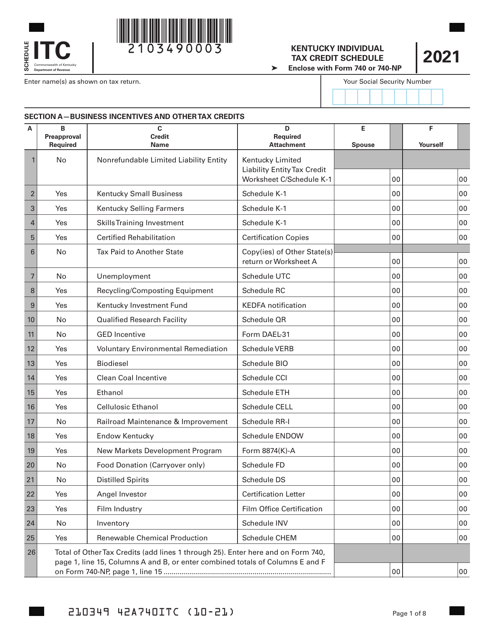

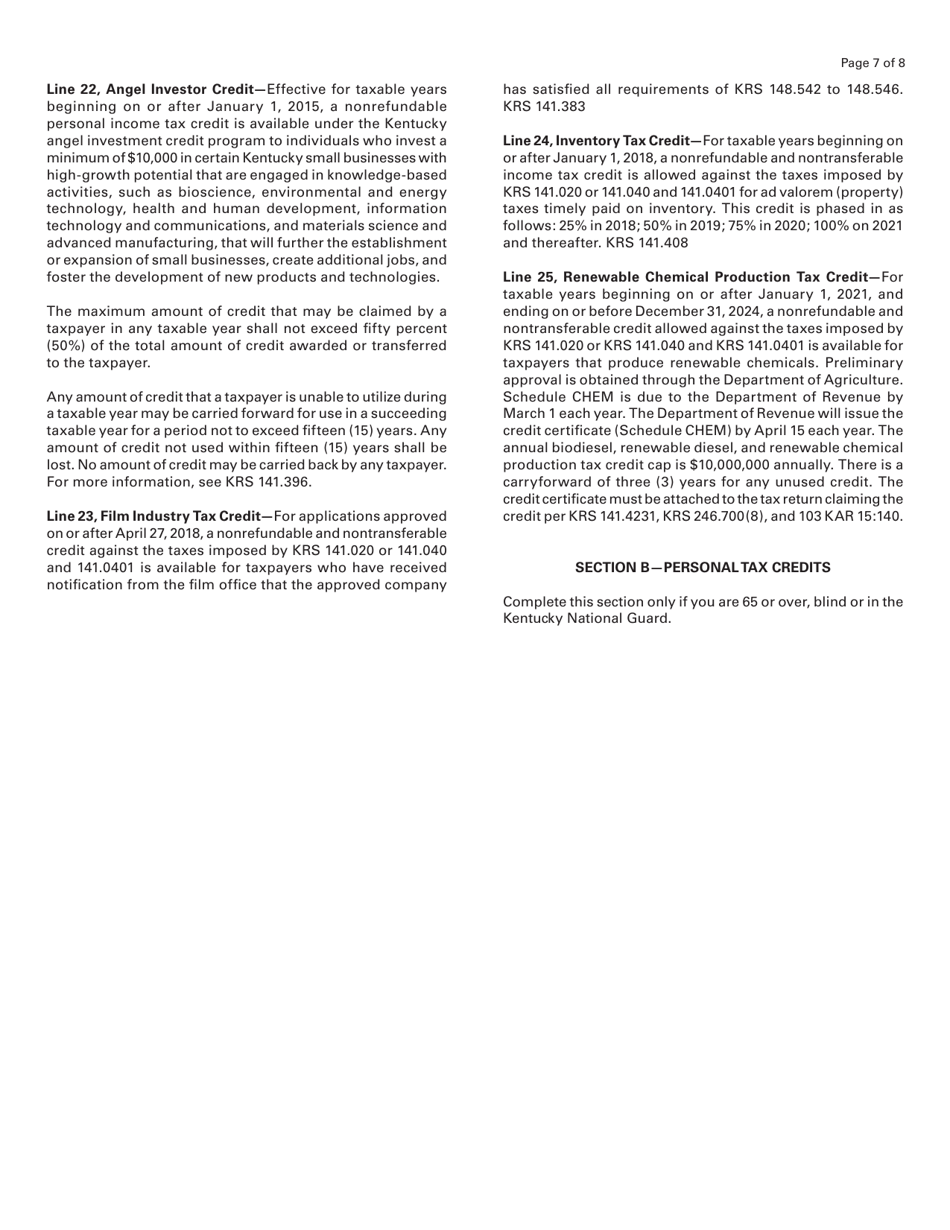

Schedule ITC Kentucky Individual Tax Credit Schedule - Kentucky

What Is Schedule ITC?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the ITC Kentucky Individual Tax Credit Schedule?

A: The ITC Kentucky Individual Tax Credit Schedule is a form used by residents of Kentucky to claim various tax credits.

Q: Who can use the ITC Kentucky Individual Tax Credit Schedule?

A: Residents of Kentucky who are eligible for specific tax credits can use the ITC Kentucky Individual Tax Credit Schedule.

