This version of the form is not currently in use and is provided for reference only. Download this version of

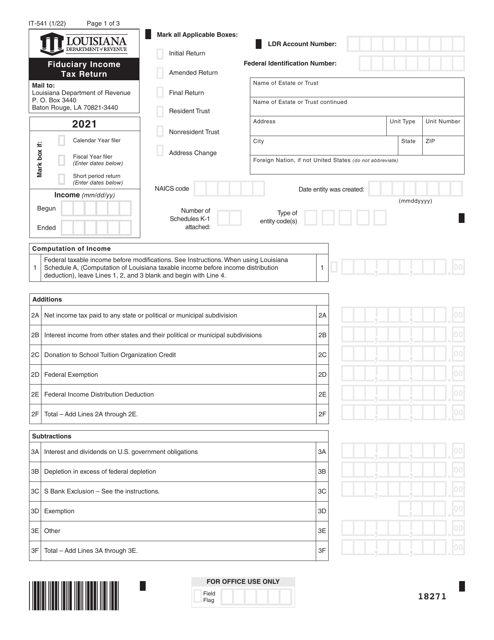

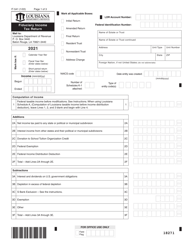

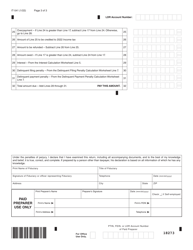

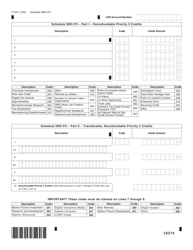

