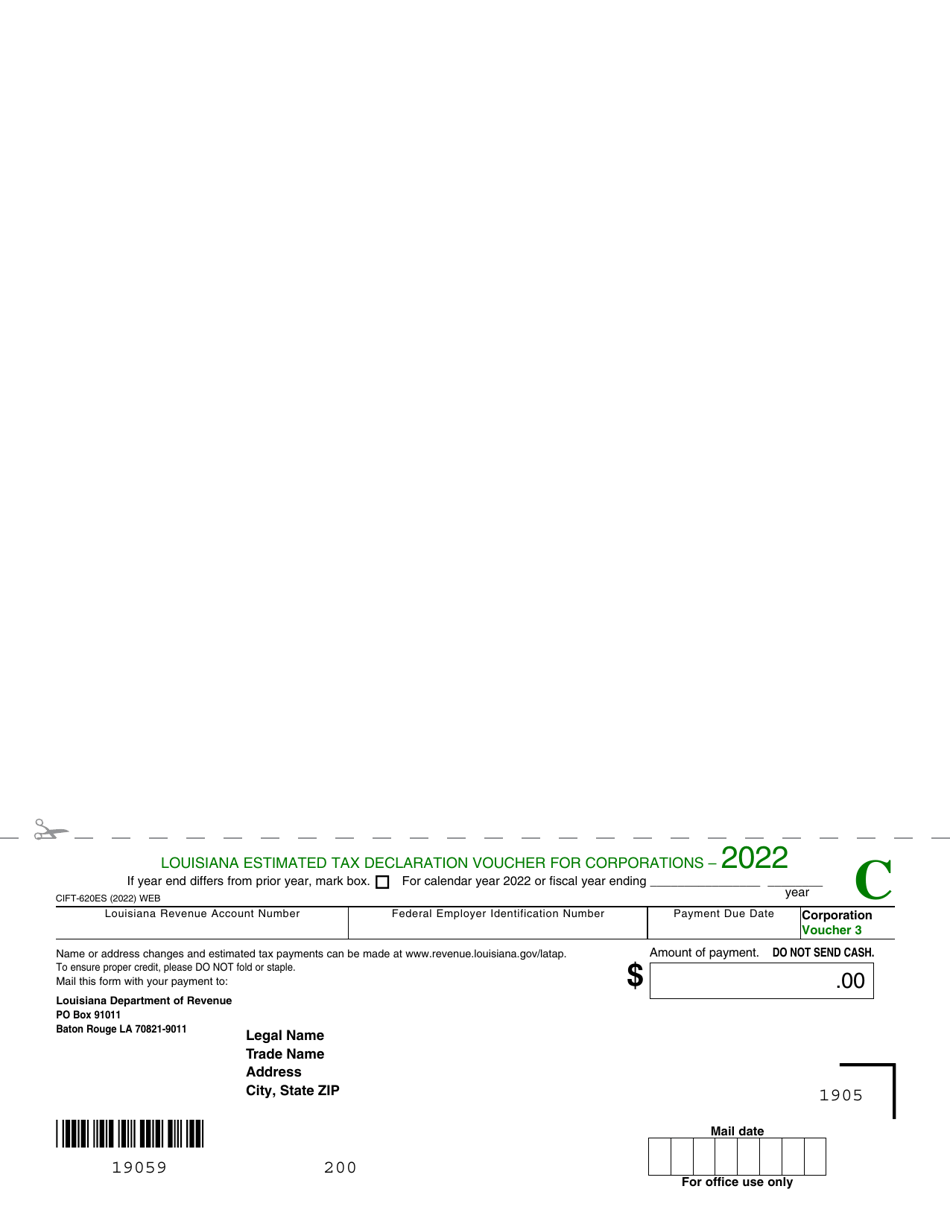

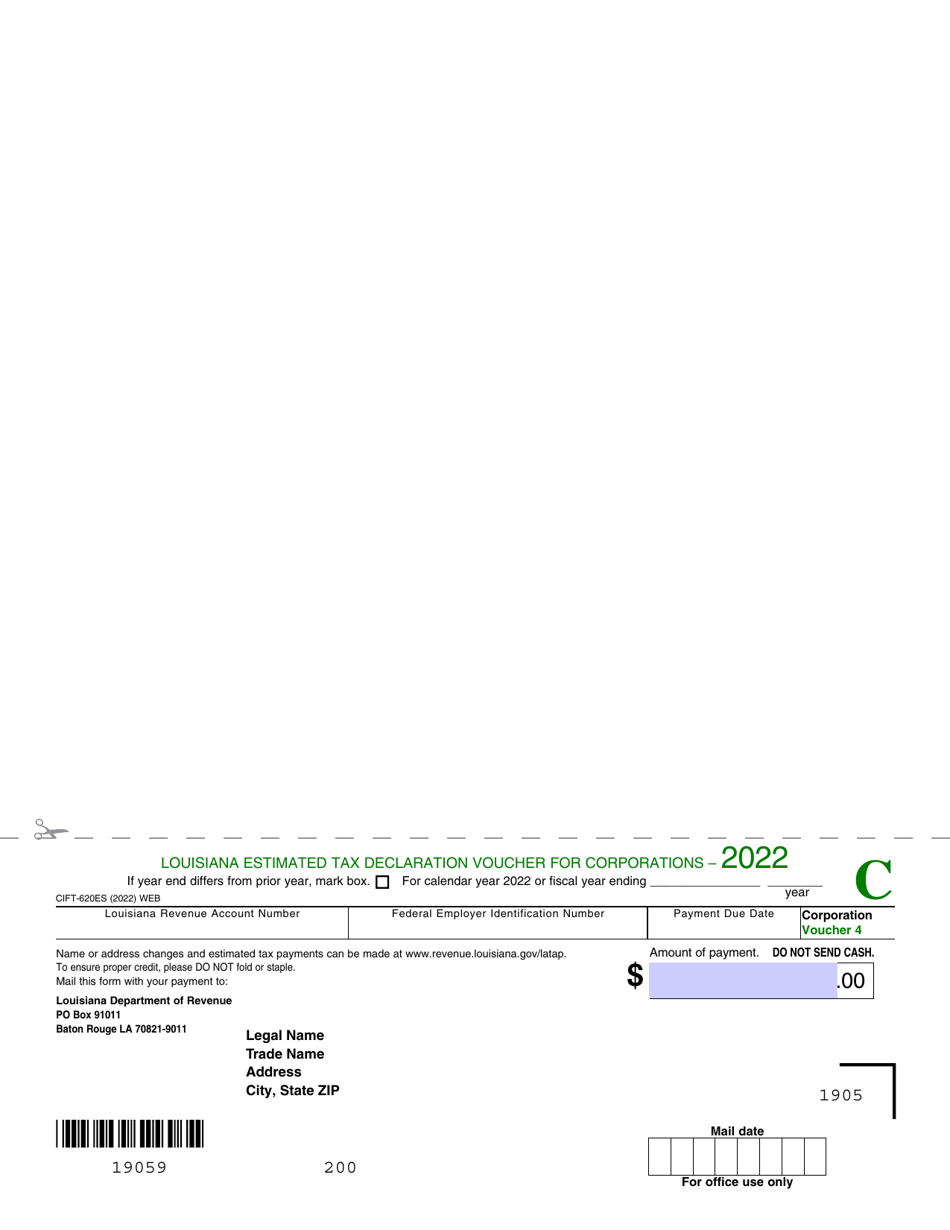

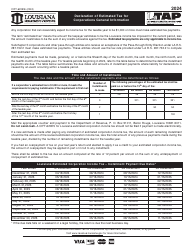

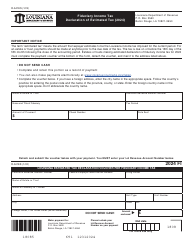

Form CIFT-620ES

for the current year.

