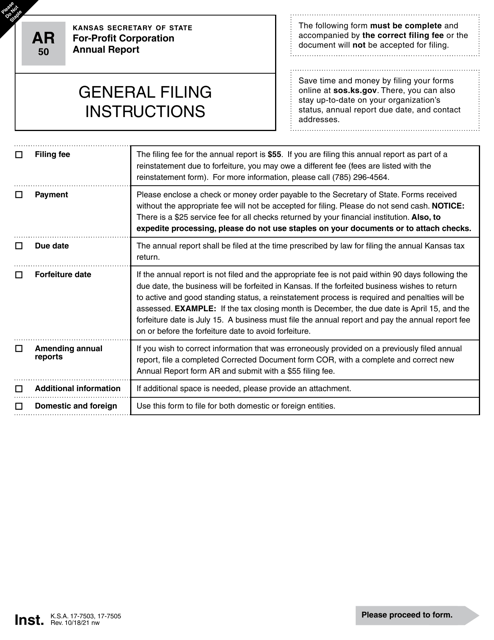

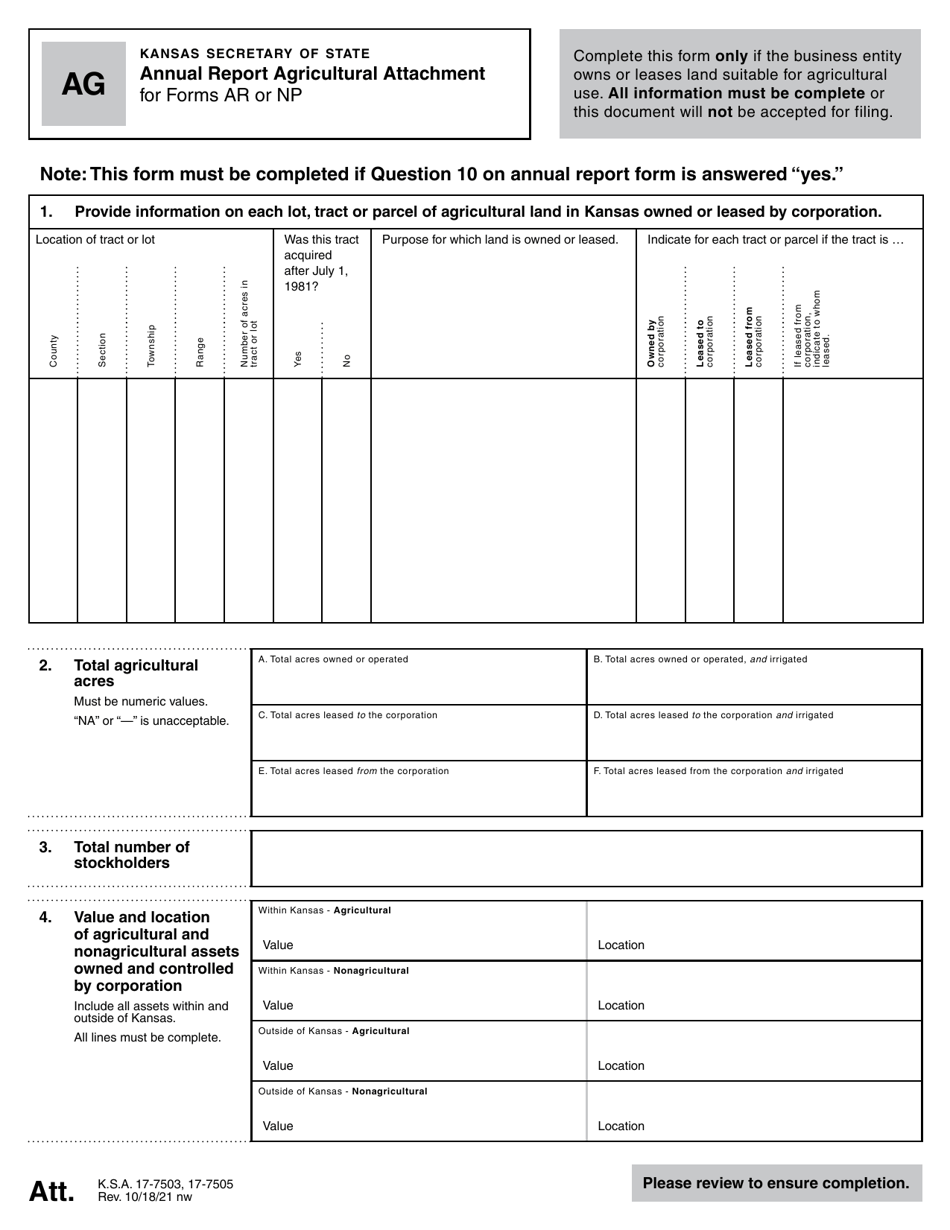

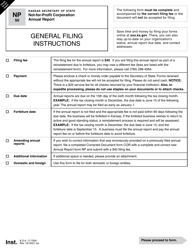

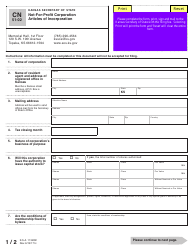

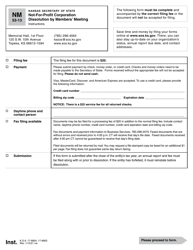

