This version of the form is not currently in use and is provided for reference only. Download this version of

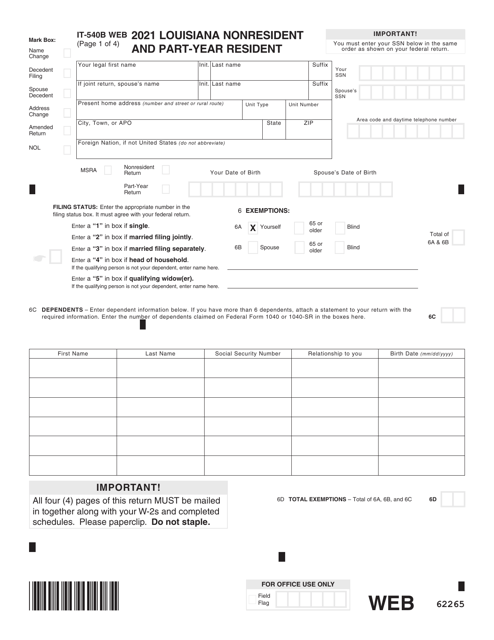

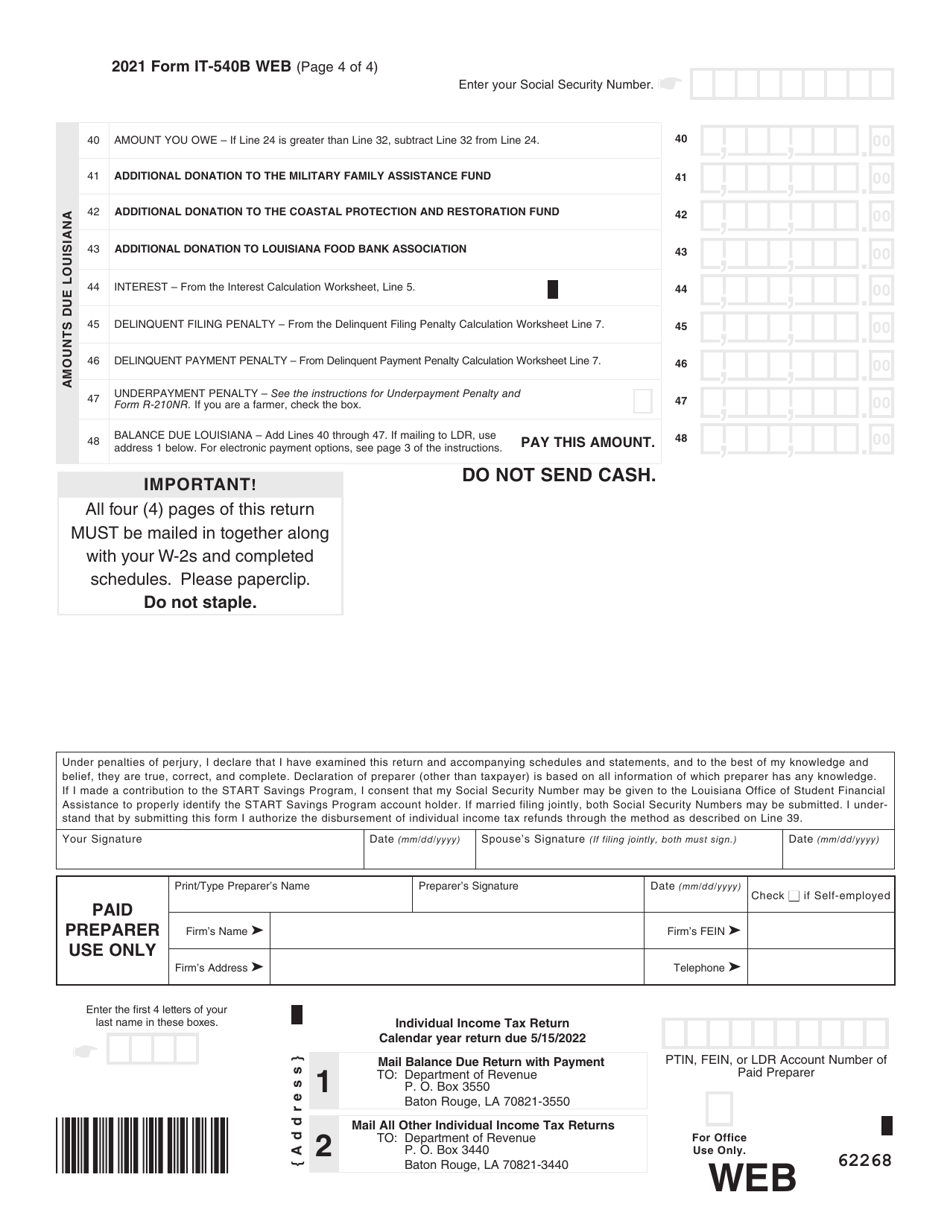

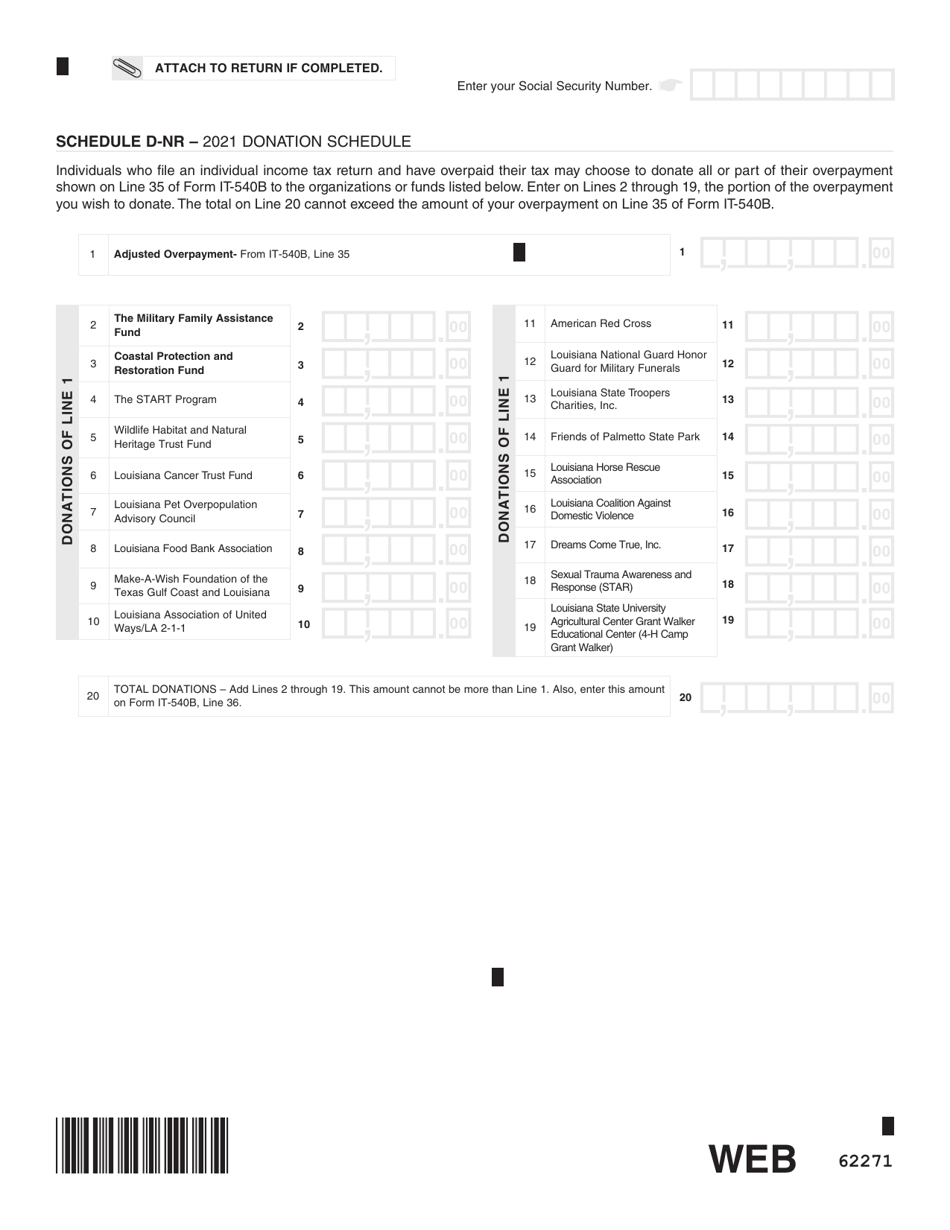

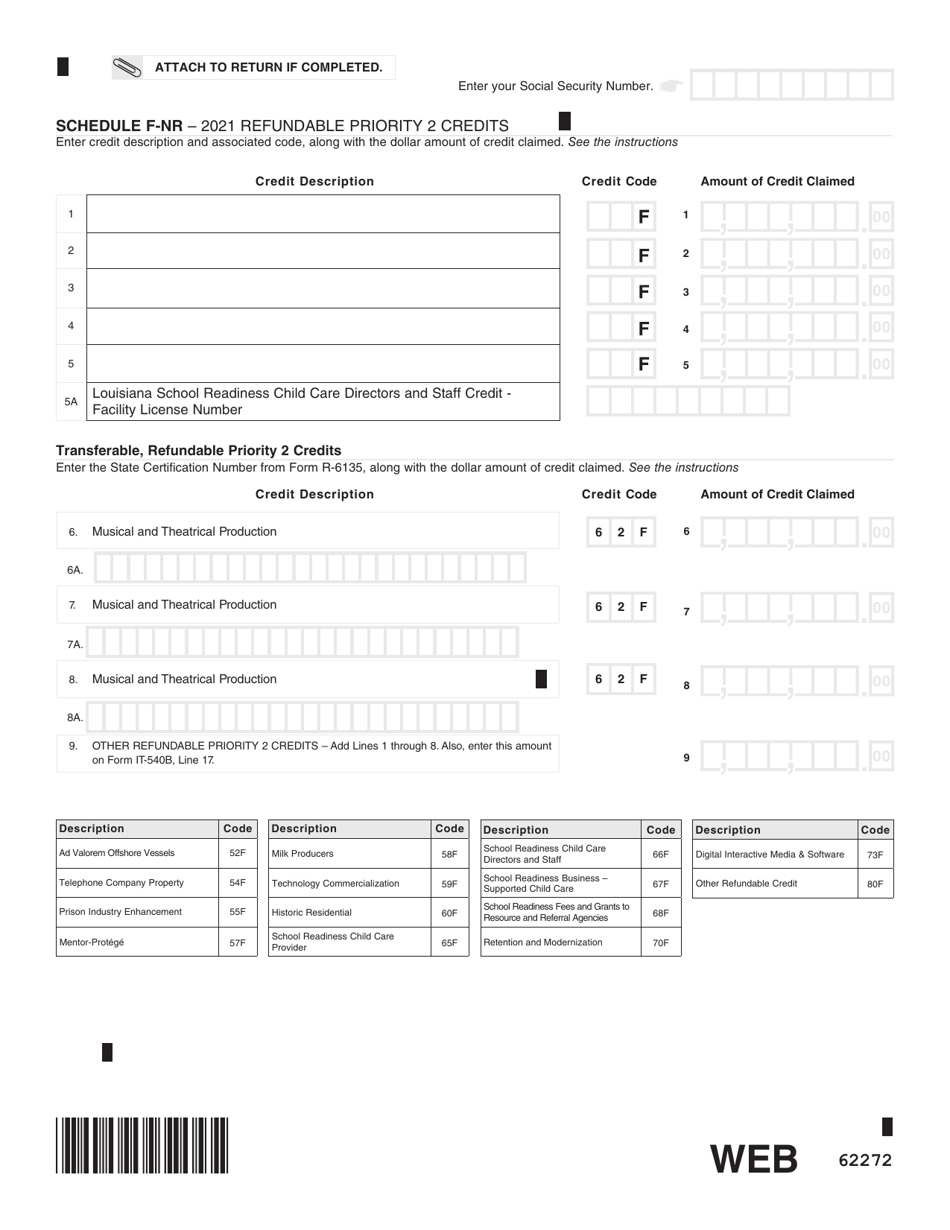

