This version of the form is not currently in use and is provided for reference only. Download this version of

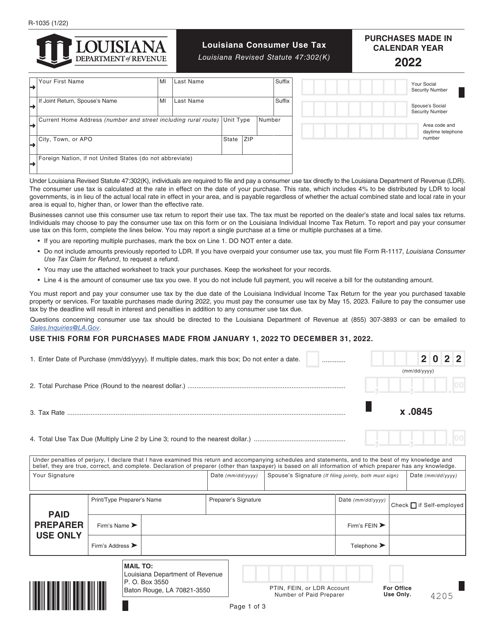

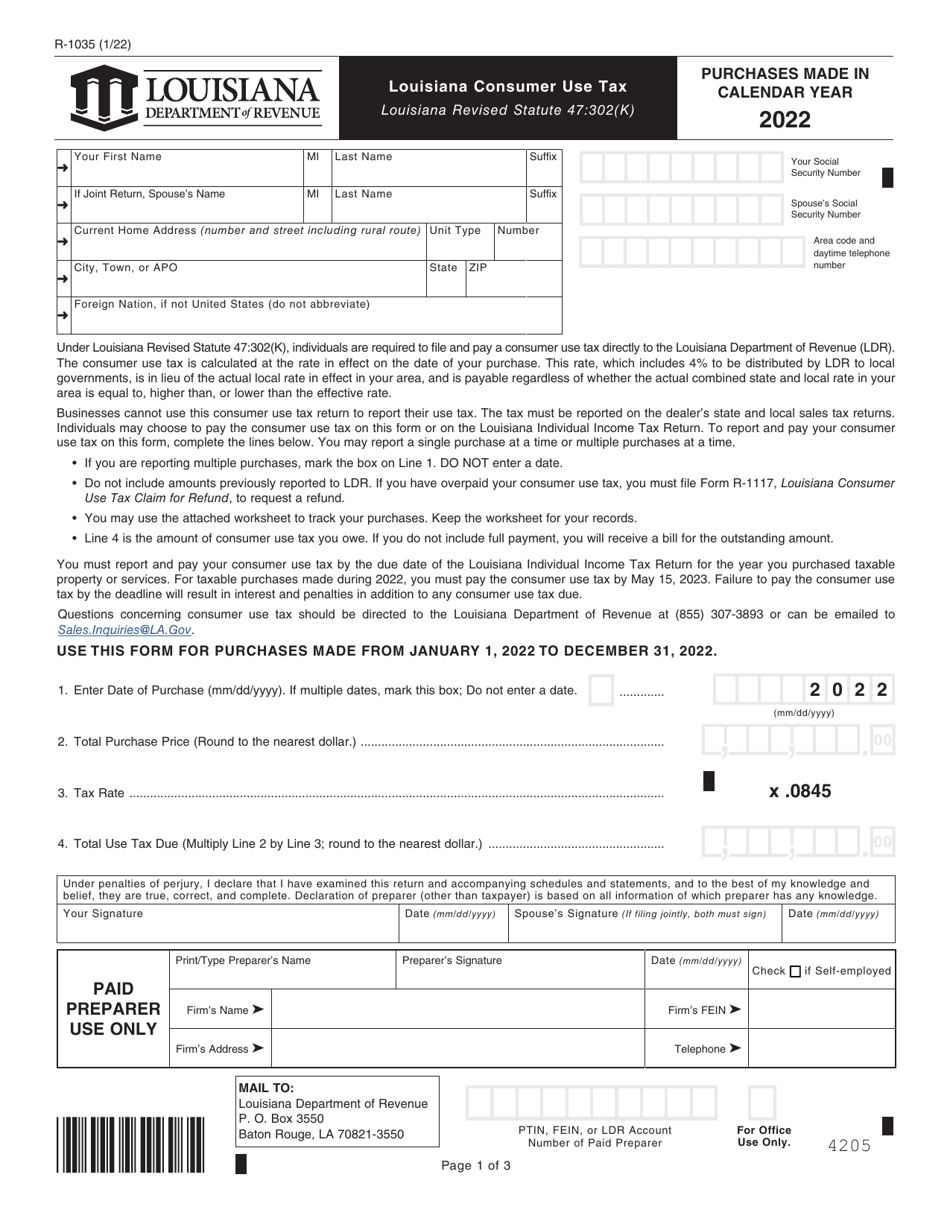

Form R-1035

for the current year.

