This version of the form is not currently in use and is provided for reference only. Download this version of

Form R-10605

for the current year.

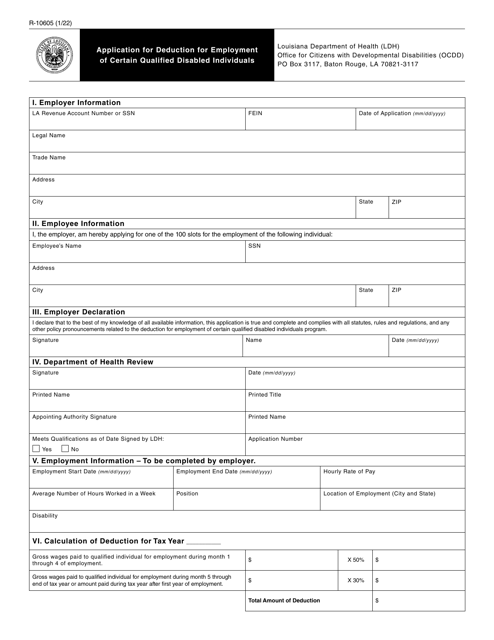

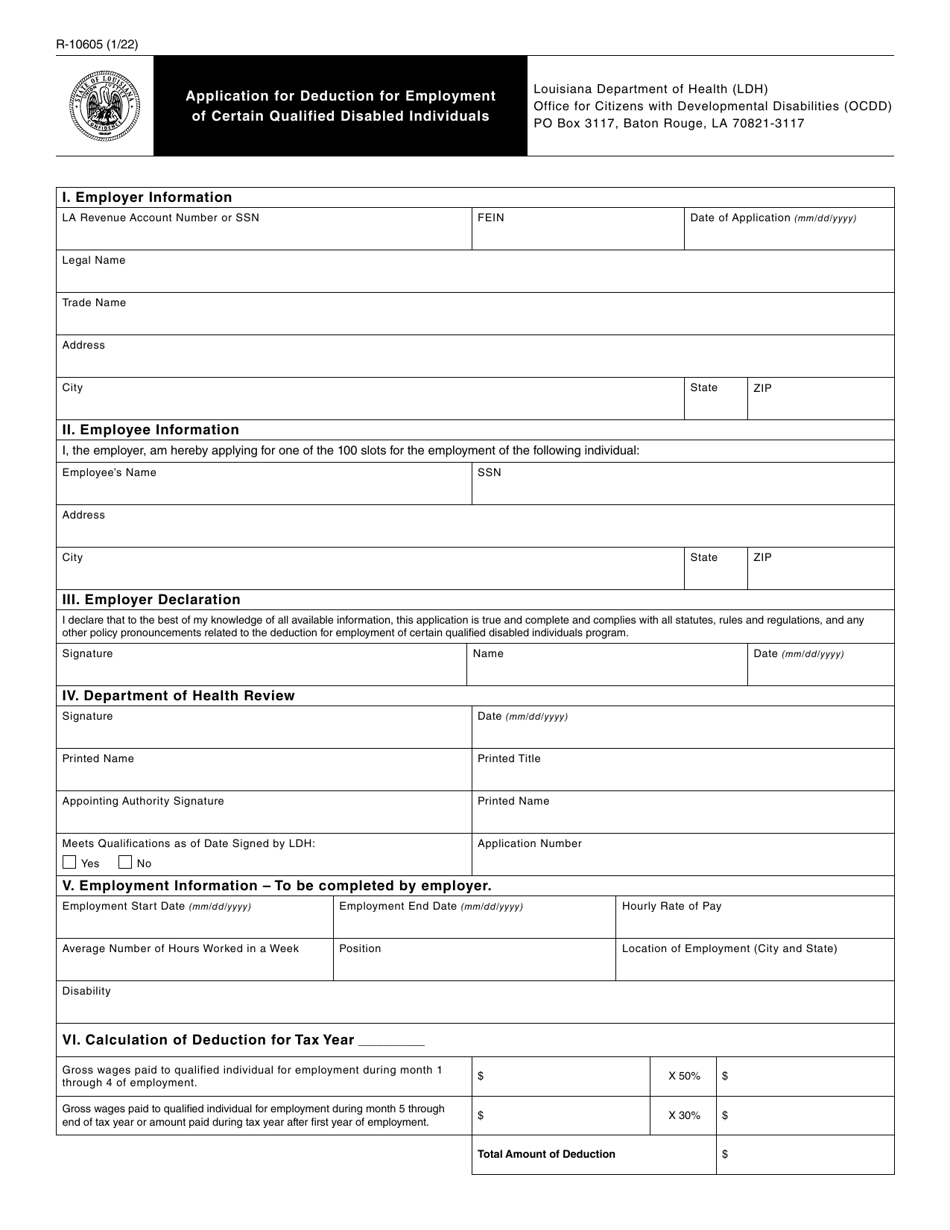

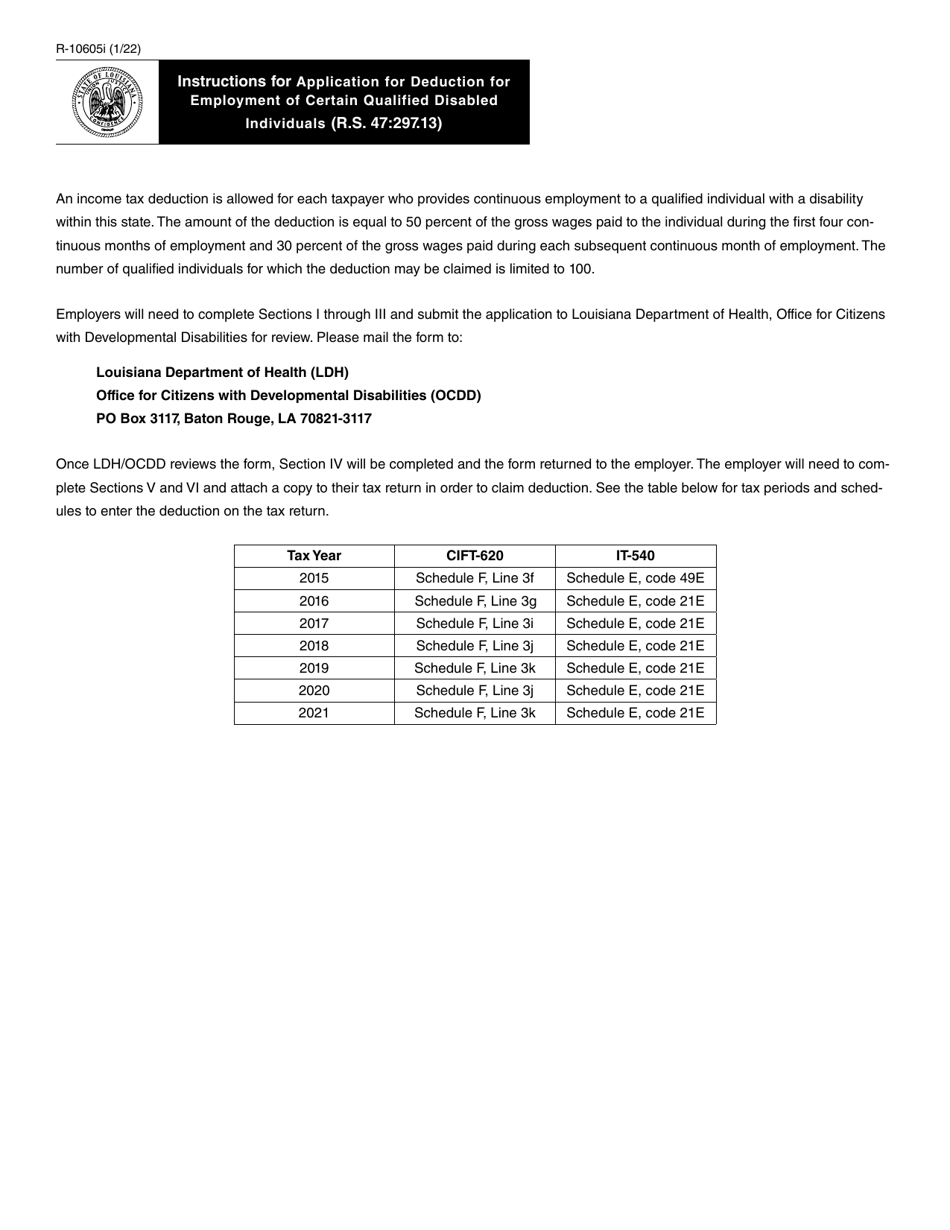

Form R-10605 Application for Deduction for Employment of Certain Qualified Disabled Individuals - Louisiana

What Is Form R-10605?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-10605?

A: Form R-10605 is an application for deduction for the employment of certain qualified disabled individuals in Louisiana.

Q: Who can use Form R-10605?

A: Employers in Louisiana who have employed qualified disabled individuals can use Form R-10605.

Q: What is the purpose of Form R-10605?

A: The purpose of Form R-10605 is to claim a deduction for the employment of qualified disabled individuals in Louisiana.

Q: What information is required on Form R-10605?

A: Form R-10605 requires information about the employer, the qualified disabled employee, and the wages paid to the employee.

Q: Is there a deadline for filing Form R-10605?

A: Yes, Form R-10605 must be filed by the deadline specified by the Louisiana Department of Revenue.

Q: Are there any restrictions or eligibility criteria for claiming the deduction?

A: Yes, there are specific eligibility criteria and restrictions for claiming the deduction. Please refer to the instructions of Form R-10605 or consult the Louisiana Department of Revenue for more information.

Q: What should I do if I have more questions about Form R-10605?

A: If you have more questions about Form R-10605, you should contact the Louisiana Department of Revenue for assistance.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-10605 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.