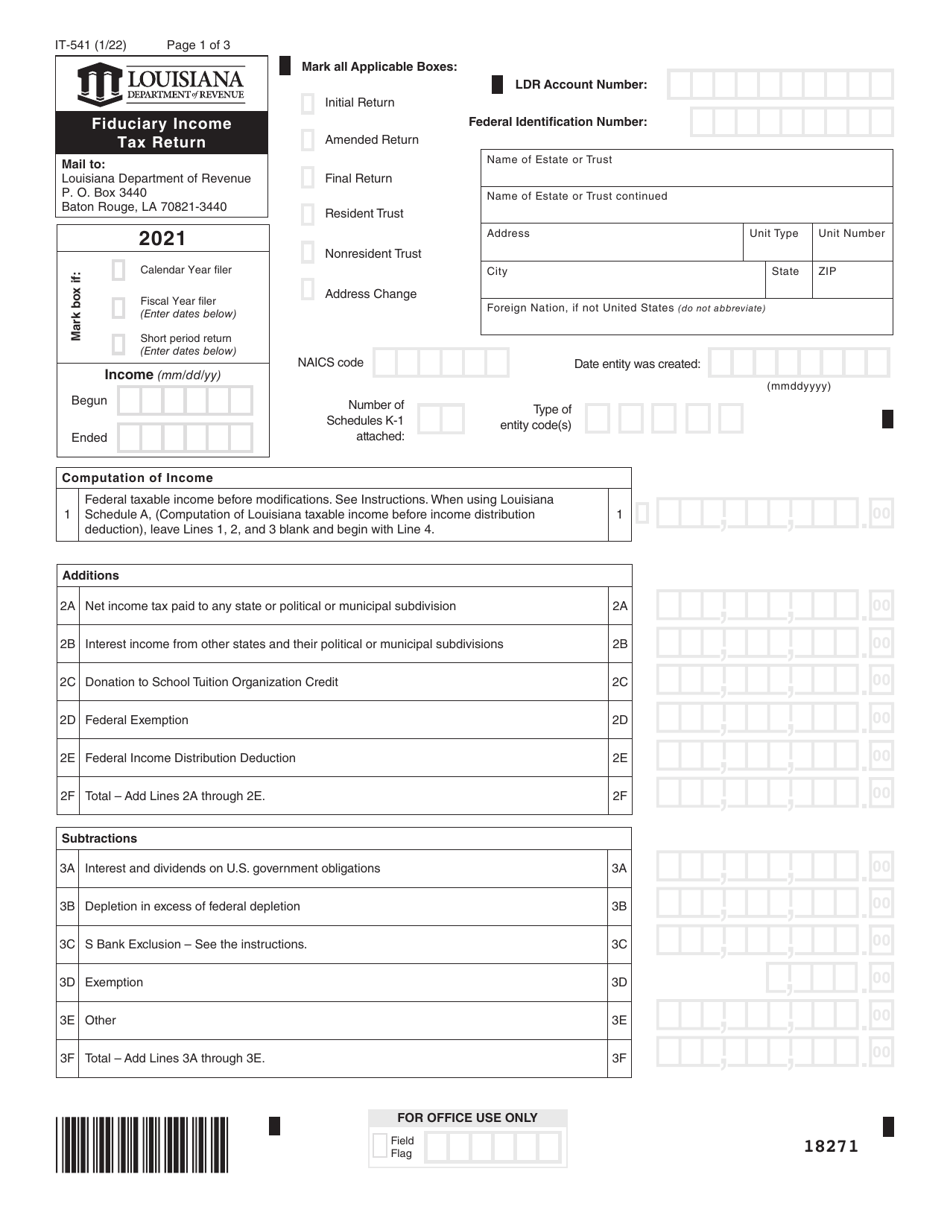

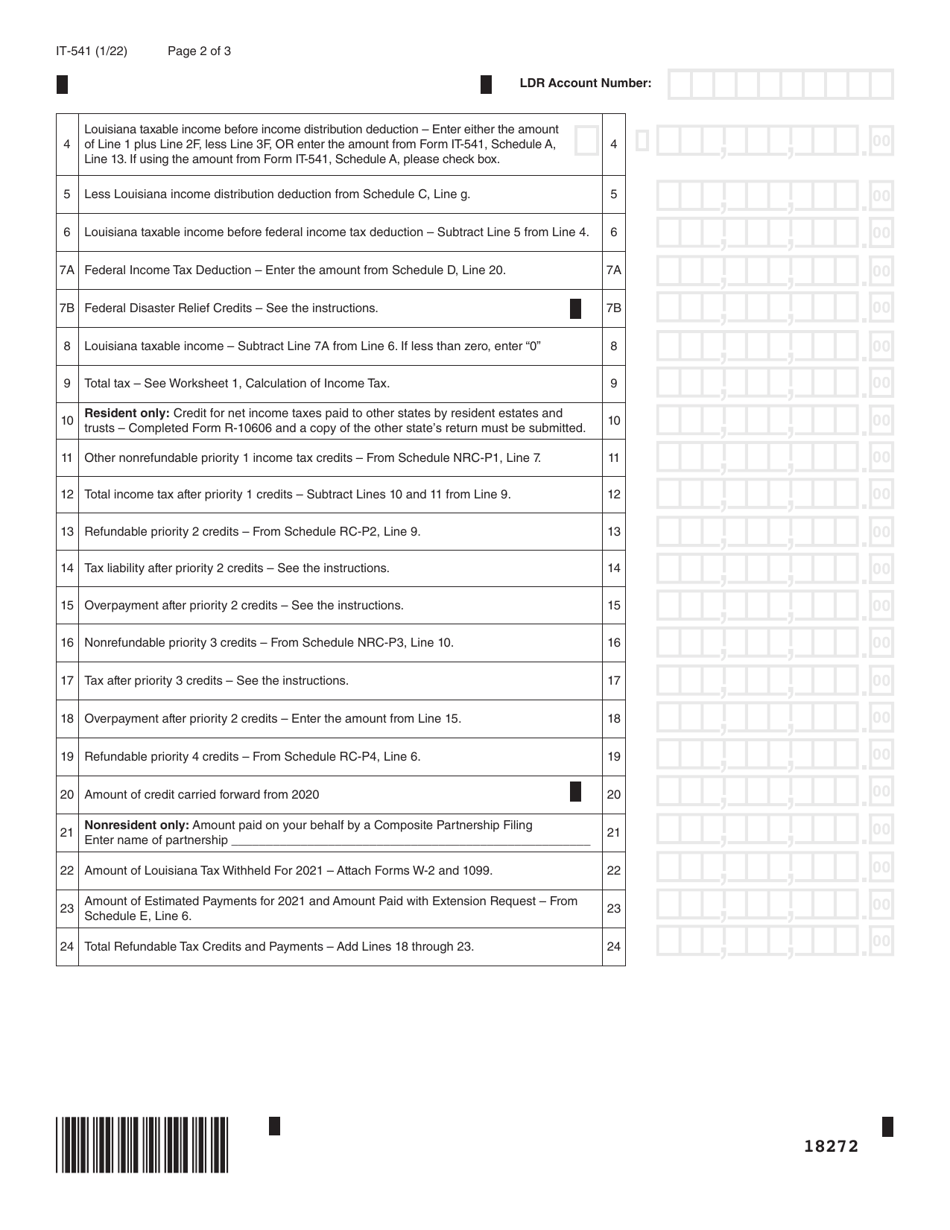

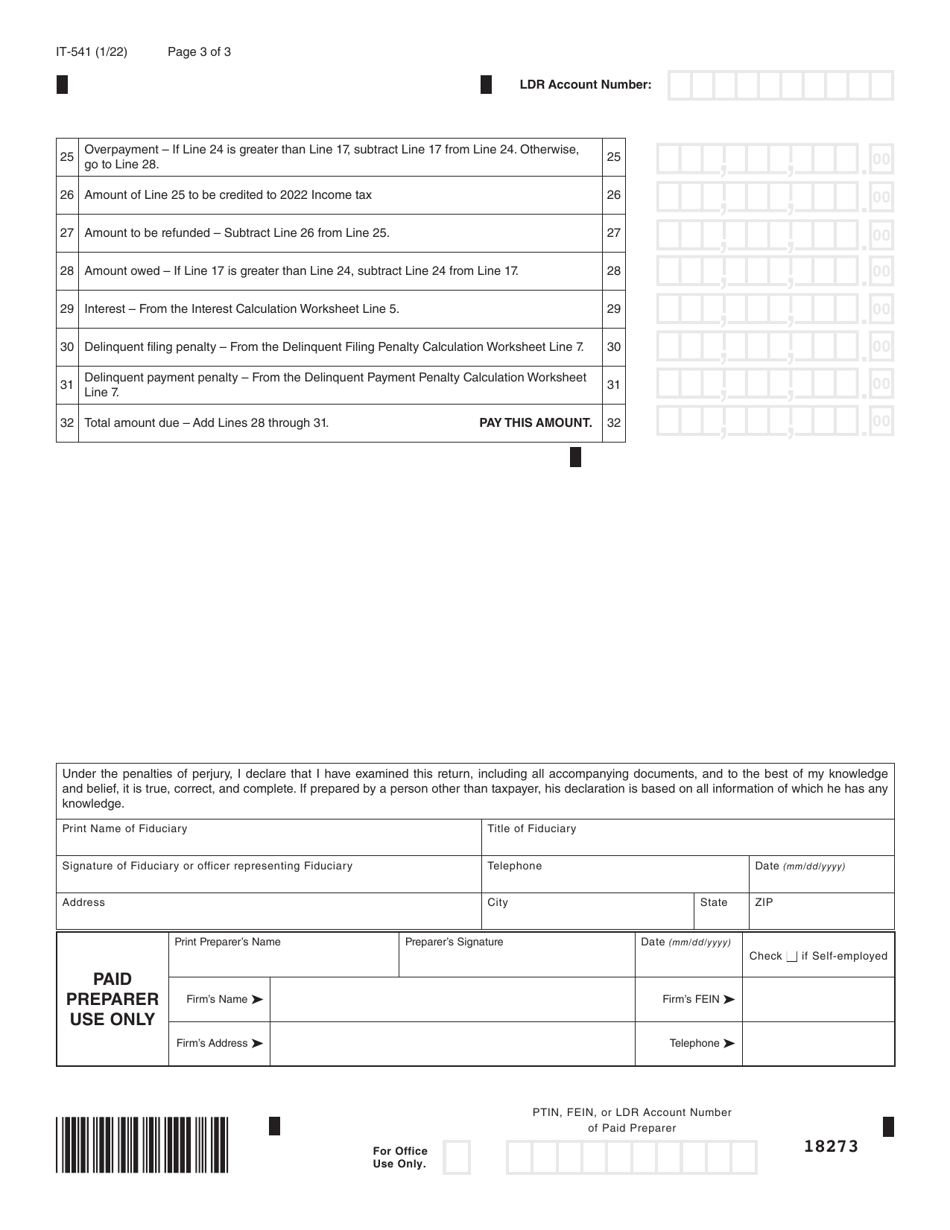