Form R-1035 Louisiana Consumer Use Tax - Louisiana

What Is Form R-1035?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1035?

A: Form R-1035 is the Consumer Use Tax form in the state of Louisiana.

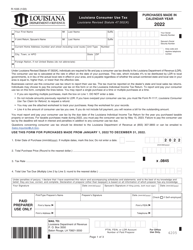

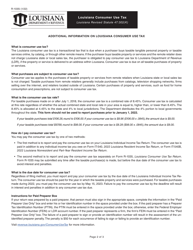

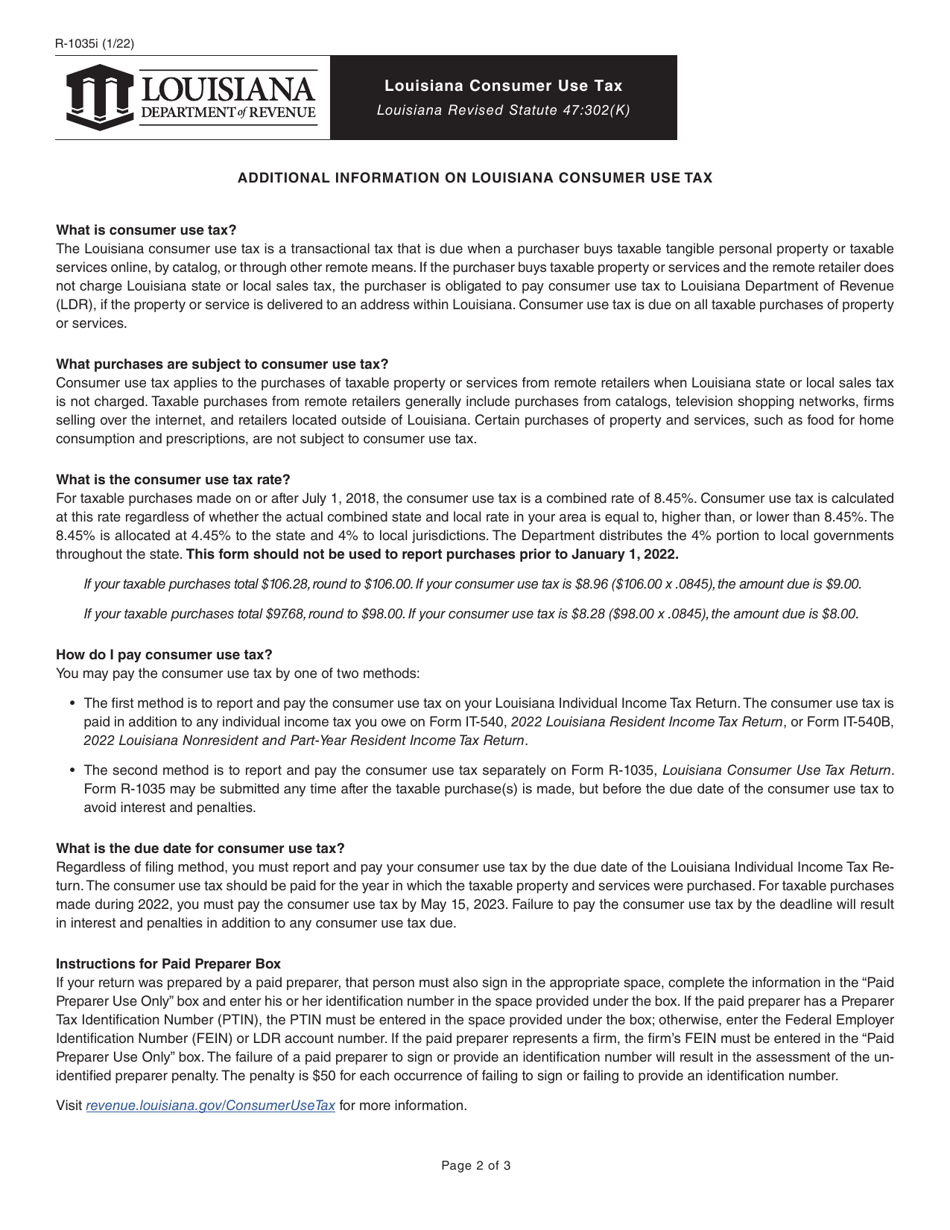

Q: What is the Consumer Use Tax?

A: The Consumer Use Tax is a tax that is equivalent to the sales tax and is imposed on purchases made out-of-state for use in Louisiana.

Q: Who needs to file Form R-1035?

A: Anyone who has made purchases out-of-state for use in Louisiana and has not paid sales tax needs to file Form R-1035.

Q: Why do I need to file Form R-1035?