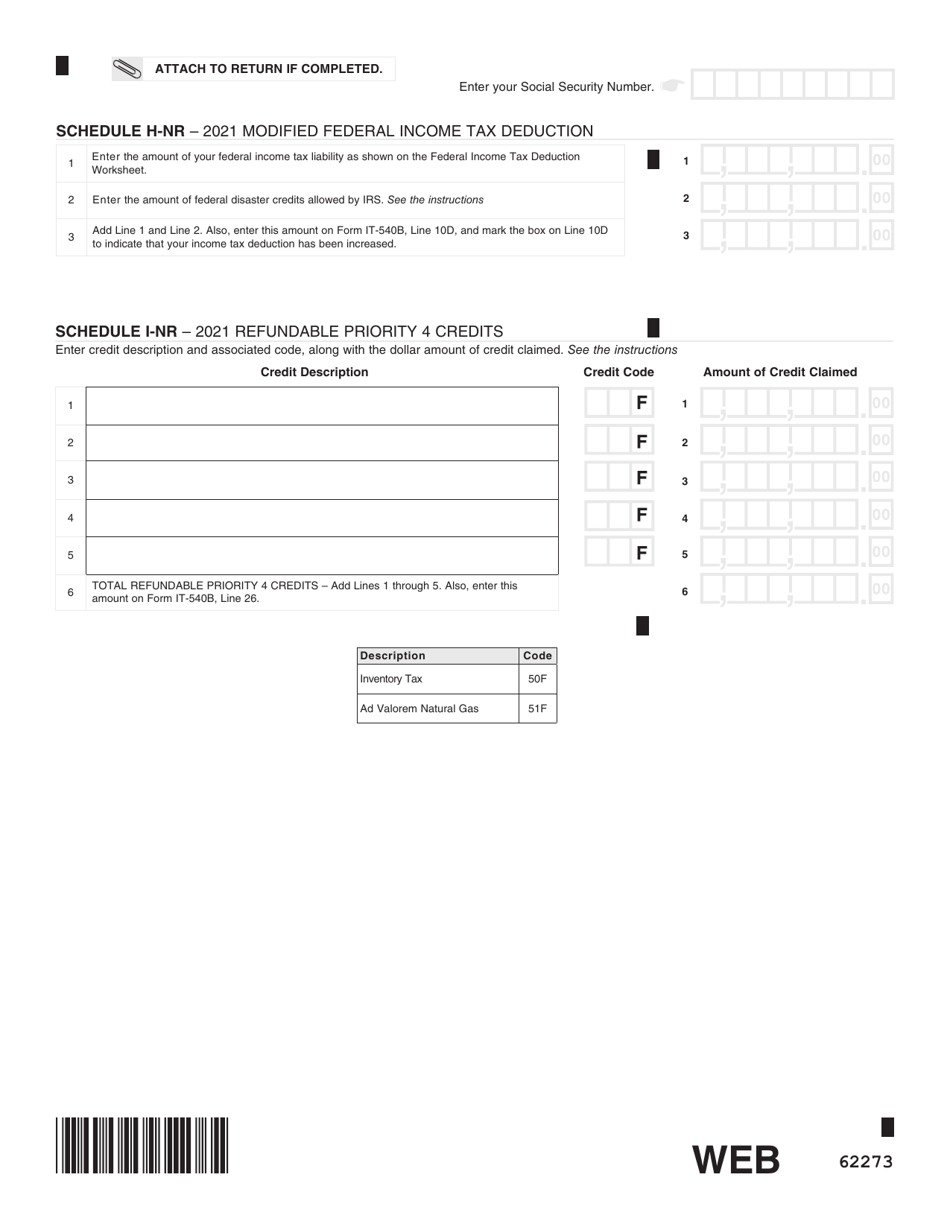

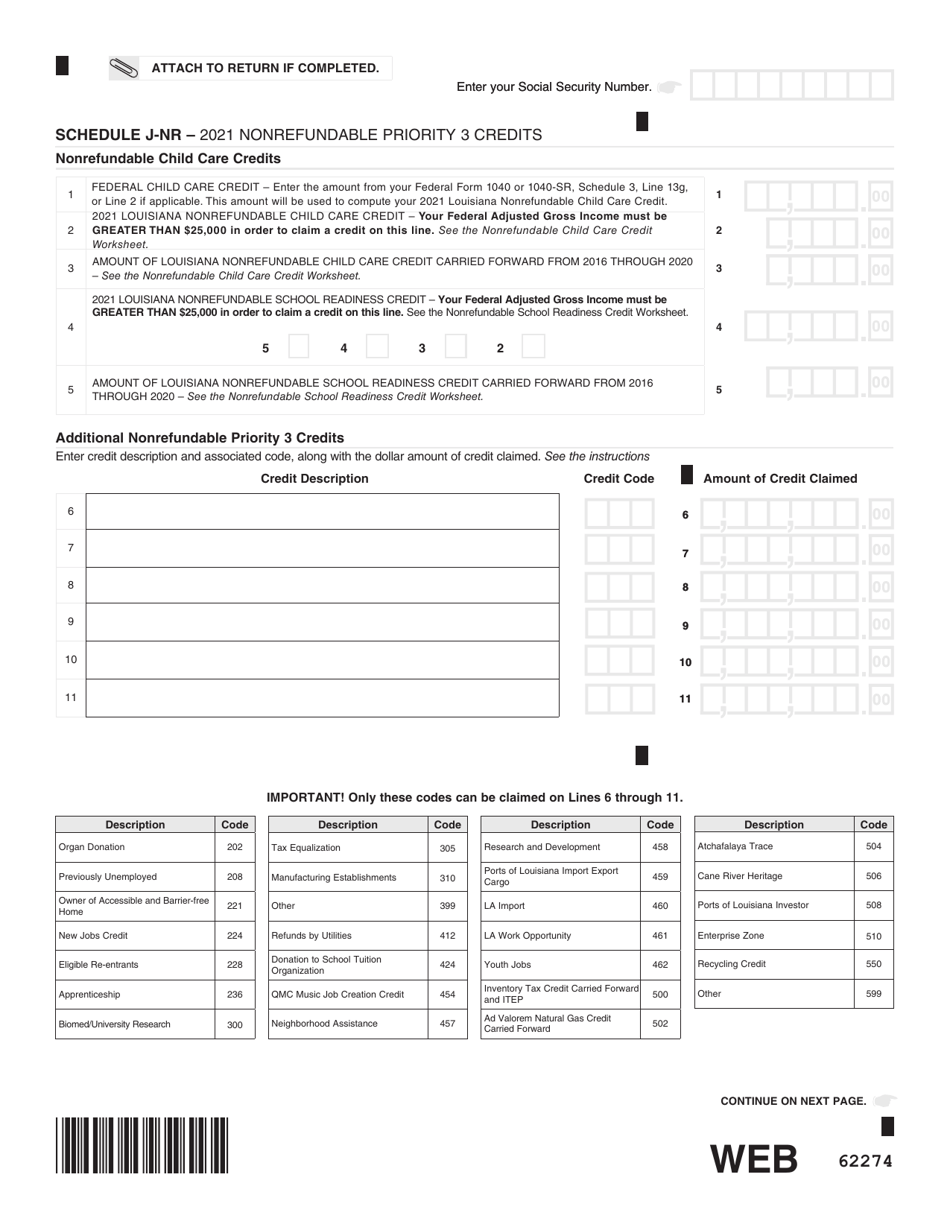

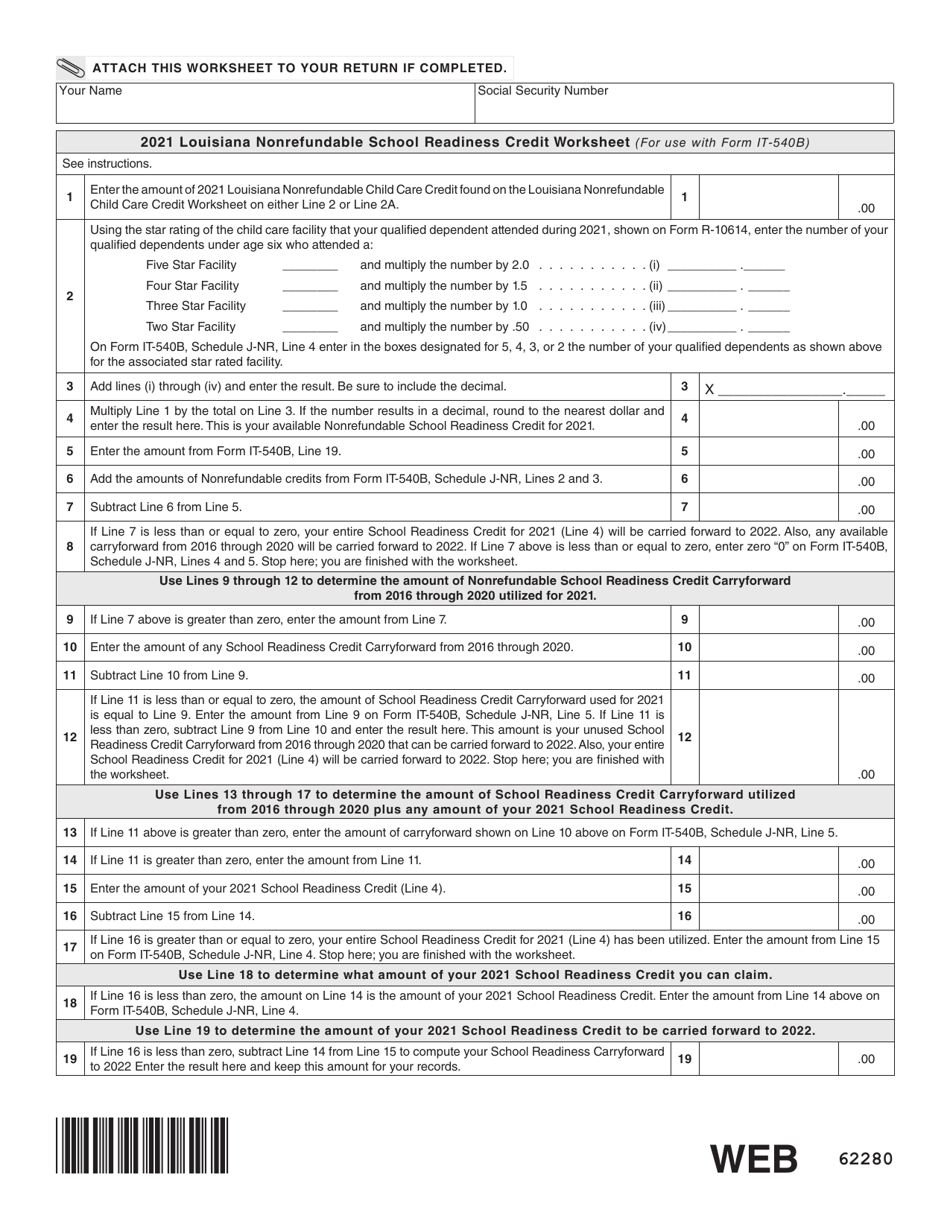

Form IT-540B

for the current year.

