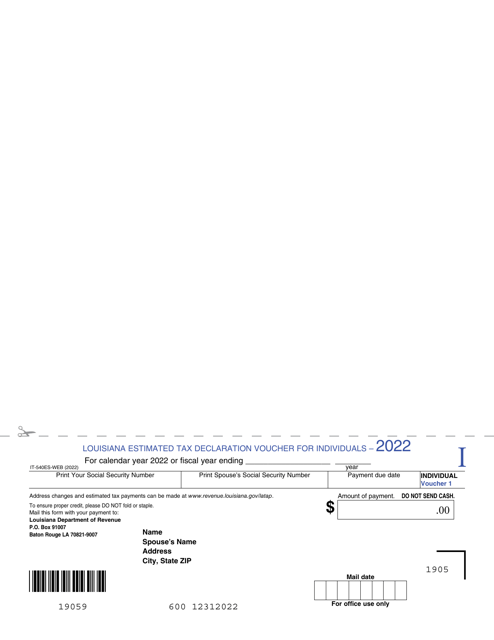

This version of the form is not currently in use and is provided for reference only. Download this version of

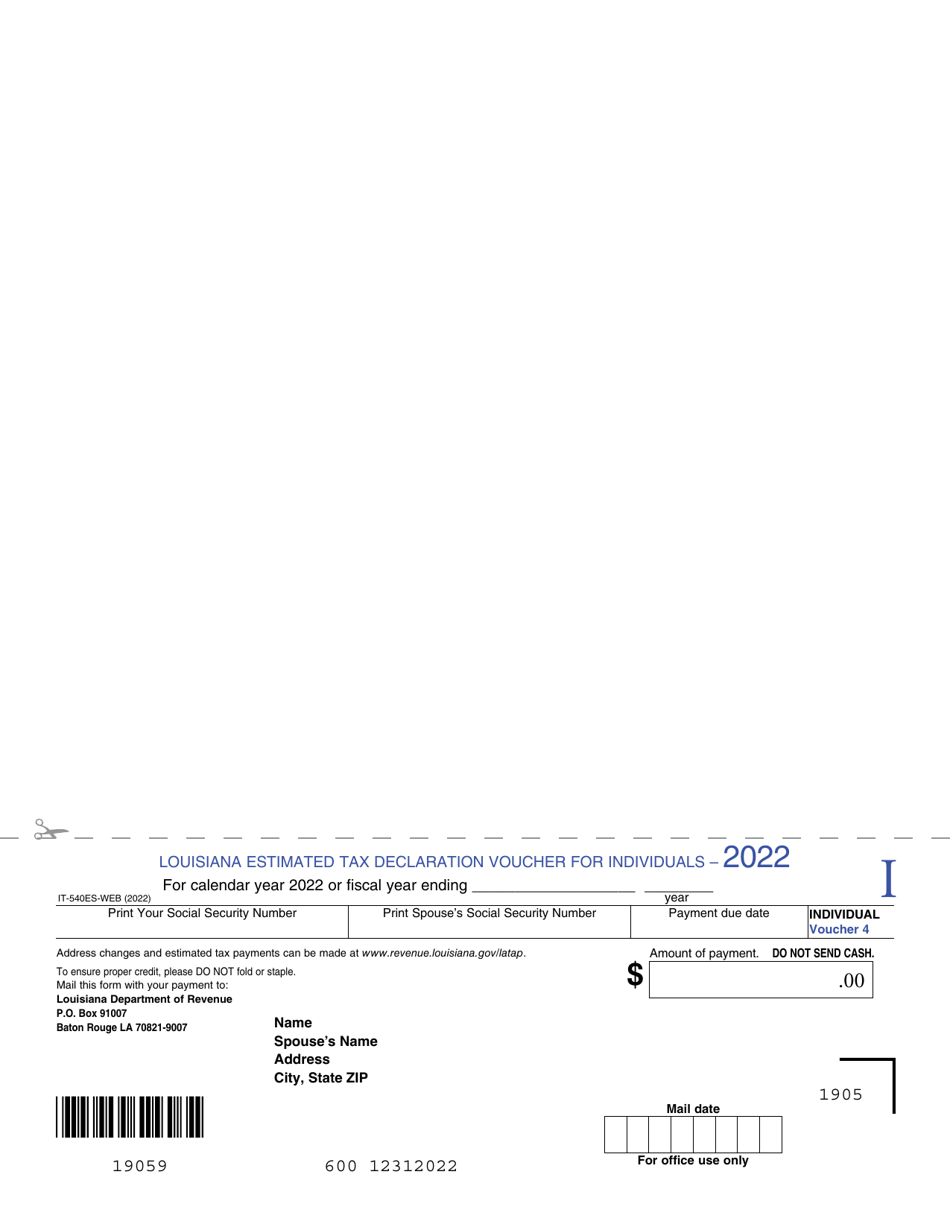

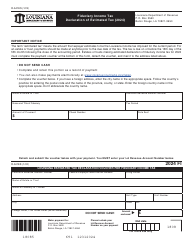

Form IT-540ES

for the current year.