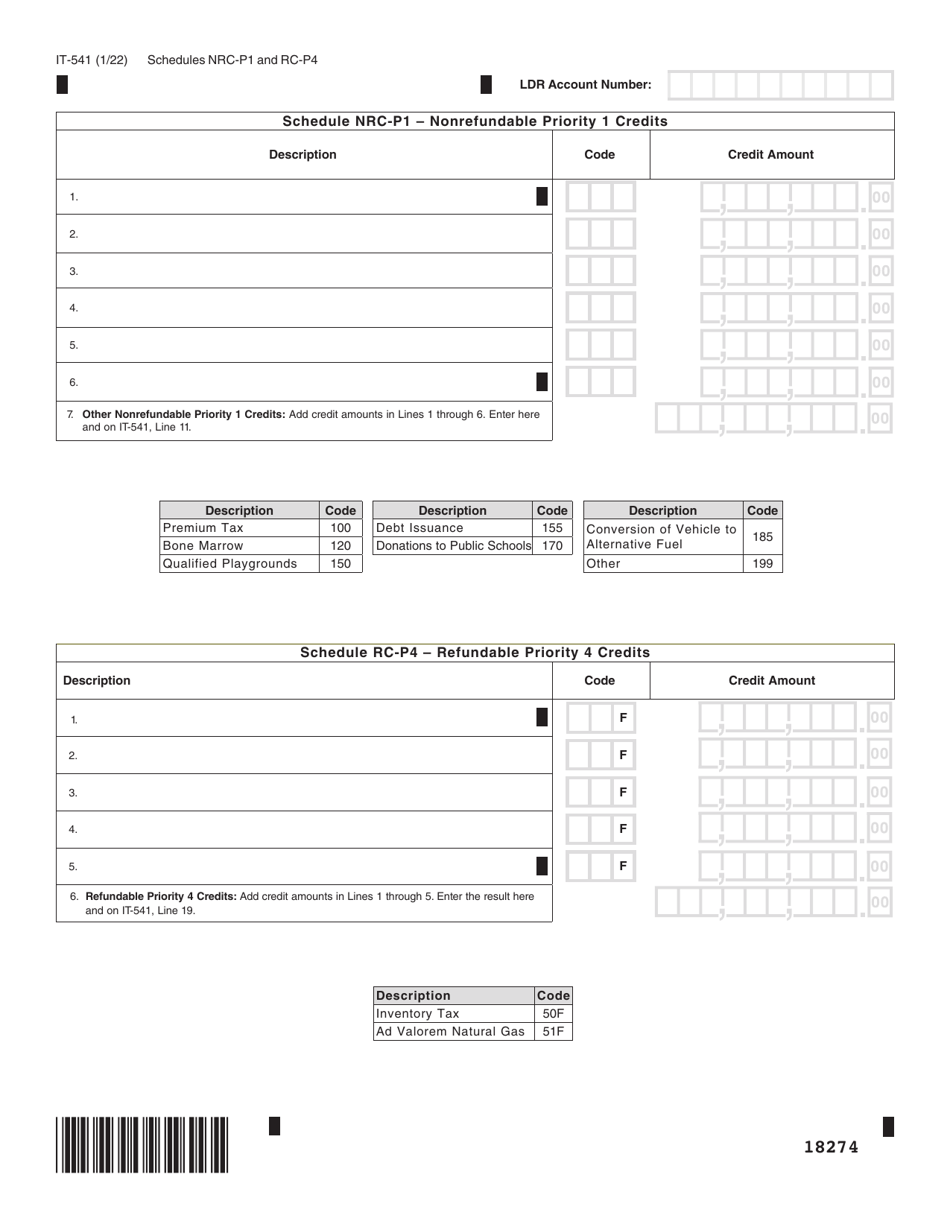

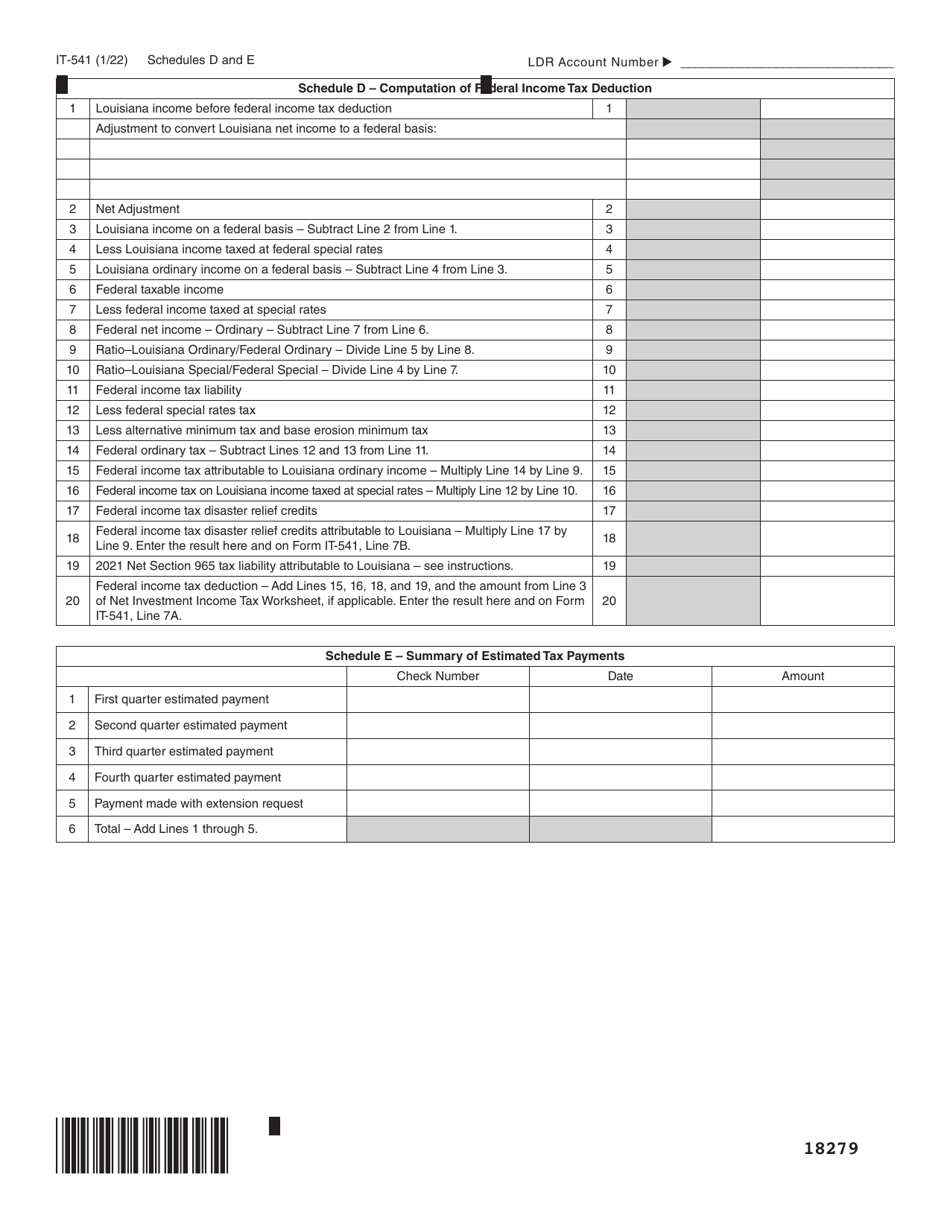

Form IT-541

for the current year.