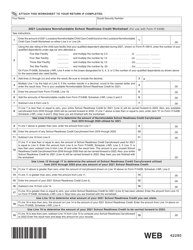

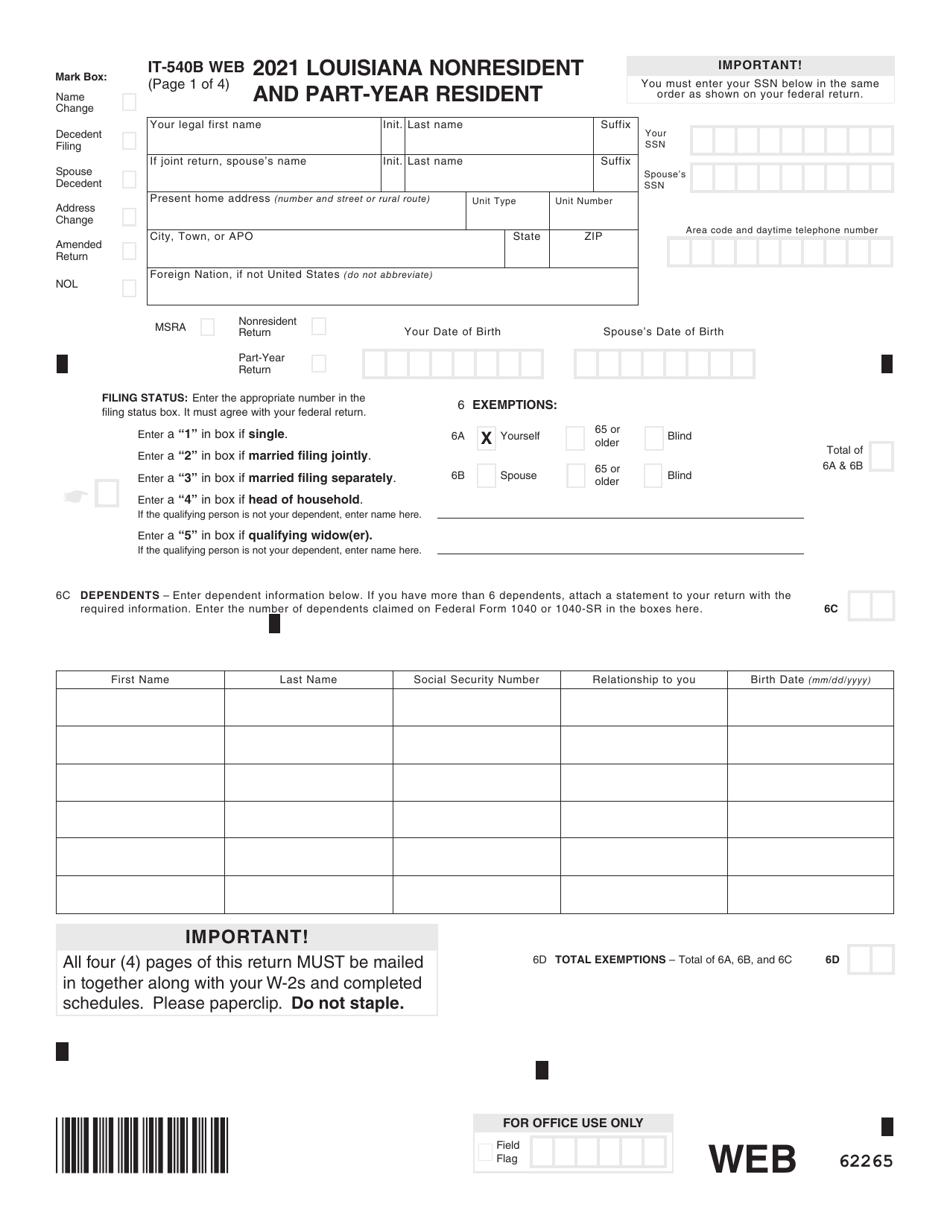

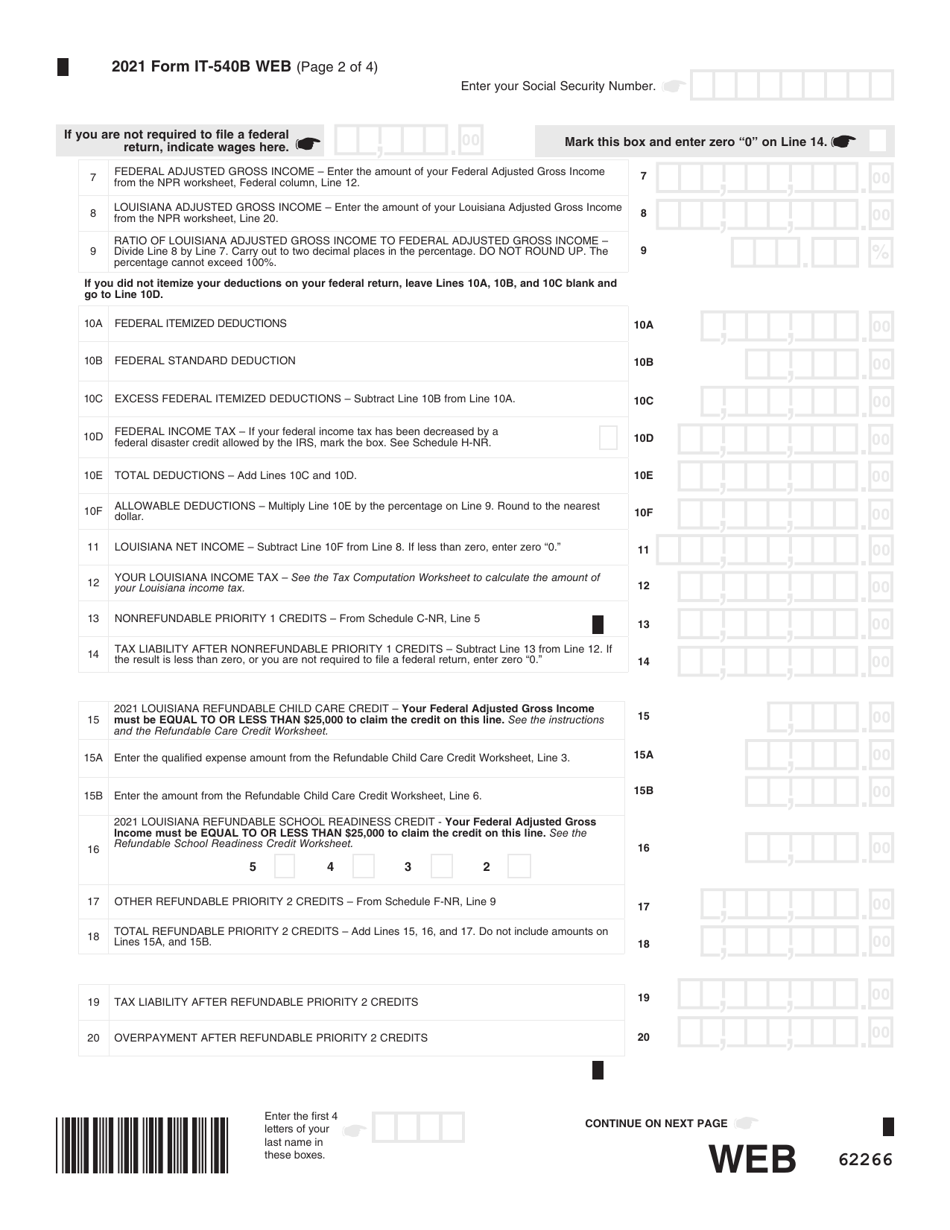

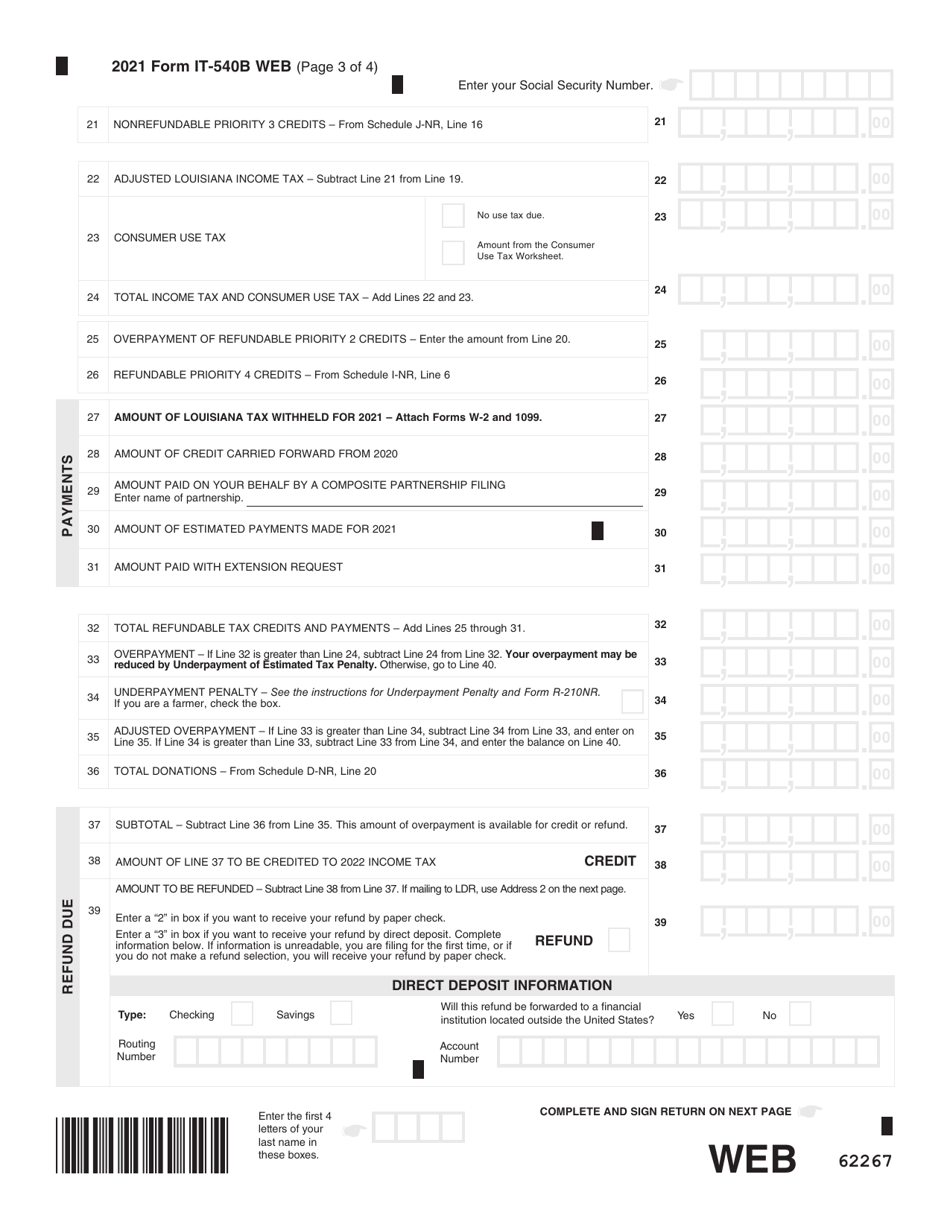

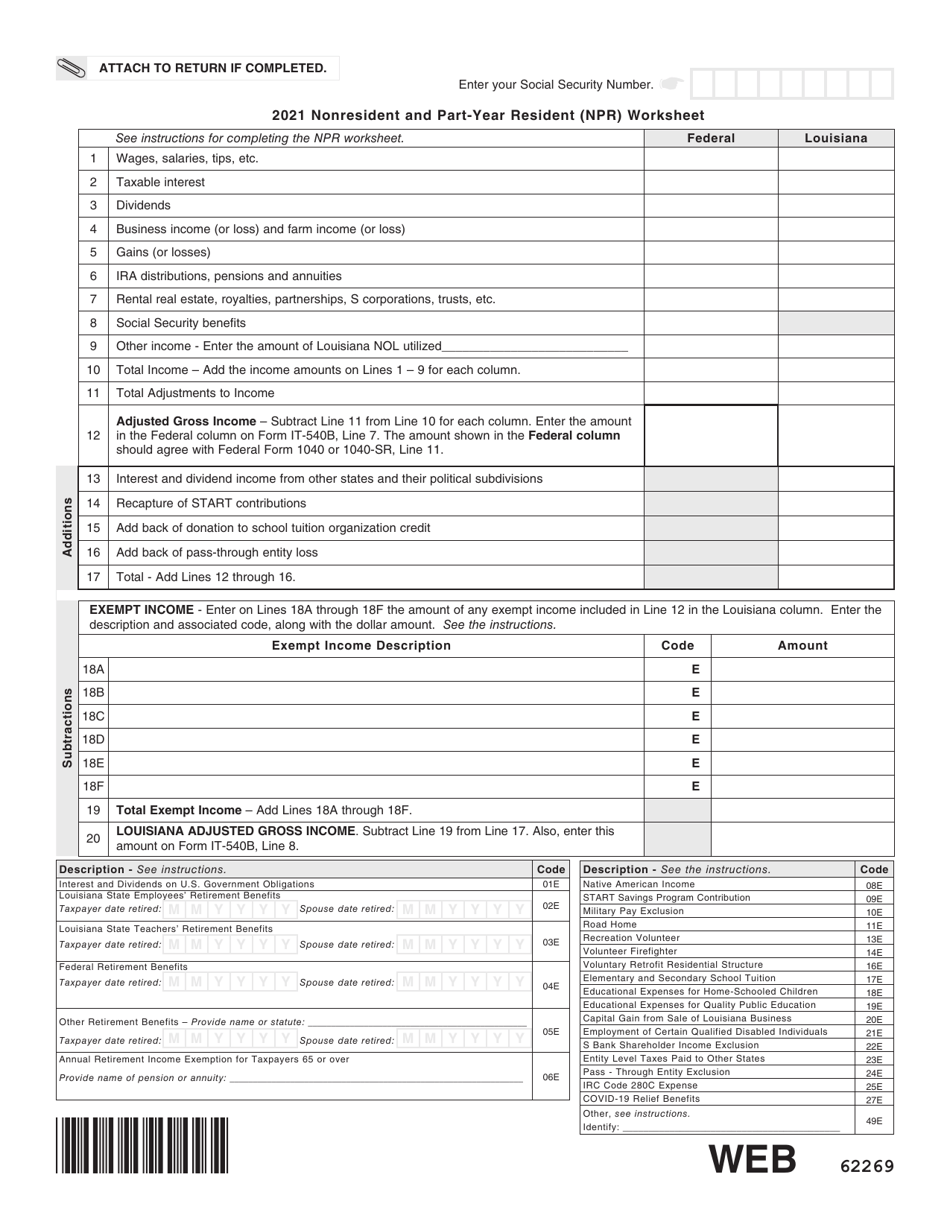

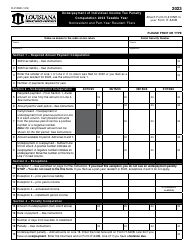

Form IT-540B Louisiana Nonresident and Part-Year Resident - Louisiana

What Is Form IT-540B?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-540B?

A: Form IT-540B is the Louisiana Nonresident and Part-Year Resident tax form.

Q: Who should file Form IT-540B?

A: Louisiana Nonresidents and Part-Year Residents should file Form IT-540B.

Q: What is the purpose of Form IT-540B?

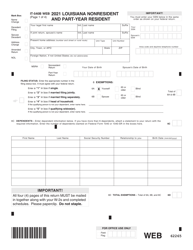

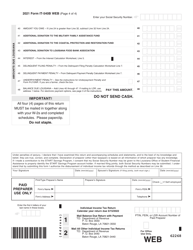

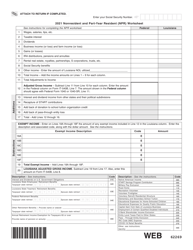

A: Form IT-540B is used to calculate and report income earned in Louisiana by nonresidents and part-year residents.

Q: What income should be reported on Form IT-540B?

A: You should report all income earned in Louisiana, including wages, self-employment income, and rental income.

Q: Do I need to file Form IT-540B if I have no income in Louisiana?

A: If you have no income in Louisiana, you are not required to file Form IT-540B.

Q: When is Form IT-540B due?

A: Form IT-540B is due on the same day as your federal income tax return, usually April 15th.

Q: Can I e-file Form IT-540B?

A: Yes, you can e-file Form IT-540B using approved tax software or through a tax professional.