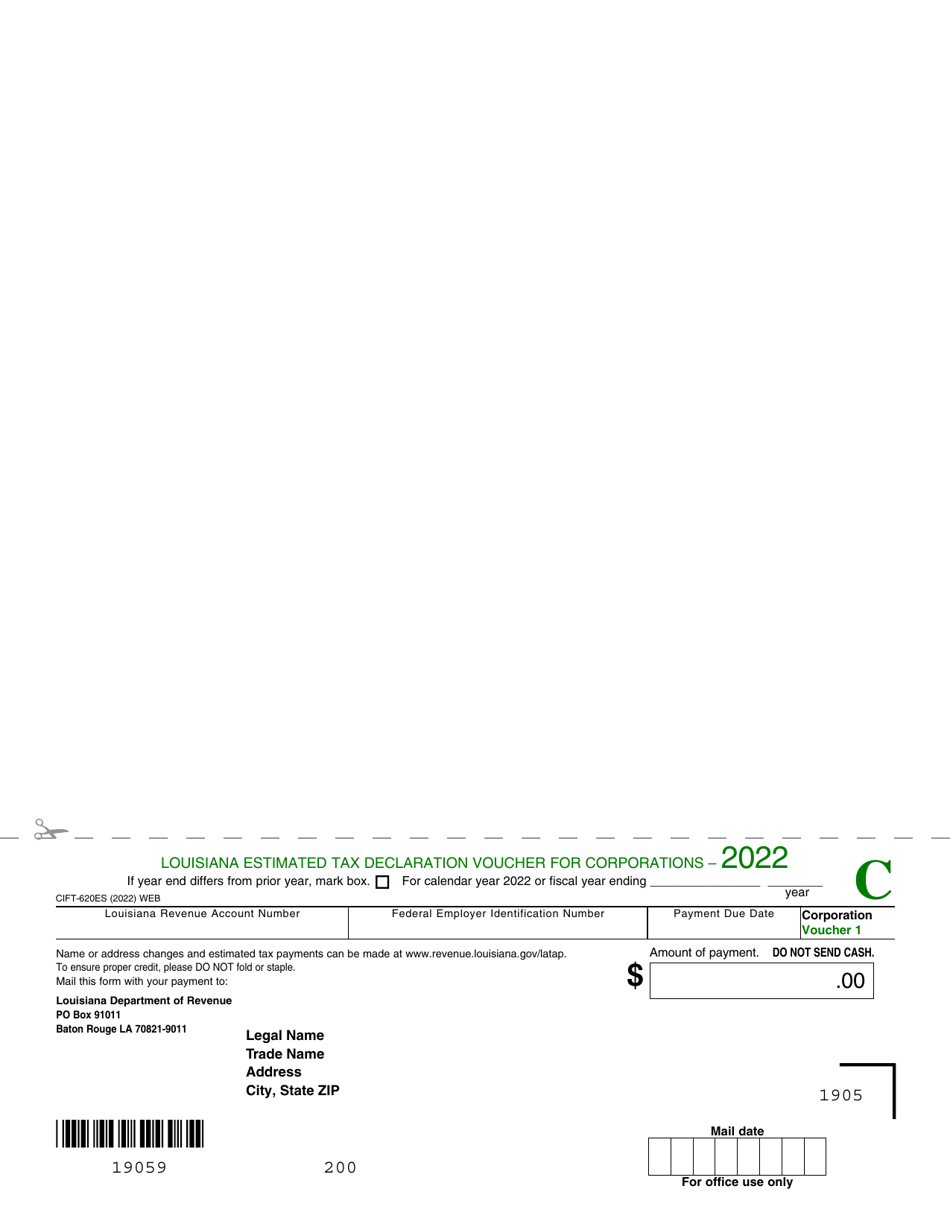

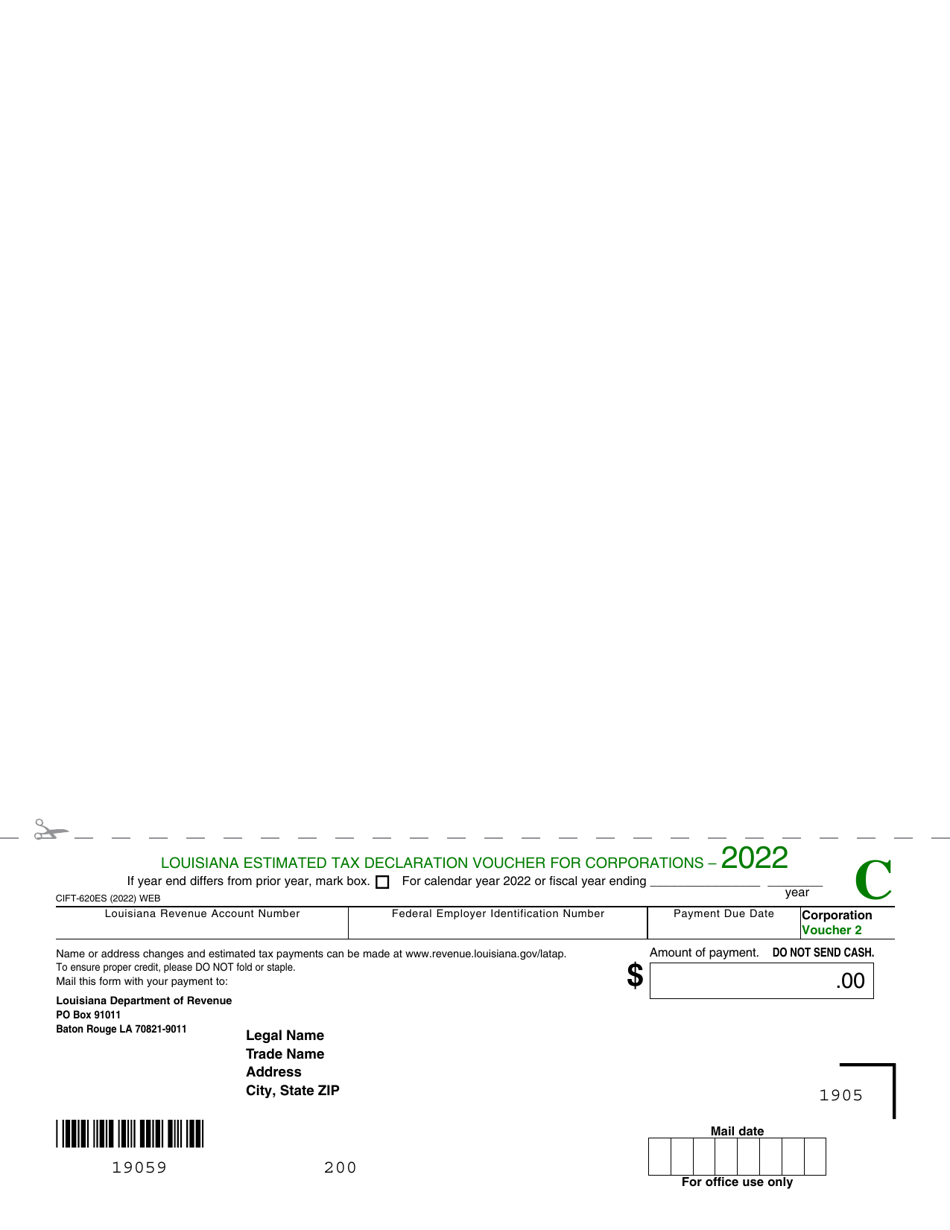

Form CIFT-620ES Louisiana Estimated Tax Declaration Voucher for Corporations - Louisiana

What Is Form CIFT-620ES?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the CIFT-620ES form?

A: The CIFT-620ES form is the Louisiana Estimated Tax Declaration Voucher for Corporations.

Q: Who needs to file the CIFT-620ES form?

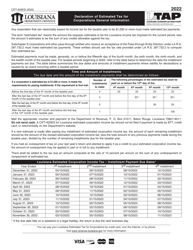

A: Corporations in Louisiana who need to make estimated tax payments must file the CIFT-620ES form.

Q: What is the purpose of the CIFT-620ES form?

A: The CIFT-620ES form is used to report and remit estimated tax payments for corporations in Louisiana.

Form Details:

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CIFT-620ES by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.