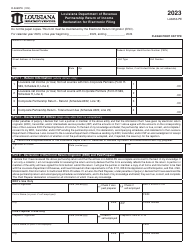

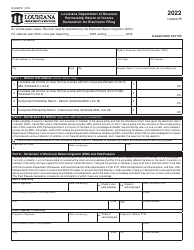

This version of the form is not currently in use and is provided for reference only. Download this version of

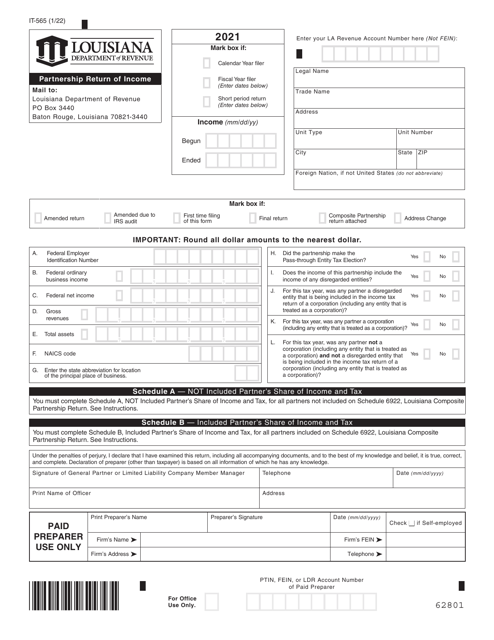

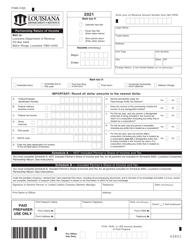

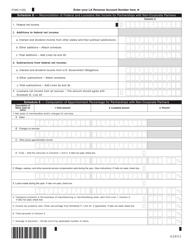

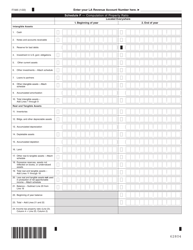

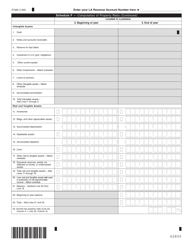

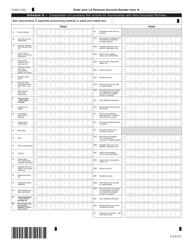

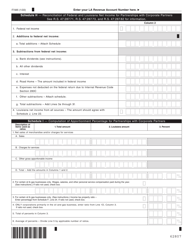

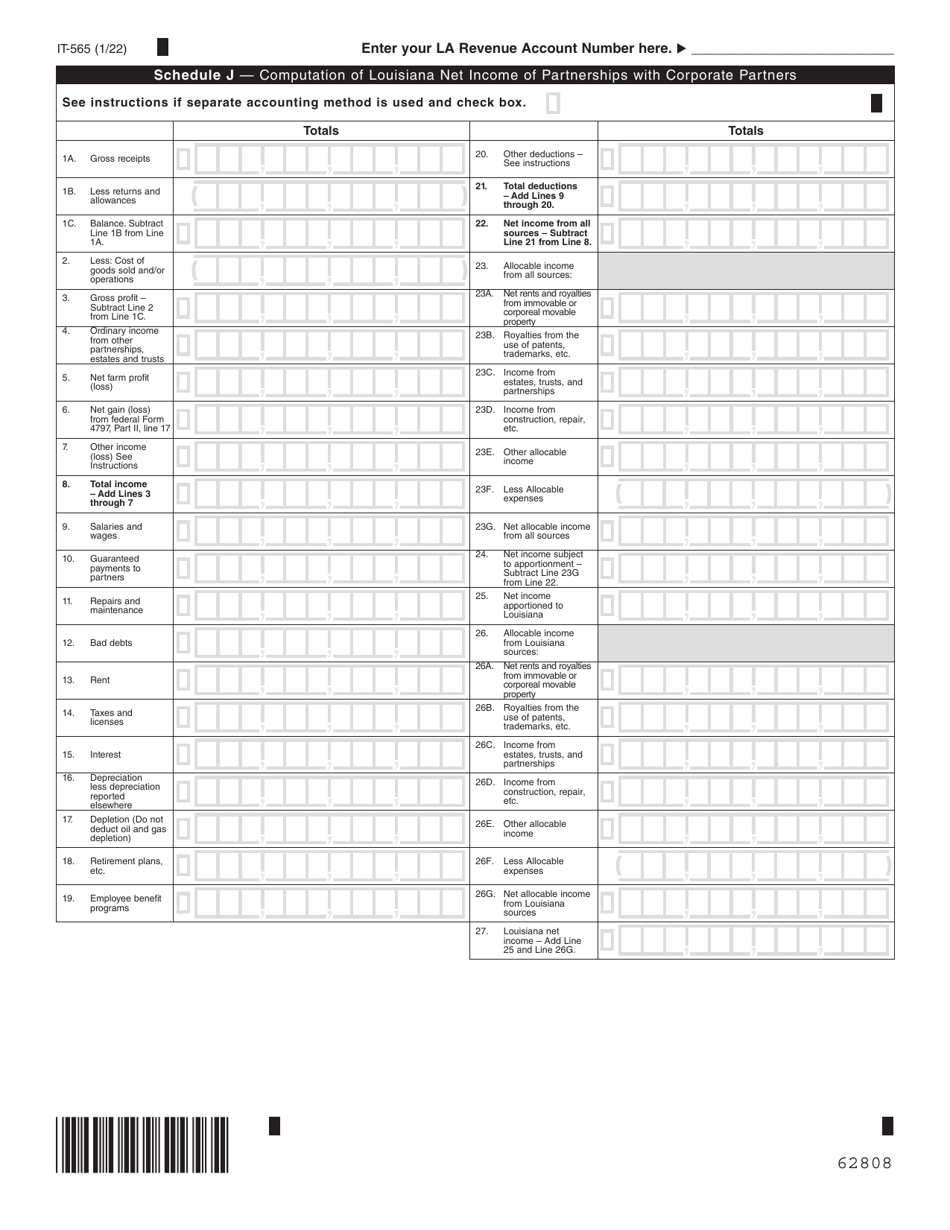

Form IT-565

for the current year.

