This version of the form is not currently in use and is provided for reference only. Download this version of

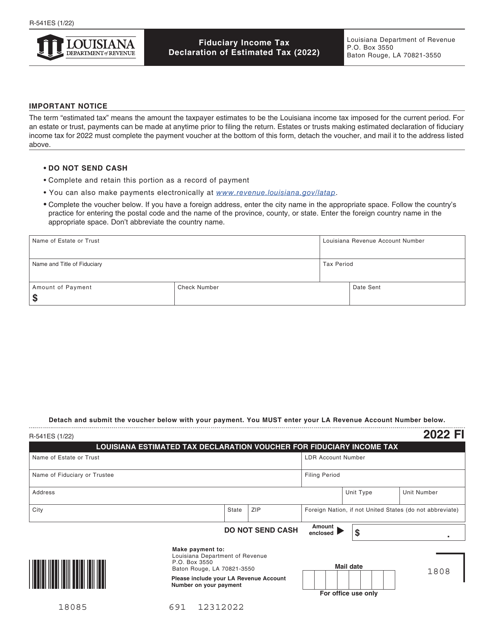

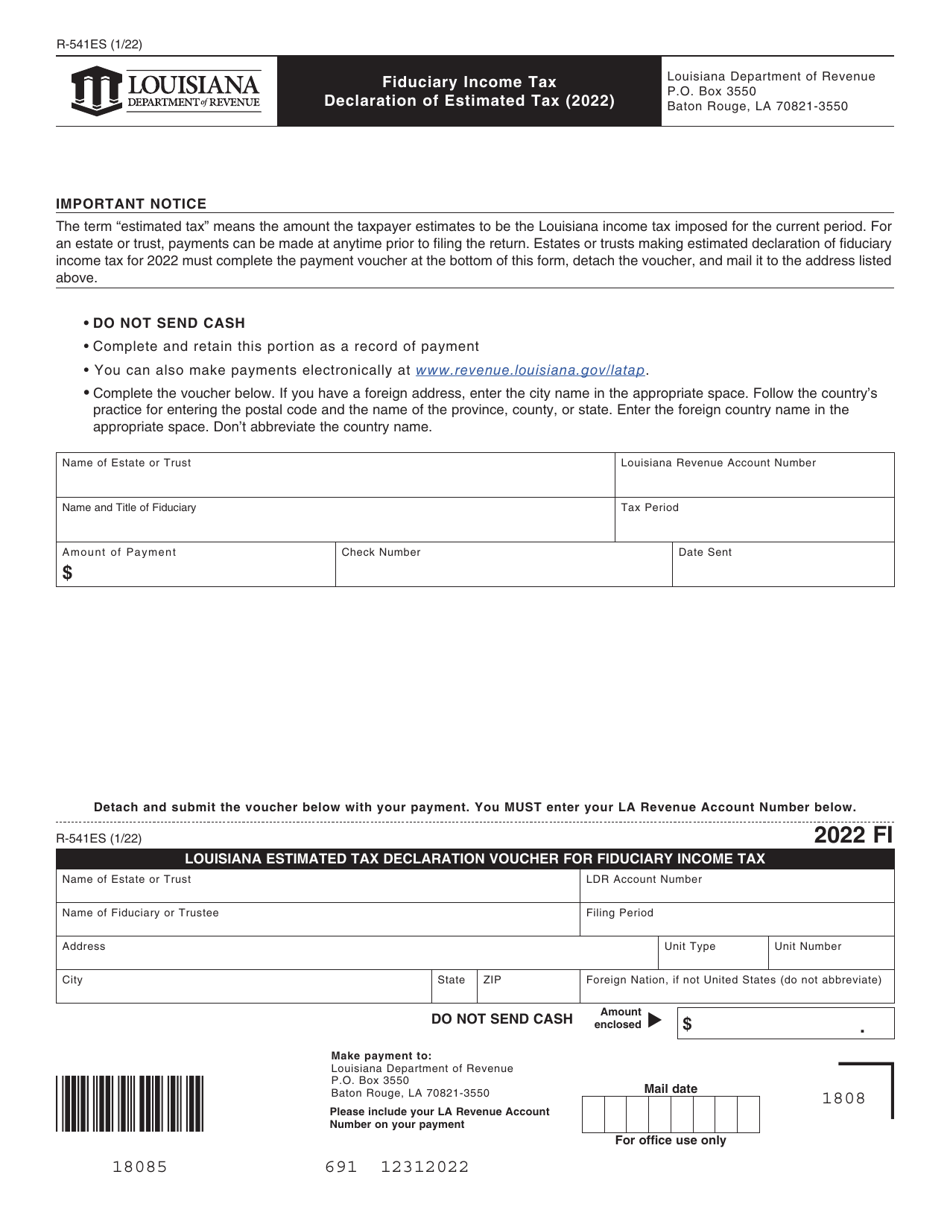

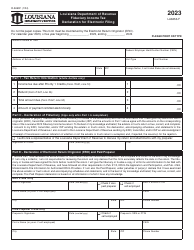

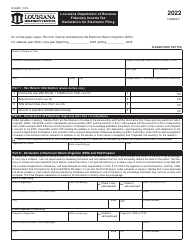

Form R-541ES

for the current year.

Form R-541ES Fiduciary Income Tax Declaration of Estimated Tax - Louisiana

What Is Form R-541ES?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-541ES?

A: Form R-541ES is the Fiduciary Income Tax Declaration of Estimated Tax for Louisiana.

Q: Who needs to file Form R-541ES?

A: Fiduciaries (trustees or executors) who expect to owe $1,000 or more in Louisiana income tax for the current tax year must file this form.

Q: What is the purpose of Form R-541ES?

A: Form R-541ES is used to report and pay the estimated tax liability for fiduciaries in Louisiana.

Q: When is Form R-541ES due?

A: Form R-541ES is due on or before the 15th day of the 4th, 6th, 9th, and 12th months of the taxable year.

Q: What should I do if I make a mistake on Form R-541ES?

A: If you make a mistake on Form R-541ES, you should correct it as soon as possible. You can file an amended return or contact the Louisiana Department of Revenue for guidance.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-541ES by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.