This version of the form is not currently in use and is provided for reference only. Download this version of

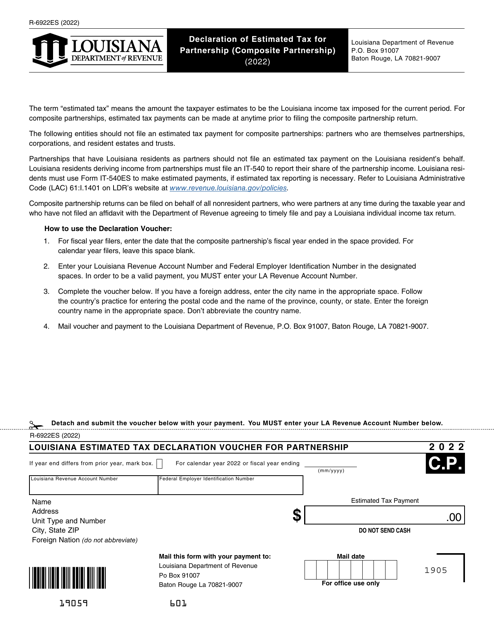

Form R-6922ES

for the current year.

Form R-6922ES Declaration of Estimated Tax for Partnership (Composite Partnership) - Louisiana

What Is Form R-6922ES?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6922ES?

A: Form R-6922ES is a declaration of estimated tax form for partnership (composite partnership) in Louisiana.

Q: Who should file Form R-6922ES?

A: Partnerships or composite partnerships in Louisiana should file Form R-6922ES.

Q: What is the purpose of Form R-6922ES?

A: Form R-6922ES is used to report and pay estimated income tax for partnerships in Louisiana.

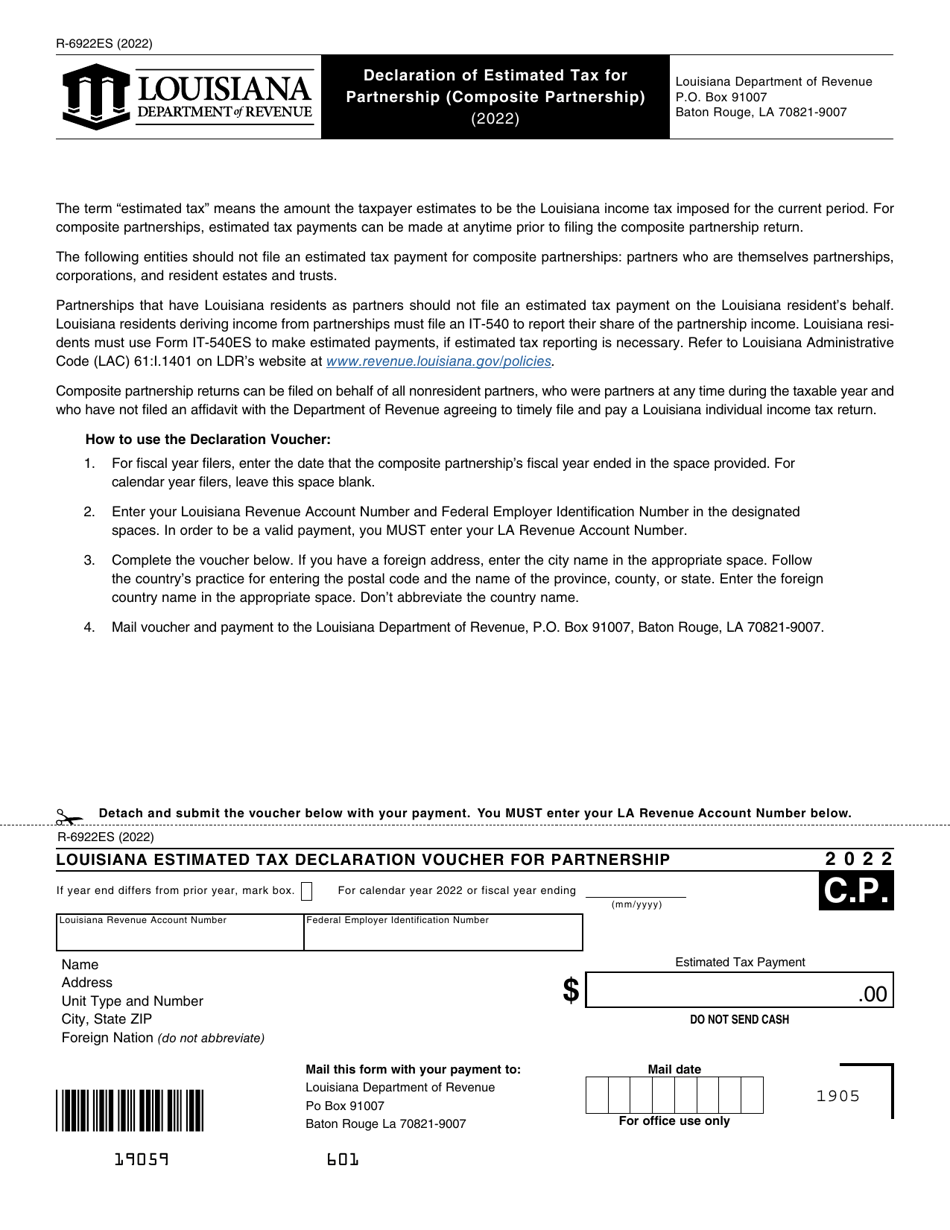

Q: When should Form R-6922ES be filed?

A: Form R-6922ES should be filed on a quarterly basis, with payments due by the 15th day of the 4th, 6th, 9th, and 12th months of the partnership's taxable year.

Q: Are there any penalties for late filing or payment of Form R-6922ES?

A: Yes, penalties may apply for late filing or payment of Form R-6922ES. It is important to file and pay on time to avoid penalties and interest.

Q: Can I make payments for Form R-6922ES electronically?

A: Yes, the Louisiana Department of Revenue offers electronic payment options for Form R-6922ES.

Q: Do I need to attach any additional documents with Form R-6922ES?

A: No, there are no additional documents required to be attached with Form R-6922ES.

Q: Is Form R-6922ES used for individual taxpayers?

A: No, Form R-6922ES is specifically for partnerships and composite partnerships, not for individual taxpayers.

Form Details:

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6922ES by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.