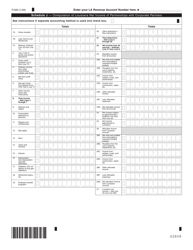

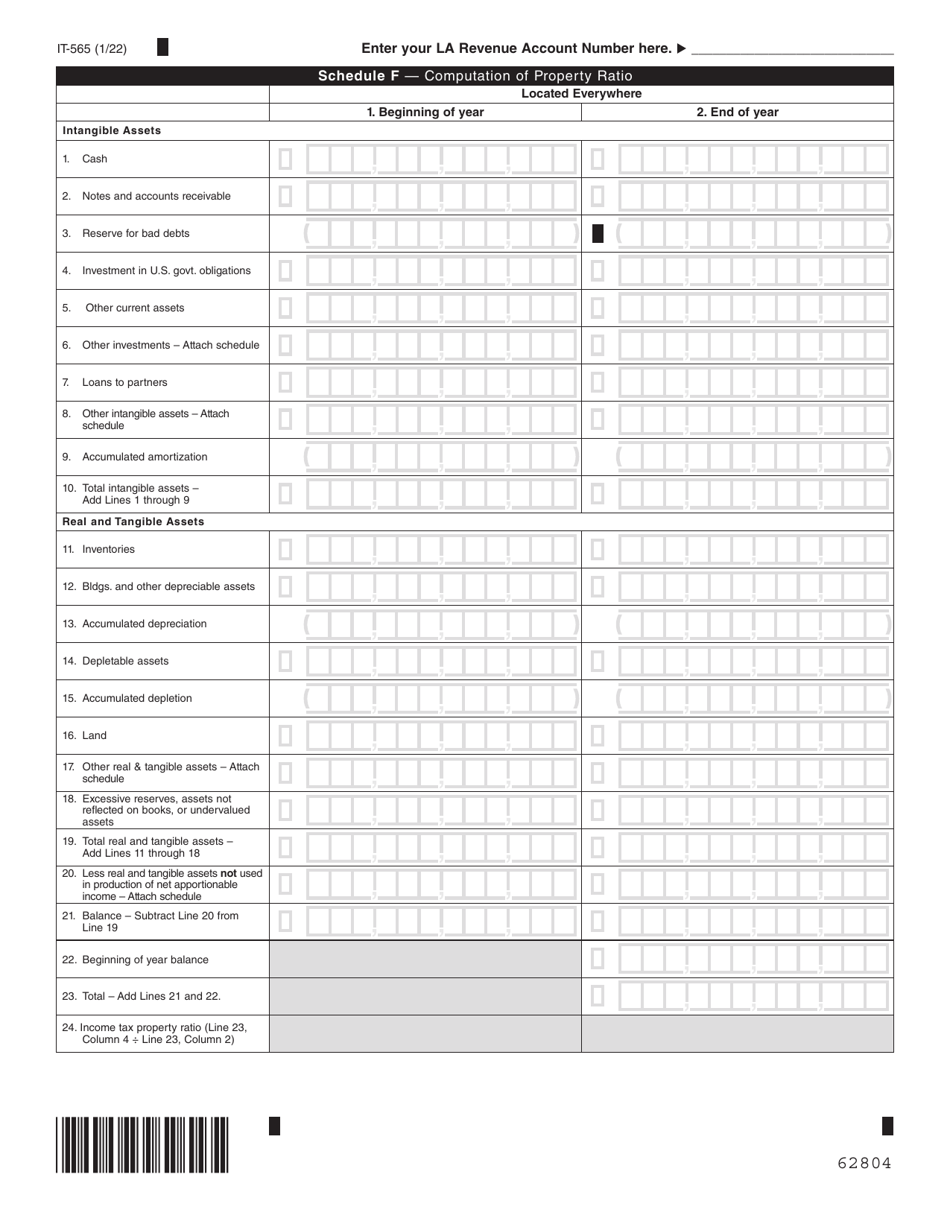

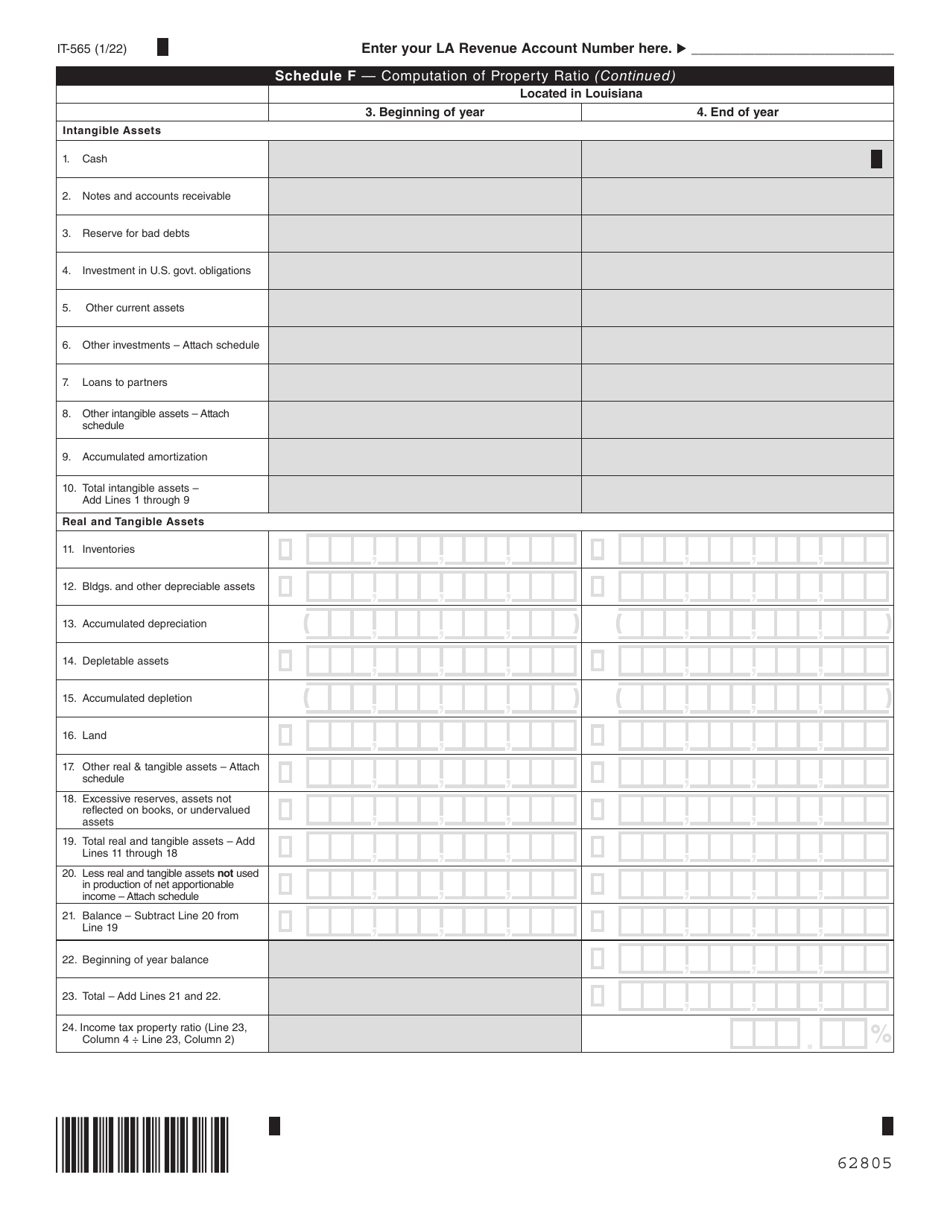

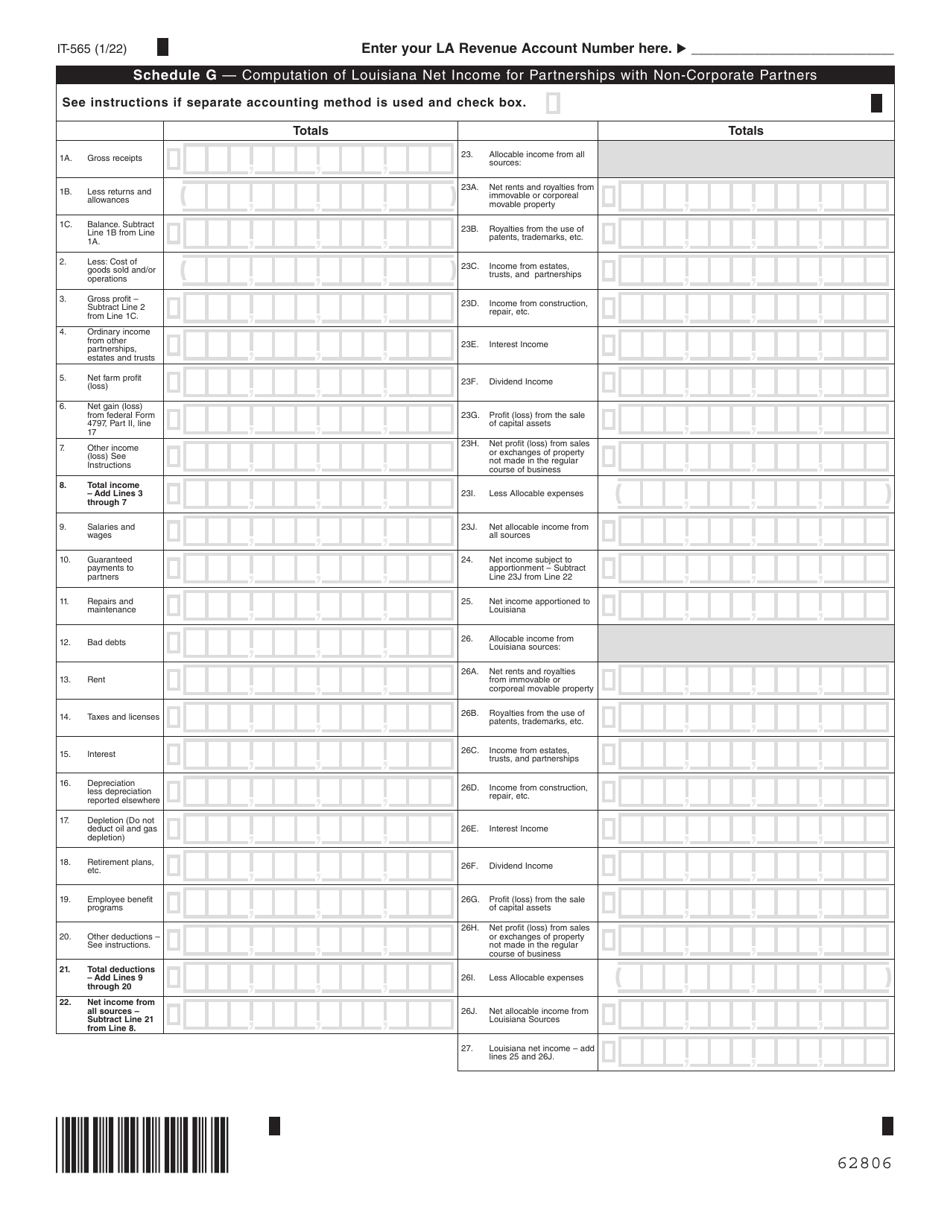

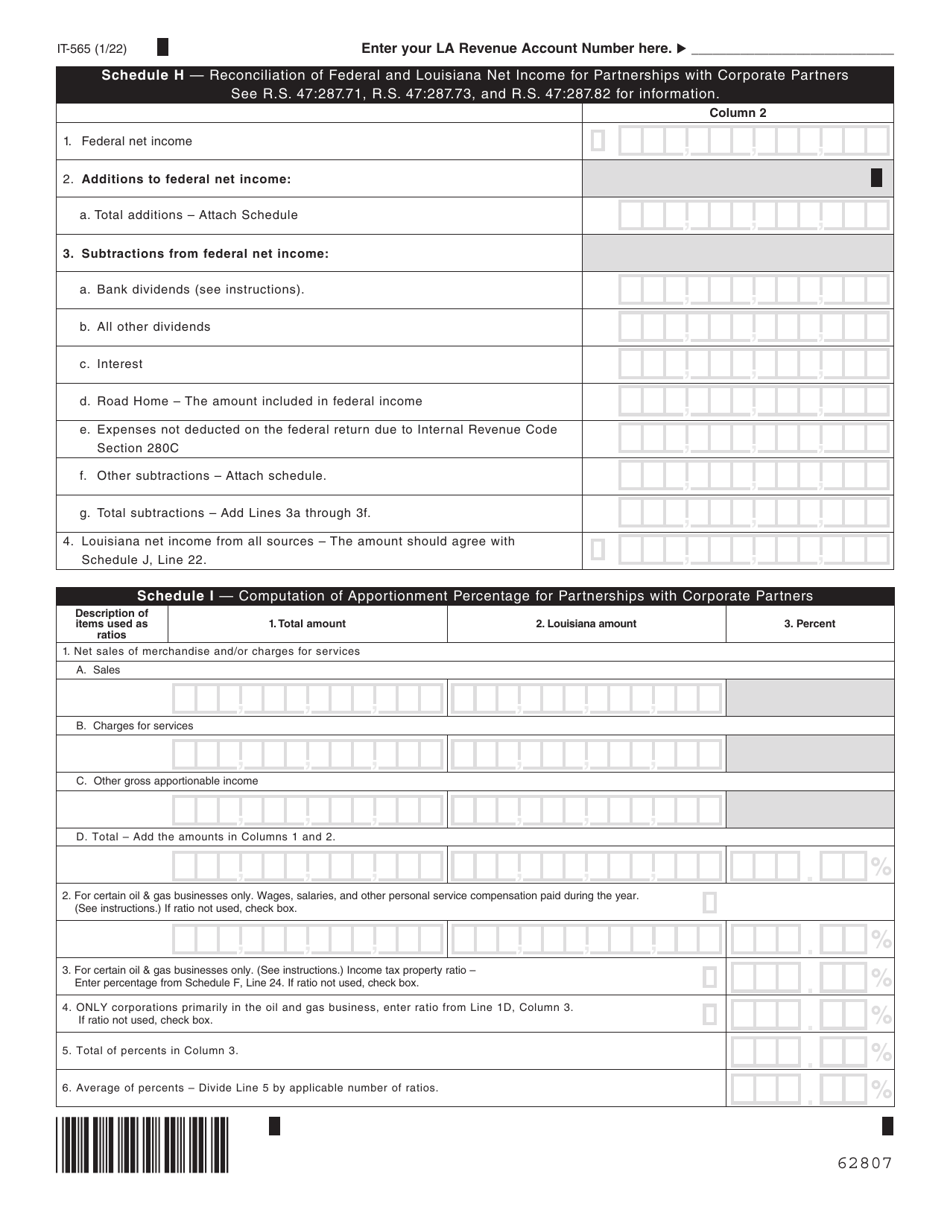

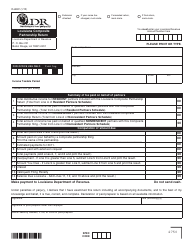

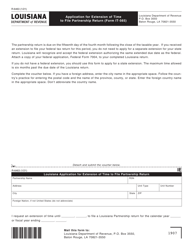

Form IT-565 Partnership Return of Income - Louisiana

What Is Form IT-565?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-565?

A: Form IT-565 is a Partnership Return of Income form used in Louisiana.

Q: Who needs to file Form IT-565?

A: Partnerships in Louisiana are required to file Form IT-565.

Q: What is the purpose of Form IT-565?

A: Form IT-565 is used to report partnership income, deductions, and credits in Louisiana.

Q: When is Form IT-565 due?

A: Form IT-565 is due on the 15th day of the fourth month after the end of the partnership's tax year.

Q: Are there any filing fees for Form IT-565?

A: Yes, there is a $25 filing fee for Form IT-565 in Louisiana.

Q: Is an extension available for filing Form IT-565?

A: Yes, partnerships can request a 6-month extension to file Form IT-565.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-565 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.