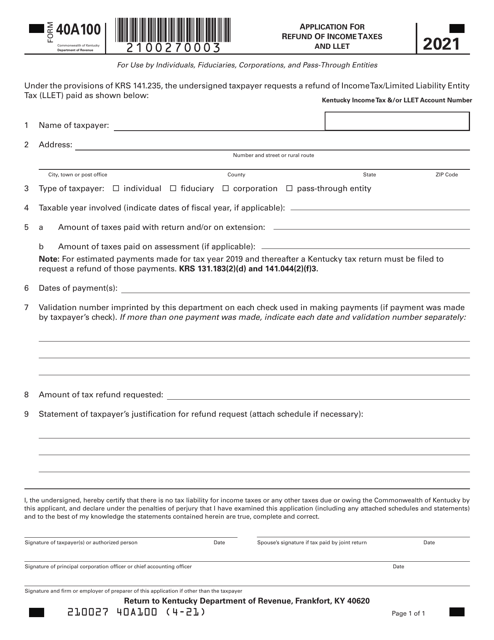

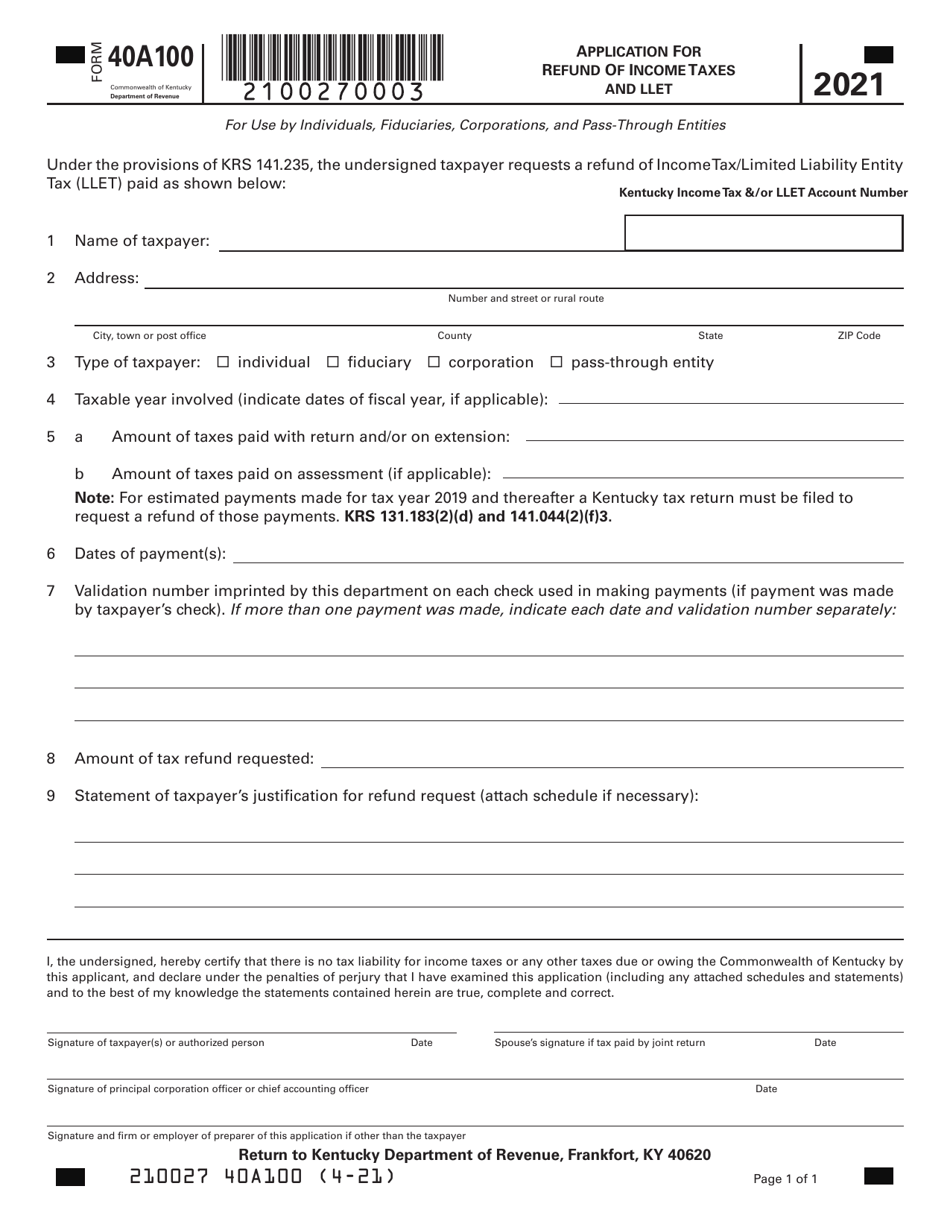

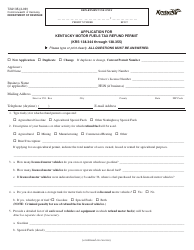

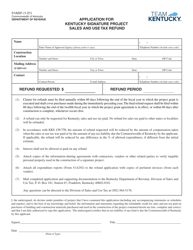

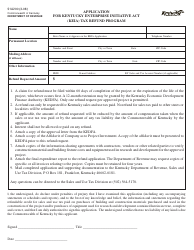

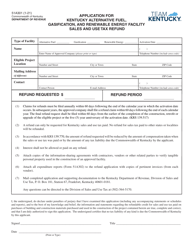

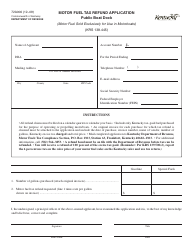

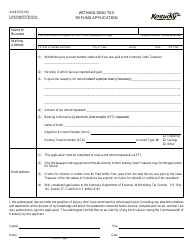

Form 40A100 Application for Refund of Income Taxes and Llet - Kentucky

What Is Form 40A100?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

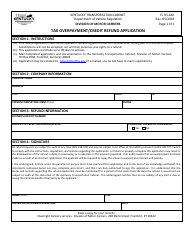

Q: What is Form 40A100?

A: Form 40A100 is an application used in Kentucky for requesting a refund of income taxes and llet.

Q: Who can use Form 40A100?

A: Any individual who wants to request a refund of income taxes and llet in Kentucky can use this form.

Q: What is the purpose of Form 40A100?

A: The purpose of Form 40A100 is to apply for a refund of income taxes and llet paid in Kentucky.

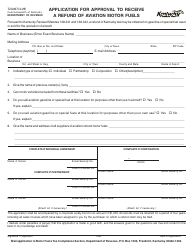

Q: Are there any fees associated with filing Form 40A100?

A: No, there are no fees associated with filing Form 40A100.

Q: What documents do I need to attach with Form 40A100?

A: You may need to attach copies of your tax returns and any supporting documents related to your refund claim.

Q: How long does it take to process Form 40A100?

A: The processing time for Form 40A100 varies, but it typically takes several weeks to receive a refund.

Q: Can I file Form 40A100 electronically?

A: No, currently there is no electronic filing option available for Form 40A100. It must be filed by mail or in person.

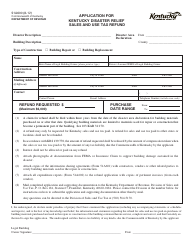

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 40A100 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.