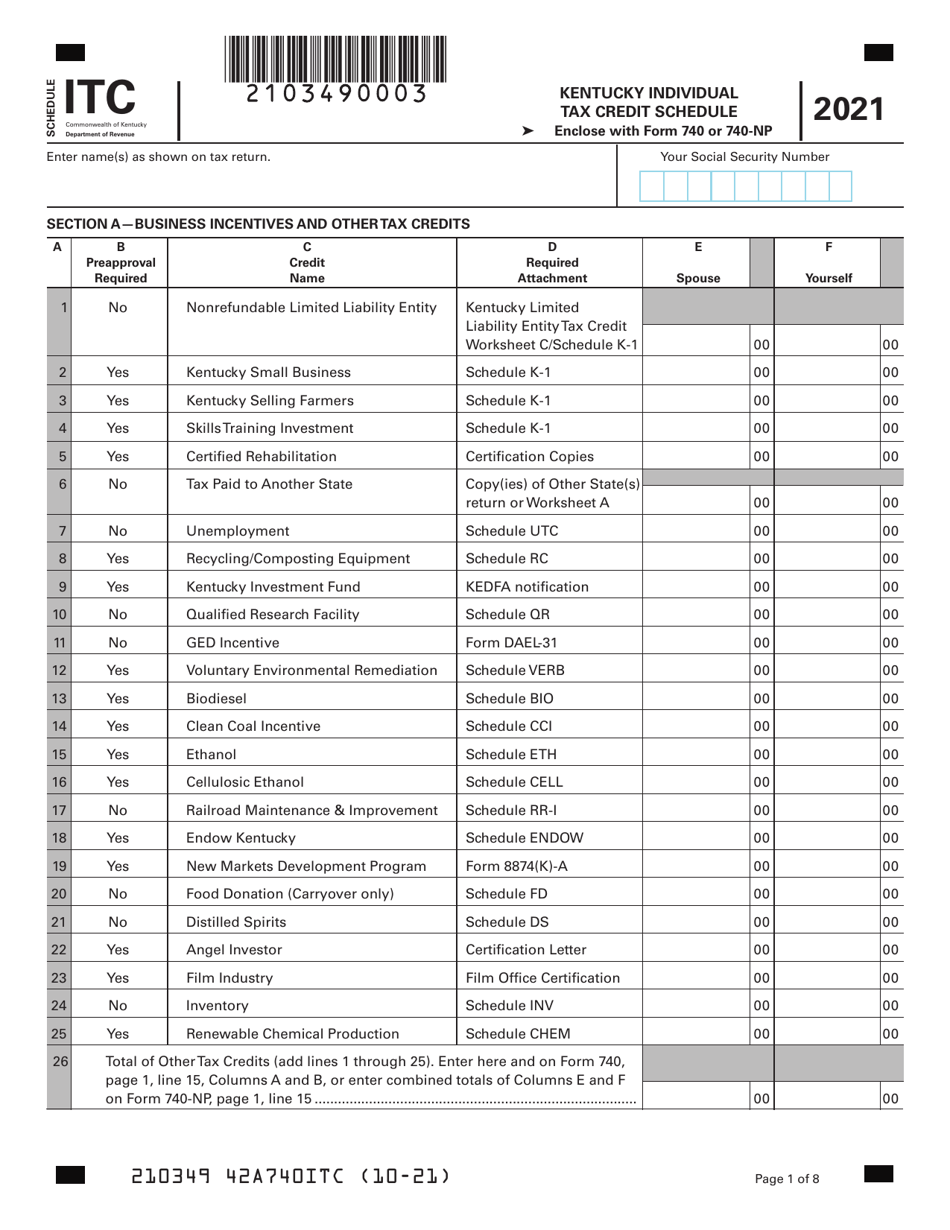

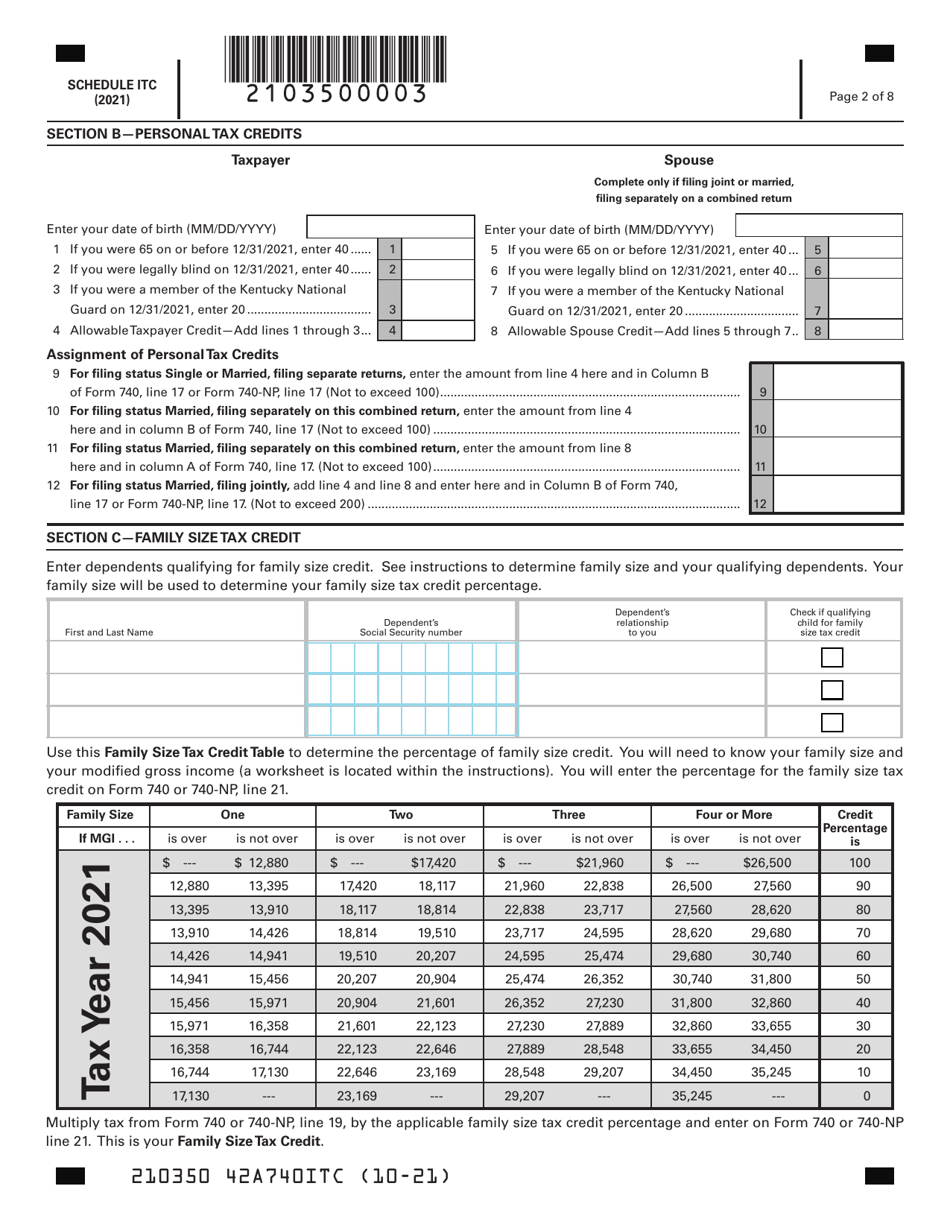

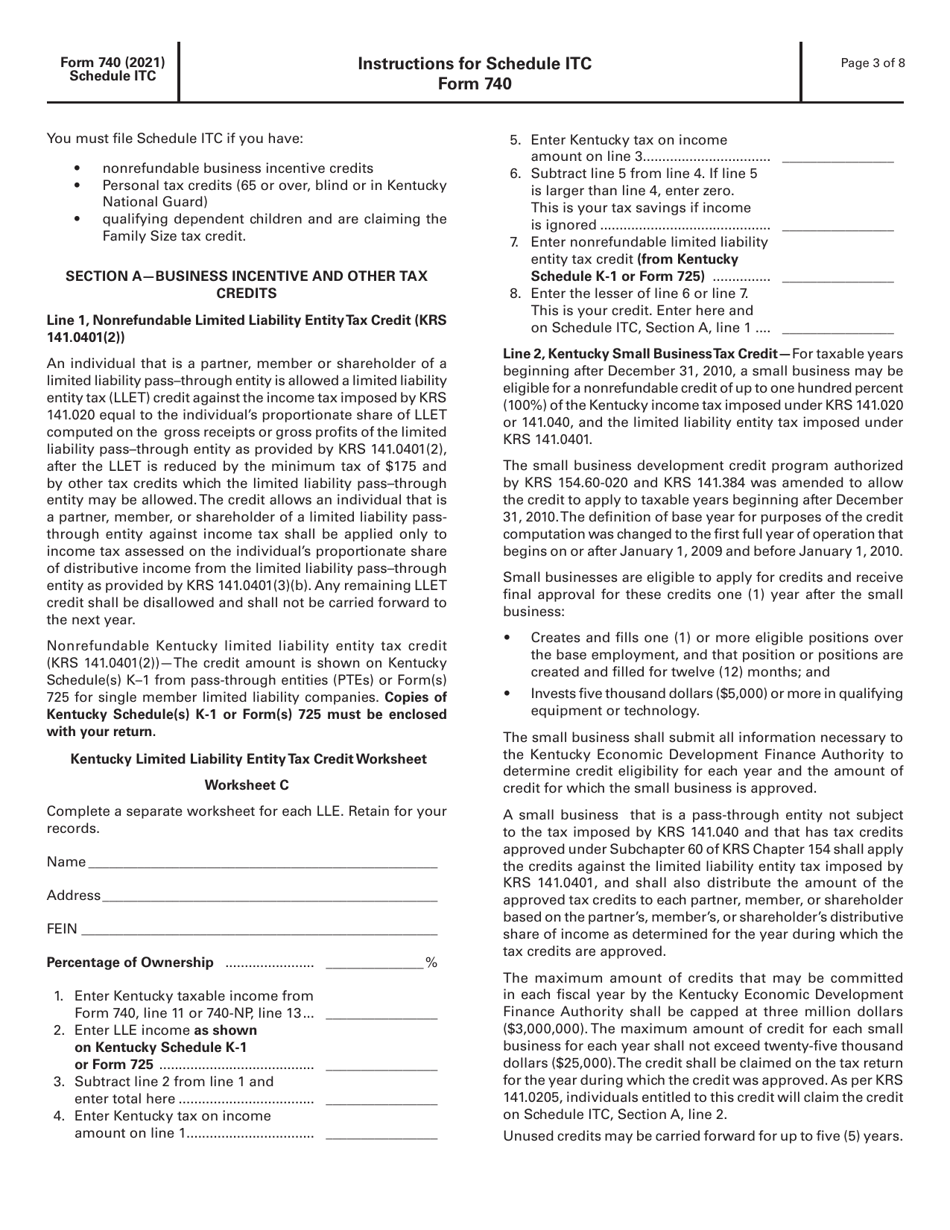