A: Filing Form R-1035 ensures that you are in compliance with the consumer use tax laws of Louisiana.

Q: When is the deadline for filing Form R-1035?

A: The deadline for filing Form R-1035 is the same as the deadline for filing your Louisiana state income tax return.

Q: Are there any penalties for not filing Form R-1035?

A: Yes, if you fail to file Form R-1035 or pay the consumer use tax, you may be subject to penalties and interest.

Q: How do I calculate the consumer use tax?

A: The consumer use tax is calculated based on the purchase price of the item and the applicable tax rate in Louisiana.

Q: Can I claim a credit for taxes paid to another state?

A: Yes, if you have already paid sales or use tax on the purchase in another state, you can claim a credit on Form R-1035.

Q: What supporting documentation do I need to include with Form R-1035?

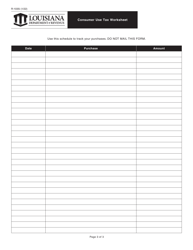

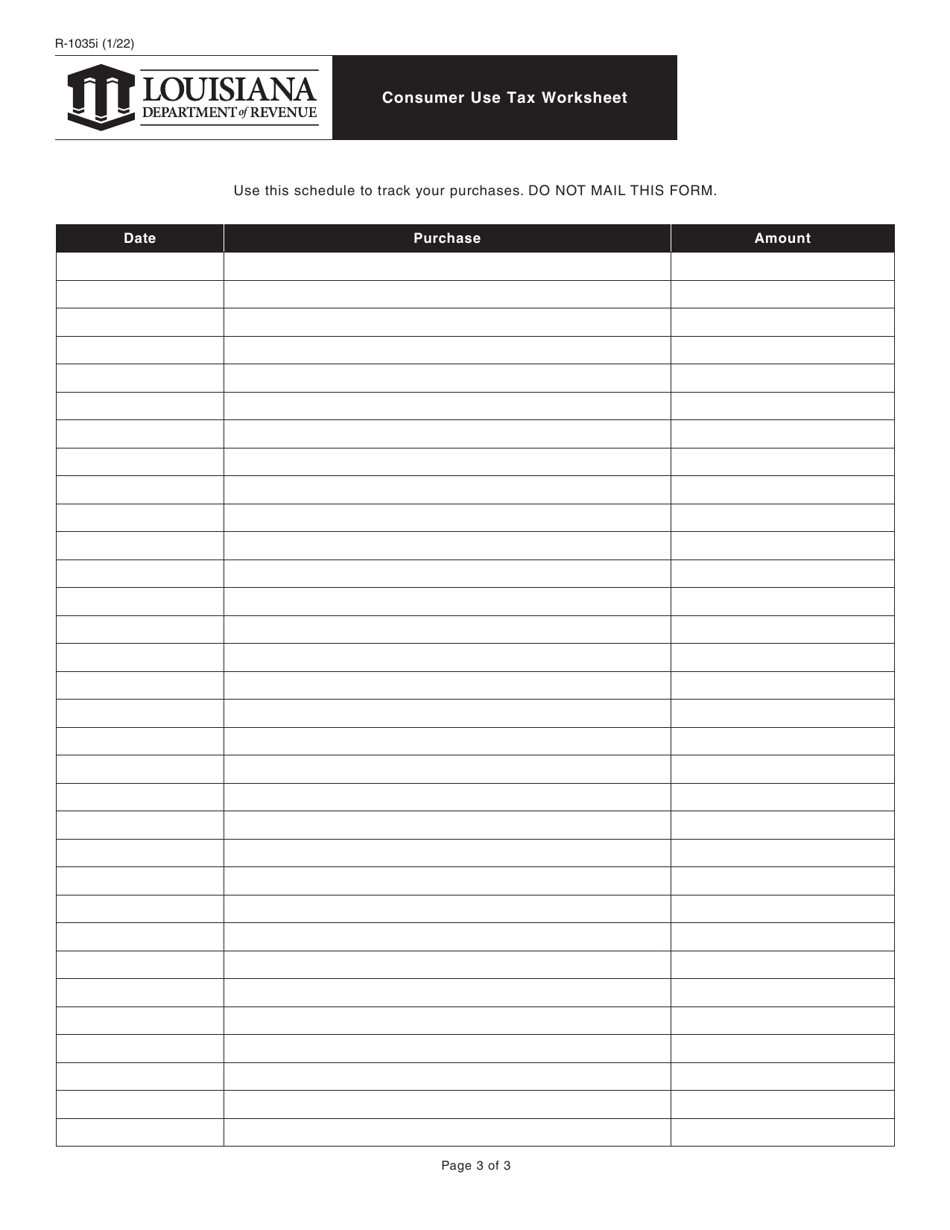

A: You should include receipts or other proof of purchase to support the amounts reported on Form R-1035.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1035 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.