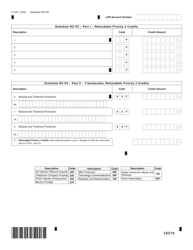

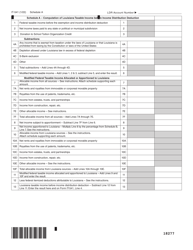

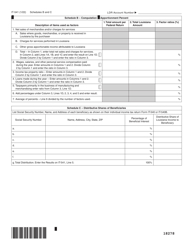

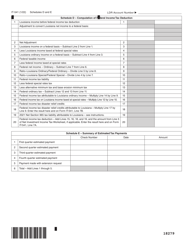

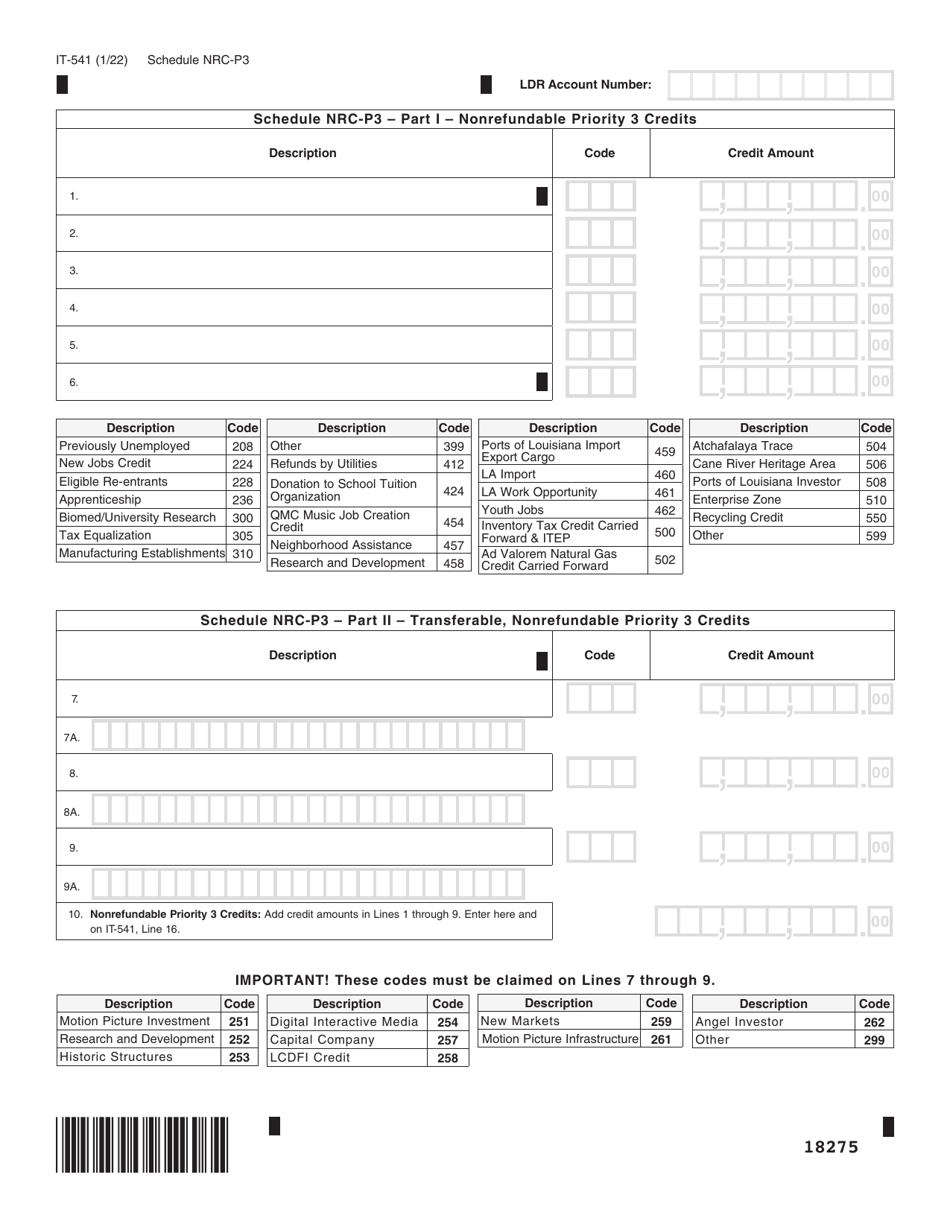

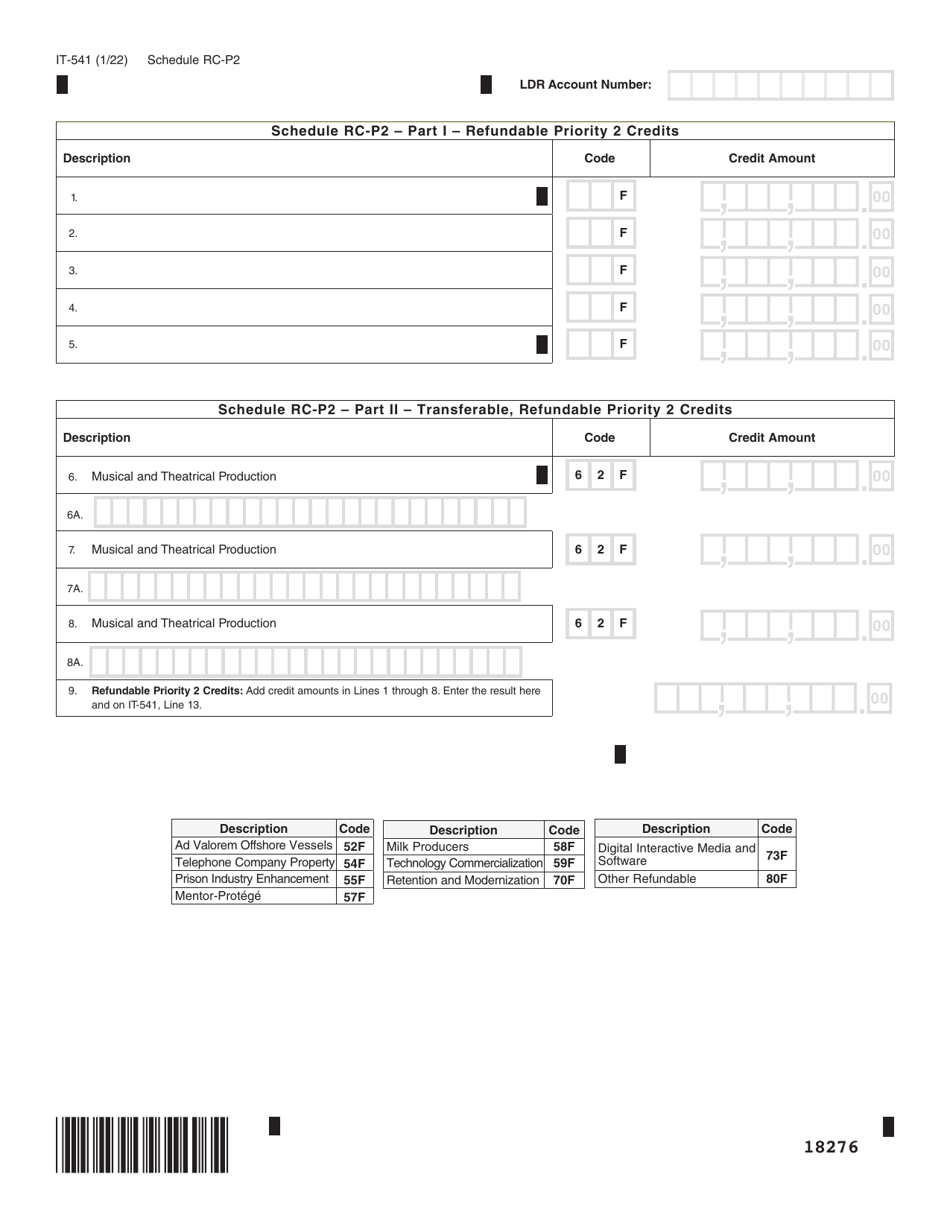

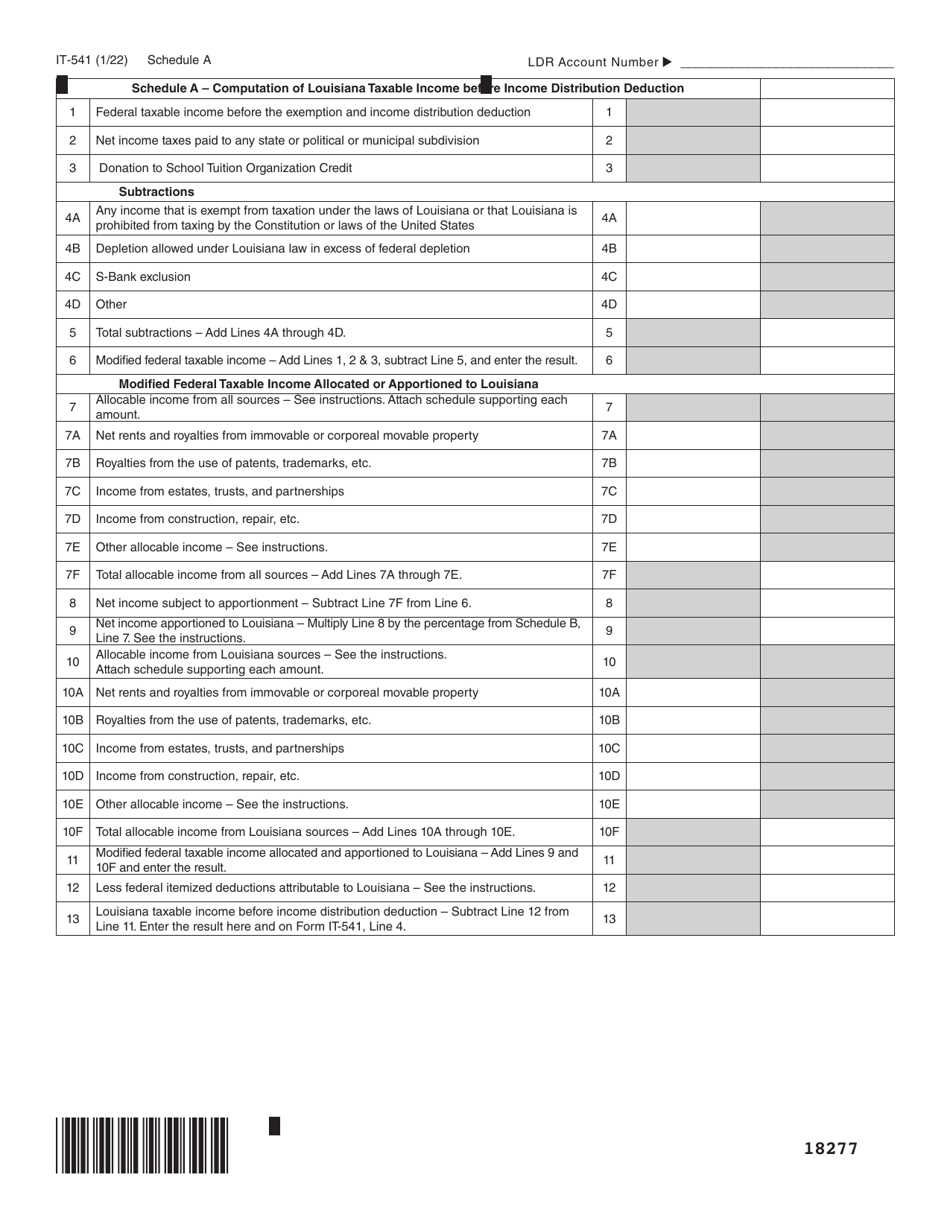

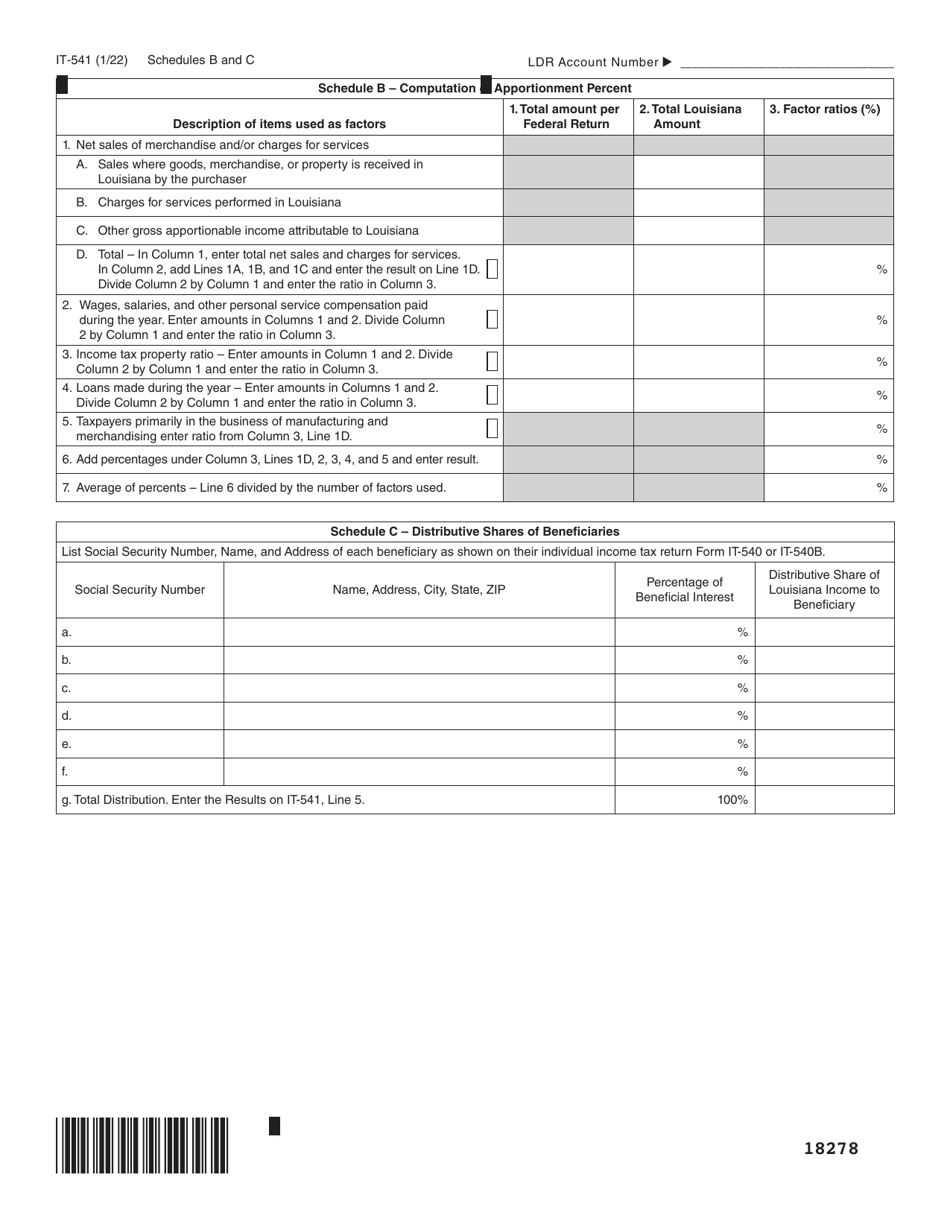

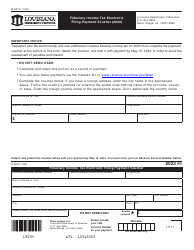

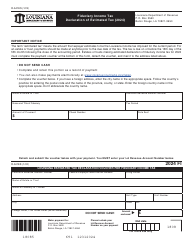

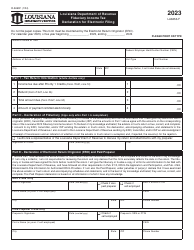