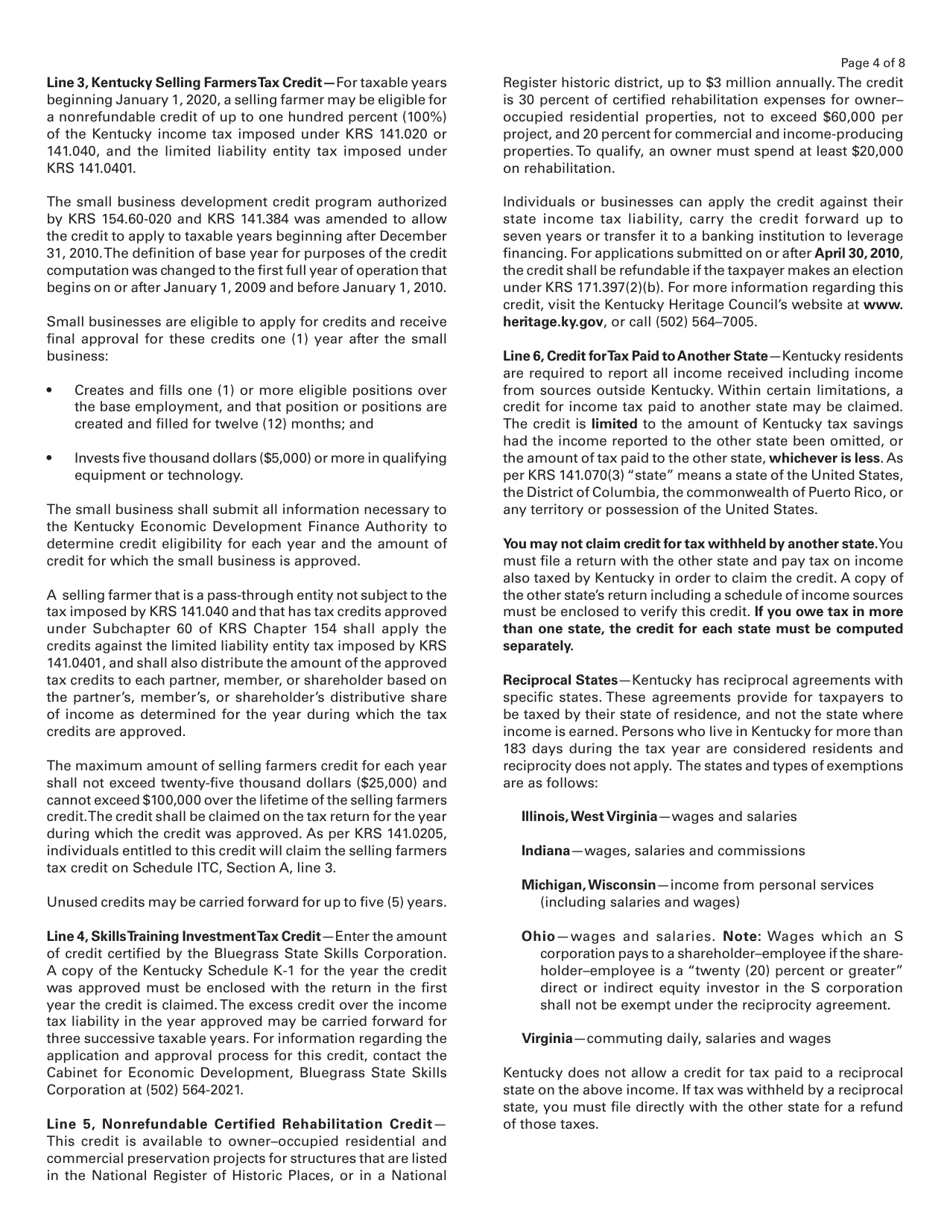

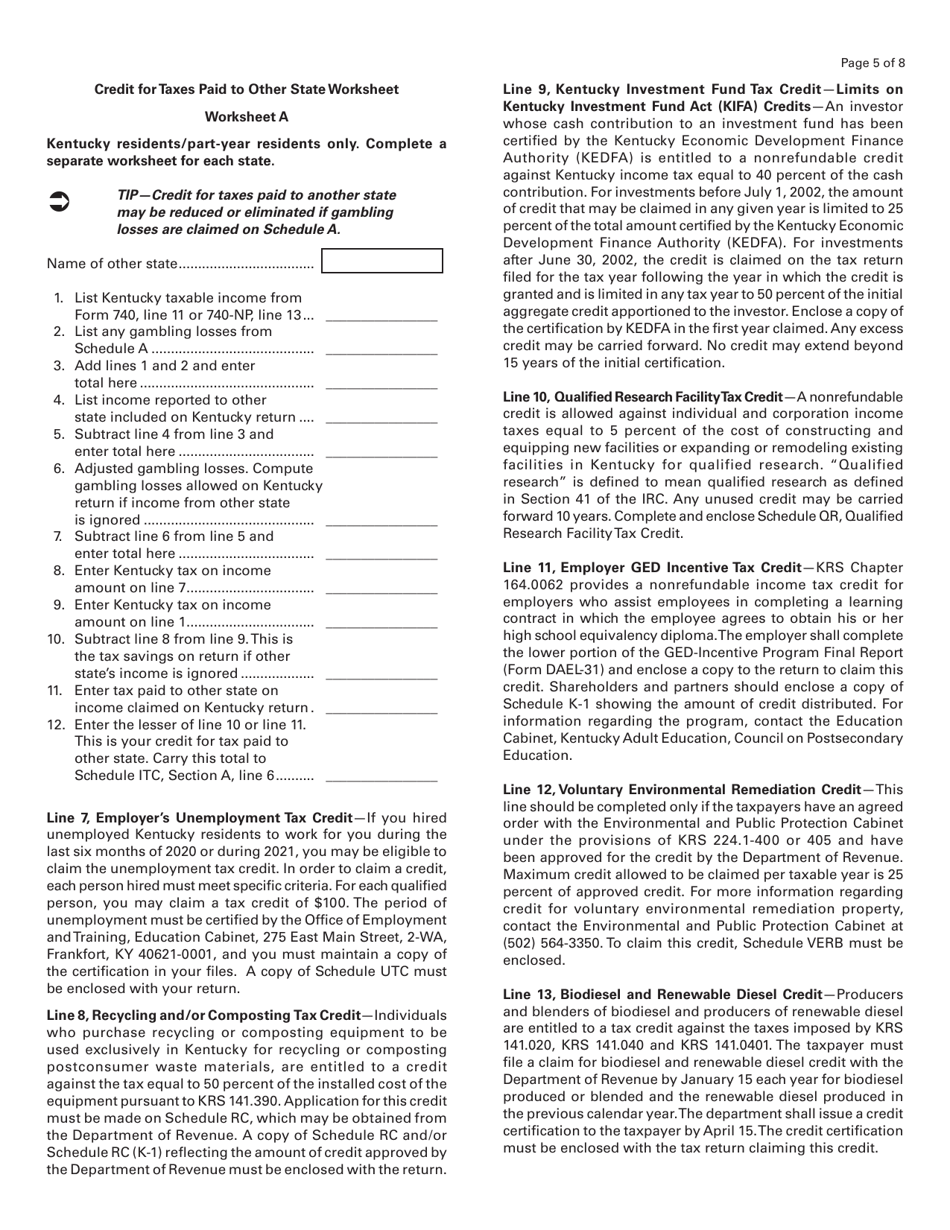

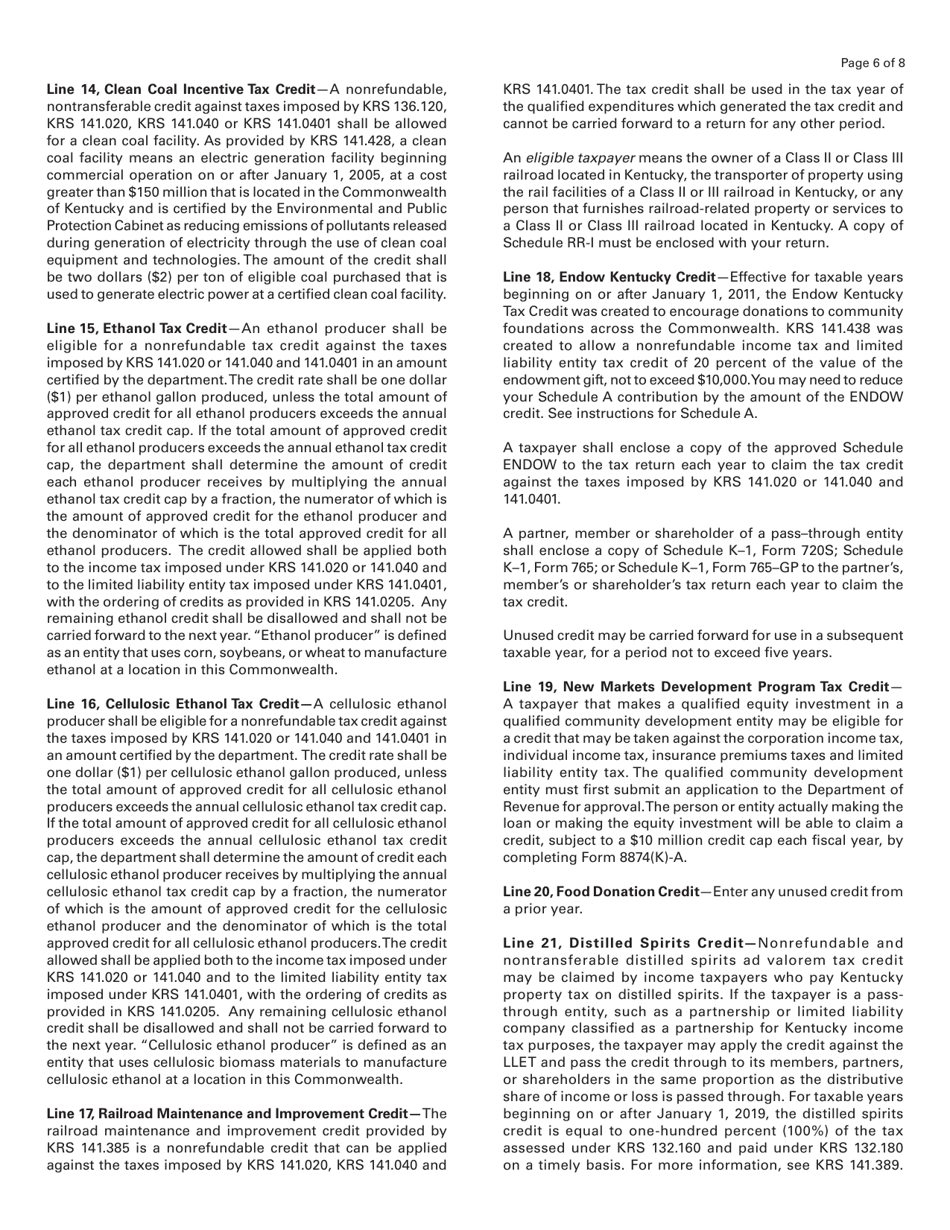

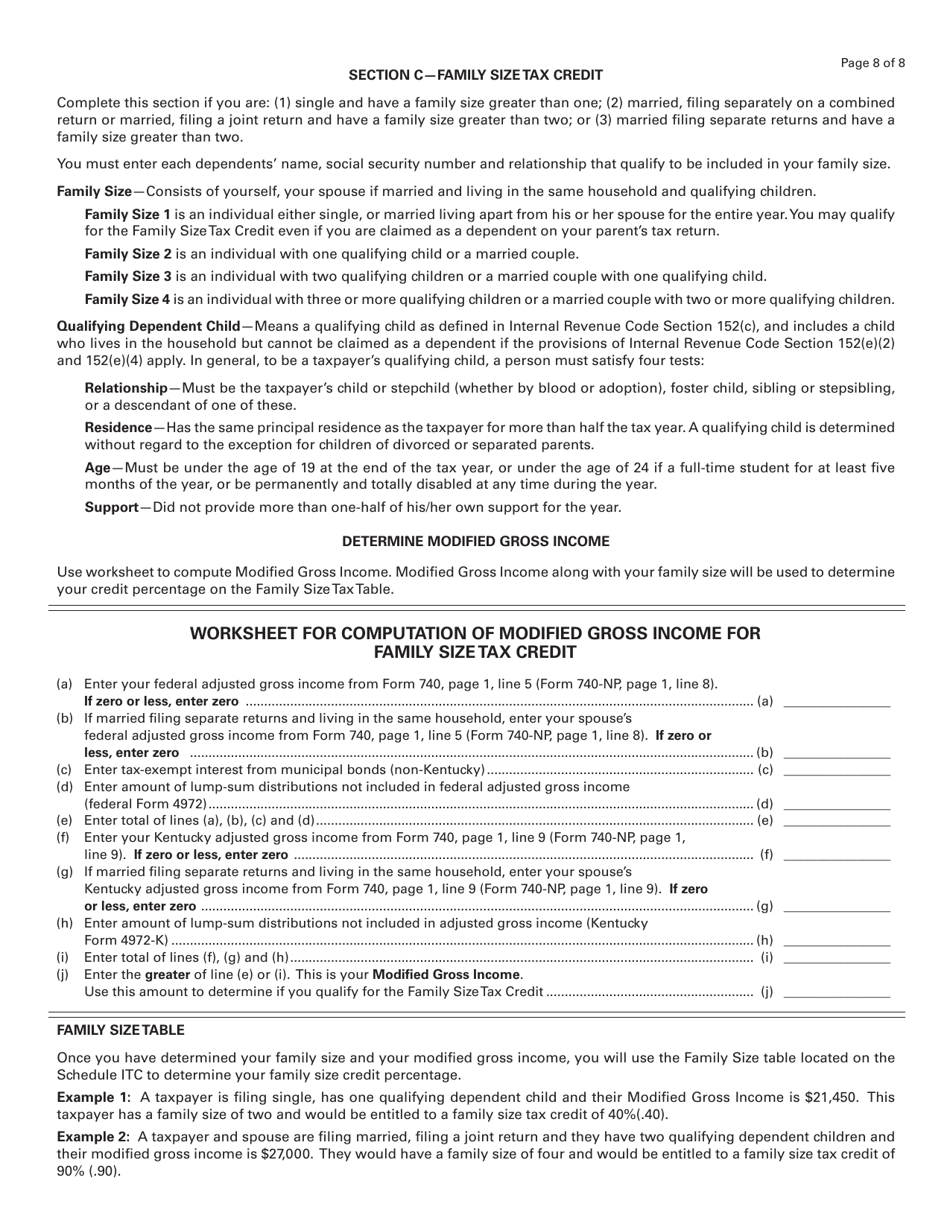

Q: What tax credits are available on the ITC Kentucky Individual Tax Credit Schedule?

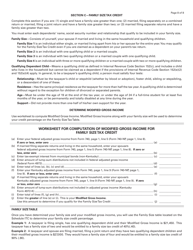

A: The ITC Kentucky Individual Tax Credit Schedule includes tax credits for various purposes, such as education, energy efficiency, and historic preservation.

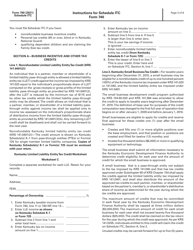

Q: How do I fill out the ITC Kentucky Individual Tax Credit Schedule?

A: You need to provide the necessary information related to the specific tax credits you are claiming on the ITC Kentucky Individual Tax Credit Schedule.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule ITC by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.