Form AR50 For-Profit Corporation Annual Report - Kansas

What Is Form AR50?

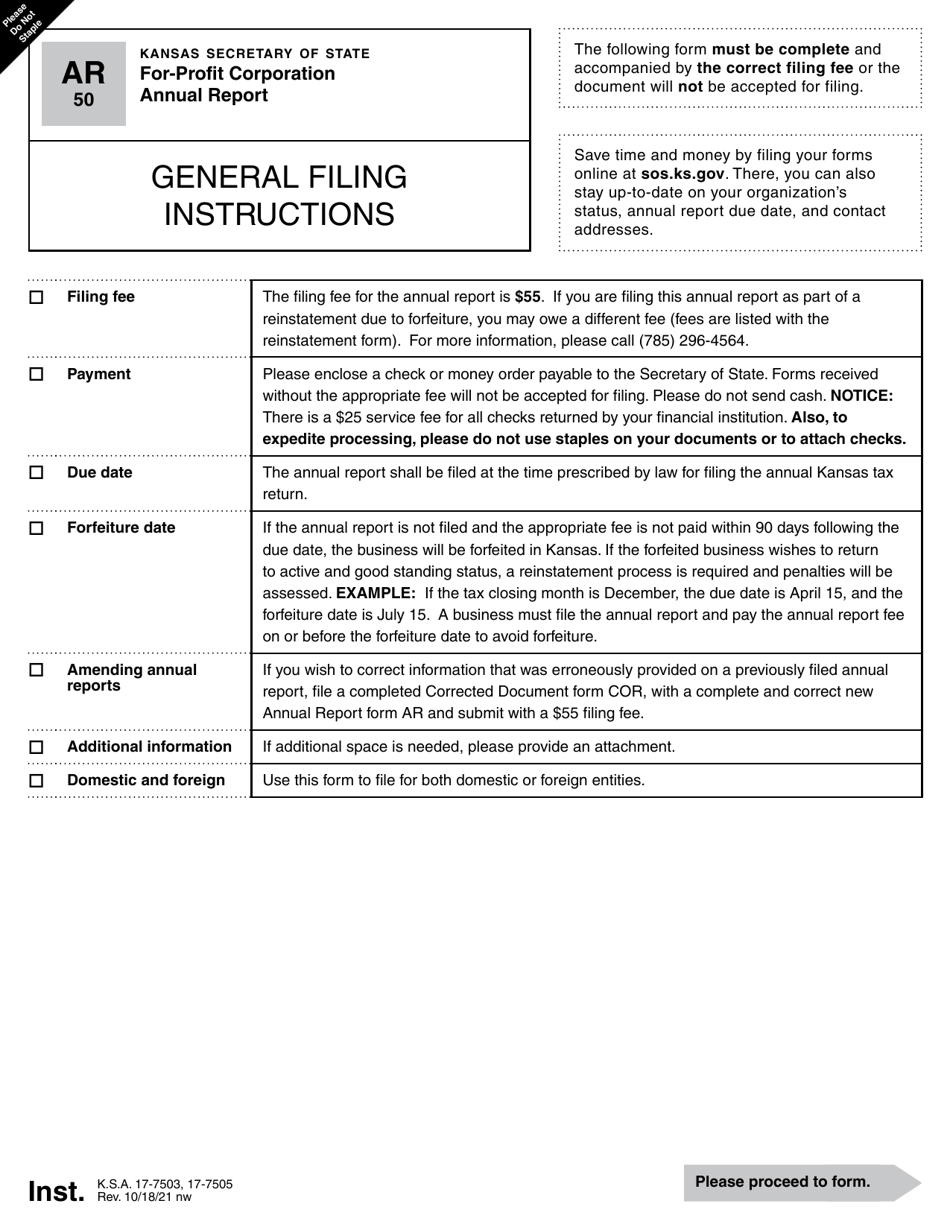

This is a legal form that was released by the Kansas Secretary of State - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form AR50?