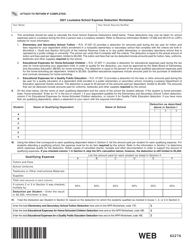

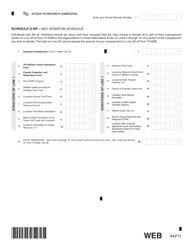

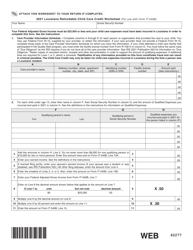

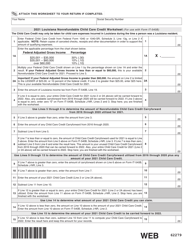

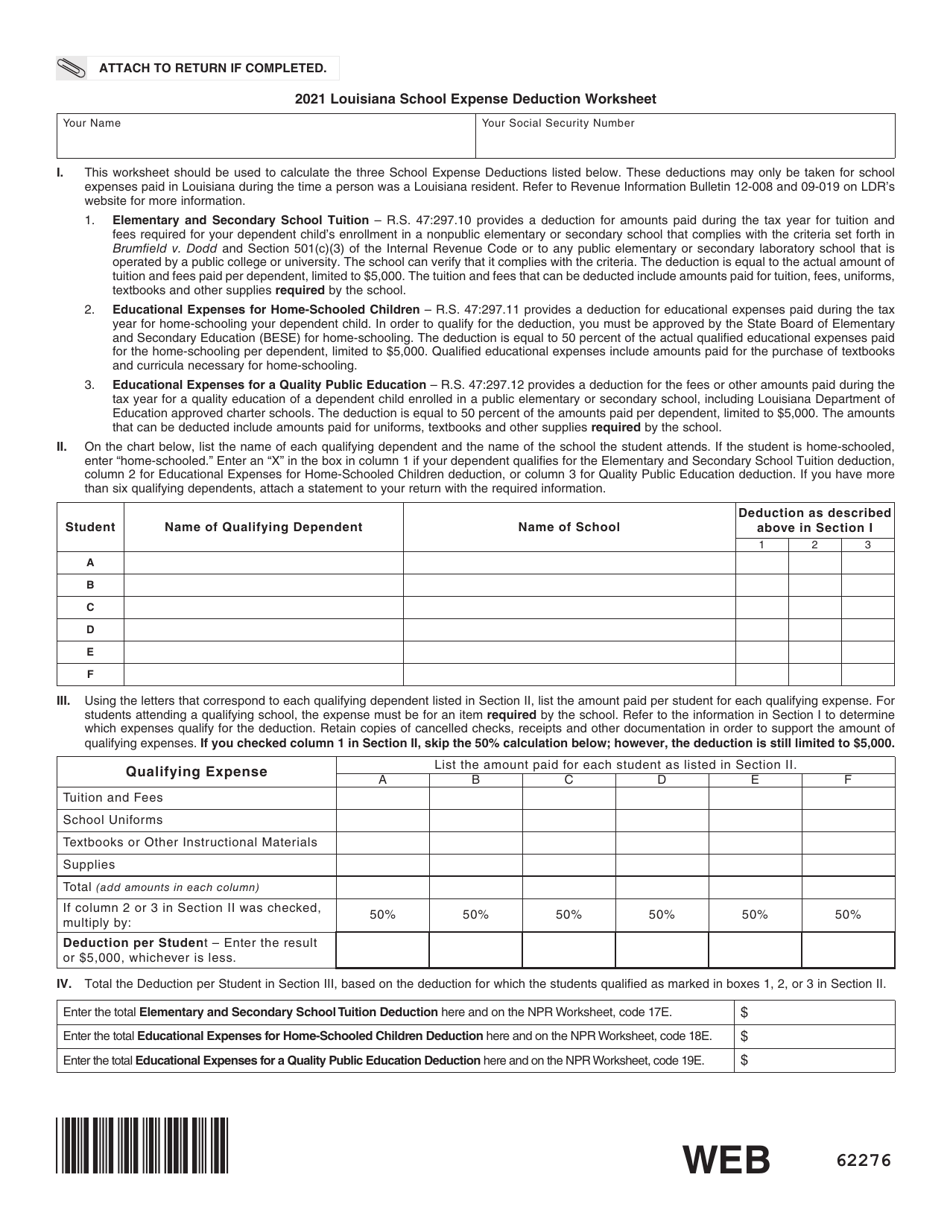

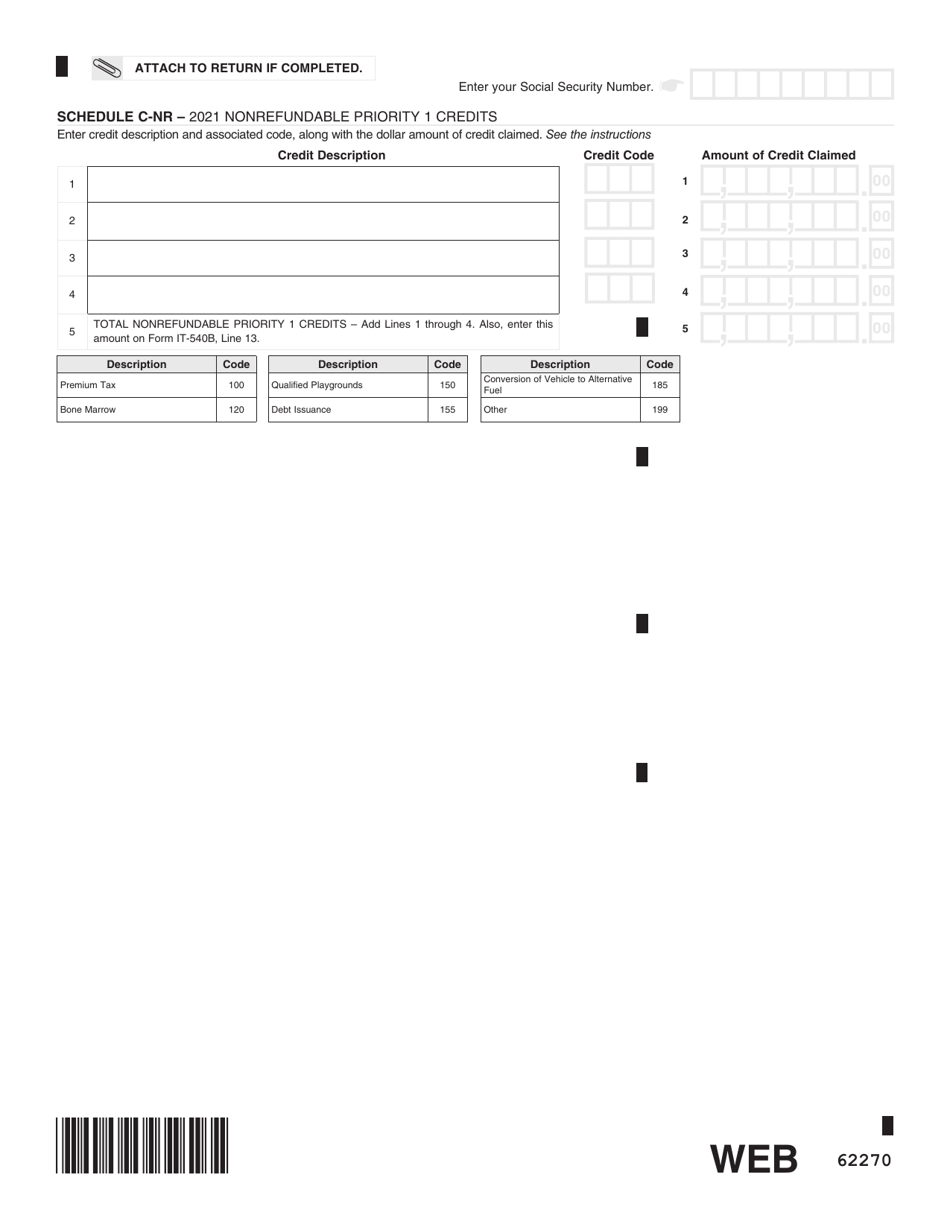