Form IT-541 Fiduciary Income Tax Return - Louisiana

What Is Form IT-541?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-541?

A: Form IT-541 is the Fiduciary Income Tax Return for residents of Louisiana.

Q: Who needs to file Form IT-541?

A: Form IT-541 is filed by fiduciaries, such as trustees or executors, who are responsible for filing income tax returns for estates or trusts in Louisiana.

Q: What is the purpose of Form IT-541?

A: Form IT-541 is used to report the income, deductions, and credits of an estate or trust in Louisiana.

Q: When is Form IT-541 due?

A: Form IT-541 is due on the 15th day of the fourth month following the close of the taxable year.

Q: Are there any filing requirements for Form IT-541?

A: Yes, if the estate or trust has gross income over a certain threshold or if there is a nonresident beneficiary, Form IT-541 must be filed.

Q: Can Form IT-541 be e-filed?

A: Yes, Form IT-541 can be e-filed using approved software or through a tax professional who participates in Louisiana's e-file program.

Q: What supporting documents do I need to include with Form IT-541?

A: You may need to include copies of federal income tax returns, Schedule K-1s, and other relevant forms and documents.

Q: Is there a penalty for late filing of Form IT-541?

A: Yes, if Form IT-541 is not filed by the due date, a penalty may be imposed.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-541 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.