A: Form AR50 is the For-Profit Corporation Annual Report required by the state of Kansas.

Q: Who needs to file Form AR50?

A: For-profit corporations operating in Kansas need to file Form AR50.

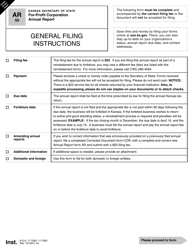

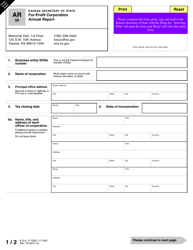

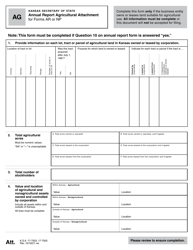

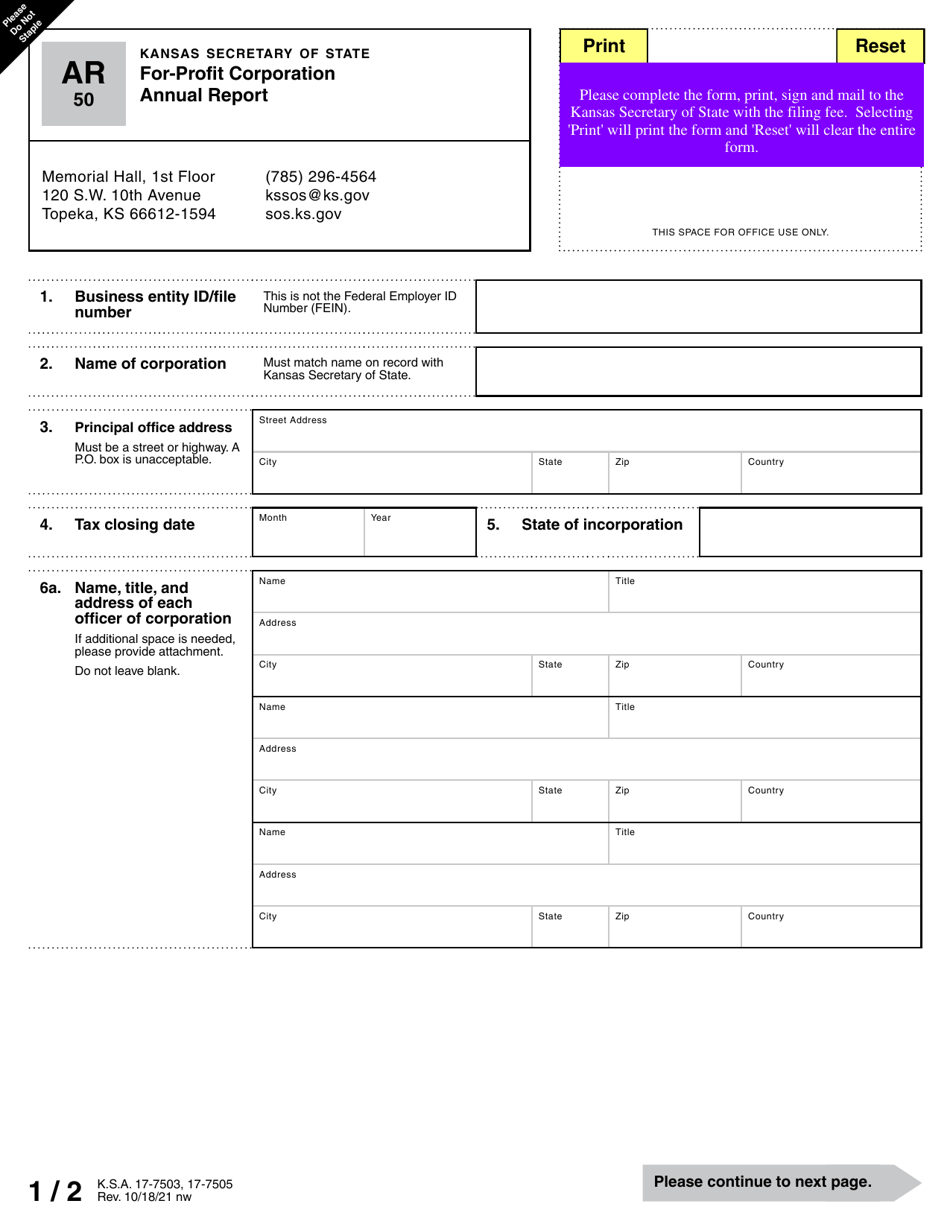

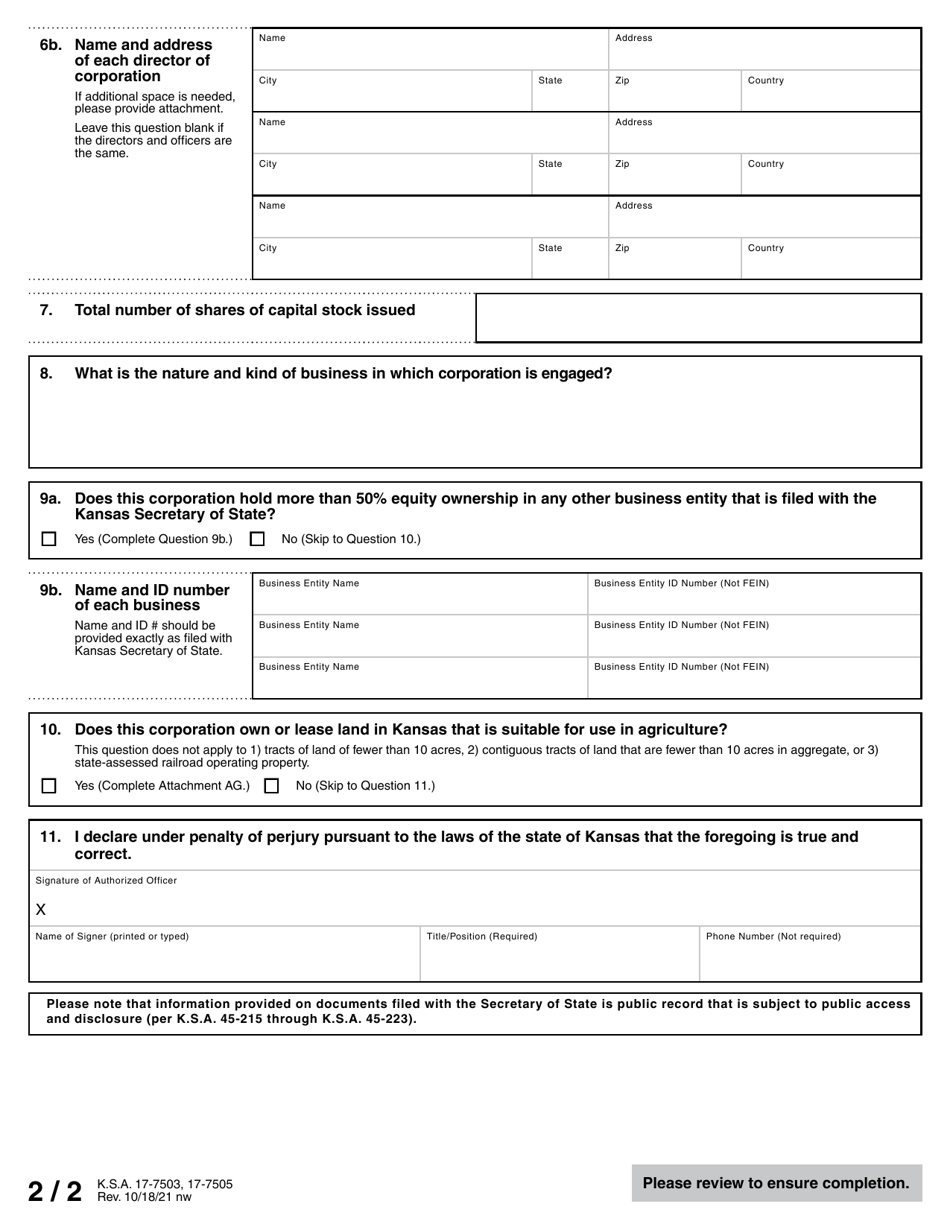

Q: What information is required in Form AR50?

A: Form AR50 requires information such as the corporation's name, principal place of business, registered agent details, and financial information.

Q: When is the deadline to file Form AR50?

A: Form AR50 must be filed by the 15th day of the fourth month following the end of the corporation's fiscal year.

Q: What happens if Form AR50 is not filed?

A: Failure to file Form AR50 may result in penalties and the loss of certain rights and privileges.

Form Details:

- Released on October 18, 2021;

- The latest edition provided by the Kansas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR50 by clicking the link below or browse more documents and templates provided by the Kansas Secretary of State.