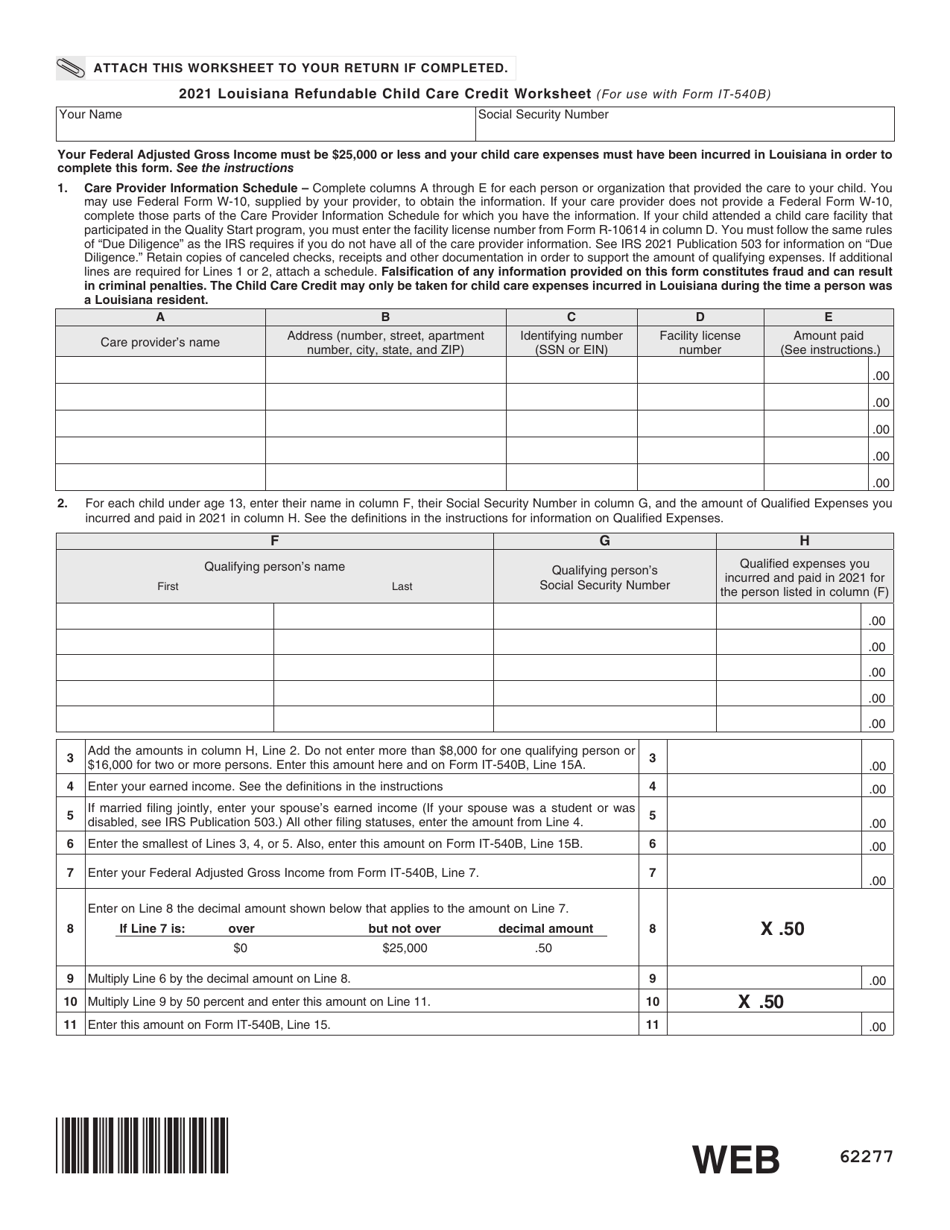

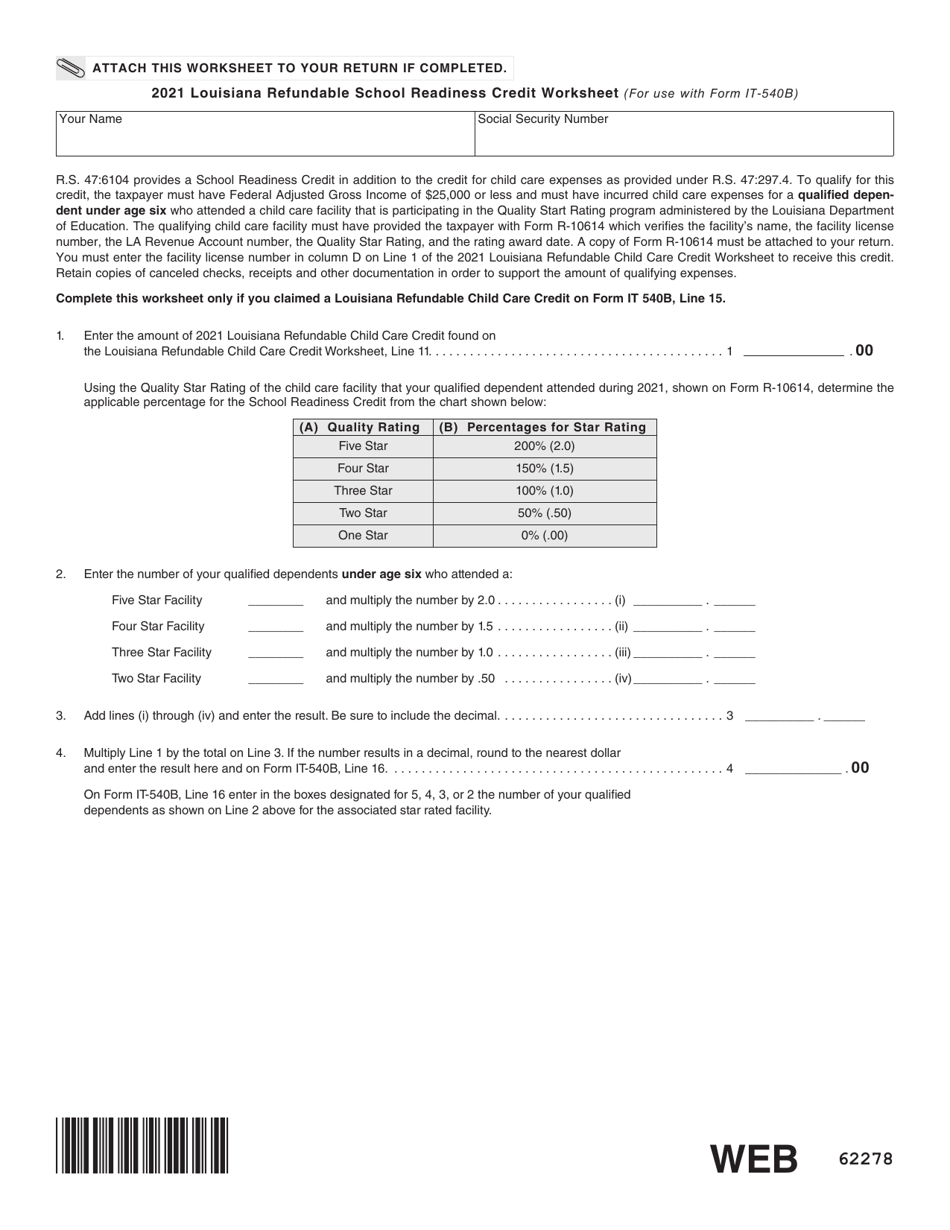

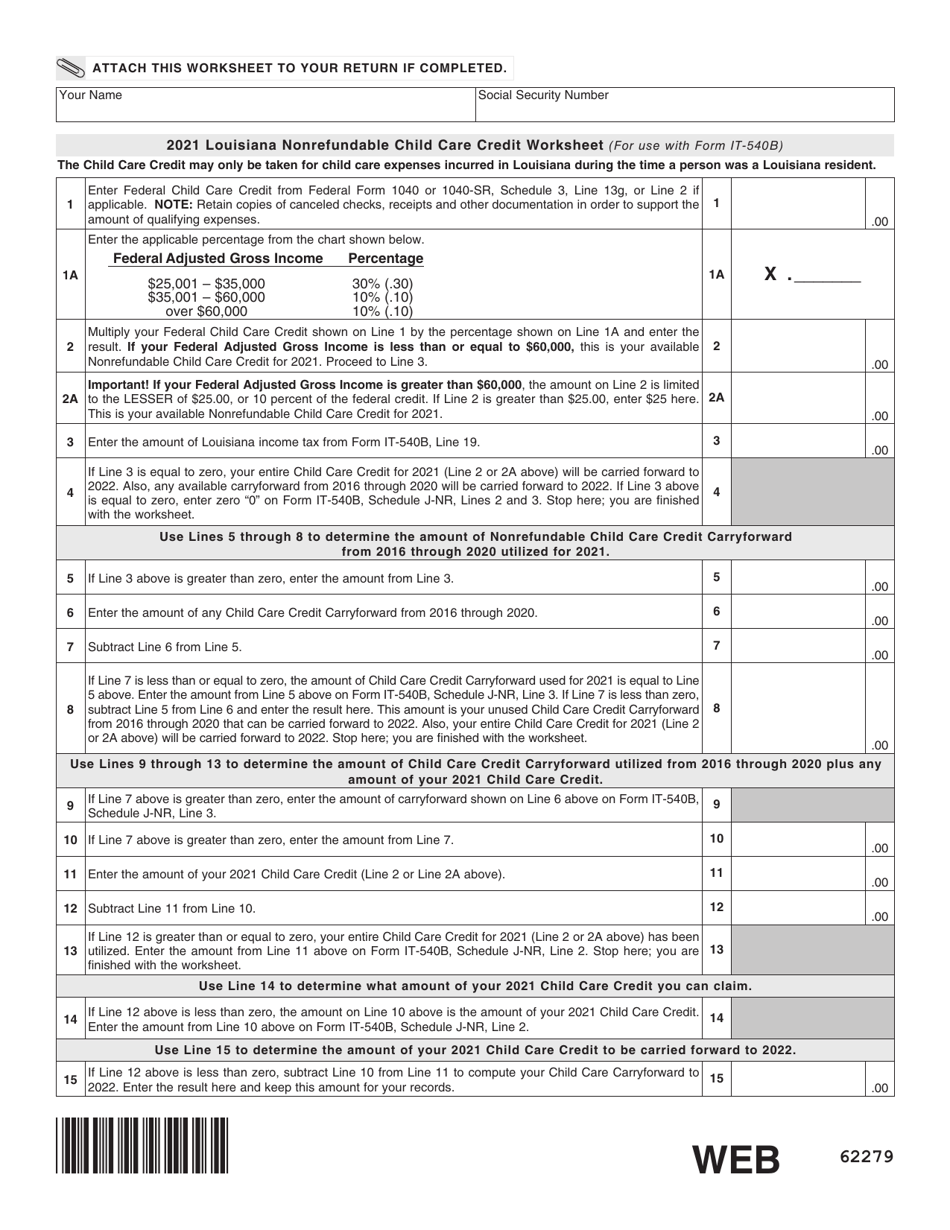

Q: Are there any special deductions or credits for nonresidents and part-year residents?

A: Yes, there are certain deductions and credits available for nonresidents and part-year residents, such as the Louisiana Earned Income Credit.

Form Details:

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-540B by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.