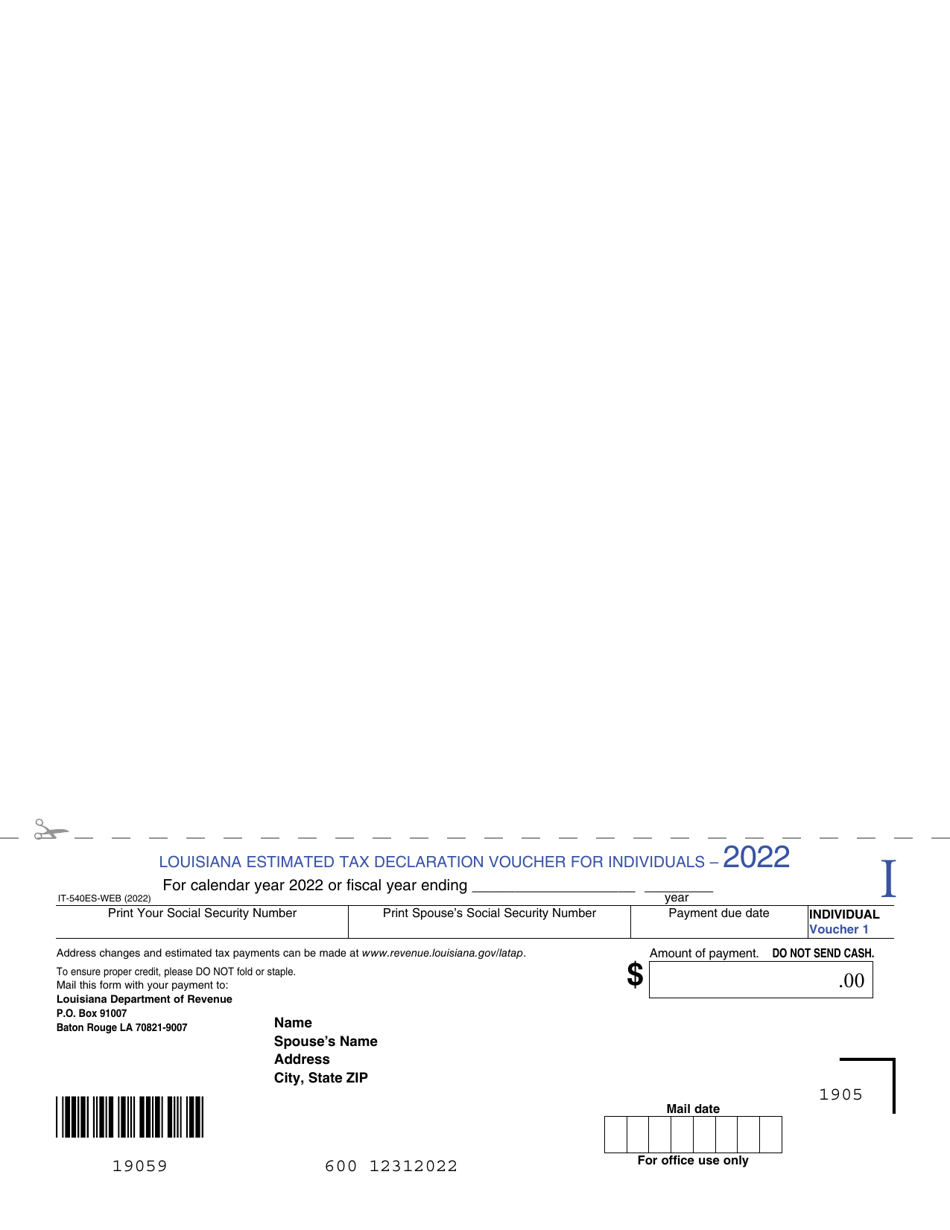

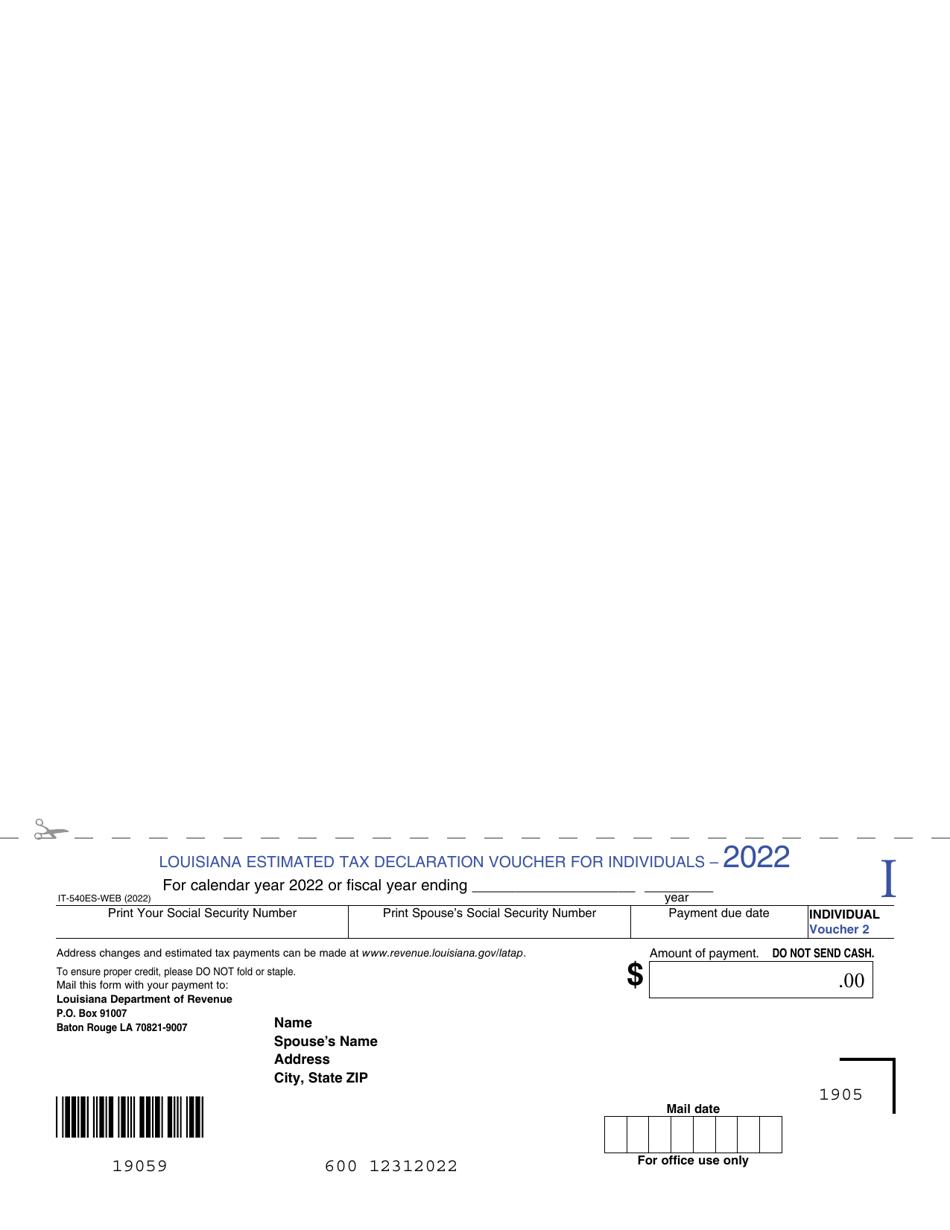

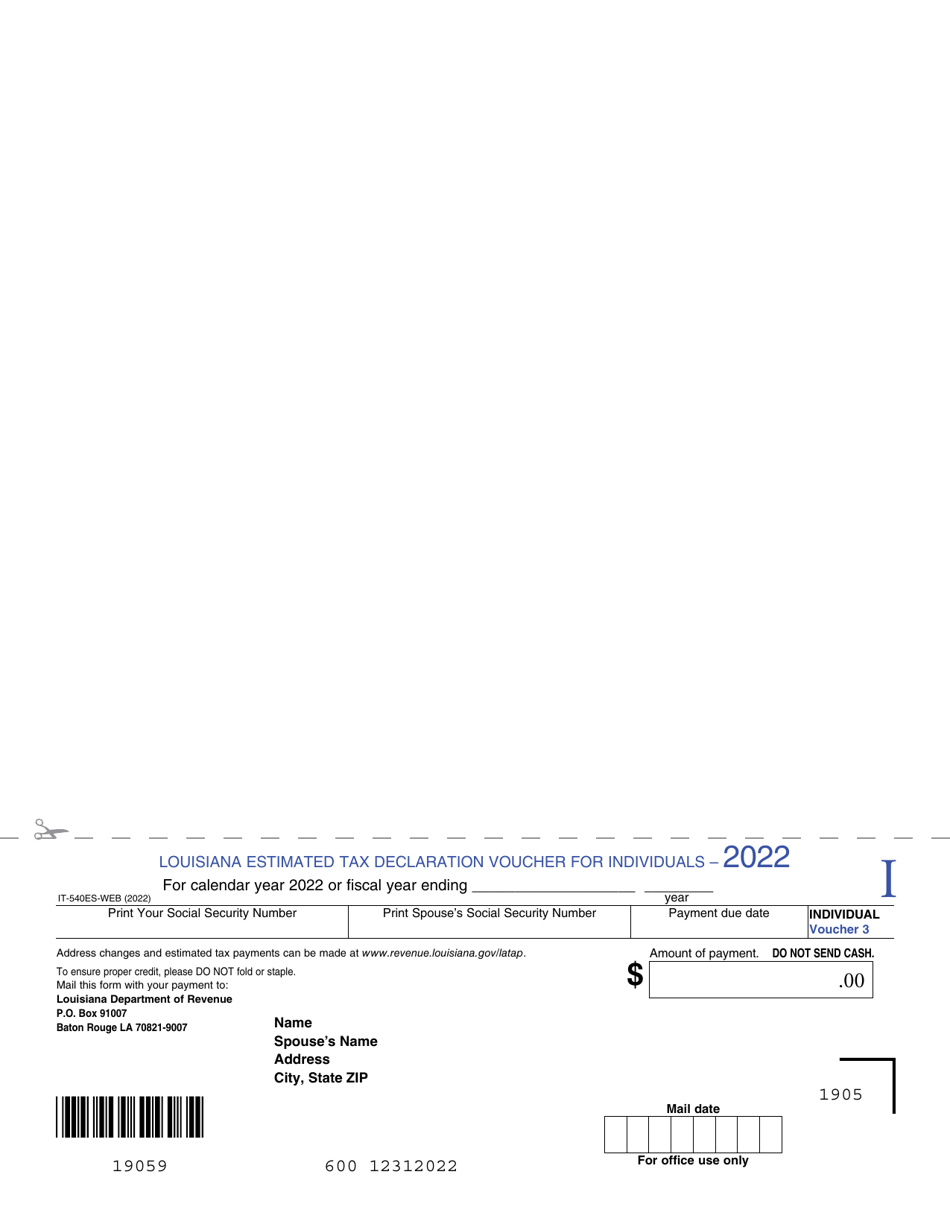

Form IT-540ES Louisiana Estimated Tax Declaration Voucher for Individuals - Louisiana

What Is Form IT-540ES?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-540ES?

A: Form IT-540ES is the Louisiana Estimated Tax Declaration Voucher for Individuals.

Q: Who needs to file Form IT-540ES?

A: Individuals who are residents of Louisiana and have income that is not subject to withholding need to file Form IT-540ES.

Q: What is the purpose of Form IT-540ES?

A: The purpose of Form IT-540ES is to make estimated tax payments throughout the year in order to avoid underpayment penalties.

Q: When is Form IT-540ES due?

A: Form IT-540ES is due on April 15th of each year.

Q: What information is required on Form IT-540ES?

A: Form IT-540ES requires the taxpayer's name, social security number, estimated tax amount, and payment information.

Form Details:

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-540ES by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.